Prevent fake account creation with real-time fraud risk intelligence

Block synthetic IDs and suspicious behavior before signup completion

Solutions

AO issues we resolve

CrossClassify detects and blocks the following attack vectors.

Multi-Accounting Fraud Prevention

Block users creating multiple accounts to exploit promotions, free trials, or gain unfair advantages. Detect repeat devices and behavioral patterns using multi-account fraud detection tools.

Synthetic Identity Fraud Detection

Identify and stop synthetic ID fraud by analyzing device, behavior, and geo patterns at signup. CrossClassify prevents fake identities built with stolen or fabricated information.

New Account Fraud Protection

Detect fraudulent new signups before they reach your platform. Our solution blocks fake and malicious accounts used for scams, bonus abuse, and bot attacks.

Bot-Based Signup Detection

Stop automated bots creating fake accounts at scale. CrossClassify uses device fingerprinting and behavioral signals to block bot-driven account fraud.

Bonus Abuse Fraud Detection

Prevent fraudsters from creating fake accounts to exploit referral or signup bonuses. Detect repeated fraud attempts using device and behavior analytics.

Fake Review Account Blocking

Stop review fraud from fake or duplicate accounts used to manipulate product ratings or brand reputation. Ensure only trusted users leave feedback.

Loyalty and Referral Fraud Defense

Detect and block loyalty fraud and referral system abuse through account duplication and device manipulation.

Free Trial Fraud Protection

Prevent repeated use of free trials using fake accounts. Stop users from creating new accounts to bypass trial limits and gain ongoing free access.

Subscription Fraud Detection

Block users who use fake identities or stolen payment methods to abuse subscription models. Score user risk at the point of signup.

Ban Evasion Fraud Prevention

Detect and block users evading bans by creating new accounts with device spoofing or VPNs. Fingerprint devices and behavior to enforce bans.

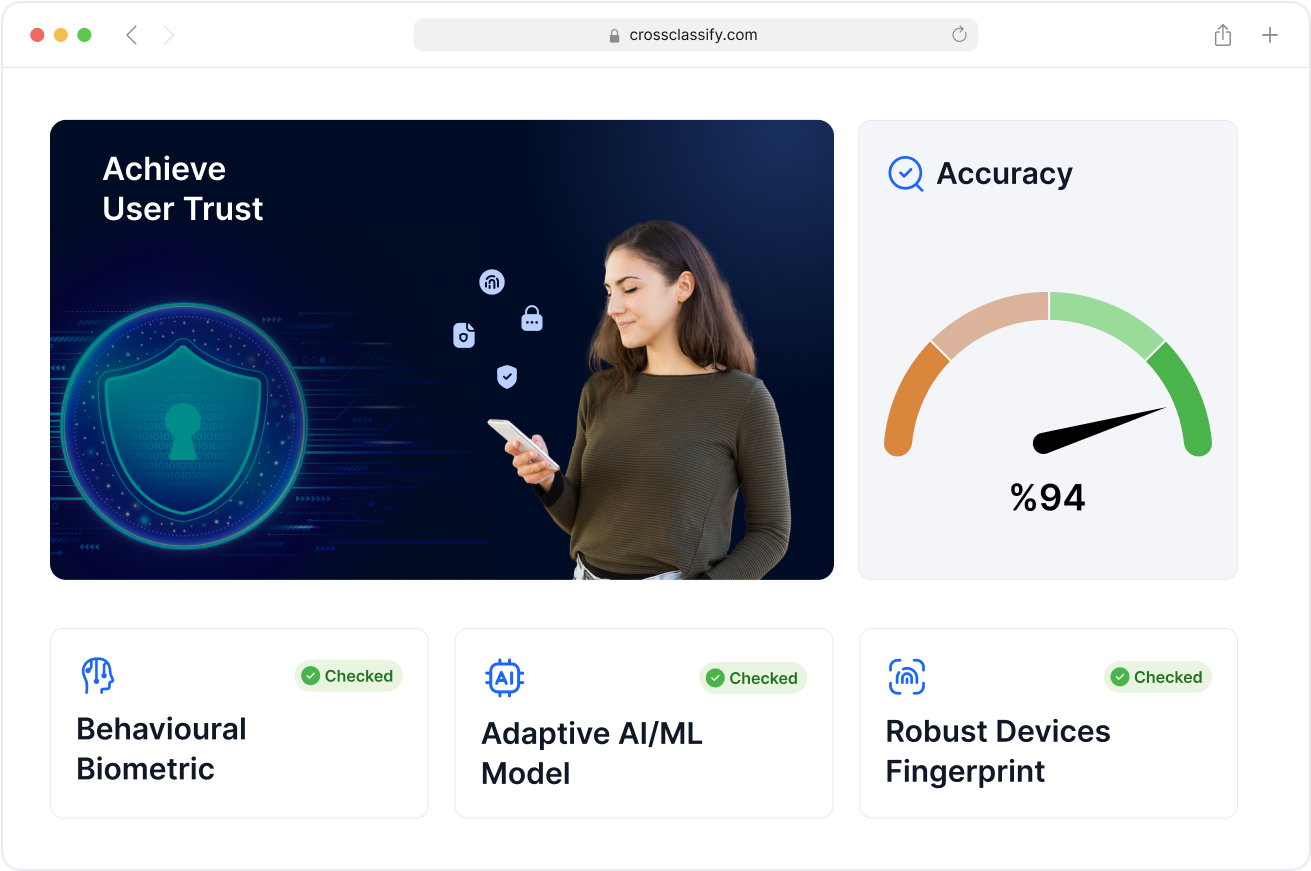

Our Approach to AO Protection

We use the latest industry-level technologies to monitor and detect abnormal activities to prevent account takeover.

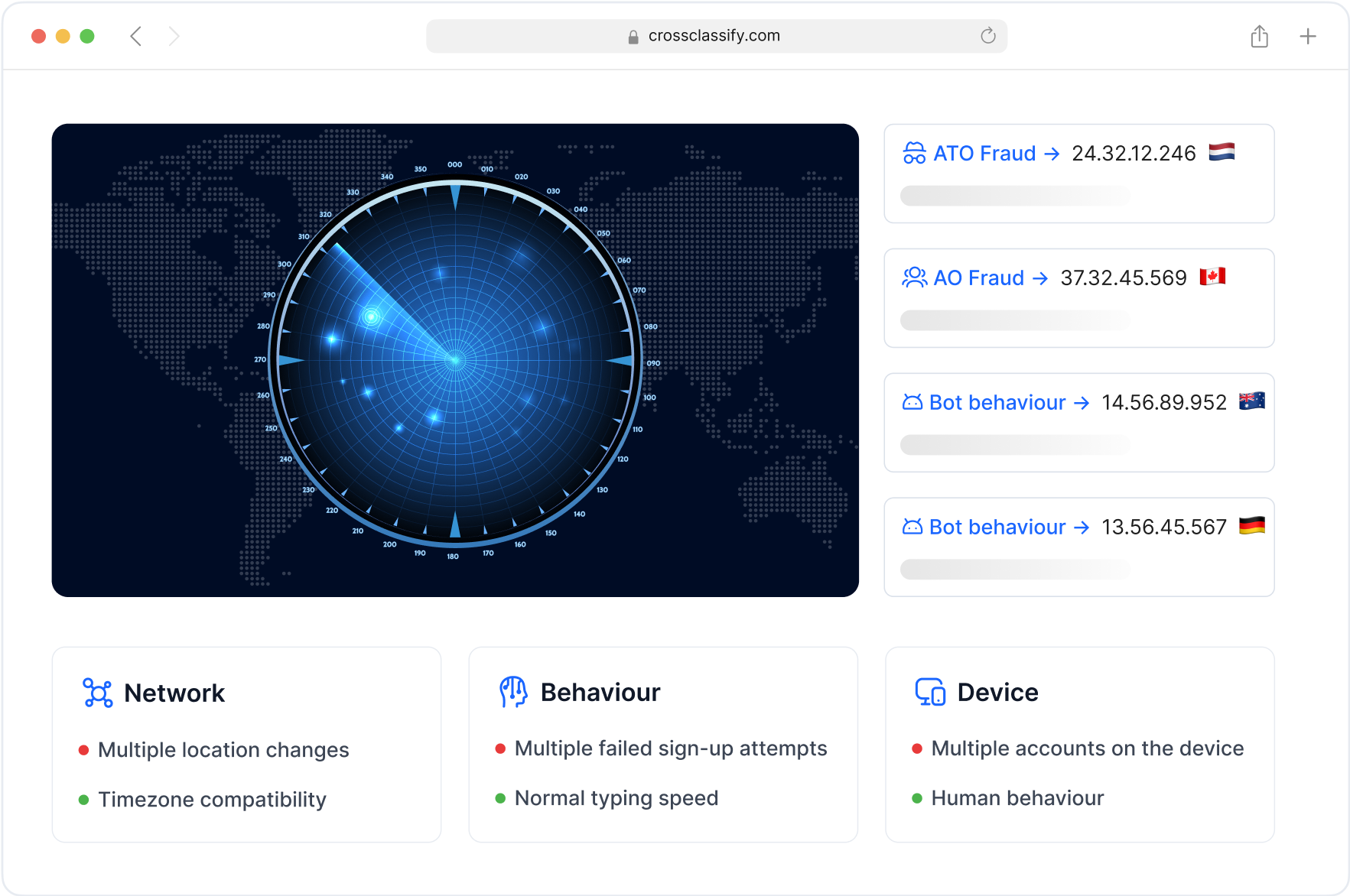

Continuous Monitoring of Account Creation Risk

CrossClassify provides real-time monitoring of account signups , enabling early detection of high-risk behaviors, fake account creation attempts, and abuse during onboarding. By tracking velocity, behavioral anomalies, and device usage, we proactively stop fraudulent account openings before they impact your business.

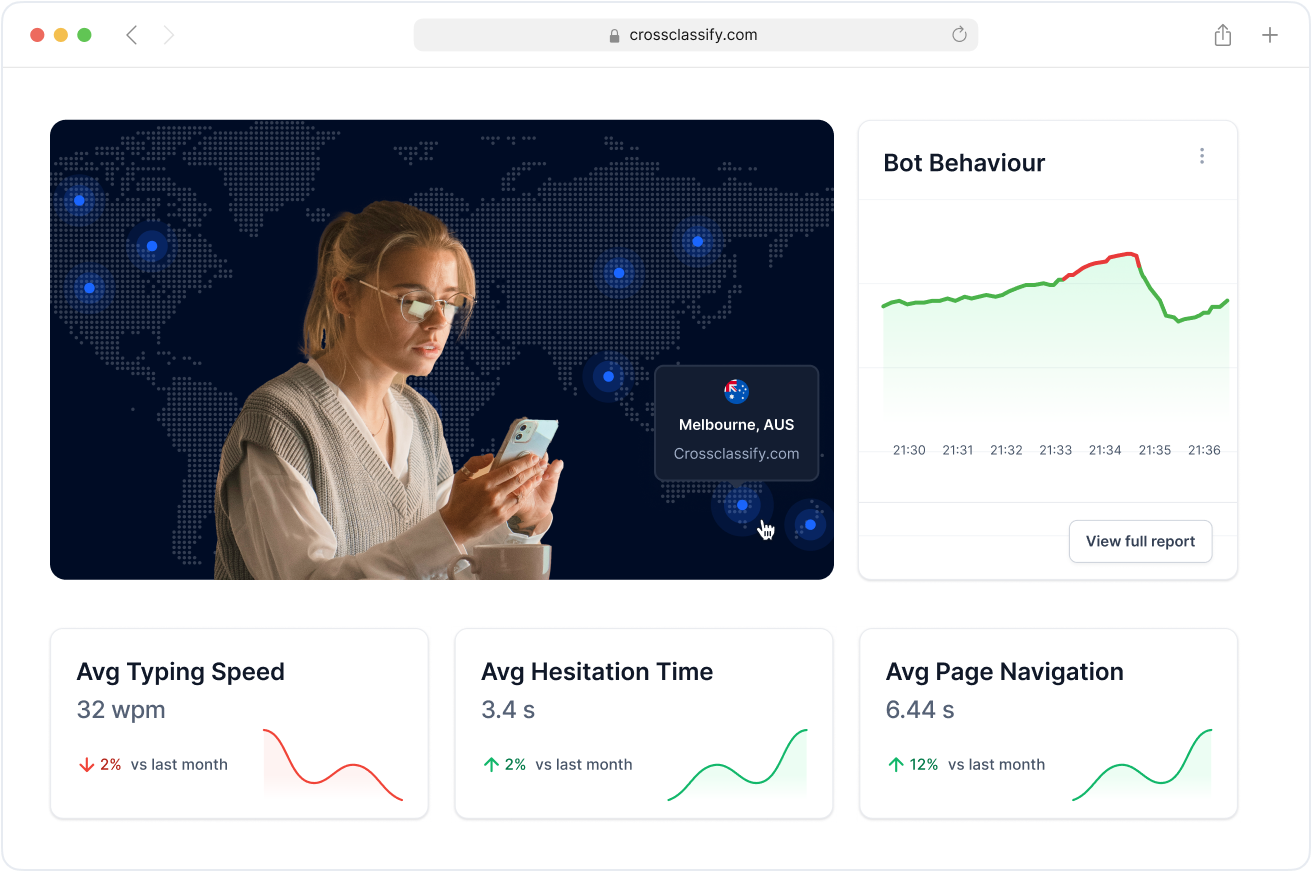

Behavior Analysis of New User Signups

Uncover synthetic identities and fraudulent behaviors by analyzing behavioral biometrics such as keystrokes, mouse movements, and session flow during the account registration process. Detect robotic signups, human fraud farms, or identity mismatch attempts in real time.

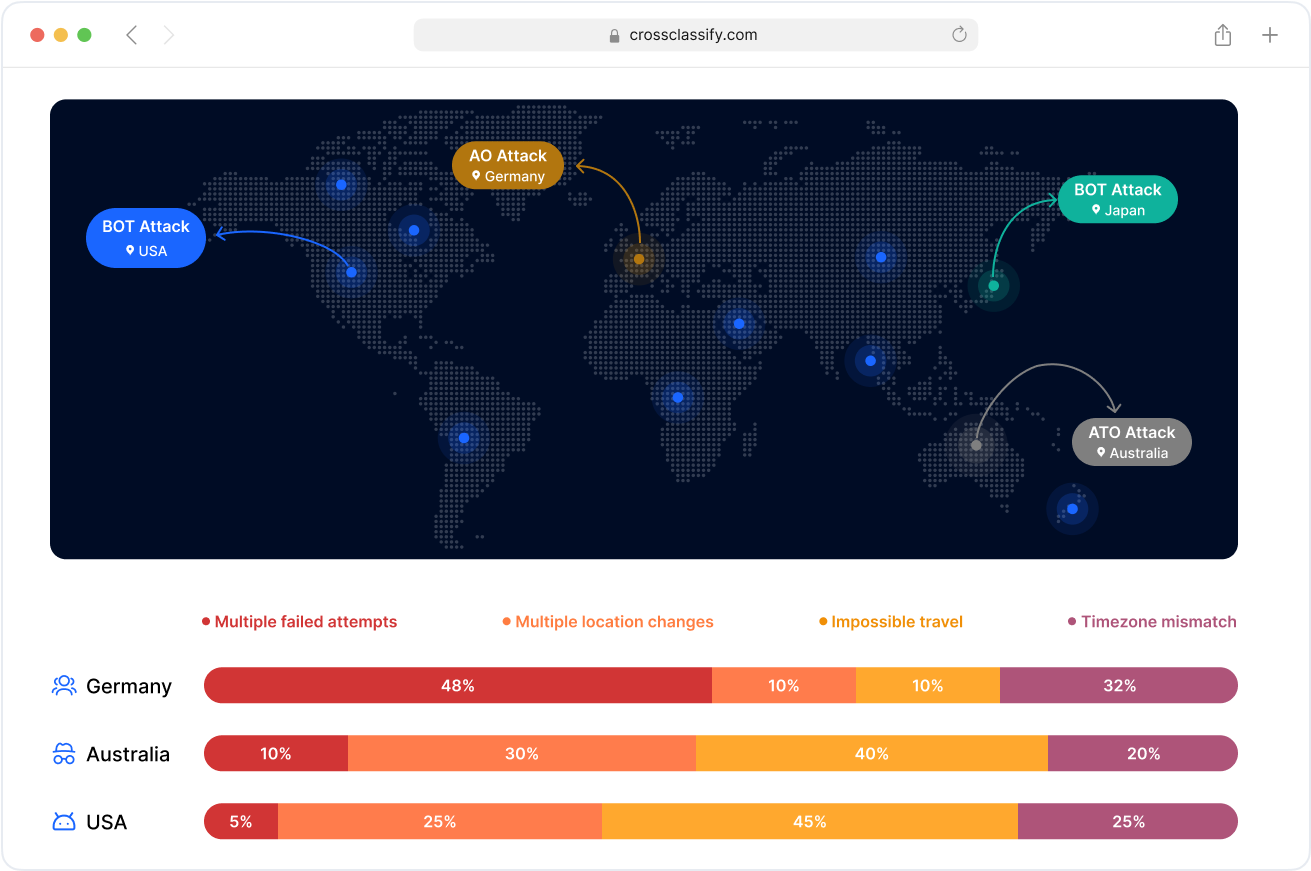

Geo Analysis of Account Registration Attempts

Track and flag signups from suspicious or geo-inconsistent locations to prevent VPN abuse, location spoofing, or IP anomalies often associated with account opening fraud. Combine geo signals with behavioral and device data to build trust scores.

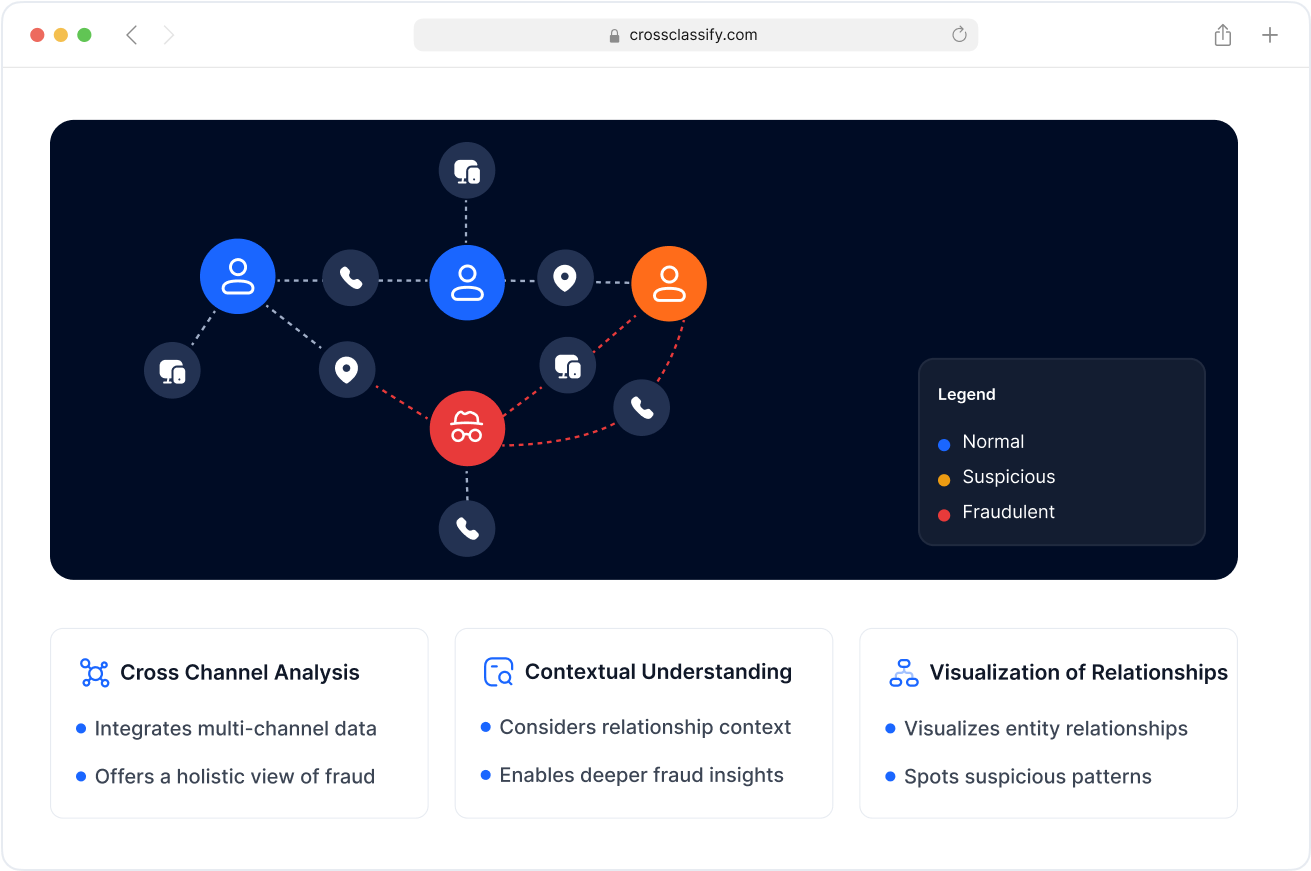

Link Analysis Across Signup Attempts

Identify connected fraudulent accounts through relationship mapping, revealing hidden signup fraud networks, multi-accounting, and referral abuse rings. CrossClassify maps behavioral and device similarities to surface coordinated fraud.

Enhanced Security and Signup Fraud Accuracy

Combine device fingerprinting, behavioral data, and IP intelligence to increase the precision of account fraud detection. Reduce false positives while ensuring accurate decisions in blocking fake or suspicious new accounts.

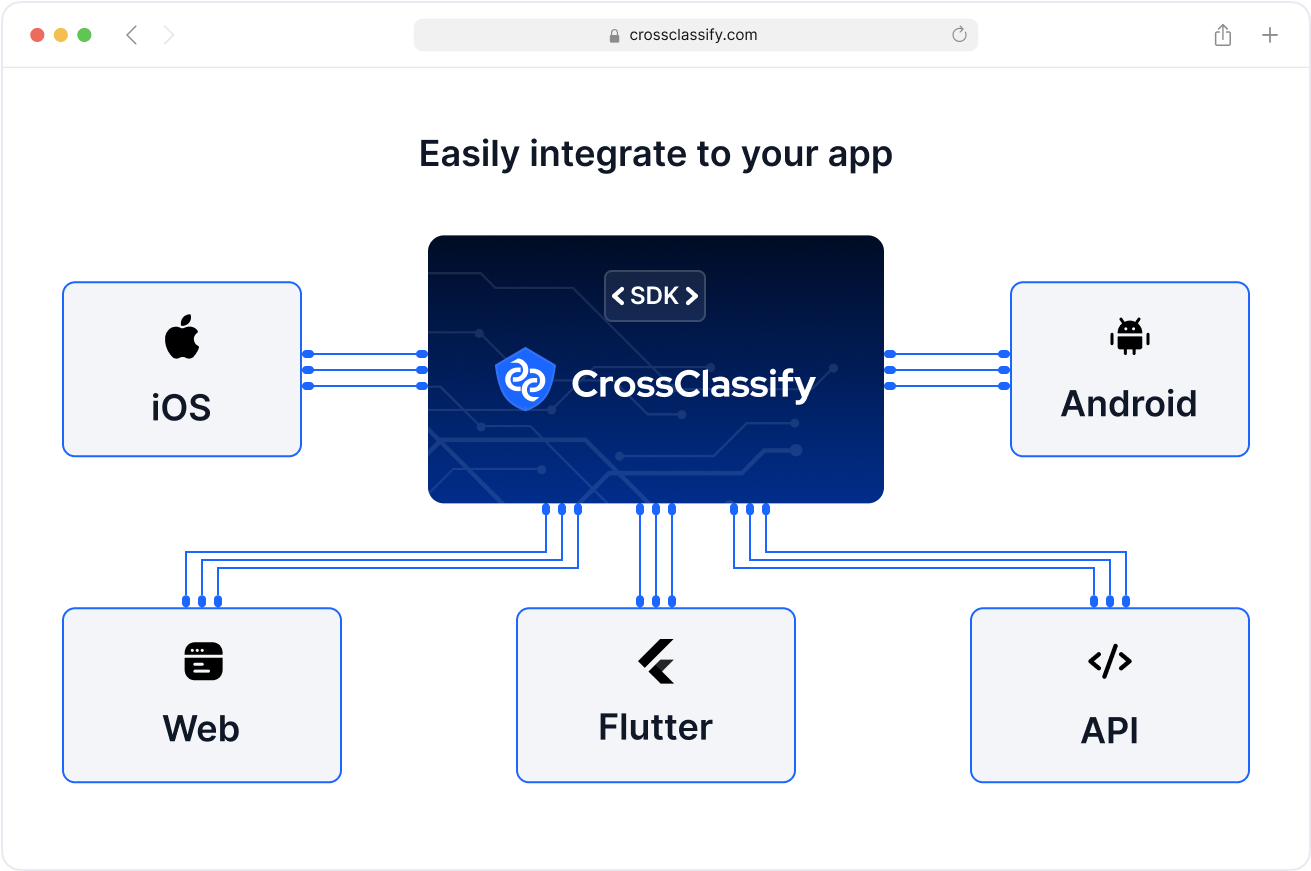

Seamless Integration into Onboarding Flows

CrossClassify integrates effortlessly into your account registration forms, user onboarding flows, or ID verification pipelines via flexible API or SDK. Get fraud prevention built into signups without disrupting UX.

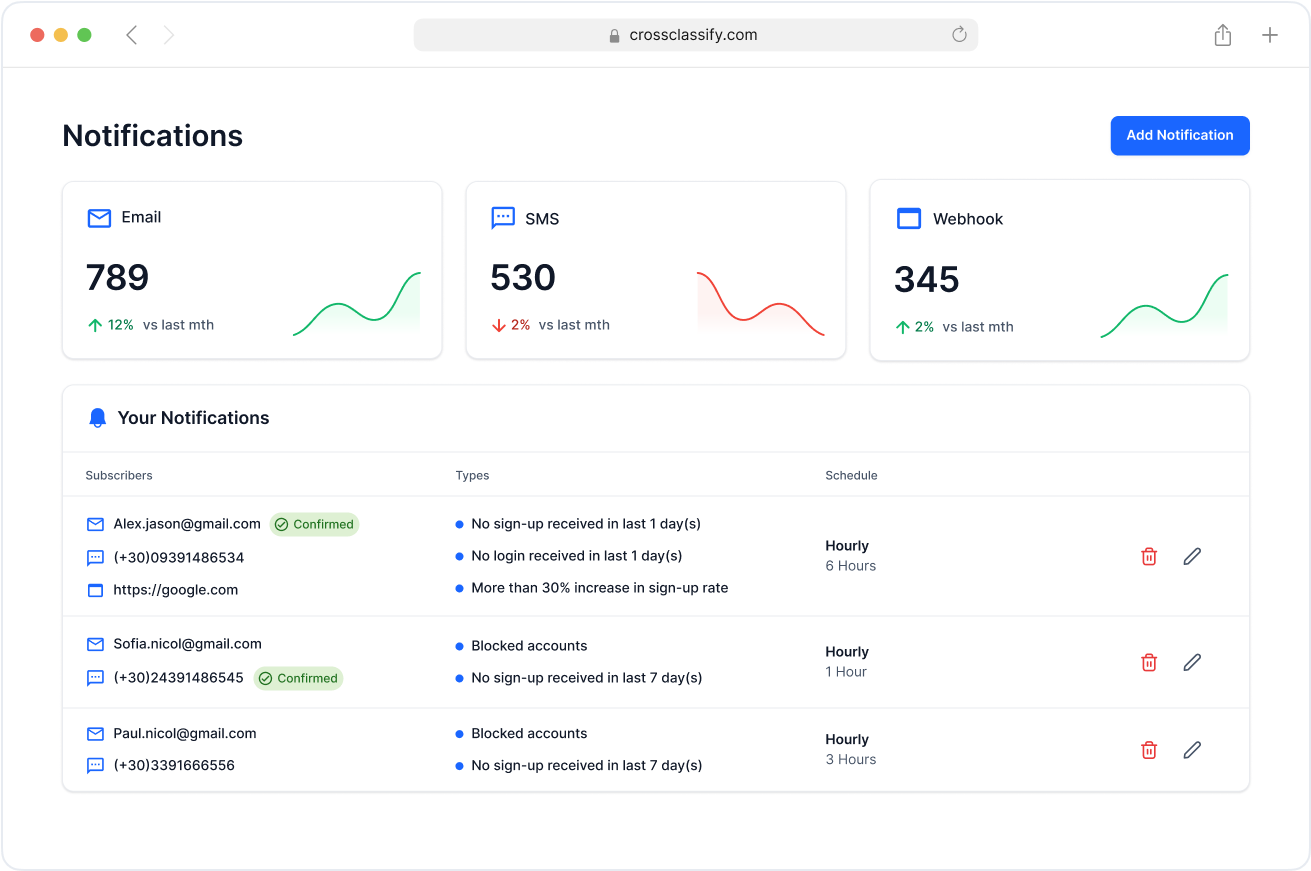

Alerting and Notification of Suspicious Signups

Receive real-time alerts for fraudulent registration attempts, including synthetic identities, referral fraud, or bot activity. Customize rules and thresholds to automate workflows and act instantly.

Blog

Latest from Cross Classify

Frequently asked questions

CrossClassify detects account opening fraud early by analyzing behavioral, identity, and device-based signals before accounts are created.

Read more

CrossClassify identifies patterns across digital identity, device usage, and behavioral signals to detect fraud during account creation.

Read more

CrossClassify uses behavioral biometrics and device fingerprinting to flag these anomalies instantly.

Read more

CrossClassify applies continuous adaptive risk and trust assessment to block high-risk applications without impacting UX.

Read more

CrossClassify’s fingerprinting technology links risky behaviors to devices, even if the attacker changes identity or IP address.Read more in our articles on How Does Device Fingerprinting Work? and Device Fingerprinting: Revolutionizing Digital Security and Beyond

CrossClassify builds risk scores using these behavioral patterns to stop bot-driven account creation.

Read more

CrossClassify detects inconsistencies across behavioral and device fingerprints to identify synthetic identity fraud in real time.

Read more

CrossClassify adds intelligence at the point of onboarding—detecting fraud that WAF and MFA miss.

Read more

CrossClassify links behavior and device data to block fraudulent sign-ups before rewards are issued.

Read more

It enables adaptive trust models that balance fraud prevention and user experience.

Read more

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required