Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

Account Takeover Protection

43% of all breaches are insider threats, either intentional or unintentional.

70%

Detect of ATO Fraud Attacks

85%

Block Phishing-based Attacks

How We Prevent Account Takeover

Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

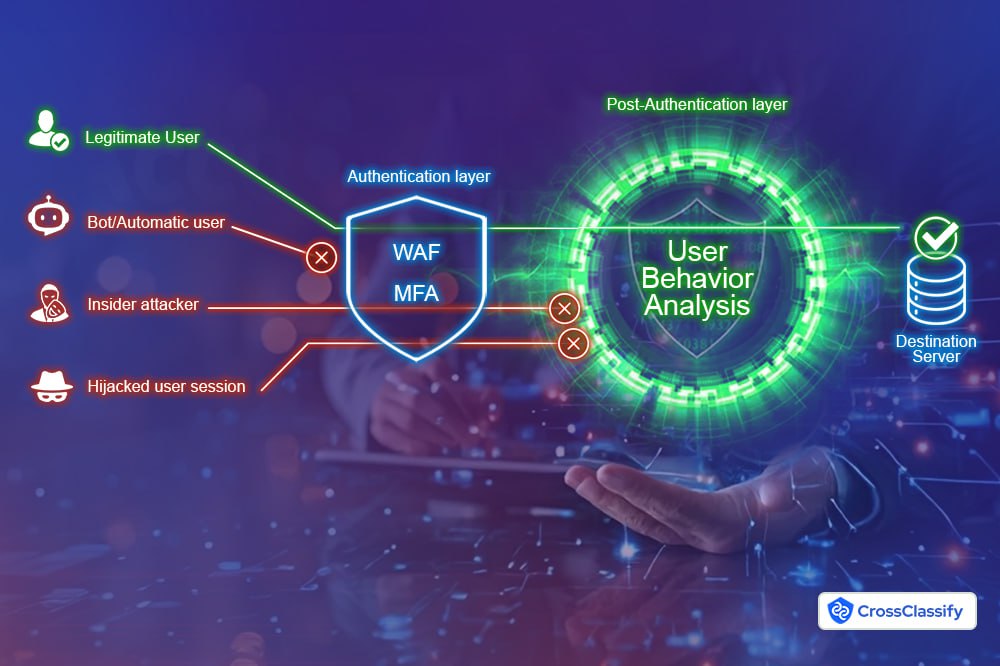

Learn More ❯Why WAF & MFA Are Not Enough

How Cross Classify fills the gaps they missed

| Security Measure | What It Protects Against | What It Misses | Why CrossClassify is Needed |

|---|---|---|---|

Blocks known threats SQL injectionXSSDDoSbots | CrossClassify detects fraud after authentication, identifying real users vs. fraudsters. | ||

Prevents unauthorized logins phishingbrute-force | We detect behavioral anomalies even if MFA is passed. | ||

Detects sophisticated fraudsession hijackingdevice & behavior anomalies | Prevents account takeover (ATO), synthetic fraud, and insider threats |

Features

Block Fraud Instantly

Avoid the risk of data breaches with our AI-driven solution

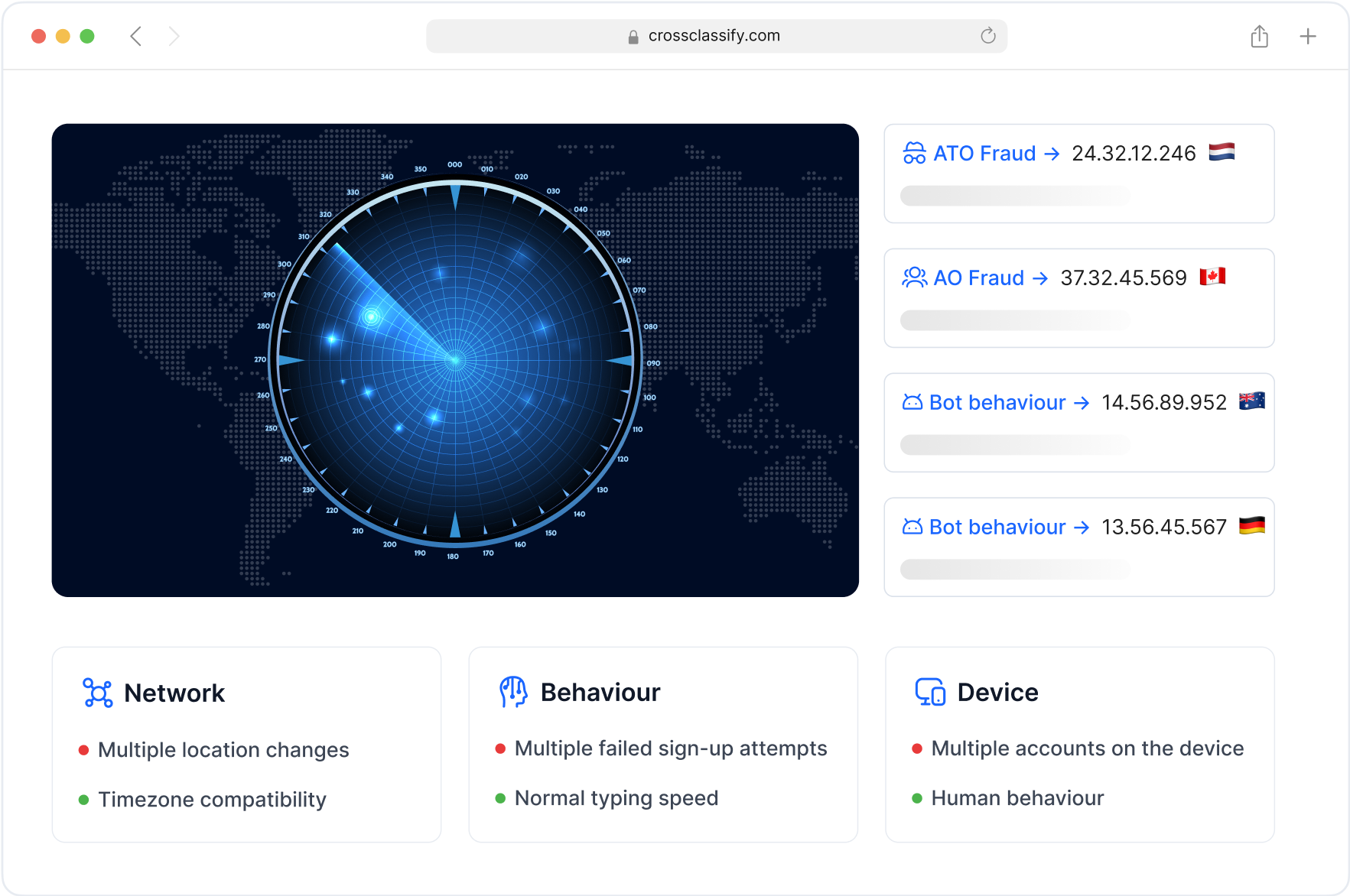

Continuous Monitoring

Keep your business secured 24/7 with our continuous monitoring tool. Stay ahead of fraudsters with real-time data and insights.

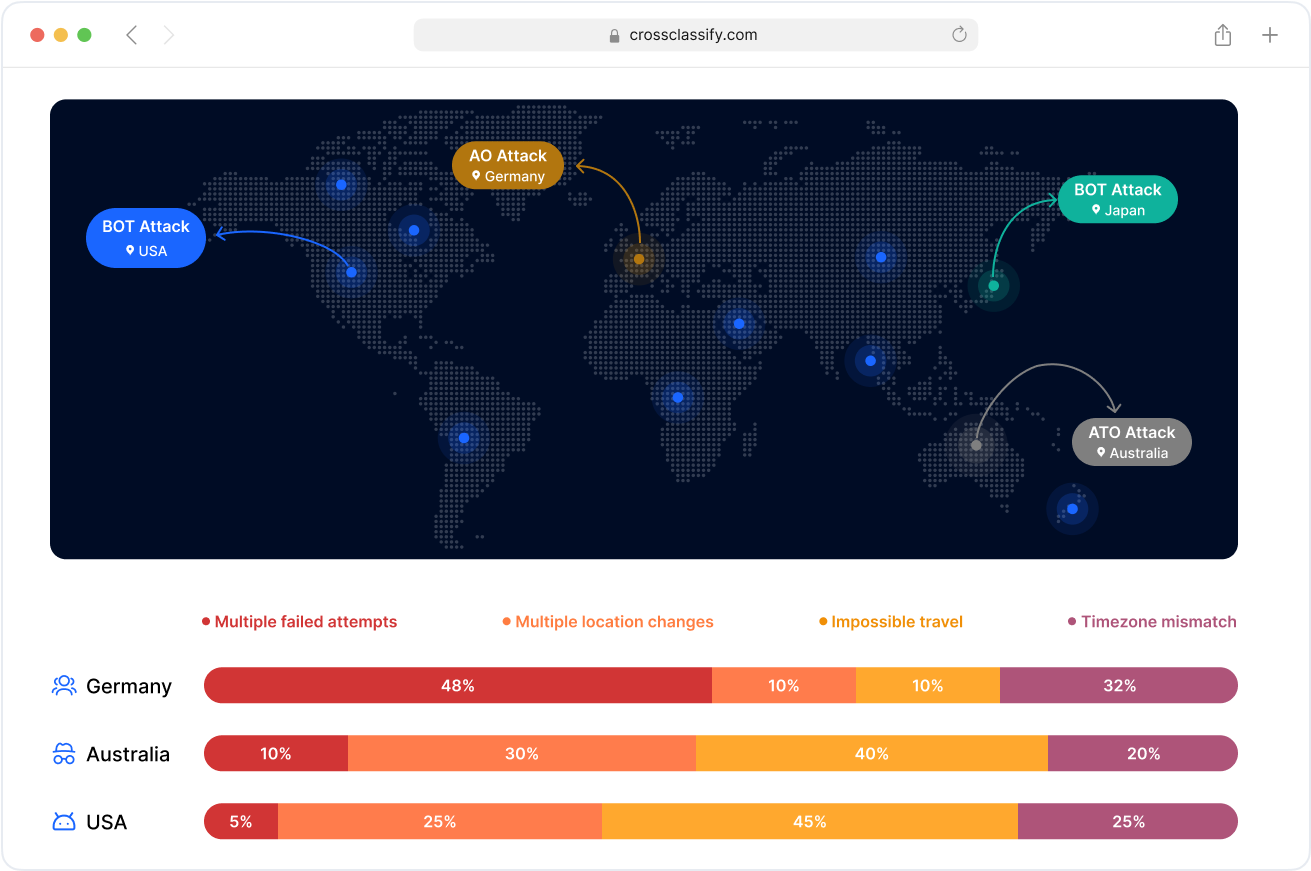

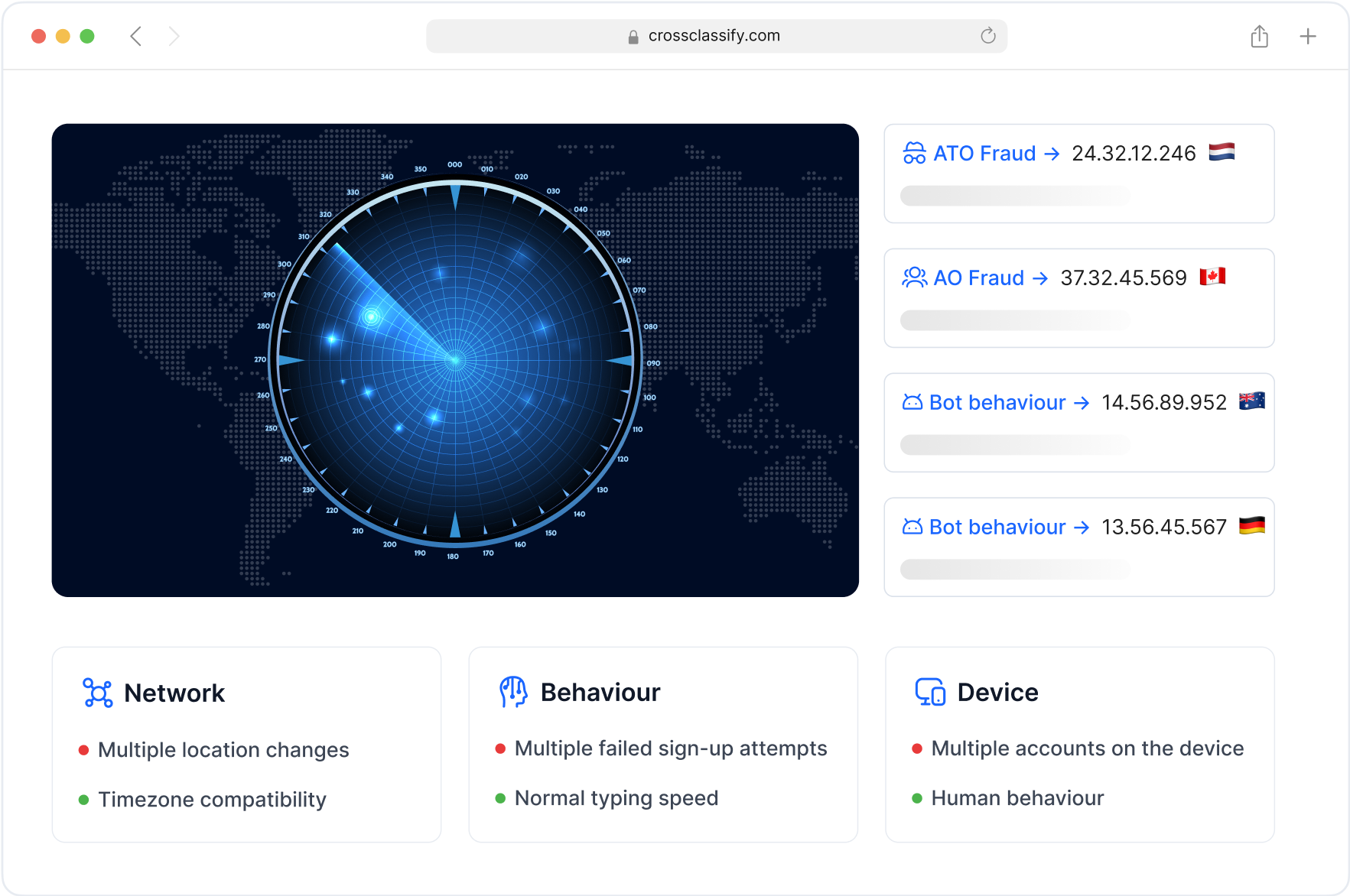

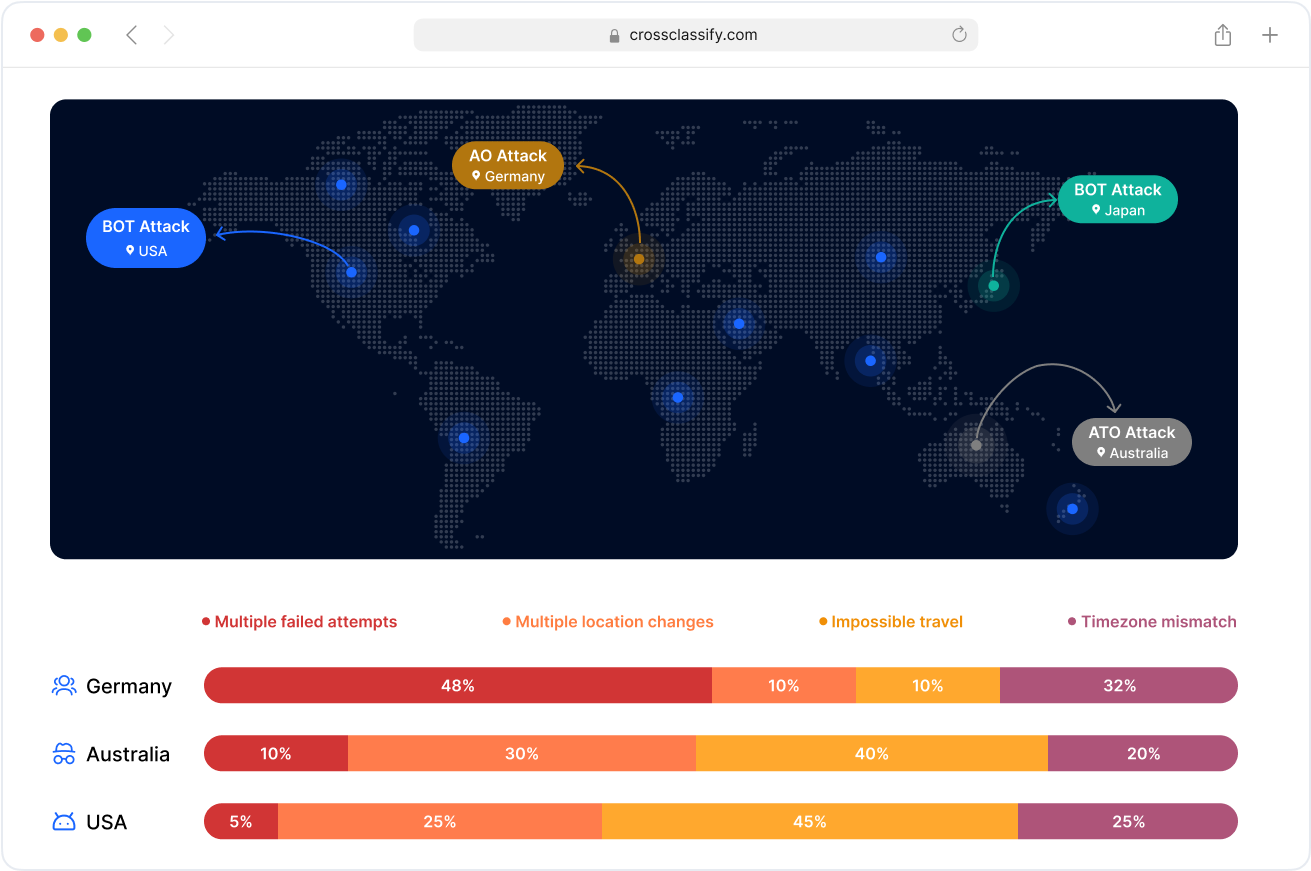

Geo Analysis

Analyze user accounts and detect inconsistencies or high-risk locations. Geo analysis discovers fraudulent access attempts from unexpected locations with high precision.

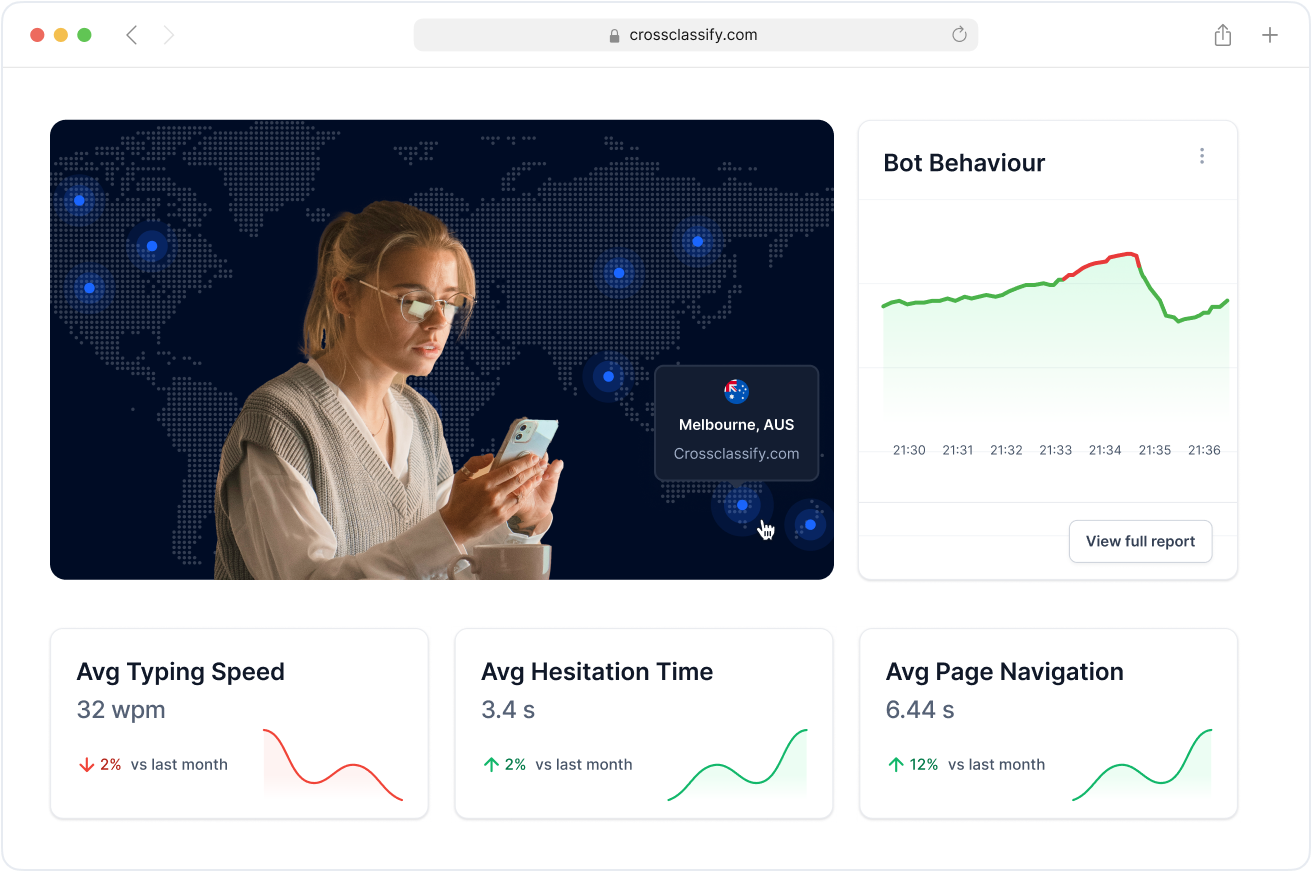

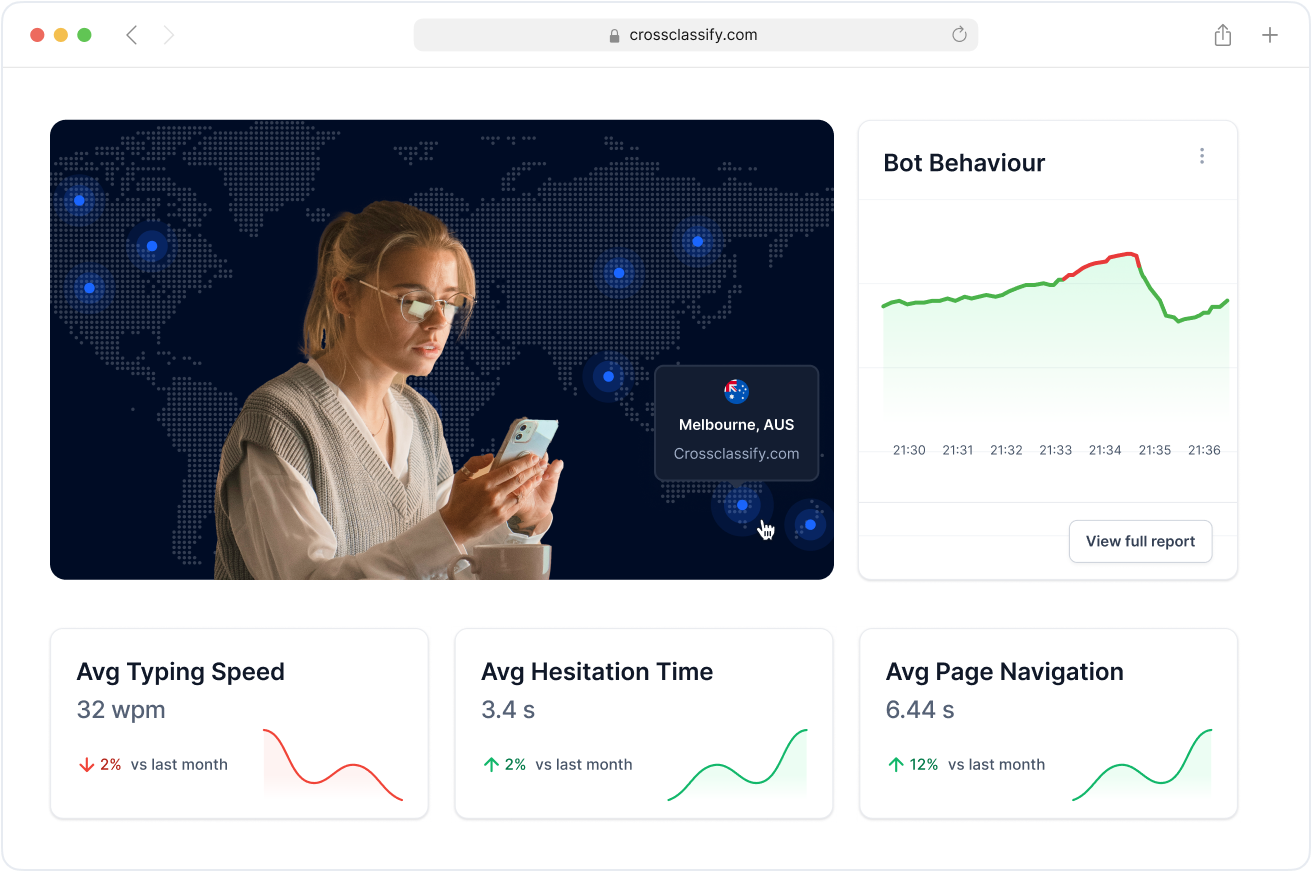

Behavior Analysis

Monitor user interactions in real time to identify unusual patterns. Our AI-powered behavior analysis quickly flags anomalies that could indicate fraudulent activity.

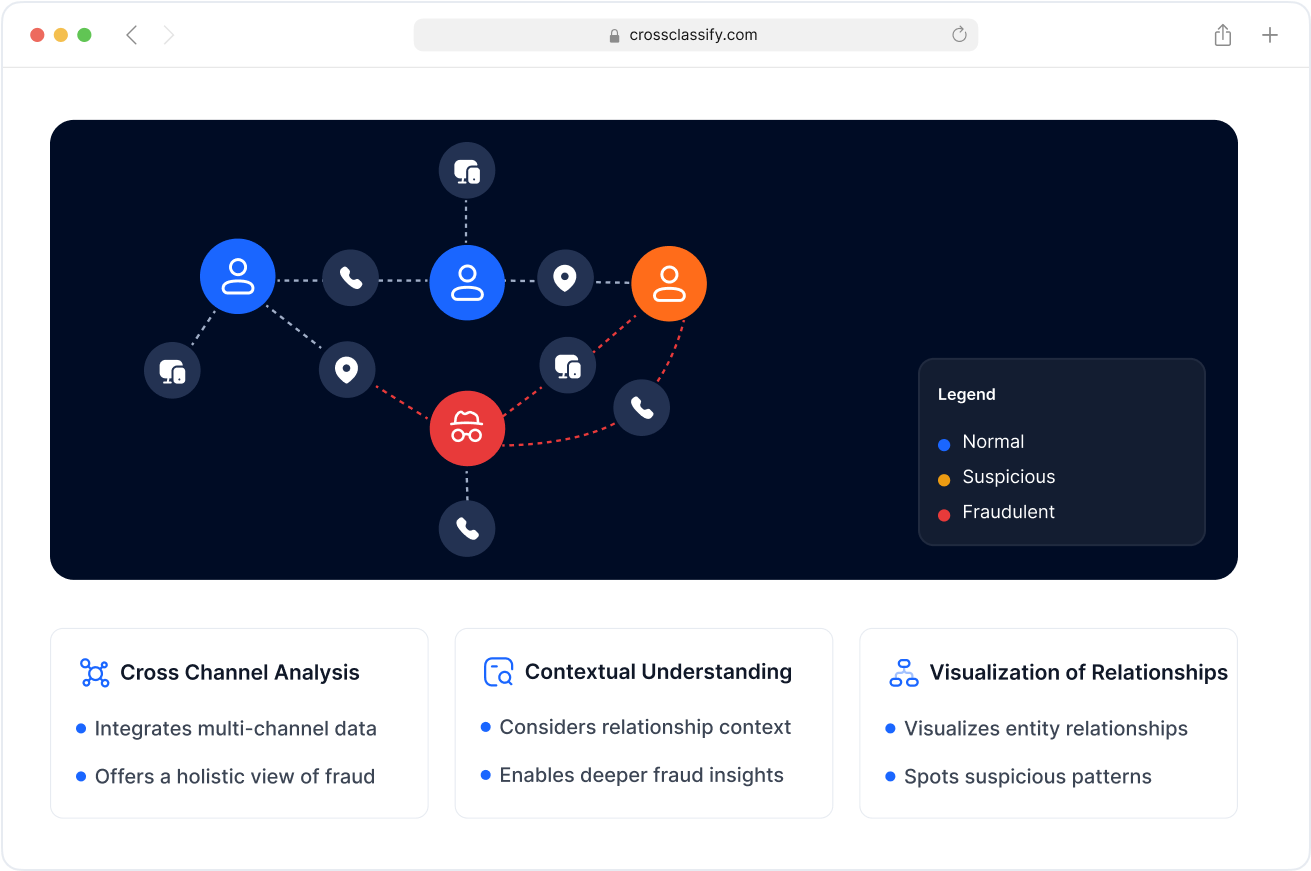

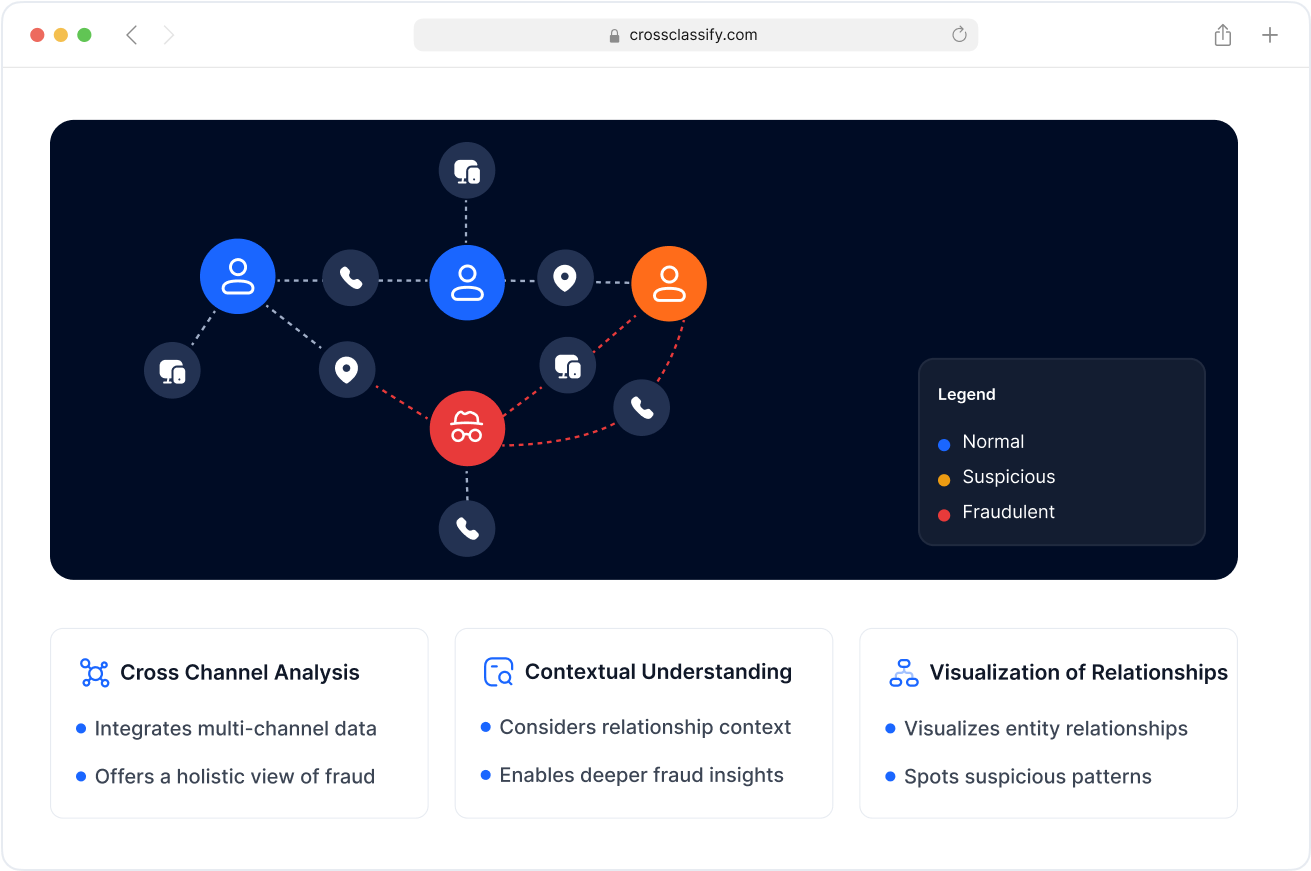

Link Analysis

Uncover hidden patterns with our advanced link analysis, empowering you to detect and prevent fraud through network connections between accounts, devices, and locations.

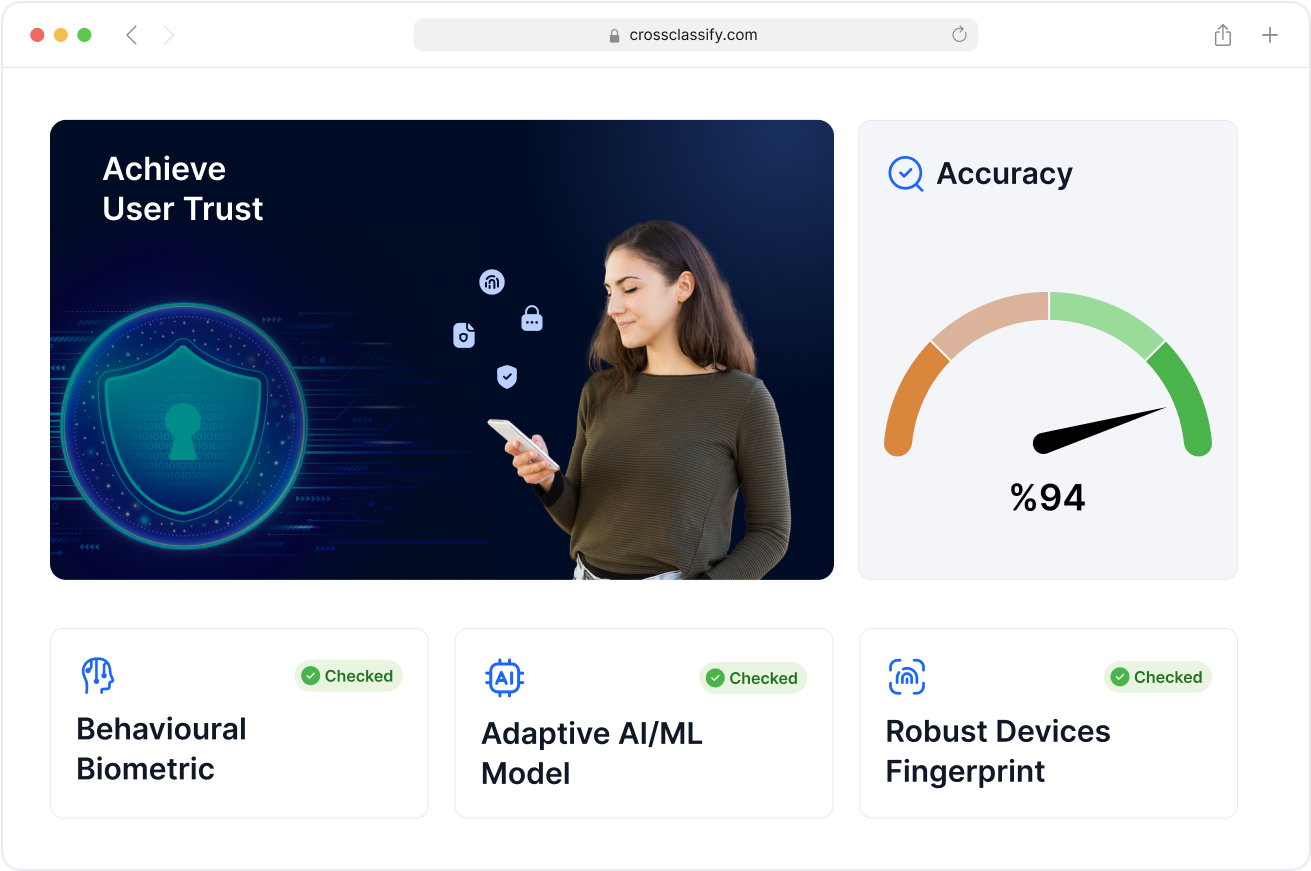

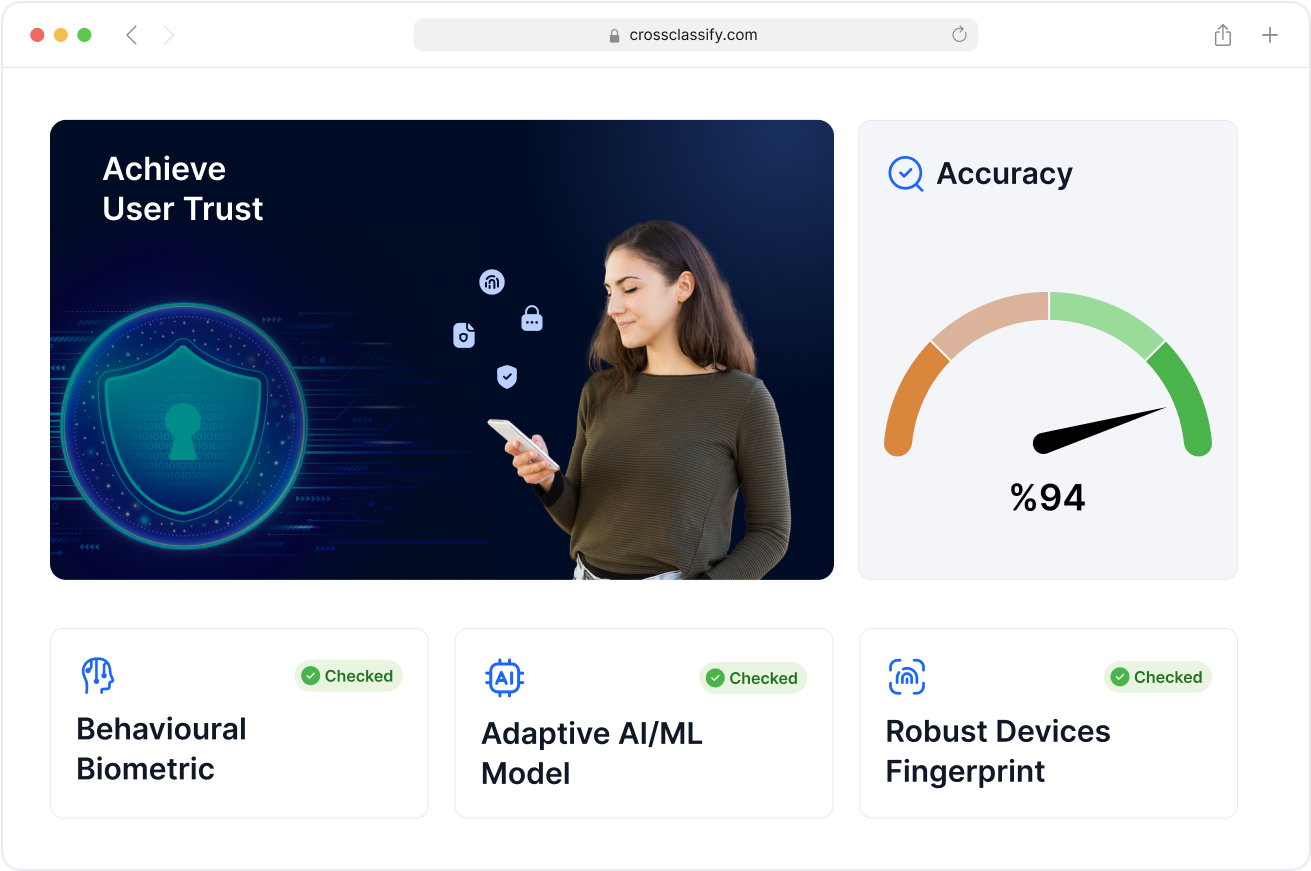

Enhanced Security and Accuracy

Achieve superior fraud detection with minimized false positives and negatives. Our adaptive technology evolves with new fraud methods, ensuring accuracy and building trust over time.

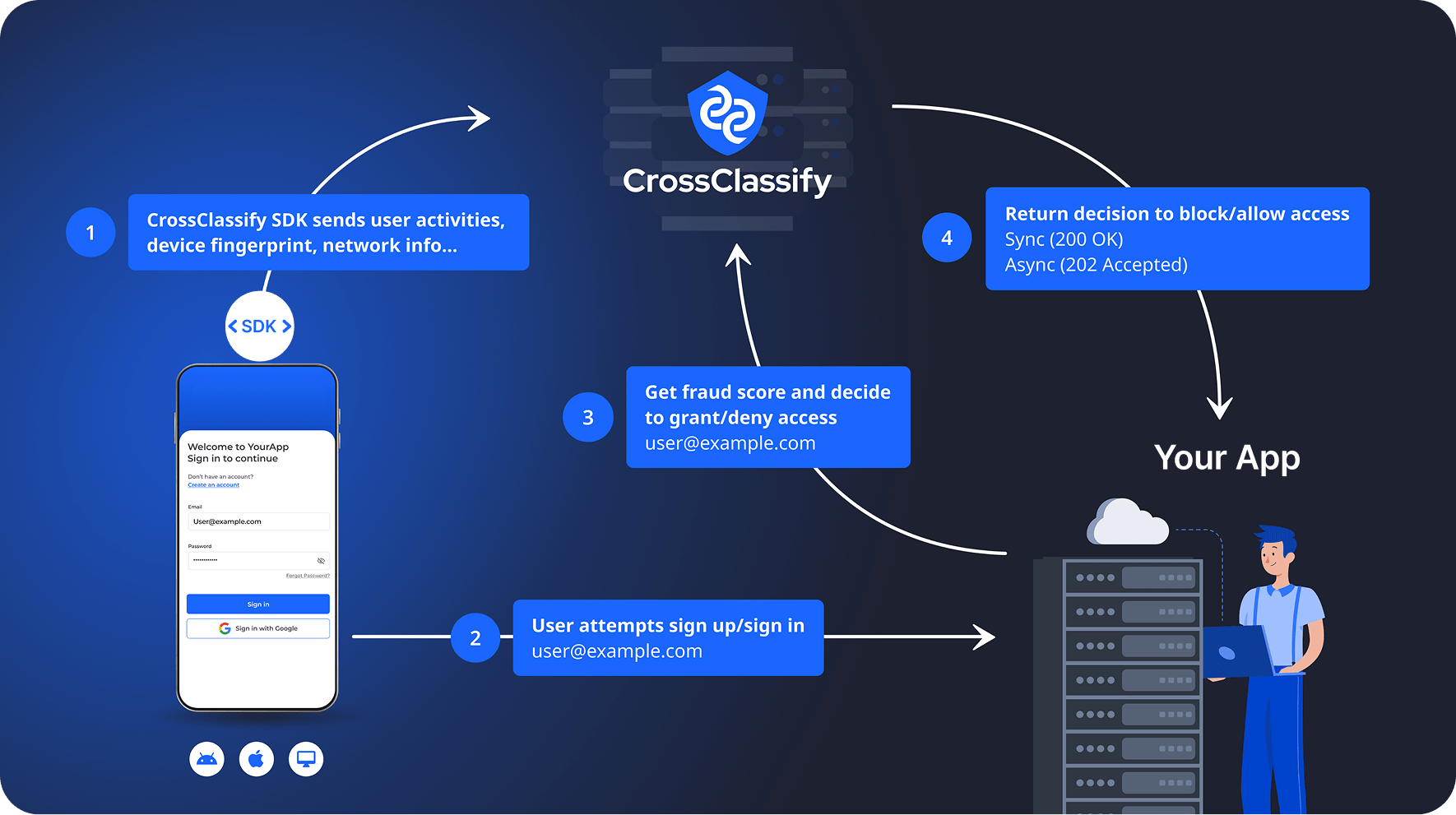

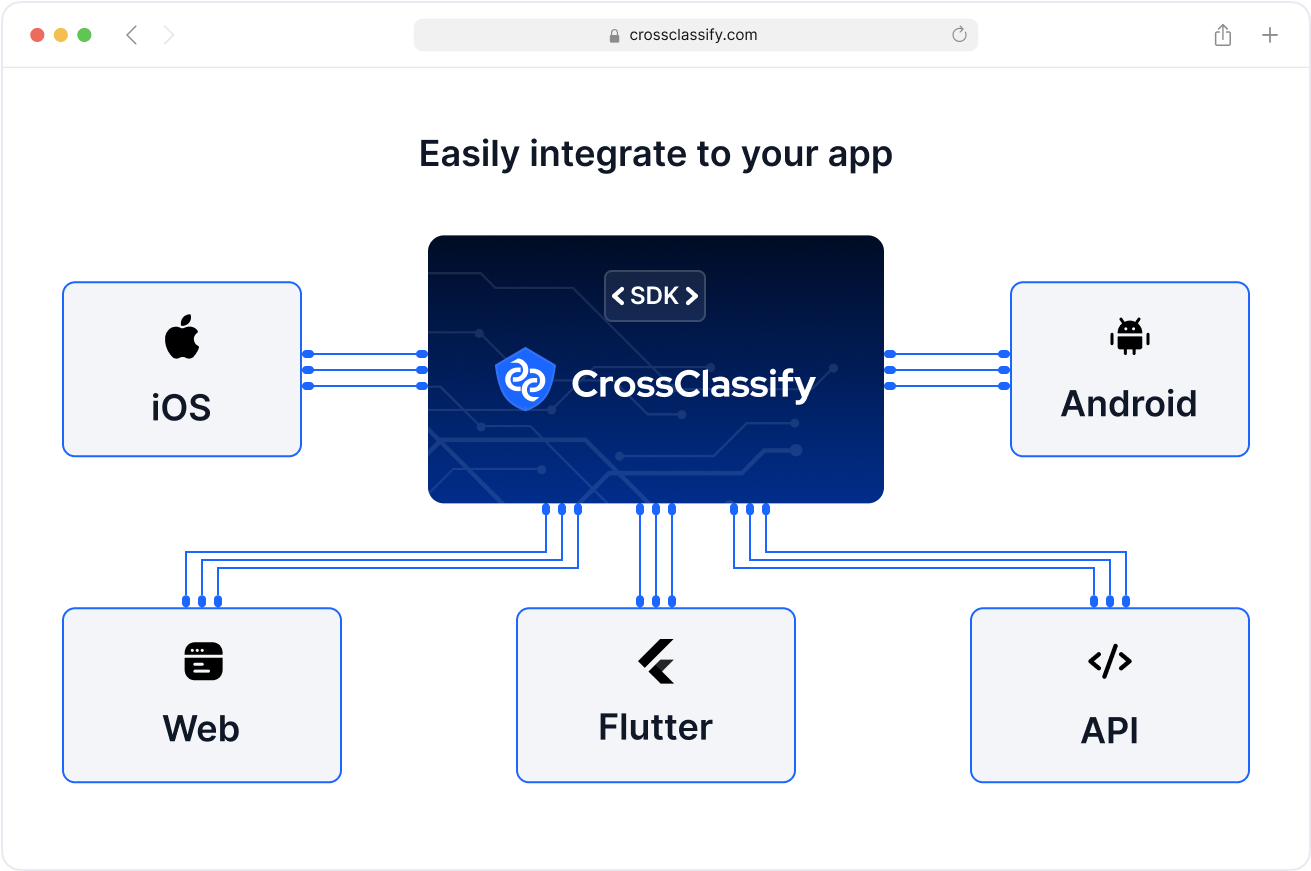

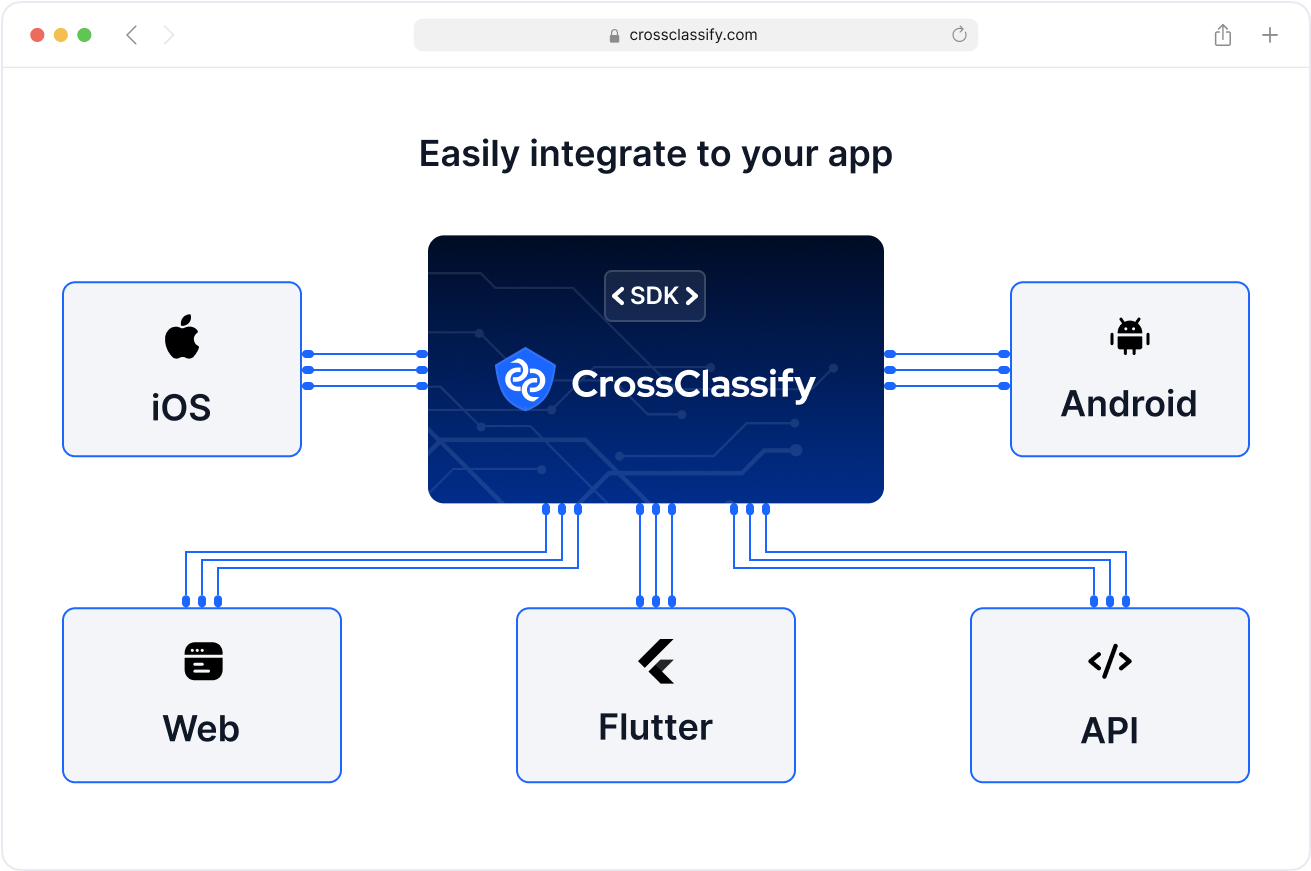

Seamless Integration

Easily integrate CrossClassify with your existing apps using our versatile SDKs available for different platforms (such as iOS, Android, Flutter, and more). Ensuring a smooth setup and seamless operation without disrupting your workflows.

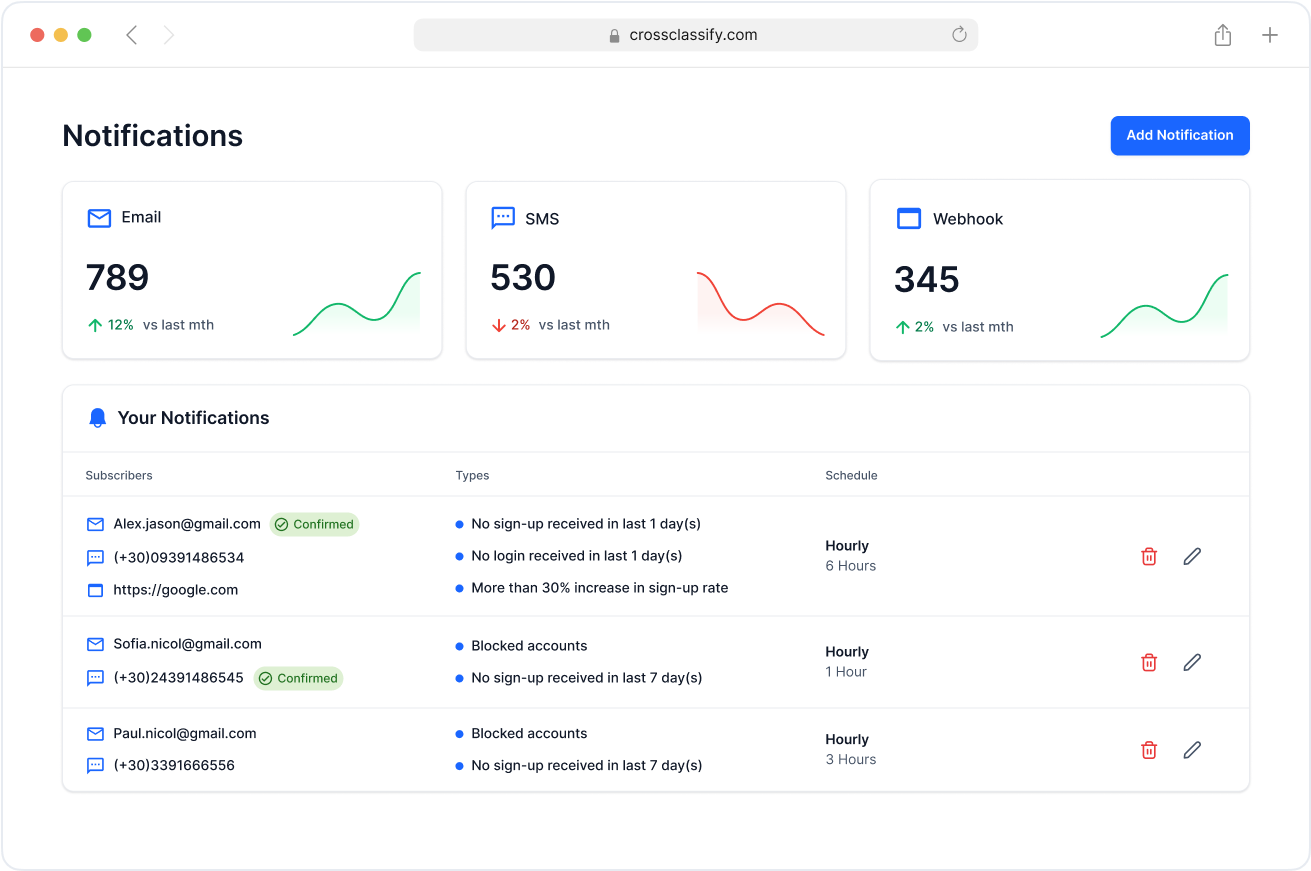

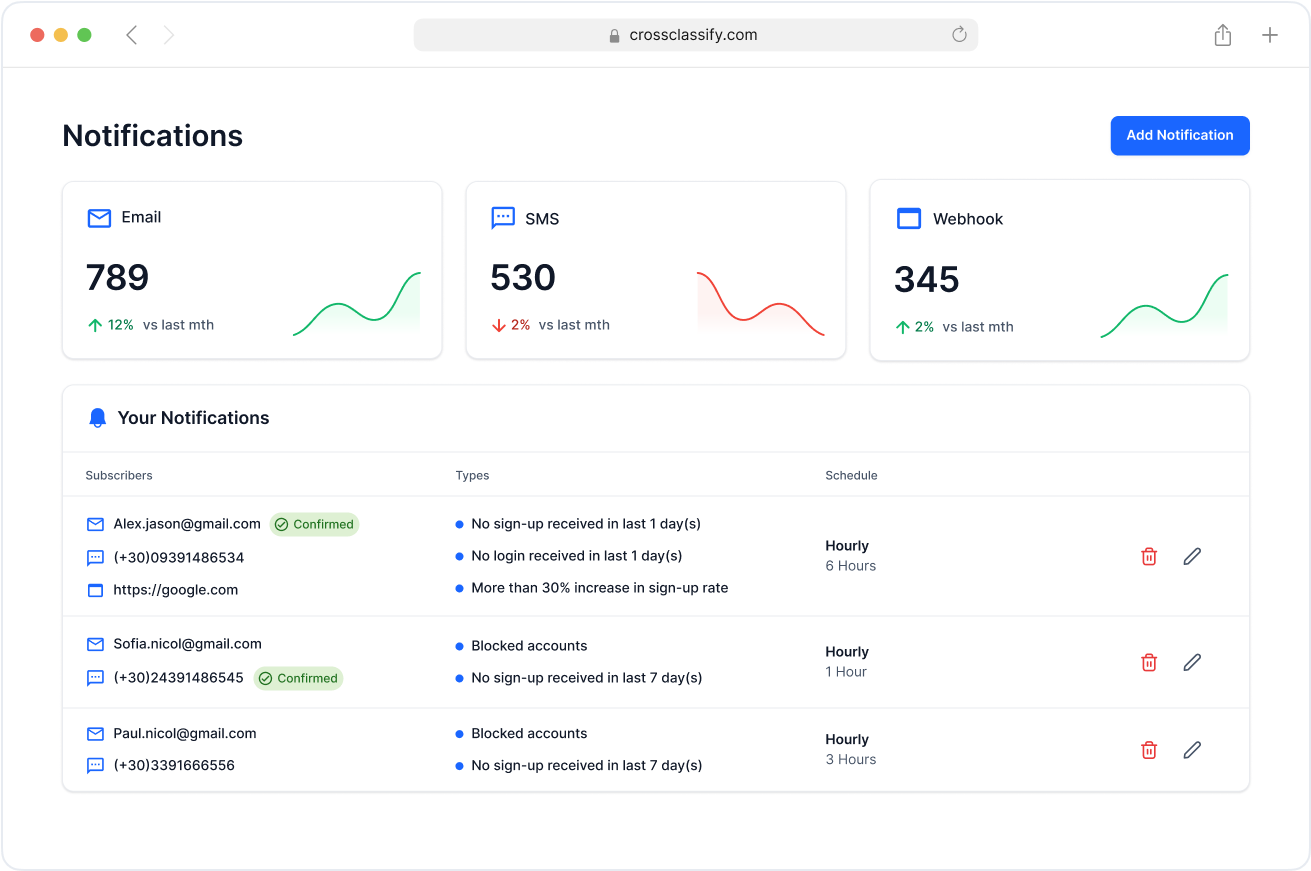

Alerting and Notification

Stay informed with instant alerts and notifications about high-risk activities, ensuring you take immediate action when it matters most.

Continuous Monitoring

Keep your business secured 24/7 with our continuous monitoring tool. Stay ahead of fraudsters with real-time data and insights.

Geo Analysis

Analyze user accounts and detect inconsistencies or high-risk locations. Geo analysis discovers fraudulent access attempts from unexpected locations with high precision.

Behavior Analysis

Monitor user interactions in real time to identify unusual patterns. Our AI-powered behavior analysis quickly flags anomalies that could indicate fraudulent activity.

Link Analysis

Uncover hidden patterns with our advanced link analysis, empowering you to detect and prevent fraud through network connections between accounts, devices, and locations.

Enhanced Security and Accuracy

Achieve superior fraud detection with minimized false positives and negatives. Our adaptive technology evolves with new fraud methods, ensuring accuracy and building trust over time.

Seamless Integration

Easily integrate CrossClassify with your existing apps using our versatile SDKs available for different platforms (such as iOS, Android, Flutter, and more). Ensuring a smooth setup and seamless operation without disrupting your workflows.

Alerting and Notification

Stay informed with instant alerts and notifications about high-risk activities, ensuring you take immediate action when it matters most.

Reduce Losses,

Enhance Security

Strengthen your business with AI-driven fraud detection, increasing accuracy and speed to stay ahead of evolving threats.

Boost operational efficiency by up to 45%

Reduce fraud detection time by 90%

Increase fraud detection accuracy to over 95%

Save from $200K annually from fraud prevention

CrossClassify incorporates cutting-edge technologies endorsed by global standards

Why Us

Great choice for your business

Effortless Security Without Compromising User Experience

AI-Powered Fraud Detection

Leverage advanced AI and machine learning to detect evolving fraud patterns with precision. Our tool combines real-time fraud detection, link analysis and behavioral biometrics to identify anomalies proactively.,

Seamless & Easy Integration

Quickly integrate CrossClassify fraud prevention tool into your app with minimal effort. Our streamlined setup process ensures you can start detecting fraud instantly without operational delay.

Frictionless fraud management solution

Protect your business while maintaining a smooth user experience. Our solution minimizes false positives, ensuring legitimate users enjoy uninterrupted service.

Flexible Pricing Options

Choose a pricing plan that suits your business needs. Our fraud detection software offers scalable and transparent pricing to fit businesses of all sizes and budgets.

Blog

Featured insights from СrossClassify

Access our latest resources on fraud detection and prevention

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required