Last Updated on 12 Aug 2025

The Hidden Threats in Fintech: Fraud and Cybersecurity Challenges

Share in

Key Notes

•

Over $50 billion in fintech-related fraud losses were reported globally in recent years.•

74% of fintech platforms experienced account takeover attempts in the last 12 months.•

Regulatory non-compliance can cost fintechs up to $5 million annually.

Introduction to the Fintech Industry

The fintech industry represents the convergence of finance and technology, reshaping traditional financial services into more accessible, digital-first platforms. From digital wallets to neobanks, fintech apps have enabled faster, cheaper, and more user-centric experiences. As of 2024, the industry spans over 200 countries and impacts nearly 2 billion users globally. These innovations are deeply embedded into everyday life, yet they also expose new attack surfaces for cybercriminals. Understanding fintech's scope is critical for recognizing the magnitude of its fraud and security challenges.

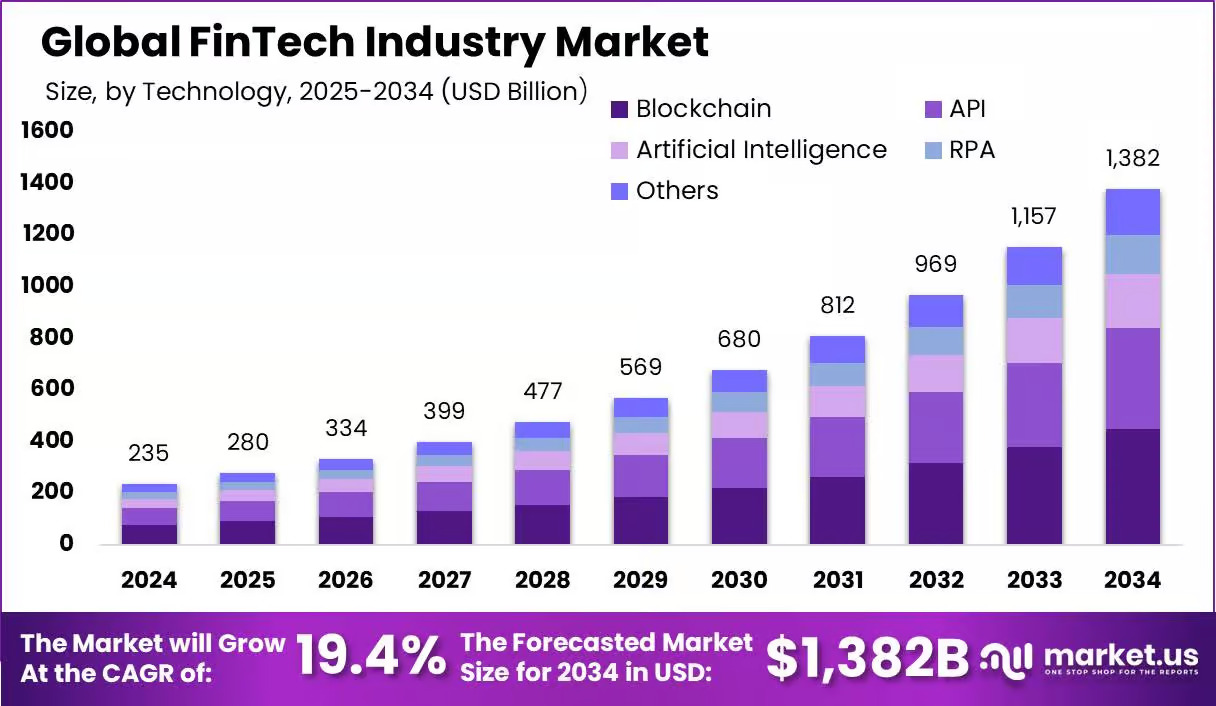

Market Size and Growth of the Fintech Industry

The global fintech market was valued at over $305 billion in recent years and is expected to surpass $500 billion by 2027. With over 26,000 fintech startups and more than 500 million app installs annually, digital transformation is accelerating rapidly. Countries like India, Brazil, and Nigeria are experiencing explosive fintech adoption. Additionally, fintech platforms boast more than 1,500 implementation partners and support ecosystems that include insurance tech, lending APIs, and regtech integrations. This scale also multiplies the opportunities for fraud vectors to emerge.

Source: Market.us

Fraud Size in the Fintech Industry

Fraud losses in fintech are staggering. According to LexisNexis, the cost of fraud for digital financial services has risen 41% since recent years. Common fraud vectors include synthetic identities, stolen credentials, and bot-driven attacks. The shift to remote interactions during the pandemic created new vulnerabilities, especially for mobile-first applications. AI-powered fraud detection and risk scoring tools are essential to reduce these losses and improve threat visibility.

Real-World Cases of Fraud in Fintech

Real-world cases show the tangible risks fintech platforms face from both internal vulnerabilities and external threats. Below are notable examples of fraud that shook the fintech industry and highlight the need for advanced security:

•

Revolut Data Breach (2022): In September 2022, Revolut suffered a data breach that affected over 50,000 customers worldwide. Attackers accessed sensitive customer data due to a social engineering attack on a Revolut employee. This incident shows how a single human vulnerability can expose critical infrastructure.•

FTX Collapse (2022): The FTX crypto exchange collapsed due to a combination of internal fraud, lack of transparency, and poor governance. Billions of dollars in customer funds were misused, and over one million customers were affected. The case underscores the importance of internal fraud detection and continuous risk auditing. (source)•

Cash App Fraud (2023): Block Inc. revealed that a former employee downloaded reports containing personal data of over 8 million users of its Cash App investing platform. The insider had access even after departure, exposing failures in offboarding and access control.•

Robinhood Phishing Incident (2021): A hacker used social engineering to gain access to customer support systems, leaking personal data of over 7 million Robinhood users. This breach illustrates the impact of inadequate internal control over support platforms.•

Zelle Payment Scams (2022-2023): Fraudsters exploited Zelle to trick users into authorizing instant payments to criminals. Although the transactions were authorized, users were unaware of the fraud. This case raised legal and regulatory questions around fintech platform responsibility. (source)

These examples reinforce that both technology-driven attacks and insider negligence must be addressed through layered, adaptive security systems.

Main Consequences of Not Being Protected Against Fraud and Data Breaches

Failing to protect against fintech fraud and data breaches can have severe consequences on multiple fronts:

•

Financial Loss: Fraudulent transactions, chargebacks, and regulatory fines cost fintechs millions annually. According to IBM, the average cost of a data breach in financial services reached $5.9 million in 2023.•

Reputational Damage: In the fintech sector, trust is everything. A single security incident can erode customer confidence, leading to mass user churn and plummeting valuations, especially for publicly traded or venture-backed firms.•

Legal and Compliance Costs: Regulatory bodies impose steep penalties on platforms that fail to comply with GDPR, PSD2, and KYC/AML mandates. These fines are compounded by class-action lawsuits and the cost of post-breach remediation.•

Loss of Operational Continuity: In the wake of a breach, fintech platforms often must halt operations to conduct audits, freeze assets, and investigate root causes, resulting in lost revenue and customer dissatisfaction.•

Investor and Partner Risk: Data breaches damage stakeholder confidence. Fintech companies relying on strategic partnerships or VC funding may face funding delays, partnership terminations, or acquisition fallout.

Failure to implement proactive, AI-based fraud detection exposes fintech companies to risks that jeopardize both short-term operations and long-term sustainability.

Compliance & Regulatory Pressures in the Fintech Sector

The fintech sector is tightly regulated due to its sensitive role in handling consumer data, payments, and lending. Companies must comply with international, regional, and industry-specific regulations:

•

GDPR: Enforces data privacy for EU citizens. Non-compliance may lead to fines of up to 4% of annual global turnover.•

PSD2: Requires Strong Customer Authentication (SCA) for electronic payments, which many fintechs must implement to operate legally in the EU.•

KYC/AML Regulations: Financial institutions must validate the identity of users and monitor transactions for money laundering. Failing this can lead to severe criminal liabilities.•

PCI DSS: Ensures the secure handling of cardholder data, especially for fintechs that process payments or store card credentials.•

SOC2 and ISO/IEC 27001: These certifications demonstrate secure handling of data and are essential for fintechs seeking to work with enterprise clients or financial institutions.

These regulatory frameworks demand not only compliance but also verifiable audits, monitoring, and reporting, often requiring fraud risk management solutions embedded into the fintech stack.

Fraud Types in the Fintech Industry: Stats and Case Studies

Fraud in fintech comes in multiple forms, each evolving with new technologies. Here are the most common and critical types:

•

Account Opening Fraud: This occurs when cybercriminals use stolen identities or deepfake documents to open fintech accounts. According to Javelin Research, over 1.3 million U.S. adults were victims of new account fraud in recent years.•

Account Takeover Fraud: Attackers gain control of legitimate accounts through phishing, credential stuffing, or SIM swapping. See detailed analysis in The Anatomy of Account Takeover.•

Bot and Automation Attacks: Fraudsters deploy bots to register fake accounts, perform card testing, or execute microtransactions. These attacks operate at scale and often bypass CAPTCHA systems.•

Payment Fraud: Includes fraudulent chargebacks, triangulation scams, and misuse of stolen payment credentials. Fraudulent transactions can inflate operational costs and damage customer satisfaction.•

Synthetic ID Fraud: This advanced attack combines fake and real information to create new digital personas, making them harder to detect. These accounts appear genuine, pass KYC, and can remain dormant for months before executing fraud.

Each of these fraud types can be tackled more effectively using AI-driven tools like device fingerprinting and behavioral analysis.

Insider Threats in Fintech: The Overlooked Danger

Fintech platforms often overlook the dangers posed by insider threats. As detailed in this article, insiders are not always malicious. They fall into distinct categories:

•

Negligent Employees: These insiders may use weak passwords, fall victim to phishing, or accidentally expose sensitive data.•

Malicious Insiders: Former or current employees who knowingly steal, sell, or delete company data for personal or financial gain.•

Third-party Vendors: Contractors or partners with excessive access to internal systems, increasing attack surfaces.•

Shadow Access: Employees or admins who circumvent security policies using unauthorized tools or sharing credentials.

To combat insider threats, fintechs must implement visibility tools, contextual access controls, and anomaly detection systems.

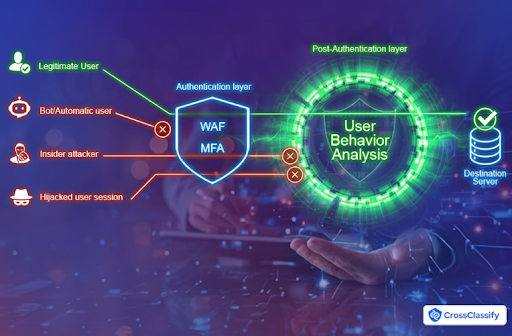

Why MFA and WAF Are Not Enough to Stop Modern Fintech Fraud

While multi-factor authentication (MFA) and web application firewalls (WAF) are foundational components of cybersecurity, they are no longer sufficient to block today's sophisticated fraud vectors.

As emphasized in this article:

•

Static Protection Limitations: MFA can be bypassed through SIM swapping or phishing. WAFs fail to stop behavioral anomalies or device-level spoofing.•

Latency in Response: MFA and WAF act at login or request-level events but miss continuous anomalies that occur after authentication.•

No Behavior Context: These tools do not track mouse movement, typing cadence, or session switching, key behavioral biometrics needed to detect fraud.

Modern fintech security requires layered solutions that analyze user behavior, fingerprint devices, and provide real-time fraud scoring beyond the login event.

New Fraud Vectors in 2024 and Beyond: Emerging Risks in Fintech

Fintech fraud is evolving rapidly, with new AI-powered and cross-border threats emerging. Key fraud vectors to monitor include:

•

Deepfake KYC Submissions: Criminals now submit AI-generated faces or voice videos to bypass facial recognition systems in onboarding.•

Voice Cloning in Customer Support: Attackers use voice synthesis to impersonate customers over phone-based support, resetting passwords or redirecting funds.•

AI-driven Phishing Campaigns: Personalized social engineering attacks crafted using scraped social media and leaked data.•

Cross-border Mule Networks: Fraud rings operate across jurisdictions, using local fintechs to launder money and avoid detection.•

Real-time Transaction Hijacking: Hackers inject malware into devices to intercept transactions between approval and execution.

Anticipating these emerging vectors requires continuous innovation, AI/ML-driven pattern recognition, and global threat intelligence.

Preventing Fraud During Fintech Onboarding

Onboarding is the first gate for fraud prevention in fintech, and it is also the most exploited entry point. Fraudsters use fake IDs, bots, and even deepfake images to bypass KYC. Common onboarding risks include:

•

Bot Signups: Automated scripts register hundreds of fake accounts to exploit signup bonuses or create sleeper fraud accounts.•

Document Forgery: Fraudsters use altered or generated IDs to pass identity verification.•

Stolen Identity Usage: Criminals apply with real documents acquired via data breaches or the dark web.

CrossClassify combats these threats through real-time device fingerprinting, behavioral analysis, and onboarding risk scoring. Learn more in Avoid Fake Accounts.

How CrossClassify Helps Protect Fintech Organizations from Fraud

CrossClassify offers a tailored suite of fraud detection features for fintech applications:

•

Continuous Monitoring: Fintech environments require uninterrupted oversight. CrossClassify continuously profiles account activity, monitoring shifts in login behavior, transaction spikes, and location anomalies. Read more•

Behavior Analysis: Detect subtle behavioral shifts that suggest fraud, such as irregular click patterns or suspicious typing speeds. Learn more•

Geo Analysis: Analyze geographic data to detect unusual user behavior, such as simultaneous logins from multiple regions. Explore•

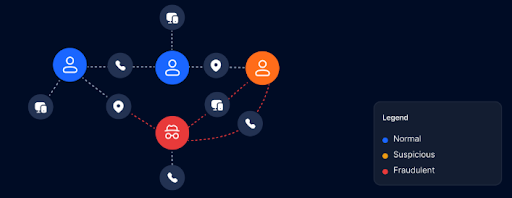

Link Analysis: Discover connections between users, devices, and IPs to identify fraud rings. Read article•

Enhanced Security and Accuracy: With risk scoring and anomaly detection, CrossClassify ensures high accuracy with low false positives. See more•

Seamless Integration: Fintech stacks can integrate easily using CrossClassify's APIs and SDKs. Integration guide•

Alerting and Notification: Real-time alerts for high-risk behaviors or flagged users help compliance and fraud teams act immediately. Notifications can be configured per event, user role, or device ID.

Conclusion: Building Secure, Trusted, and Scalable Fintech Platforms

Fraud in the fintech industry is growing in sophistication and scale. From account takeovers to synthetic ID fraud, threats evolve faster than traditional defenses can adapt. As this article has shown, regulatory pressure, financial risk, and reputational damage are pushing fintechs to adopt modern, AI-powered fraud prevention systems. Behavioral analysis, device fingerprinting, and real-time monitoring are not just optional tools, they are essential.

CrossClassify equips fintech companies with the technology needed to detect, score, and stop fraud with precision. With seamless API integration, context-aware analysis, and low-latency responses, it empowers platforms to protect user trust, meet compliance obligations, and grow securely in a competitive digital economy.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

Account takeover protection in fintech platforms is critical as attackers use phishing, SIM swaps, or credential stuffing to gain control of user accounts. CrossClassify stops this by combining device fingerprinting, session tracking, and behavior monitoring to detect and block unauthorized access. Learn more

Fintech account onboarding risk scoring helps detect bots, forged IDs, and synthetic profiles before they enter the system. CrossClassify uses behavioral biometrics and real-time fingerprinting to block fake signups instantly. Learn how

Block bot attacks in fintech signup flows by using dynamic behavior profiling and device recognition. CrossClassify's engine detects bot-generated traffic, fake promo abuse, and automated attacks across sessions. Full details here

Synthetic ID fraud in fintech onboarding is rising as fraudsters blend real and fake data to create trusted personas. CrossClassify flags these patterns through behavioral scoring and usage profiling. Explore more

No, MFA and WAF alone can't prevent fintech fraud involving insider threats, behavioral anomalies, or session hijacking. CrossClassify fills the gap with contextual AI models and continuous post-login monitoring. See full explanation

Real-time fintech fraud detection solutions are essential to flag risky payments before they complete. CrossClassify offers adaptive scoring models and live risk evaluations across digital payment flows. Dive deeper

Insider threat detection in fintech systems must go beyond login records. CrossClassify detects unusual access patterns, off-hours activity, and privilege abuse using behavior analytics. Learn more

Yes, regtech-ready fintech fraud prevention tools from CrossClassify support PSD2 SCA enforcement, identity validation, and risk monitoring for compliance with global financial standards. See compliance features

AI behavioral analytics for fintech apps allows early detection of fraud through keystroke analysis, navigation flow, and session behavior. CrossClassify identifies subtle signs of manipulation or account hijacking in real time. Read more

Link analysis in fintech fraud detection reveals relationships between accounts, devices, and IP addresses used in coordinated fraud. CrossClassify's engine maps hidden networks and flags anomalies before large-scale abuse occurs. Learn more

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required