Last Updated on 11 Aug 2025

Cybersecurity and Fraud in the Travel Industry: Threats, Trends, and Solutions

Share in

Key Notes

•

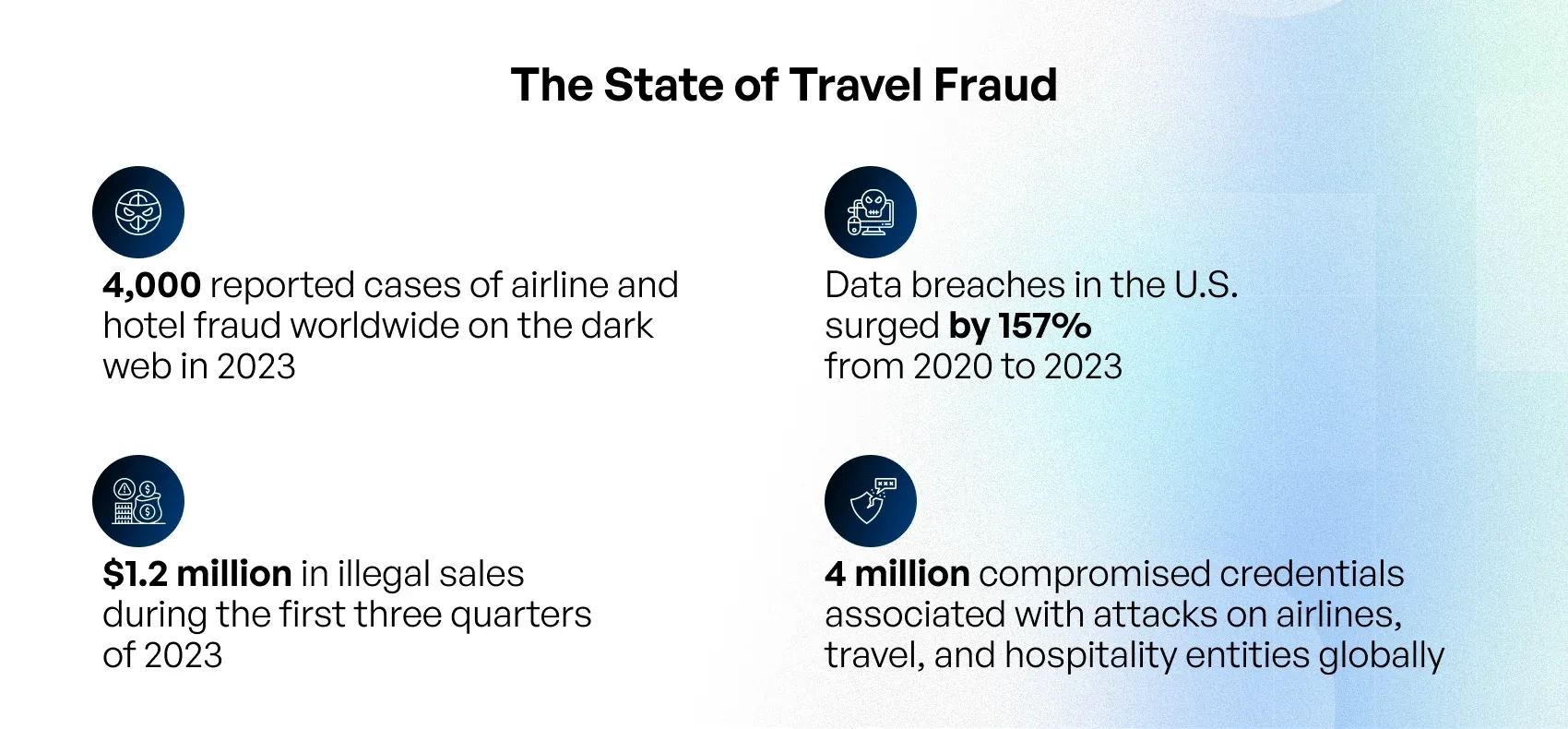

Travel fraud losses reached $21 billion globally in recent years, driven by online bookings and digital scams.•

Over 60% of travel account fraud cases are linked to account takeover.•

Loyalty programs are increasingly targeted, with $1 billion in point fraud losses annually.

What is the Travel Industry and How Big Is It?

The travel industry encompasses services such as tourism, hospitality, online travel agencies (OTAs), airlines, and booking platforms that support business and leisure travel. With digital transformation reshaping the industry, online bookings now account for more than 70% of total bookings globally. According to Statista, the global travel and tourism market is expected to reach $927 billion by 2026. Platforms like Booking.com, Airbnb, and Expedia each serve millions of users in over 200 countries. Mobile-first trends are accelerating, with over 60% of all travel-related searches coming from smartphones.

With thousands of implementation partners including payment providers, fraud detection platforms, and logistics operators, the industry's interconnectedness makes it a high-value target for cybercriminals. The growing reliance on APIs and third-party services only amplifies its risk exposure.

With thousands of implementation partners including payment providers, fraud detection platforms, and logistics operators, the industry's interconnectedness makes it a high-value target for cybercriminals. The growing reliance on APIs and third-party services only amplifies its risk exposure.

Fraud and Security Concerns in the Travel Industry: The Big Picture

The digital nature of travel transactions, personal data, payments, and itinerary management, creates broad attack surfaces. Fraud and cybersecurity challenges in the travel industry typically fall into three major categories:

User Identity and Account Abuse: Fraudsters create fake accounts or take over legitimate ones. These attacks impact user trust and result in stolen points, funds, or credentials. See: The Growing Threat of Account Opening Fraud.

Automated and Scalable Fraud Tactics: Bots scrape inventory, abuse promos, or simulate behavior across thousands of devices to exploit weaknesses in travel websites.

Infrastructure and Integration Gaps: APIs and third-party integrations introduce vulnerabilities, especially in booking and payment systems that lack end-to-end visibility or layered security.

For a resilient defense, platforms must shift from reactive measures to continuous, AI-driven monitoring, read more in Continuous Adaptive Risk and Trust Assessment.

User Identity and Account Abuse: Fraudsters create fake accounts or take over legitimate ones. These attacks impact user trust and result in stolen points, funds, or credentials. See: The Growing Threat of Account Opening Fraud.

Automated and Scalable Fraud Tactics: Bots scrape inventory, abuse promos, or simulate behavior across thousands of devices to exploit weaknesses in travel websites.

Infrastructure and Integration Gaps: APIs and third-party integrations introduce vulnerabilities, especially in booking and payment systems that lack end-to-end visibility or layered security.

For a resilient defense, platforms must shift from reactive measures to continuous, AI-driven monitoring, read more in Continuous Adaptive Risk and Trust Assessment.

Market Size of the Travel Industry

The travel industry is one of the world's largest, contributing 7.6% to global GDP in recent years, according to the World Travel & Tourism Council. It employed over 300 million people and served over 1.5 billion international travelers annually. Digital bookings account for over $500 billion, with platforms like Trip.com, Agoda, and Hopper leading mobile-first adoption. Over 85% of millennials and Gen Z travelers use at least one mobile travel app, indicating a tech-savvy yet vulnerable user base.

Source: Grand View Research

Fraud Size in the Travel Industry

Fraudulent activity in the travel sector is growing in volume and complexity. A 2023 Juniper Research study estimated that the industry suffered over $21 billion in fraud losses globally, with online booking fraud and loyalty scams leading the charge. Travel platforms face constant pressure to allow seamless experiences while defending against stealthy, evolving fraud vectors. This dichotomy creates blind spots that criminals are quick to exploit, especially during high-travel seasons or global crises like pandemics and natural disasters.

Source: Onix Systems

The Anatomy of Travel Industry Fraud

Travel fraud comes in many forms, each with its own tactics and consequences:

- Fake Bookings: Fraudsters create non-existent listings or use stolen cards to book travel services. These scams often lead to chargebacks and loss of inventory availability.

- Loyalty Abuse: Hackers gain unauthorized access to user accounts to drain loyalty points. The monetization of loyalty points on dark markets has made this a profitable fraud channel.

- Triangulation Scams: A scammer buys legitimate travel services using stolen cards and resells them to unsuspecting users at discounted rates, leaving the business liable for chargebacks.

- Synthetic IDs: Fraudsters fabricate user profiles using a blend of real and fake information. These accounts bypass basic KYC checks and slowly build trust before committing larger fraud.

- Collusion with Fake Vendors: Criminals set up fake travel agencies or tour guides and collaborate with insiders to siphon funds or inflate transaction volumes.

Account Takeover in the Travel Sector

Account Takeover (ATO) has become a dominant threat in the travel space. Fraudsters use credential stuffing, phishing, and data leaks to gain access to user accounts. Once in, they book travel, steal loyalty points, or change account details to lock out legitimate users.

The impact is multifaceted:

The impact is multifaceted:

- OTAs bear the cost of chargebacks.

- Travelers suffer disrupted plans.

- Brands endure trust erosion and legal consequences.

Fake Accounts and Synthetic Identities in Travel Platforms

Fake accounts plague travel platforms, often created using disposable emails, temporary phone numbers, or synthetic ID generators. They are primarily used to abuse referral programs, manipulate reviews, or commit fraud.

Technique: Bots generate multiple user accounts across devices, each pretending to be a real traveler.

Impact: These users can claim promotional rewards or artificially inflate booking metrics.

CrossClassify combats this using device fingerprinting, behavioral analytics, and IP intelligence. Learn more in Avoid Fake Accounts and New Account Fraud.

Technique: Bots generate multiple user accounts across devices, each pretending to be a real traveler.

Impact: These users can claim promotional rewards or artificially inflate booking metrics.

CrossClassify combats this using device fingerprinting, behavioral analytics, and IP intelligence. Learn more in Avoid Fake Accounts and New Account Fraud.

Bot and Abuse Fraud in Online Travel Agencies (OTAs)

Bots are a major problem for travel agencies. They perform a range of fraud and abuse activities:

- Inventory Scraping: Bots scrape availability and pricing data to use in competitor platforms or meta search engines.

- Fake Promo Abuse: Thousands of fake accounts redeem new user promos, draining marketing budgets.

- Credential Stuffing: Automated bots test millions of login credentials obtained from dark web leaks.

Behavioral Biometrics and Device Intelligence for Travel Security

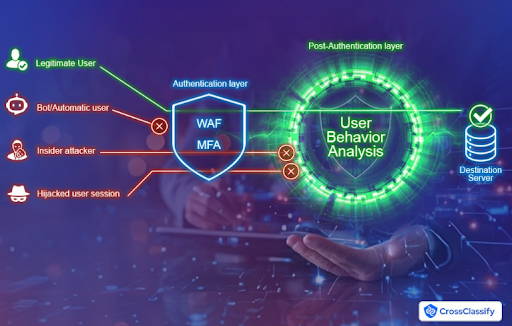

Traditional methods like passwords and CAPTCHAs are no longer enough. Behavioral biometrics and device fingerprinting offer real-time, passive detection of threats.

- Detecting Abnormal Behavior: Travel users have predictable patterns. Deviation in typing speed, mouse movement, or navigation flow can signal fraud.

- Suspicious Device Detection: Devices with emulators, spoofed geolocation, or rooted environments are flagged for investigation.

AI-Powered Fraud Detection in Travel Booking Systems

AI enables fraud systems to learn from historical fraud signals and adjust to new tactics in real time.

- Machine Learning for Anomaly Detection: Unusual booking volumes, inconsistent travel routes, or out-of-pattern user logins are flagged.

- Pattern Recognition: AI models detect sequences associated with fraud rings, such as repeat bookings on multiple cards from the same IP cluster.

Securing Loyalty Programs and High-Risk Travel Assets

Loyalty programs represent a multi-billion dollar digital currency. They're often under-protected compared to financial transactions.

- Loyalty Fraud: Points theft is executed via ATO or synthetic accounts, often converted into goods or sold online.

- Cross-Device Protection: Attackers collect small point balances across multiple accounts to avoid detection.

Case Studies and Global Trends in Travel Fraud

- Seon.io: Identified a spike in synthetic IDs during summer 2023 targeting European OTA platforms.

- Trustfull: Noted a 35% increase in loyalty point abuse during holiday travel peaks.

- Ravelin: Detected coordinated fraud rings using VPNs and emulators to simulate user diversity.

- Mastercard: Advocates for tokenization and device-level protection in global travel payments.

Compliance Challenges in the Travel Industry

The global nature of the travel industry puts platforms under various compliance regimes:

- GDPR: Applies to EU-based users, requiring clear data processing consent.

- PCI DSS: Governs payment security and transaction encryption.

- CCPA: Ensures California users have control over personal data.

Consequences of Inadequate Cybersecurity in Travel

Cybersecurity failures are costly:

- Direct Financial Losses: Chargebacks, refunds, and legal settlements.

- Customer Churn: Once trust is broken, travelers rarely return.

- Regulatory Penalties: GDPR violations can cost millions in fines.

- Brand Damage: Negative press leads to long-term reputation loss.

CrossClassify's End-to-End Solution for the Travel Industry

CrossClassify addresses core pain points in travel cybersecurity:

Account Takeover Protection: Advanced session tracking, fingerprinting, and behavioral analysis stop hijacks.

Fraud Scoring: Every login, booking, and transaction is scored in real time.

Device and Behavior Profiling: Identifies patterns across sessions and devices to stop coordinated fraud.

Our solution works across platforms, mobile, web, and APIs, ensuring security with minimal user friction. Learn more at CrossClassify Travel Solutions.

Account Takeover Protection: Advanced session tracking, fingerprinting, and behavioral analysis stop hijacks.

Fraud Scoring: Every login, booking, and transaction is scored in real time.

Device and Behavior Profiling: Identifies patterns across sessions and devices to stop coordinated fraud.

Our solution works across platforms, mobile, web, and APIs, ensuring security with minimal user friction. Learn more at CrossClassify Travel Solutions.

Recommendations for Travel Businesses

Here's how travel companies can strengthen their cybersecurity posture:

- Start with Visibility: Know your users and devices beyond the login form.

- Evaluate Vendors: Choose partners with transparent AI models and multi-layered protection.

- Prioritize Real-Time Detection: Prevention beats response. Stop fraud before it impacts users.

Conclusion: Staying Ahead in a Rapidly Evolving Threat Landscape

The travel industry's rapid digital transformation has brought convenience but also unprecedented exposure to fraud. From ATO to bot attacks and loyalty theft, travel platforms are on the frontlines of modern cybercrime. This article has explored fraud trends, real cases, detection methods, and future-ready strategies to navigate this complex environment.

CrossClassify helps travel businesses fight fraud with precision. Through device fingerprinting, behavioral biometrics, AI-powered scoring, and zero-trust architecture, we deliver frictionless security across the entire traveler journey. If you're ready to protect your users, data, and brand, CrossClassify is your ideal partner.

CrossClassify helps travel businesses fight fraud with precision. Through device fingerprinting, behavioral biometrics, AI-powered scoring, and zero-trust architecture, we deliver frictionless security across the entire traveler journey. If you're ready to protect your users, data, and brand, CrossClassify is your ideal partner.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

The most prevalent fraud in the travel industry is account takeover fraud in travel platforms where fraudsters hijack user accounts to make bookings or steal loyalty points. CrossClassify mitigates this by using advanced fingerprinting, session analysis, and anomaly detection to block unauthorized access in real time. Learn more →

Fake account creation in online travel agencies leads to promo abuse and fake listings, impacting revenue and user trust. CrossClassify prevents this through behavioral analytics and device fingerprinting to distinguish genuine travelers from automated or synthetic behavior. More details →

Yes, bot fraud in travel search engines remains a major issue, especially for scraping inventory or launching credential stuffing attacks. CrossClassify's real-time detection tools identify and neutralize bot-based fraud by monitoring behavior patterns. For more, read →

Loyalty point fraud in travel loyalty programs has grown due to their monetary value and limited protection. CrossClassify ensures loyalty account integrity using session profiling and suspicious device recognition. Find insights →

Fraud prevention in API-integrated travel systems is vital, as third-party services can expose booking platforms to breaches. CrossClassify offers continuous monitoring to detect API-based manipulation and hidden fraud flows. See more in →

Device fingerprinting for travel fraud detection helps uniquely identify devices being used for account abuse, promo exploitation, or synthetic behavior. CrossClassify's fingerprinting tech tracks browser, device, and network attributes to stop suspicious activity. Learn how it works →

No, travel fraud prevention requires more than MFA and WAF which are often bypassed using advanced threats. CrossClassify complements these tools with adaptive behavioral biometrics and IP analysis. Dive deeper →

Triangulation booking fraud in travel platforms is tricky, involving legitimate bookings made with stolen credentials. CrossClassify detects these patterns using multi-point risk scoring across accounts, devices, and IP ranges. Discover more →

Yes, AI travel fraud detection platforms can analyze large datasets in real time to detect anomalies in booking patterns, user behavior, and payment flows. CrossClassify applies adaptive AI models that continuously learn from evolving threats. Learn more →

Behavioral biometrics in online travel agencies helps track unique user behavior, such as mouse movements and keystroke rhythm, to detect bots or fraudsters. CrossClassify uses this data to build secure, frictionless travel experiences. Explore how →

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required