Last Updated on 25 Aug 2025

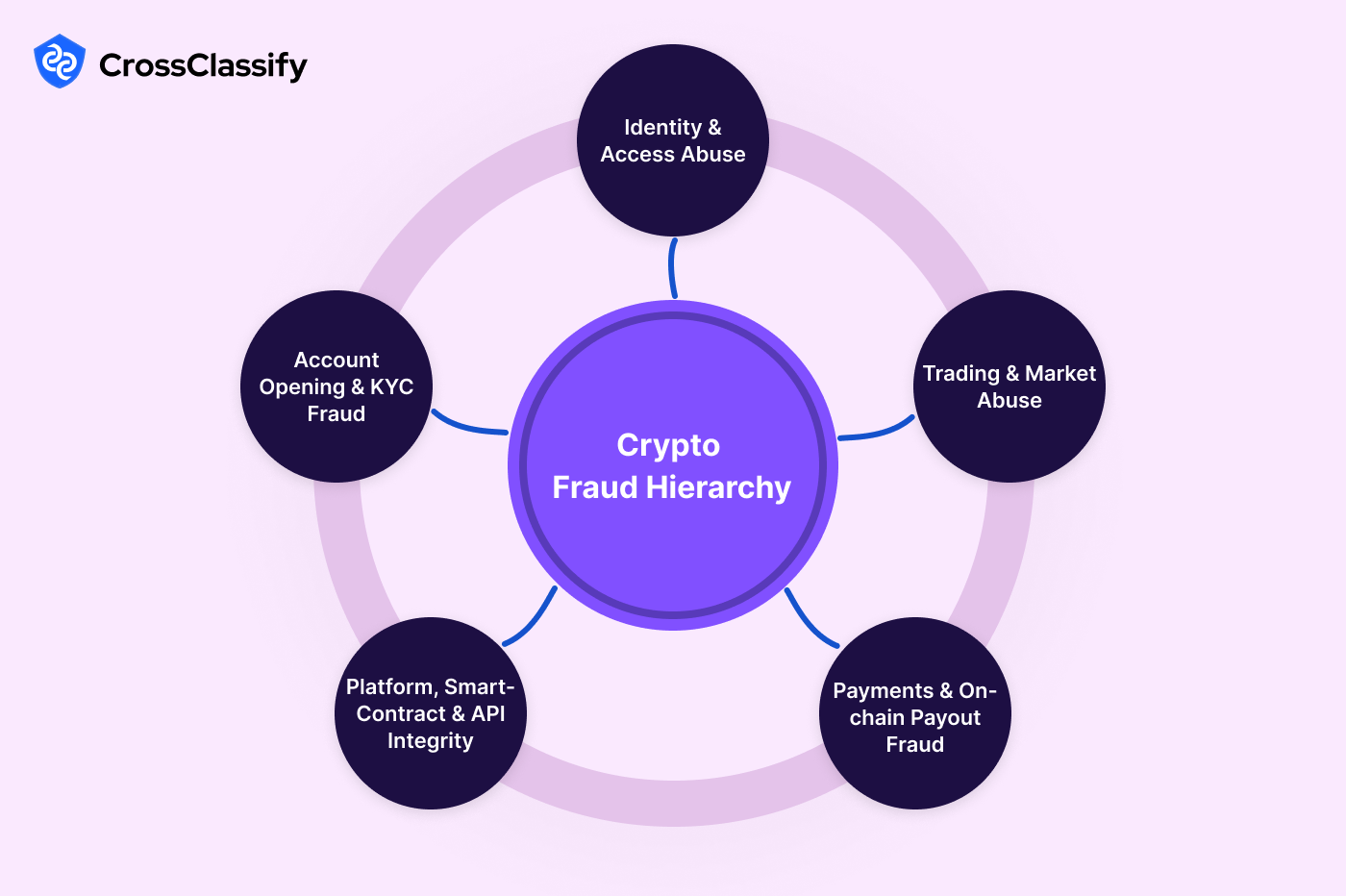

The Crypto Fraud Hierarchy: From Signals to Evidence and Action

Share in

Introduction

Growth in crypto means instant onboarding, instant swaps, and instant payouts. That same speed attracts rings that pivot between account takeover, synthetic onboarding, bridge hopping, wash trading, and API probing in a single session. This field guide turns the crypto fraud hierarchy into an operating model your risk, compliance, and product teams can use today. For product fit and integrations, see the crypto solution page. For a deep dive on crypto specific risks and layered controls, review navigating fraud and cybersecurity risks in the crypto industry.

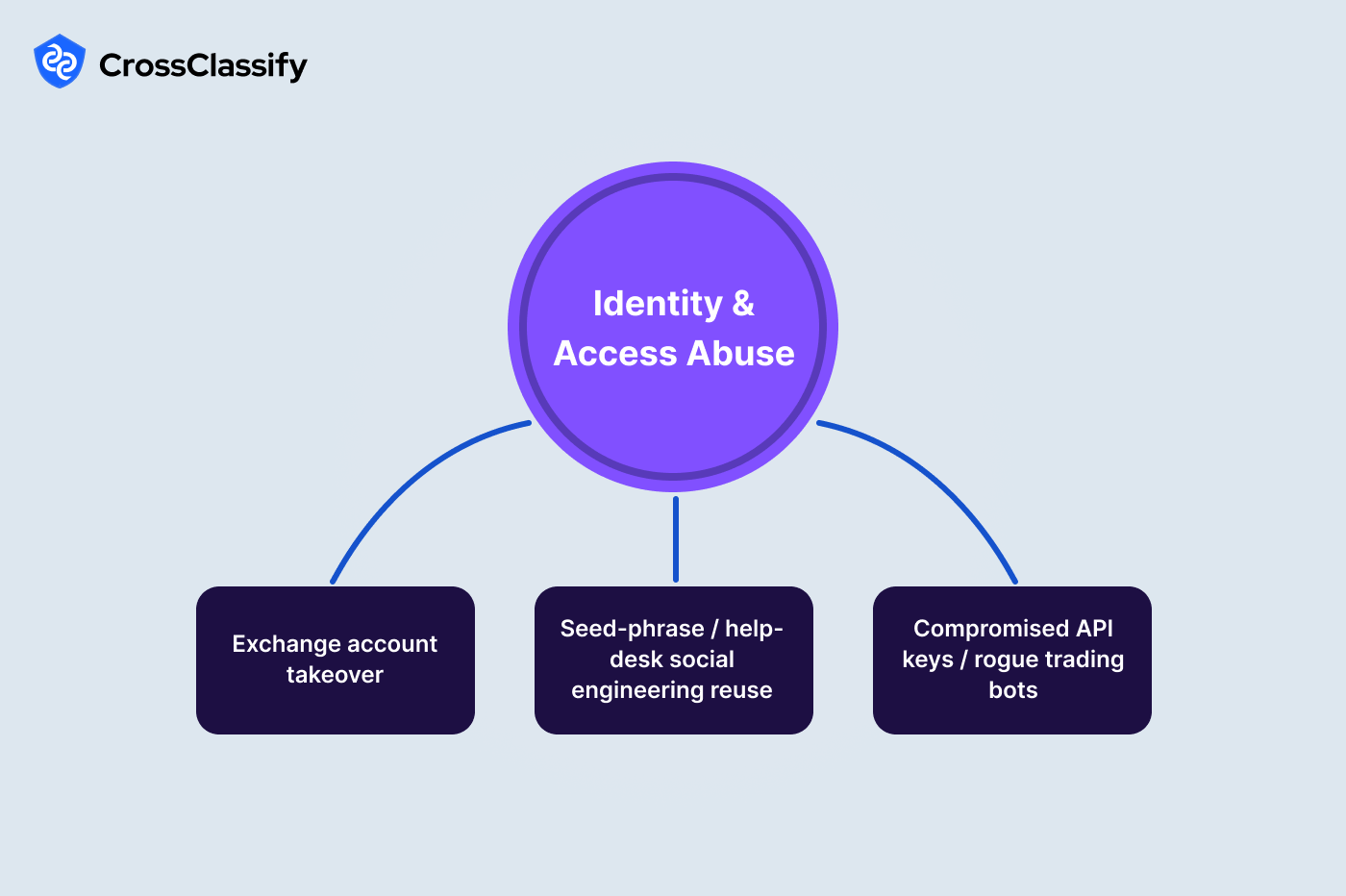

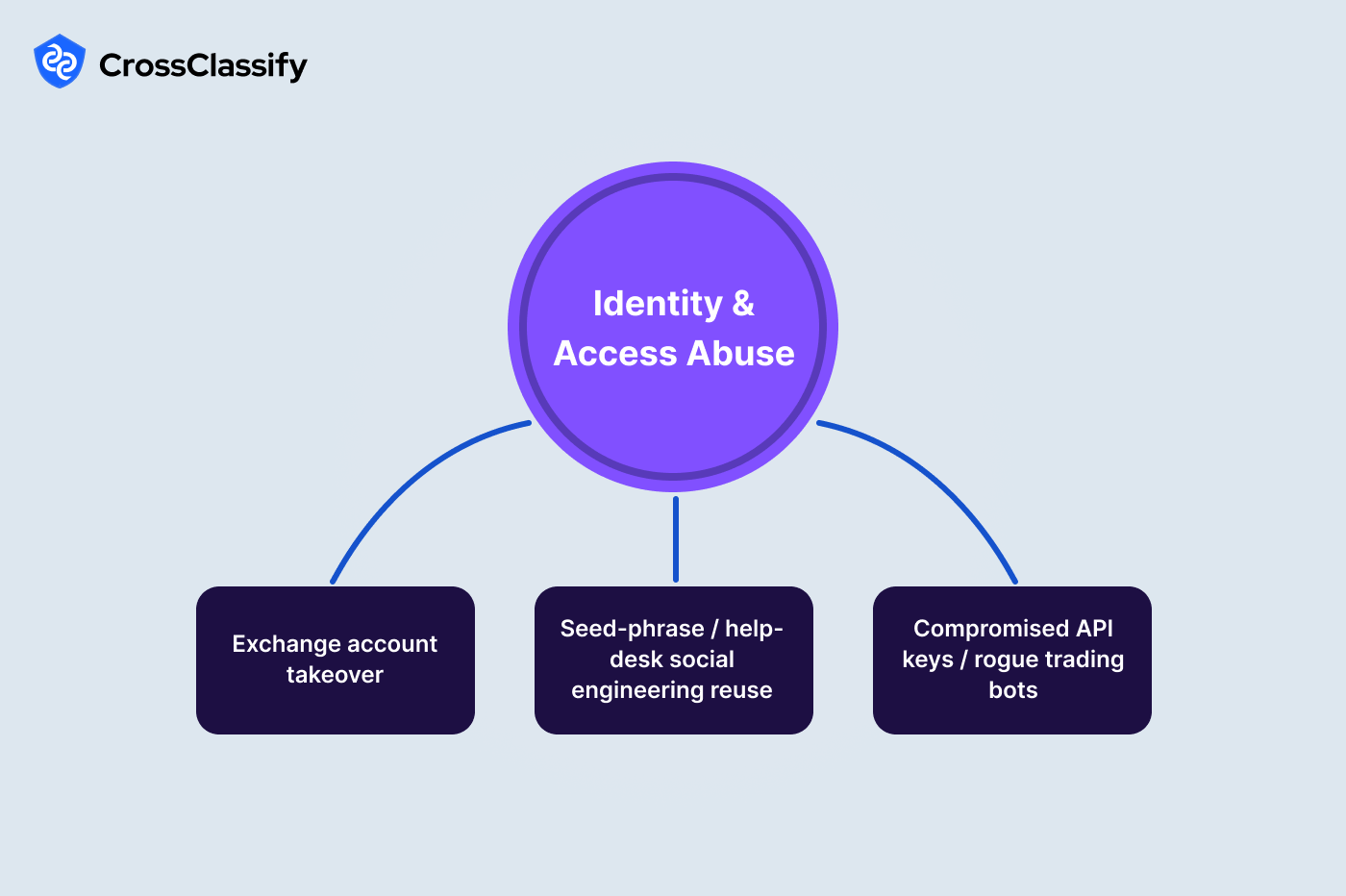

Identity and Access Abuse in Crypto Portals

Customer and API access are the front doors for every withdrawal, limit change, and trade. Credential stuffing, SIM swap, and social engineering attacks target hot wallet withdrawals and profile edits that redirect funds. Rings also compromise API keys and attach bots that fire orders at microsecond cadence. Large incidents in the sector have shown takeover waves after news events and during promotional windows. The defensive pattern that wins is a session level risk engine that binds actions to persistent devices and human behavior, not just to a username and password.

1. Exchange account takeover

- New device and unfamiliar region minutes before crypto withdrawal: Look for clusters outside your home markets shortly before a withdrawal. Healthy traffic stays in expected geographies and daylight windows.

- Burst of failed logins followed by a success then a limit change: Stuffing creates a fail spike that flips to success on an active credential and is often followed by a limit raise or new beneficiary.

2. Seed phrase and help desk social engineering reuse

- Contact change followed by reset within ten minutes: Honest users rarely chain these events. Tight coupling reveals a bypass playbook.

- Behavioral biometrics score drops during the same session: When an intruder takes over, typing cadence, field dwell, and navigation rhythm diverge from the enrolled pattern.

3. Compromised API keys and rogue trading bots

- Orders from a new ASN using an existing API key: Keys should fire from registered networks only.

- Orders per second bursts above bot policy: Automation creates short, tall spikes that exceed policy.

Why CrossClassify: The platform unifies device fingerprinting for crypto with behavioral biometrics and continuous adaptive risk so approvals, edits, and withdrawals are protected in motion. See how device identity is created in plain language in "How Does Fingerprinting Work?" and the product view in "Device Fingerprinting". Attack patterns that bypass MFA and WAF are explained with practical controls in "Uncover the Threats WAF and MFA Miss" and "The Anatomy of Account Takeover". The scoring model design is detailed in "Continuous Adaptive Risk and Trust Assessment" and "Behavioral Biometrics".

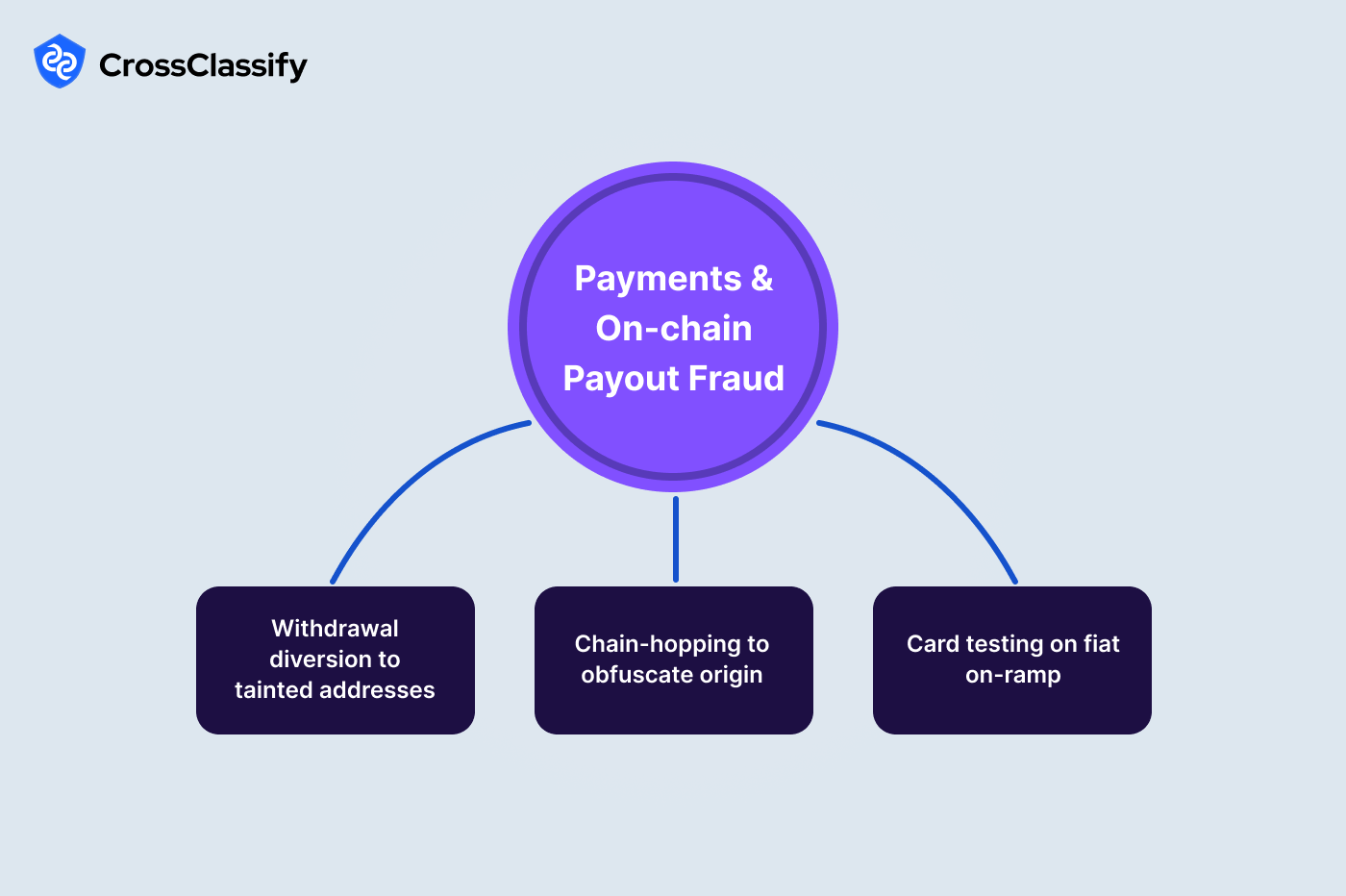

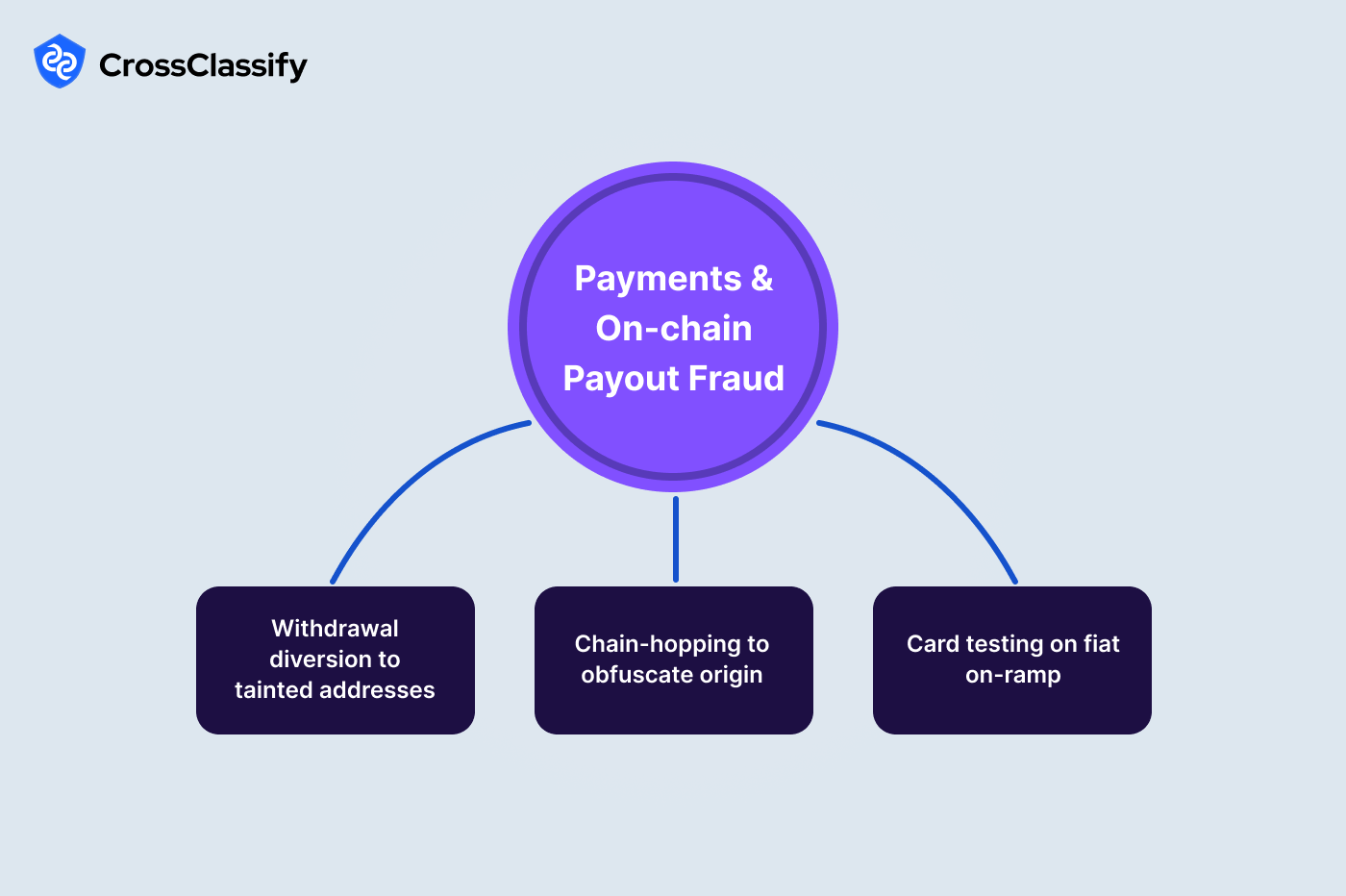

Payments and On-chain Payout Fraud

The payout surface spans fiat on ramps, exchange withdrawals, and cross chain bridges. Adversaries route funds to tainted addresses, hop chains to obfuscate origin, and probe card rails with micro authorizations. Public breaches have shown laundering through mixers and high risk bridges after major exchange or DeFi exploits.

1. Withdrawal diversion to tainted addresses

- First time withdrawal to an address with mixer or sanctions adjacency: One hop proximity to mixers or sanctioned clusters raises immediate red flags.

- Beneficiary reuse across multiple accounts and devices: Hubs indicate mule routing and brokered cash out.

2. Chain hopping to obfuscate origin

- Rapid swaps across two or more chains within thirty minutes: Compressed sequences show intent to break provenance.

- Bridge used immediately after a risky session: Coupling a high risk login with immediate bridge activity is a strong diversion signal.

3. Card testing on the fiat on ramp

- AVS or CVV mismatch spike by BIN: A single BIN with a sharp rise marks testing.

- Repeating micro authorization waves with rapid retries: Periodic, saw tooth spikes signal scripted tests.

Why CrossClassify: The engine links device fingerprinting for crypto withdrawals and address risk networks to payout actions in real time. Risk backed actioning ranges from beneficiary revalidation to payout pause. The platform view of device identity and cross account hubs is covered in "Device Fingerprinting", while fraud program design is summarized in "Fraud Risk Management".

Account Opening and KYC Fraud

Onboarding attacks blend recycled documents, selfie spoofing, disposable domains, and device farms. The goal is to pass KYC once and then monetize fast through promo abuse, loan stacking on CeFi, or cross chain laundering. High profile airdrops have battled Sybil farms, and regulators have warned about sanctions evasion through intermediaries.

1. Synthetic identities for CEX

- Document or PDF hash reuse across applicants: A single fingerprint under multiple names is decisive evidence of kit based forgery.

- Spike in young or disposable email domains: A tall bar in the youngest bin points to throwaway identities.

2. Airdrop and promotion farming (Sybil)

- Many signups from the same device cluster: Dominant clusters indicate farms.

- Zero depth sessions that jump straight to promo endpoints: A surge in the zero depth bin shows scripted flows.

3. Sanctions and PEP evasion via strawmen

- Deposits from addresses one hop from sanctioned entities: Short paths to risky clusters highlight exposure.

- Reused withdrawal address across KYC tiers: Cross tier reuse links straw accounts to a single beneficiary.

Why CrossClassify: The system combines behavioral biometrics with device persistence to stop fake accounts silently and steps up only when evidence stacks. Practical guidance on avoiding fake accounts and stopping new account fraud is summarized in "Avoid Fake Accounts" and "New Account Fraud". The broader view of account opening attacks appears in "The Growing Threat of Account Opening Fraud".

Trading and Market Abuse

After access and onboarding, adversaries move to manipulate price discovery. NFT markets see self dealing loops that inflate floor price and volume. DEX venues face MEV sandwiches that bracket victim swaps in the same block. CEX order books are targeted by quote spam and cancel bursts. Public research and enforcement actions have documented wash trading on several NFT venues and front running patterns on popular chains.

1. NFT wash trading

- Repeated trades among the same wallet triads: Dense triangles reveal self dealing cliques.

- Prices far above floor with self funded flows: High outliers tied to the same wallets signal manipulation.

2. DEX MEV sandwich and front running

- Buy sell pairs that bracket a victim transaction inside one block: Clear pre and post legs wrap the victim swap.

- Abnormally high slippage compared with peers: A fat high slippage tail marks targeted accounts.

3. CEX spoofing and cancel bursts

- Cancel to trade ratio spikes per account: Breaches of policy bands expose spoof pressure.

- Quote to trade ratio outliers: Extremely high ratios identify order book spam.

Why CrossClassify: The platform scores order velocity, counterparty repetition, and slippage outliers in stream, then applies targeted friction that does not slow honest market makers. Continuous scoring is described in "Continuous Adaptive Risk and Trust Assessment".

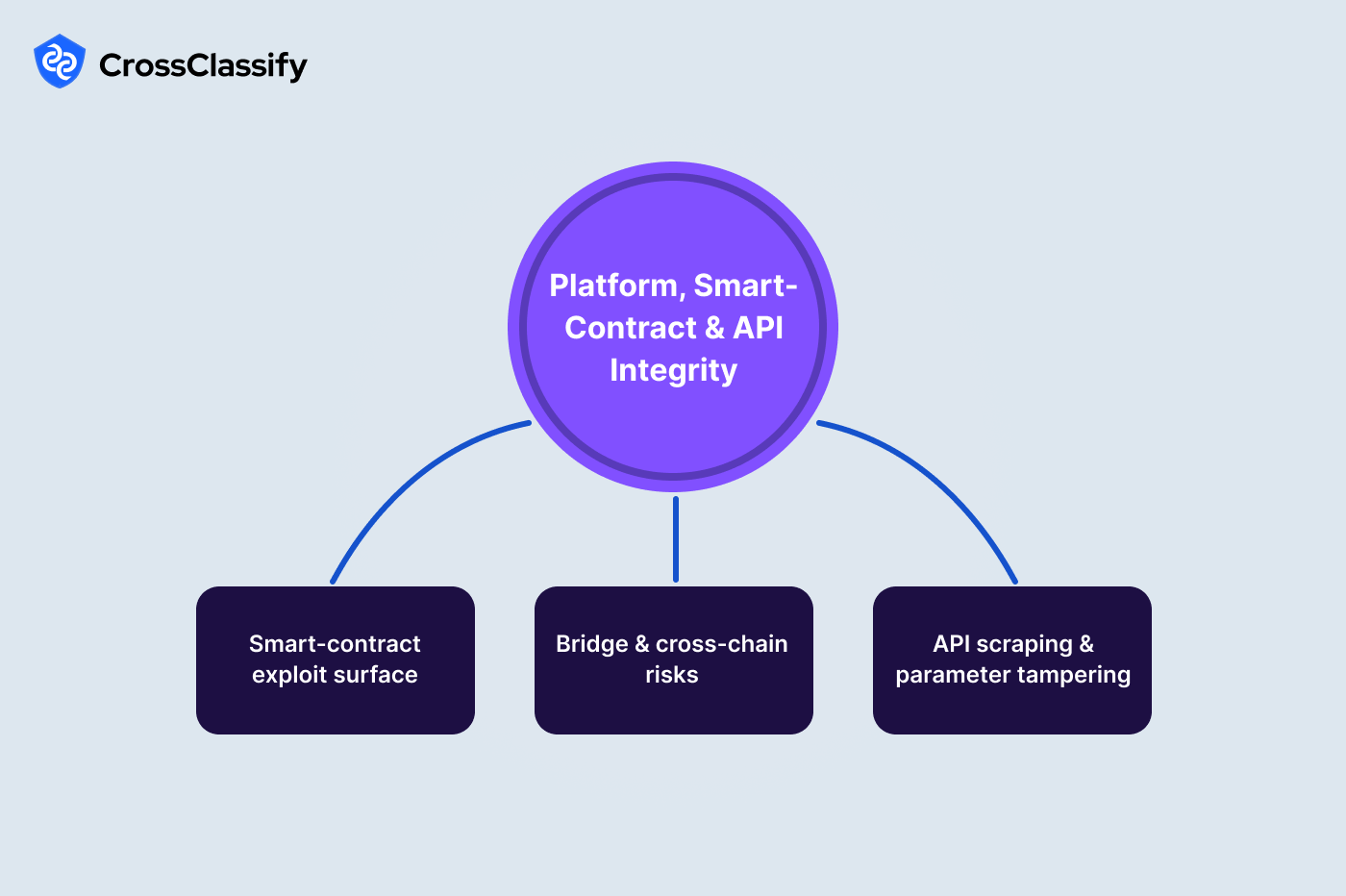

Platform, Smart Contract, and API Integrity

Attackers probe public content, scrape pricing and routing APIs, and tamper with parameters to induce fee or price deltas. DeFi has suffered from bridge compromises and contract logic bugs involving re entrance and oracle manipulation. Incidents like large bridge exploits show how fast attackers move value across chains once a weakness appears.

1. Smart contract exploit surface

- Unusual Permit or Permit2 approvals to unknown spenders: Long tail spenders receiving fresh approvals are a strong early warning.

- Rapid re entrance or oracle dependent loops: Tight, repeated calls on sensitive paths indicate a live exploit.

2. Bridge and cross chain risks

- Withdrawals routed to high risk bridges: Elevated scores identify destinations with poor reputation.

- Mismatched chain IDs or malformed calldata: Spikes in invalid values reveal probing and fuzzing.

3. API scraping and parameter tampering

- Headless and script user agents dominate price or route endpoints: Automation surpassing browser traffic is a scraping signal.

- Quoted versus charged fee or price deltas show positive outliers: Positive clusters beyond tolerance indicate tampering.

Why CrossClassify: Evidence backed decisions attach the exact diagram, dashboard, table, graph, or network that triggered the control, which is critical when throttling partners or pausing contracts. The platform's device and session integrity layer is covered in "Device Fingerprinting" and how simple WAF or MFA checks miss real risk is shown in "Uncover the Threats WAF and MFA Miss".

How CrossClassify Operationalizes the Crypto Hierarchy

CrossClassify's AI powered crypto fraud detection platform unifies identity signals, device intelligence, browser telemetry, human behavior, payments metadata, and on-chain analytics into a single, continuously refreshed risk score. The score does not stop at login. It recomputes during every sensitive step, for example a contact edit, an API key call, a withdrawal request, a bridge transfer, a contract approval, or a batch order. This continuous evaluation lets you place precise controls exactly where harm occurs, while keeping legitimate traders and holders fast.

Device fingerprinting for crypto binds risky actions to the true device, even through private browsing or VPN use. The SDK collects stable, privacy-preserving traits such as TLS and JA3 style handshakes, OS and GPU hints, sensor consistency, emulator flags, and app attestation on mobile, then resolves them into a persistent identifier that resists cookie clears and IP rotation. You can spot multi-account rings that share one workstation, connect profile edits to the later withdrawal from the same hardware, and detect API keys that suddenly execute from an unapproved ASN. For a plain-English explainer of the technique and its limits, see "How Does Fingerprinting Work?".

Behavioral biometrics for crypto separates trusted humans from scripts and social engineers without capturing form content. CrossClassify learns keystroke cadence, dwell and flight time between fields, mouse travel, scroll rhythm, copy and paste usage, tab focus changes, and mobile touch gestures. Per-role models adapt to market makers, retail users, and support agents, so a legitimate power user is not penalized for speed. When rhythm shifts abruptly during a high-risk step, for example a contact change followed by a reset or a limit increase, the system raises risk only for that session. A deeper walkthrough is in "Behavioral Biometrics".

On-chain risk intelligence is fused into the same score so payouts and deposits reflect blockchain reality. The platform computes address taint and proximity to mixers or sanctioned clusters, tracks beneficiary reuse across many accounts, detects chain-hopping patterns that compress swaps and bridge moves into short windows, and flags contract approval bursts to unknown spenders. For DEX activity, timing and price features highlight MEV sandwich patterns and abnormal slippage tails, while NFT modules identify wash-trading cliques through repeated wallet triads and self-funded outliers.

Real time, adaptive decisioning converts these signals into precise actions. Controls include step-up MFA, just-in-time payout holds, beneficiary revalidation, edit locks for profile or bank details, API throttles, and smart-contract call rate limits. Policies are thresholded on the unified score and can require multiple pieces of evidence to avoid false positives. The approach aligns with continuous risk principles described in "Continuous Adaptive Risk and Trust Assessment".

Evidence and explainability are built in. Every alert carries the artifact that proved the case, for example a geo-by-hour heatmap that lights up just before a withdrawal, a fail-to-success login timeline aligned to a limit increase, a wallet-to-beneficiary network that exposes a payout hub, or a bridge-usage table that shows tight coupling to a risky session. Analysts can export these objects to cases, engineers can tune policies with confidence, and customer support can unblock honest users quickly.

Integration and performance are simple. Lightweight web and mobile SDKs stream behavior and device signals, server connectors ingest KYC, ledger, dispute, and on-chain events, and real-time APIs return risk in milliseconds so your app can allow, challenge, or block without slowing the flow. SIEM and warehouse adapters keep security and analytics teams fully visible, while privacy controls for hashing, tokenization, and configurable retention align with compliance.

Program governance closes the loop. CrossClassify ships scorecards, drift monitors, and playbooks that map to your hierarchy: identity and access, payments and on-chain payouts, account opening and KYC, trading and market abuse, and platform, contract, and API integrity. You get measurable KPIs for takeover reduction, payout diversion prevention, chargeback containment, and ring dismantling, with audit trails that satisfy internal review. A practical framework for standing up and maturing this function is outlined in "Fraud Risk Management".

Together these capabilities deliver behavioral biometrics for crypto exchanges, device fingerprinting for crypto wallets, and real time risk scoring for on-chain transactions in one platform that is explainable, adaptive, and production-ready.

Device fingerprinting for crypto binds risky actions to the true device, even through private browsing or VPN use. The SDK collects stable, privacy-preserving traits such as TLS and JA3 style handshakes, OS and GPU hints, sensor consistency, emulator flags, and app attestation on mobile, then resolves them into a persistent identifier that resists cookie clears and IP rotation. You can spot multi-account rings that share one workstation, connect profile edits to the later withdrawal from the same hardware, and detect API keys that suddenly execute from an unapproved ASN. For a plain-English explainer of the technique and its limits, see "How Does Fingerprinting Work?".

Behavioral biometrics for crypto separates trusted humans from scripts and social engineers without capturing form content. CrossClassify learns keystroke cadence, dwell and flight time between fields, mouse travel, scroll rhythm, copy and paste usage, tab focus changes, and mobile touch gestures. Per-role models adapt to market makers, retail users, and support agents, so a legitimate power user is not penalized for speed. When rhythm shifts abruptly during a high-risk step, for example a contact change followed by a reset or a limit increase, the system raises risk only for that session. A deeper walkthrough is in "Behavioral Biometrics".

On-chain risk intelligence is fused into the same score so payouts and deposits reflect blockchain reality. The platform computes address taint and proximity to mixers or sanctioned clusters, tracks beneficiary reuse across many accounts, detects chain-hopping patterns that compress swaps and bridge moves into short windows, and flags contract approval bursts to unknown spenders. For DEX activity, timing and price features highlight MEV sandwich patterns and abnormal slippage tails, while NFT modules identify wash-trading cliques through repeated wallet triads and self-funded outliers.

Real time, adaptive decisioning converts these signals into precise actions. Controls include step-up MFA, just-in-time payout holds, beneficiary revalidation, edit locks for profile or bank details, API throttles, and smart-contract call rate limits. Policies are thresholded on the unified score and can require multiple pieces of evidence to avoid false positives. The approach aligns with continuous risk principles described in "Continuous Adaptive Risk and Trust Assessment".

Evidence and explainability are built in. Every alert carries the artifact that proved the case, for example a geo-by-hour heatmap that lights up just before a withdrawal, a fail-to-success login timeline aligned to a limit increase, a wallet-to-beneficiary network that exposes a payout hub, or a bridge-usage table that shows tight coupling to a risky session. Analysts can export these objects to cases, engineers can tune policies with confidence, and customer support can unblock honest users quickly.

Integration and performance are simple. Lightweight web and mobile SDKs stream behavior and device signals, server connectors ingest KYC, ledger, dispute, and on-chain events, and real-time APIs return risk in milliseconds so your app can allow, challenge, or block without slowing the flow. SIEM and warehouse adapters keep security and analytics teams fully visible, while privacy controls for hashing, tokenization, and configurable retention align with compliance.

Program governance closes the loop. CrossClassify ships scorecards, drift monitors, and playbooks that map to your hierarchy: identity and access, payments and on-chain payouts, account opening and KYC, trading and market abuse, and platform, contract, and API integrity. You get measurable KPIs for takeover reduction, payout diversion prevention, chargeback containment, and ring dismantling, with audit trails that satisfy internal review. A practical framework for standing up and maturing this function is outlined in "Fraud Risk Management".

Together these capabilities deliver behavioral biometrics for crypto exchanges, device fingerprinting for crypto wallets, and real time risk scoring for on-chain transactions in one platform that is explainable, adaptive, and production-ready.

Signals and Evidence You Can Ship on Day One

Each bullet pairs a decisive signal with the clearest artifact for leadership and auditors.

- Unfamiliar region before withdrawal: Heatmap of region by hour shows time boxed hotspots near withdrawal windows. This justifies step up MFA and payout pause for that session.

- Fail to success burst around a limit change: Timeline with success markers proves stuffing conversion and action coupling. Add a cool off period and re verification.

- Contact change then reset: Delta line between change and reset compresses to near zero. Apply a temporary lock with high assurance recovery.

- API key from new ASN: Table mapping keys to ASNs highlights the anomaly next to the timestamp. Rotate the key and enforce IP allow lists.

- Tainted first time beneficiary: Network showing adjacency to mixers or sanctions provides strong AML evidence for a hold.

- Chain hopping within thirty minutes: Timeline across chains surfaces compressed obfuscation sequences. Rate limit or require enhanced checks.

- BIN level AVS or CVV spike: Bar chart that towers over baseline demonstrates card testing and supports BIN level throttling.

- Document hash reuse at onboarding: Table of repeated fingerprints gives instant grounds to reject or escalate.

- Wash trading triangles: Network of repeating counterparties reveals cliques for de listing or fee removal.

- Permit approvals to unknown spenders: Dashboard of spender concentration surfaces long tail approvals for contract level mitigation.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

Failure spikes that flip to brief success bursts are the giveaway. CrossClassify learns your success and failure rhythm, adds persistent device identity, and steps up only when region or device shifts appear. The anatomy of takeover patterns is unpacked in "The Anatomy of Account Takeover".

Linked edits and withdrawals are a classic path to loss. CrossClassify correlates edits with withdrawal attempts in real time and places a just in time hold while a trusted recovery flow verifies the user. Continuous decisioning is described in "Continuous Adaptive Risk and Trust Assessment".

Synthetics recycle document templates and use young email domains from device farms. CrossClassify checks document hash reuse, domain age, and input rhythm, then triggers step up only when evidence stacks. The threat model and controls appear in "The Growing Threat of Account Opening Fraud".

Fraudsters edit payout details and trigger a large disbursement within hours. CrossClassify binds the edit to the device and detects tight coupling to payout attempts, then pauses automatically. Practical payout controls are discussed in "Fraud Risk Management".

Rings produce hub and spoke device to account graphs. CrossClassify's device persistence exposes hubs and applies targeted friction to the hub without slowing legitimate users. The device layer is explained in "Device Fingerprinting".

Scraping favors headless agents and extreme search to action ratios. CrossClassify classifies user agents, checks session depth, and throttles only automation. Why WAF and static MFA miss these patterns is shown in "Uncover the Threats WAF and MFA Miss".

Healthy books keep the dispute to settled ratio steady. CrossClassify tracks the ratio trend and links disputes back to device clusters so systematic abusers can be removed. Program building blocks are outlined in "Fraud Risk Management".

Device clusters that dominate signups and zero depth sessions that jump to promo endpoints are strong signals. CrossClassify flags both and shifts users to proof based flows only when risk is high. Techniques for avoiding fake accounts are summarized in "Avoid Fake Accounts".

Wash trading looks like tight counterparty cliques and price outliers far above floor. CrossClassify builds network maps of counterparties and filters action to the detected clique. Risk scoring patterns are described in "Continuous Adaptive Risk and Trust Assessment".

Buy and sell legs that bracket a victim swap within the same block and high slippage tails are the signals. CrossClassify watches block relative timelines and slippage distribution to flag victims fast. The crypto risk landscape that motivates this control is covered in "Navigating Fraud and Cybersecurity Risks in the Crypto Industry".

Unusual Permit approvals to unknown spenders are early warnings. CrossClassify surfaces long tail spender concentration and can require extra confirmation before approvals. The device and session layer that underpins these checks is explained in "How Does Fingerprinting Work?".

Yes, start with silent signals like device persistence and input rhythm, then add verification only when risk composes. CrossClassify delivers progressive assurance so honest users stay fast. The approach to new account risk appears in "New Account Fraud".

Show adjacency to mixers or sanctioned entities and show multi account convergence on the same beneficiary. CrossClassify packages the network view and the timeline that tie the decision together. How programs structure evidence is covered in "Fraud Risk Management".

They help at the perimeter but miss session level drift and automation that looks human. CrossClassify adds device identity and behavior analytics so risk rises or falls with the session. The gap is explained in "Uncover the Threats WAF and MFA Miss".

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required