Download our Whitepaper: Key Insights & Strategic Takeaways

Cybersecurity for Online Gaming

Keep Your Players,

Block the Fraudsters

Prevent account takeovers without compromising the gaming experience.

Stats on Online Gaming Breaches

54%

Rise in online Gaming Fraud

Online gaming fraud jumped 64% in a two-year span.

$0.0B

First-Party Fraud Losses

online Gaming operators lost $2.8 billion, with over half the losses coming from bets under $100.

0%

Logins as ATO Attempts

Around 4% of gambling platform logins have been takeover attempts.

Why Online Gaming Data Security Matters

Account Takeover Leads to Asset Theft

When player accounts are compromised, wallets, skins, and reputations are at risk. CrossClassify uses adaptive authentication and behavior monitoring to stop account takeover in online gaming platforms before damage occurs.

Bonus Abuse Erodes Operator Profits

Fraudsters use fake accounts or multi-accounting to exploit sign-up promotions and deposit bonuses, draining marketing budgets. CrossClassify detects bonus abuse in online Gaming platforms by profiling user behavior and blocking suspicious promo loops.

Multi-Account Fraud Skews Gameplay Fairness

Repeat account creation inflates user metrics, enables chip dumping, and distorts leaderboards in competitive gaming. Our platform detects multi-accounting in online gaming systems through link and device intelligence.

In-Game Bots Threaten Player Trust

Automated bots manipulate in-game economies and ruin real-player experiences across multiplayer environments. CrossClassify enables bot fraud prevention for online gaming operators, ensuring fair play and real-time detection.

Blog

Latest from Cross Classify

Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

Protect player wallets and loyalty programs from hijackers

Reduces account takeover incidents by up to 68%

30%

of ATO victims stop playing after a breach

+52%

of online Gaming fraud cases involve account takeover

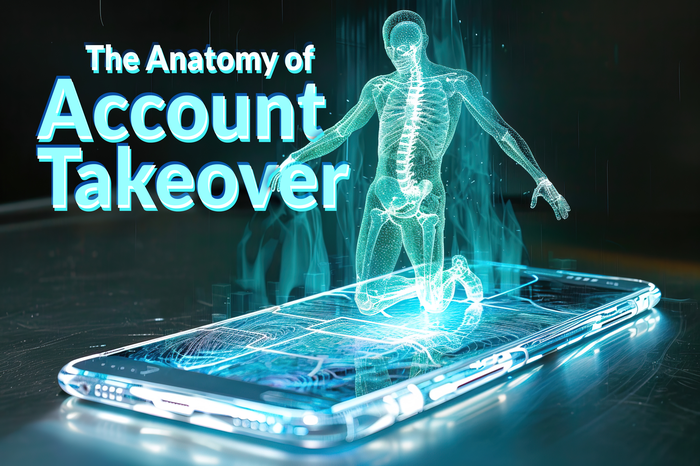

How We Prevent Account Takeover

Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

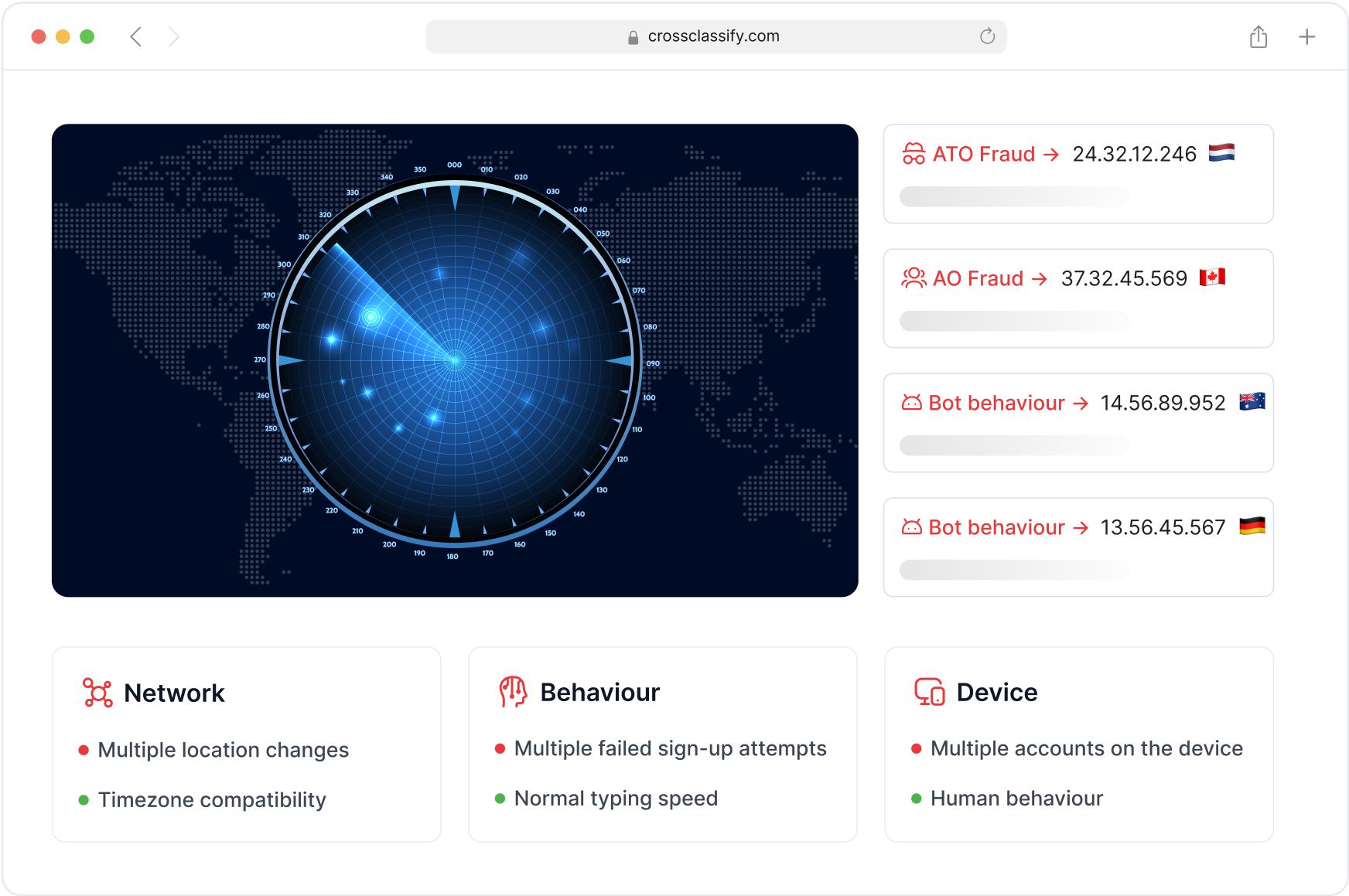

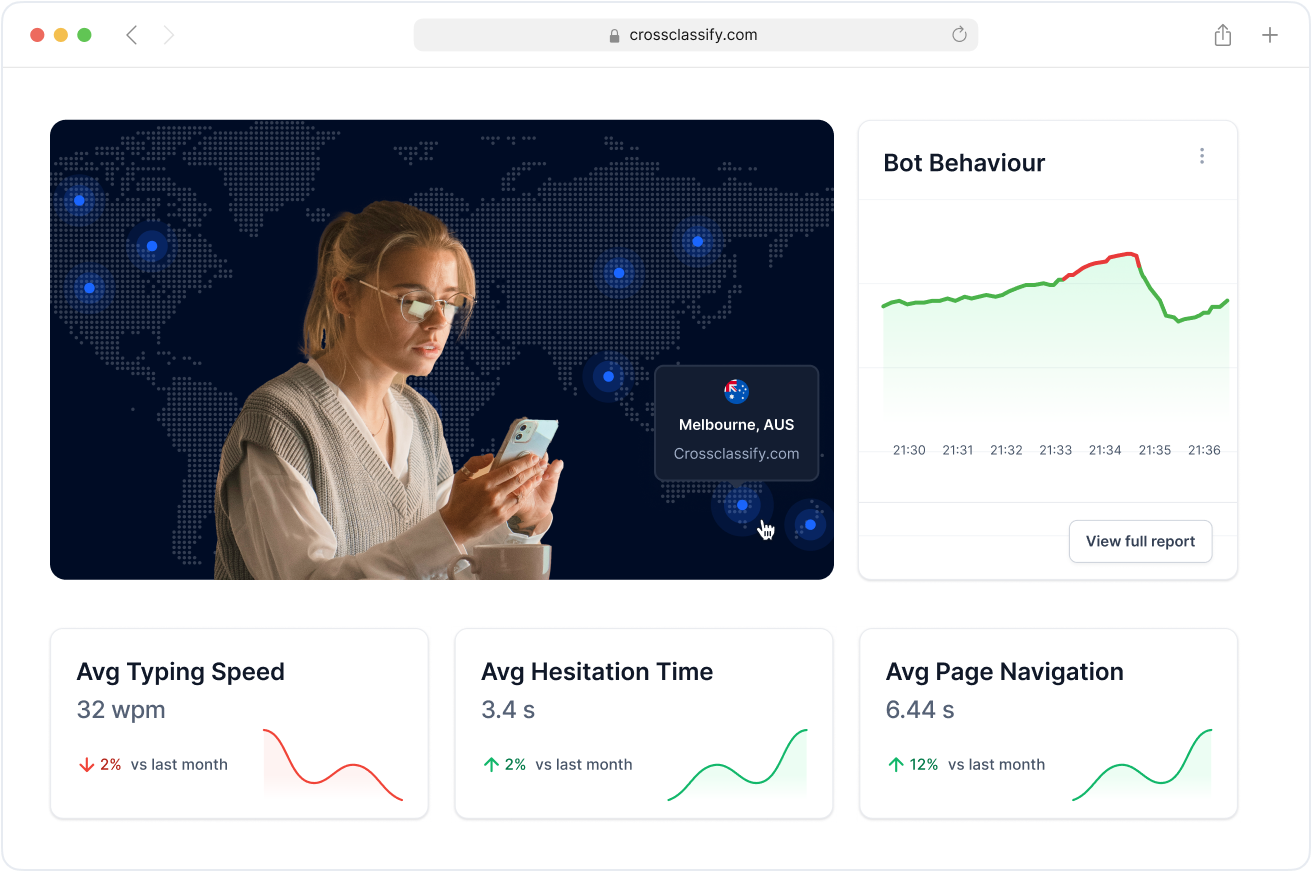

Learn More ❯Continuous Monitoring for online Gaming Sessions

In fast-paced online Gaming environments, fraud can occur post-login during gameplay or wallet interactions. CrossClassify enables continuous monitoring for online gaming platforms, detecting suspicious behavior across player sessions, from signup to withdrawals. This ensures uninterrupted risk scoring that adapts in real time to evolving threats like bonus abuse or account takeover .

Behavior Analysis for Gaming Activity

Player behavior varies across gaming genres and formats, making static rules unreliable. CrossClassify uses behavioral analysis in online Gaming fraud detection to learn individual player habits, flagging anomalies like login pattern shifts, wager abuse, or bot-like interactions. This approach stops fraud that bypasses traditional authentication.

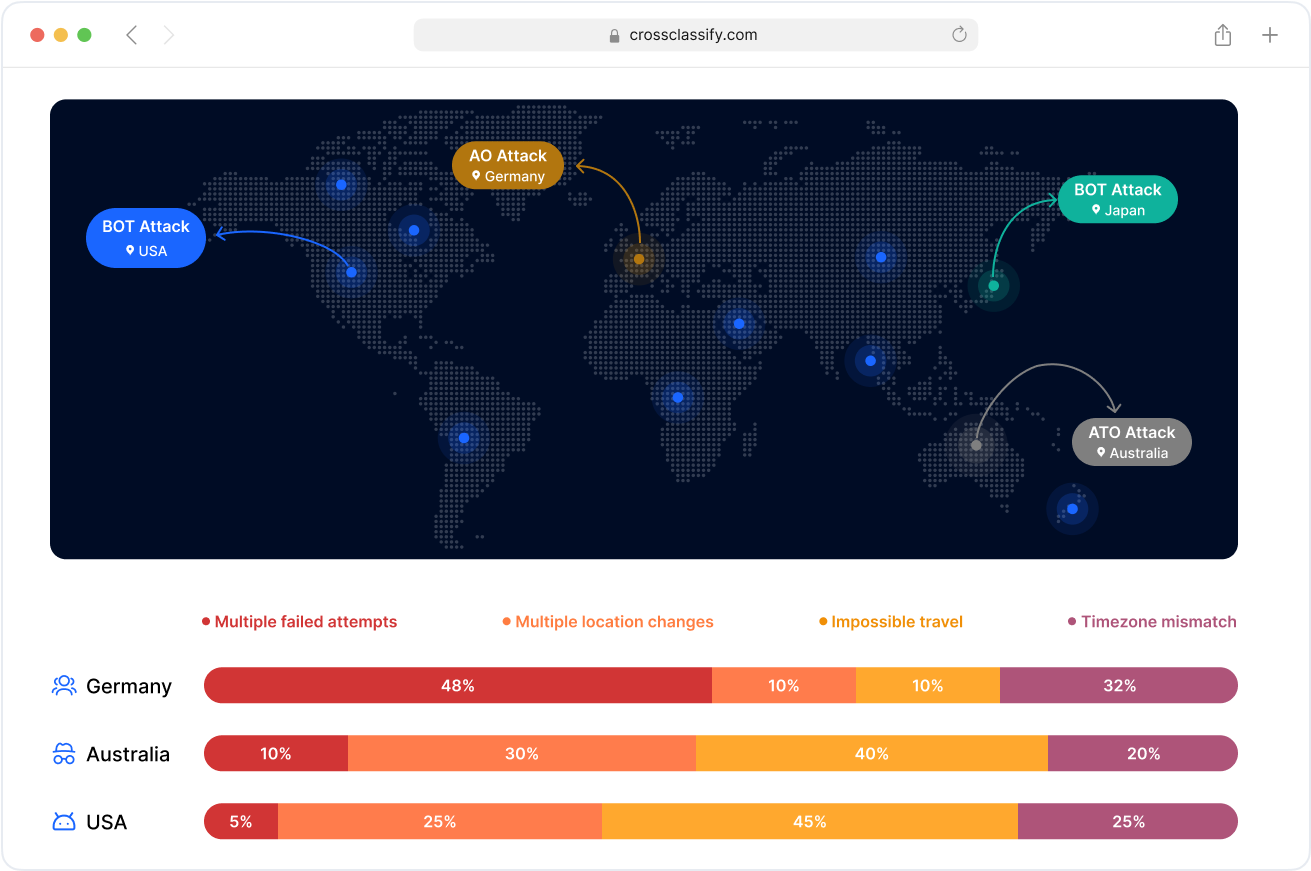

Geo Analysis for Cross-Region Promo Abuse

Fraudsters often exploit geo-restricted promotions using VPNs and multi-accounting tactics. Our geo analysis for online gaming fraud detection identifies impossible travel scenarios, device mismatches, and fraudulent location claims to stop cross-border abuse.

Link Analysis for Multi-Account Gaming Fraud

Multi-accounting is a major threat in online casinos and esports betting. CrossClassify’s link analysis for online Gaming account fraud uncovers hidden connections between users, shared devices, payment methods, and IPs—exposing fraud rings and bonus abuse loops.

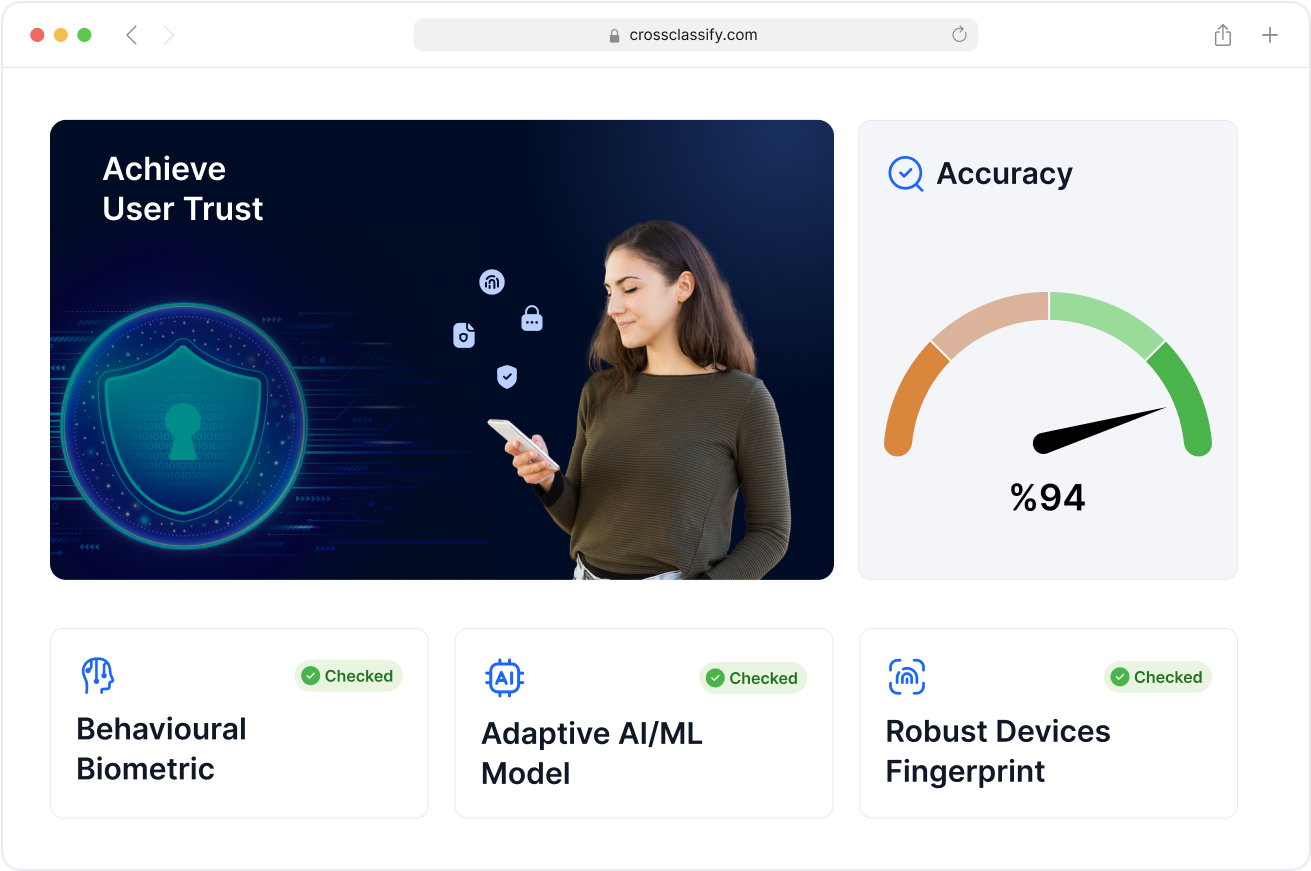

Enhanced Security and Accuracy for Gaming Operators

Traditional fraud tools often miss dynamic threats like bot activity, promo abuse, or session hijacking. CrossClassify delivers enhanced fraud detection accuracy for online Gaming platforms by layering device intelligence, behavioral scoring, and player risk profiles for superior threat precision.

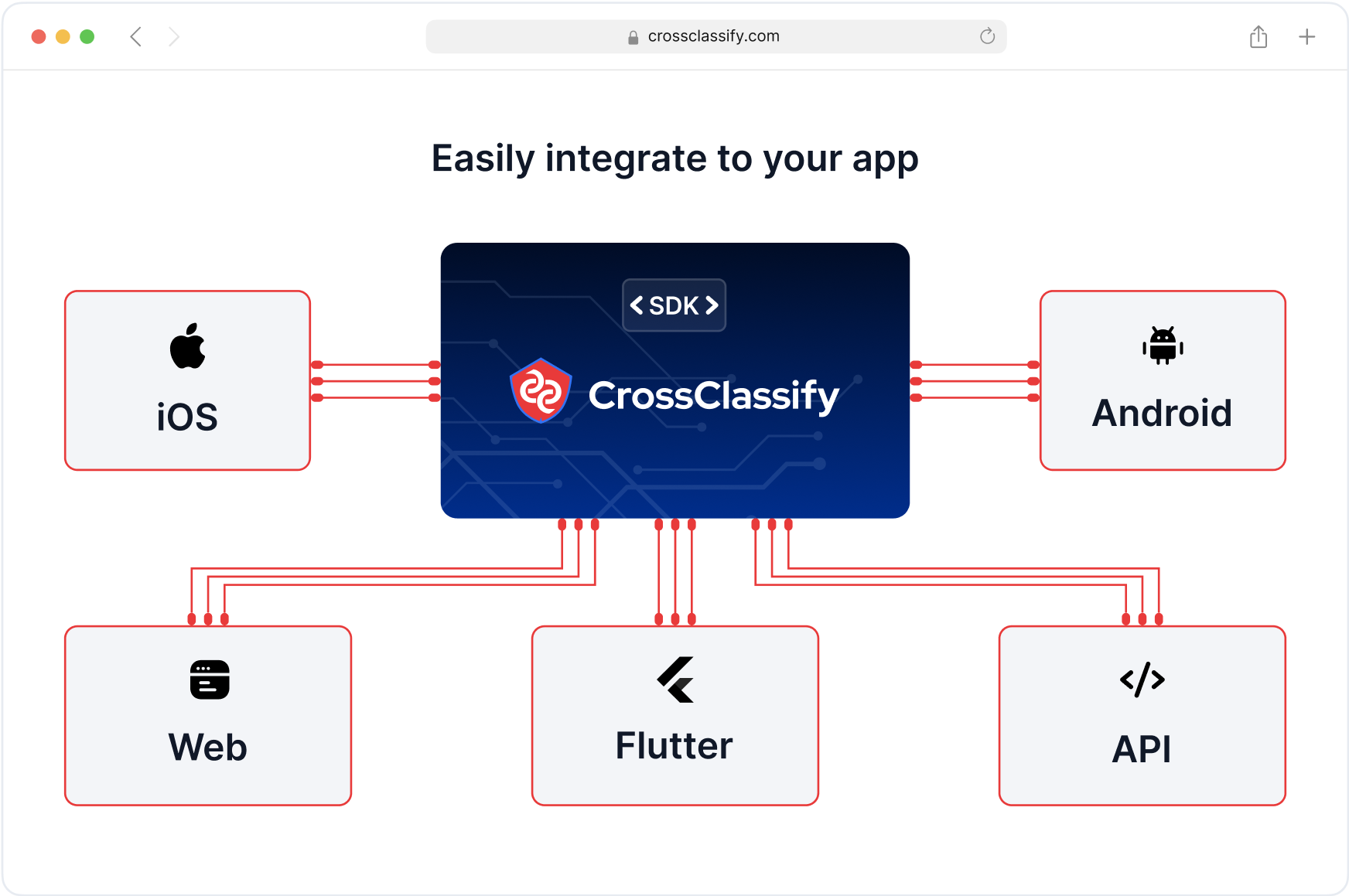

Seamless Integration with Gaming Tech Stacks

CrossClassify fits effortlessly into your online Gaming infrastructure, from sportsbook engines to casino management systems. Our fraud prevention API for online gaming integration supports fast deployment with minimal friction—ensuring protection doesn’t slow down your product velocity.

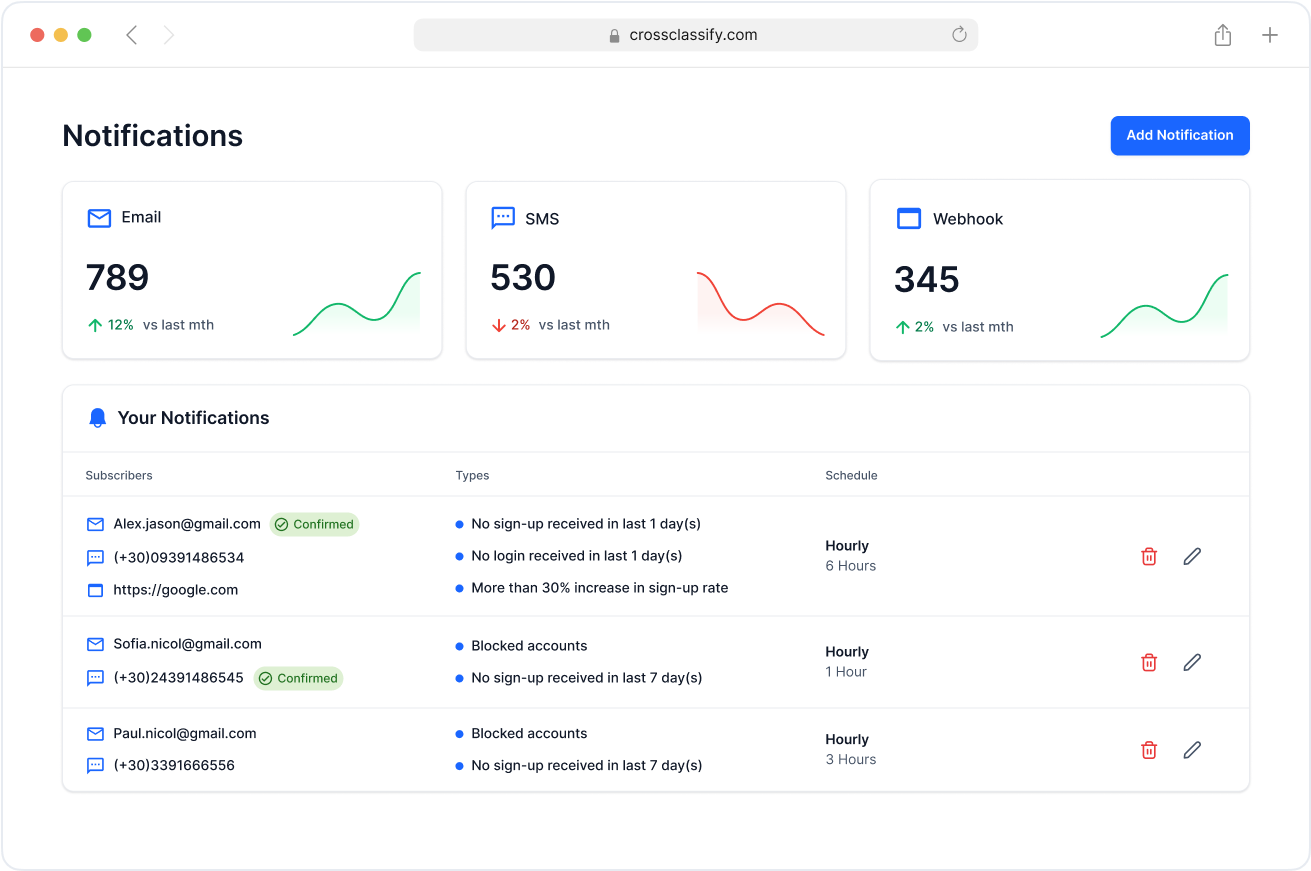

Real-Time Alerting and Notification for Fraud Incidents

Gaming platforms need instant visibility into risk spikes—from high-velocity betting to login anomalies. CrossClassify’s fraud alerting system for online Gaming platforms notifies your security team the moment suspicious activity is detected, enabling proactive resolution before financial loss.

Compliance

From Compliance to Trust

Anti-Money Laundering (AML) Regulations

Require online Gaming companies to detect and prevent money laundering activities by implementing robust monitoring and reporting systems

Resorts World Las Vegas: Agreed to pay a $10.5 million fine over purported AML failures, marking the second-largest penalty in Nevada's history.

General Data Protection Regulation (GDPR)

Mandates the protection of EU citizens' personal data, requiring online Gaming operators to implement stringent data handling and breach notification protocols

888 Holdings: An 888 subsidiary reached a settlement worth £2.9 million with the Gibraltar Gambling Commissioner over VIP-related failings in the Middle East.

Built for iGaming Risk

Unlike generic cybersecurity tools, our platform is purpose-built to combat iGaming fraud vectors like bonus abuse, fake account creation, and chip dumping. We monitor every phase of the player lifecycle to identify threats unique to online casinos, betting apps, and game marketplaces.

Multi-Account & Bot Defense

We specialize in identifying multi-account fraud and in-game bot behavior through advanced device fingerprinting, session correlation, and link analysis. This protects operators from manipulation of tournaments, leaderboards, and affiliate programs.

Frictionless Player Experience

We deliver fraud detection for iGaming with no impact on player satisfaction. Real-time monitoring allows for invisible defense against threats without interrupting onboarding, gameplay, or payment flows.

Frequently asked questions

Read more

Understanding Fraud and Cybersecurity Challenges in the online Gaming Industry.

Read more

Read more

Read more

Read more

Read more

Let's Get Started

Elevate your Online Gaming app's security with CrossClassify. Schedule a personalized demo to see how we protect customer accounts and ensure compliance with industry standards.