Cybersecurity for Crypto

Secure Every Wallet and Exchange Session

Detect post-login threats that bypass MFA and harm user trust.

Stats on Crypto Breaches

$30.9B

illicit Crypto Flow

In 2024, unauthorized crypto addresses received around $40.9 billion.

+40%

Rise in Crypto Fraud

Fraud attempts jumped from 6.4% in 2023 to 9.5% in 2024.

$0.0B

Crypto Scam Revenue

In 2024, scams generated at least $9.9 billion — possibly rising to $12.4B.

Why Crypto Data Security Matters

Protect Wallets from Account Takeover

Crypto wallets are frequent ATO targets due to high-value assets and weak post-login checks. Our continuous monitoring stops fraud that MFA alone can’t catch.

Stay Ahead of Emerging Scam Patterns

New token scams and phishing campaigns evolve daily. Our adaptive machine learning detects unknown threats early—before funds move.

Stop Synthetic ID and Bot Wallet Farms

Mass-created fake users drain airdrops, manipulate trading, and abuse onboarding funnels. Our identity and link analysis blocks them before they cause damage.

Go Beyond WAF & MFA

WAFs block known threats, MFA guards login—but crypto fraud often happens after. We protect the critical session layer where funds are transferred.

Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

MFA is not enough—secure the full session.

Reduces crypto account takeover by up to 70% without disrupting user experience.

Book a Demo99%

of crypto platforms faced ATO attempts in 2024 (Proofpoint)

90%

of ATOs bypass MFA using session theft or device emulation (Chainalysis)

How We Prevent Account Takeover

Learn More →Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

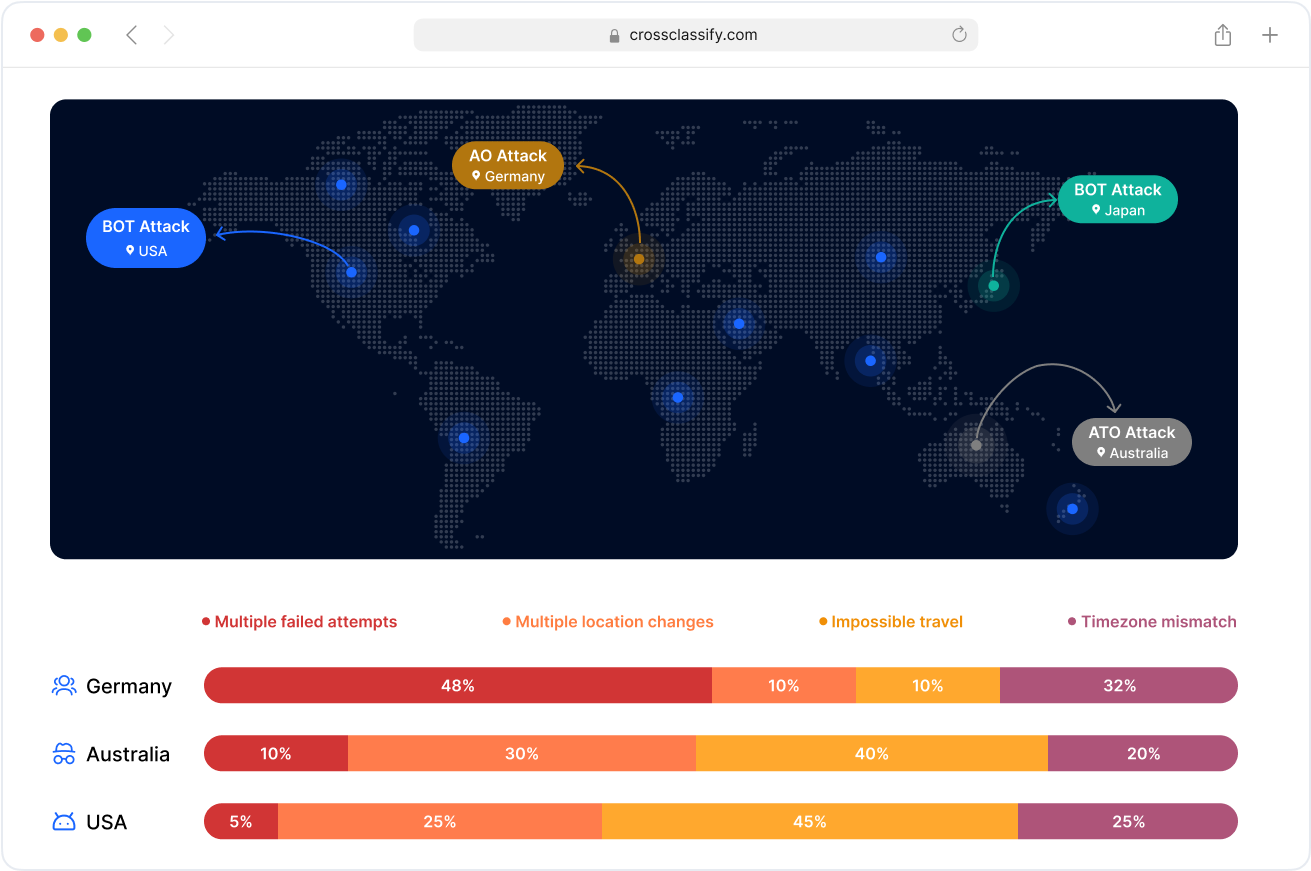

Learn More →Geo Analysis for Suspicious Crypto Access

Spot IP anomalies, sudden country switches, and location spoofing in wallet and exchange access attempts.

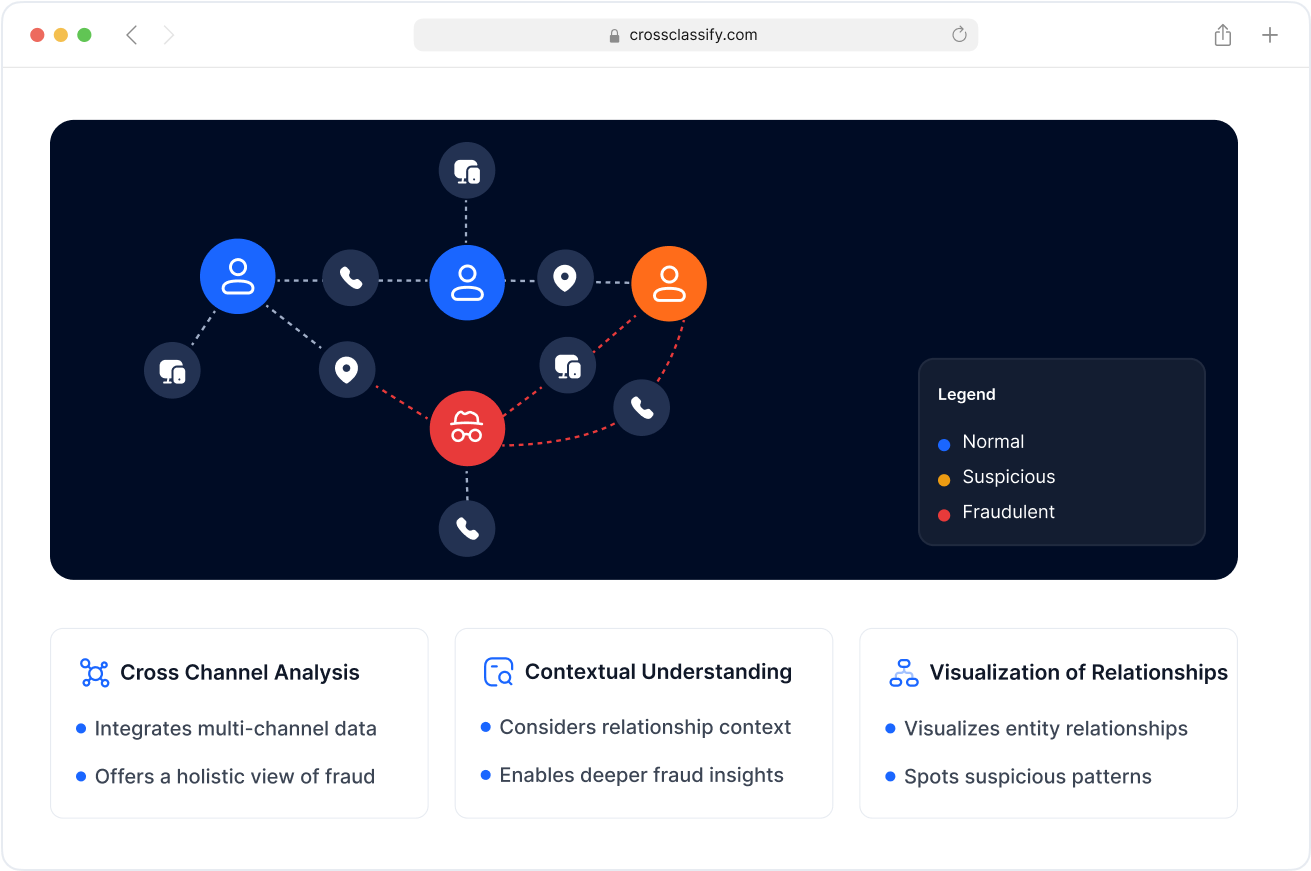

Link Analysis for Wallet Rings

Detect shared infrastructure across accounts. Stop fraud rings abusing airdrops, liquidity pools, and KYC bonuses.

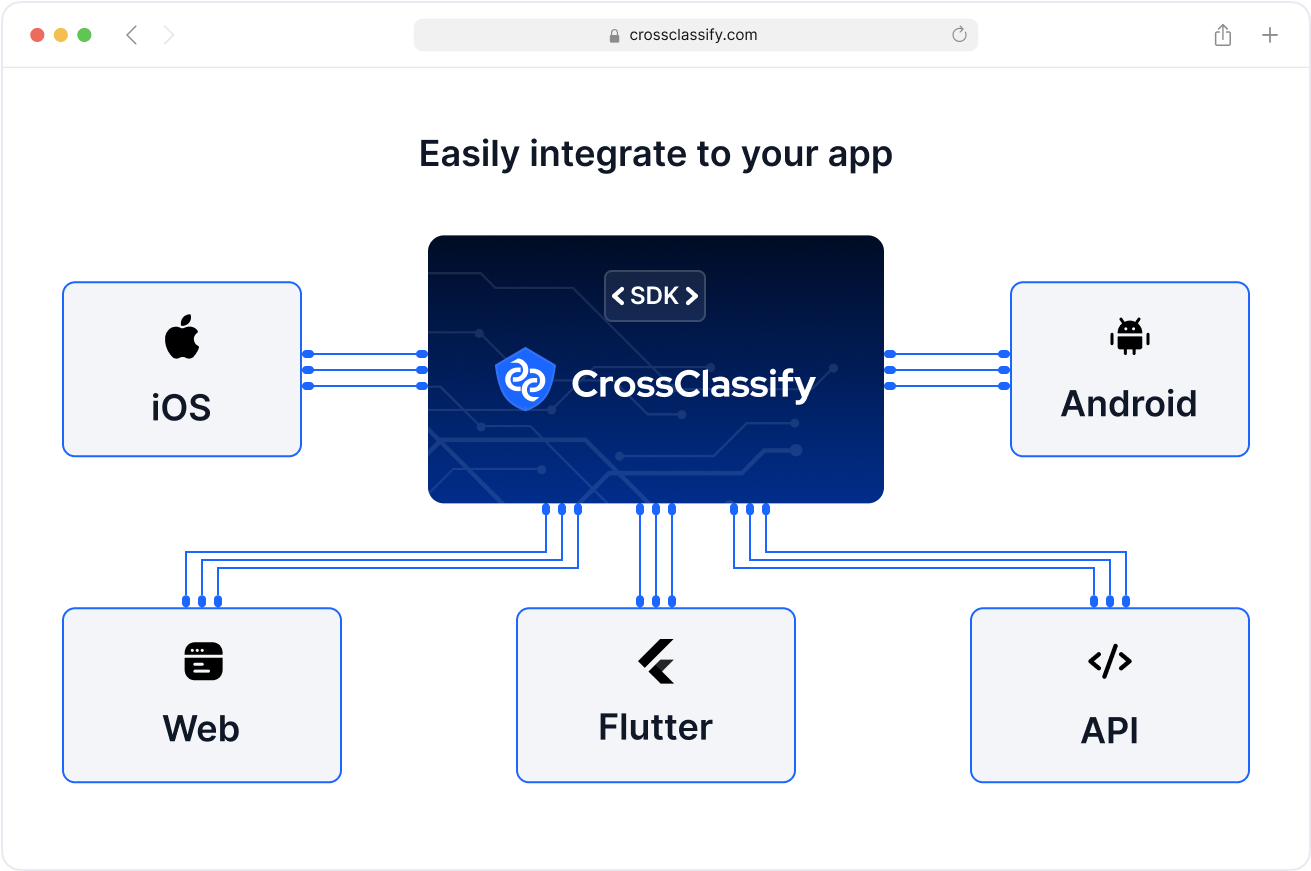

Seamless Integration with Crypto Stacks

Plug into your Web3 wallet, DEX, or CEX with SDKs and APIs. Works with custom auth and fiat ramps.

Compliance

From Compliance to Credibility

Anti-Money Laundering (AML) Regulations

Binance: Pleaded guilty to violating U.S. anti-money laundering laws, resulting in a $4.3 billion fine. CEO Changpeng Zhao resigned and personally paid a $50 million fine

OKX: The operator, Aux Cayes FinTech Co, pleaded guilty to operating an unlicensed money transmitting business, agreeing to pay nearly $505 million in fines and forfeitures.

KuCoin: Pleaded guilty to operating an unlicensed money transmitting business and agreed to pay over $297 million in fines and forfeitures.

Know Your Customer (KYC) Requirements

Binance: Fined $4.3 billion by U.S. regulators for violating anti-money laundering laws and operating without proper KYC procedures. CEO Changpeng Zhao also paid a $50 million personal fine

BitMEX: Agreed to pay $100 million to the U.S. Commodity Futures Trading Commission (CFTC) and Financial Crimes Enforcement Network (FinCEN) for failing to implement a compliant KYC and AML program.

Crypto-Specific Behavioral Intelligence

We adapt to how real crypto users act—wallet switching, rapid swaps, or token staking patterns—so anomalies are flagged early.

Beyond MFA for Crypto

Traditional MFA can’t stop session hijacking or insider abuse. We analyze post-login activity to detect fraud after access is granted.

Detect Wallet Ring Fraud

Our link analysis reveals hidden networks behind sybil attacks, fake airdrop hunters, and token wash trading.

Frequently asked questions

While blockchain is inherently secure, cryptocurrency platforms and exchanges are frequent targets for fraud, including account takeover, fake account creation, and phishing scams. Security depends on the platform's ability to detect fraud in real time—something CrossClassify specializes in.

- Account takeover (ATO) through credential stuffing

- Fake account creation for laundering or manipulation

- Phishing and impersonation scams

- Pump-and-dump schemes

- Rug pulls and scam ICOs

- Bot attacks on signups and trading APIs

We use:

- Device fingerprinting to catch fraudsters even if they change IP or identity

- Behavioral analytics to flag bots and abnormal usage

- Real-time risk scoring during login, signup, and transaction

- IP and network intelligence to detect proxy/VPN abuse or fraud rings

Key prevention measures include:

- Blocking bots and abuse at signup with device fingerprinting

- Monitoring behavior anomalies during KYC and trading

- Enforcing risk-based MFA

- Using AI-driven fraud scoring to detect high-risk transactions

- Integrating CrossClassify’s API to act before fraud happens

Some are secure, many are not. Weak KYC processes, poor session security, and lack of behavior analysis make exchanges vulnerable to fraud. CrossClassify helps exchanges stay secure without adding friction to genuine users.

Fraudsters use fake accounts to:

- Exploit referral bonuses

- Perform wash trading or manipulate volume

- Launder illicit funds across wallets

- Spam or attack NFT and DeFi platforms

CrossClassify flags synthetic and duplicate identities in real time.

- Enforcing strong identity verification

- Monitoring suspicious behavior post-KYC

- Tracking device and session anomalies for ongoing due diligence

- Generating fraud reports and audit logs

- Leveraging CrossClassify tools to support KYC/AML and evolving regulatory needs

Crypto is decentralized and pseudonymous. Fraudsters can create wallets instantly, mask location, and bypass static security checks. Traditional tools fall short—CrossClassify’s dynamic fraud detection adapts to fast-moving, multi-wallet behavior in real time.

- Sudden spikes in new accounts or withdrawals

- Irregular trading patterns or transaction clustering

- Use of anonymizers or emulators

- Multiple accounts linked to the same device or behavior

- CrossClassify identifies and scores these patterns instantly

Key platform features include:

- Invisible, real-time fraud detection

- Cross-wallet and cross-device fingerprinting

- Bot detection and abuse protection

- Full-stack fraud scoring from signup to withdrawal

- Seamless API integration into any exchange, wallet, or DeFi app

Let’s Get Started

Elevate your Crypto app's security with CrossClassify. Schedule a personalized demo to see how we protect customer accounts and ensure compliance with industry standards.