Last Updated on 18 Aug 2025

Freight Fraud Hierarchy: How to Secure Carriers, Brokers, Shippers and Platforms

Share in

Introduction

Freight and transportation platforms are high-value targets for organized rings that monetize stolen identities, spoofed carriers, double brokering, payout diversion and rate scraping. The fastest path to resilience is an AI powered freight fraud detection platform that merges identity, device and behavior into a single decision engine. CrossClassify operationalizes this through behavioral biometrics for freight operators, device fingerprinting for dispatchers and brokers and real time risk scoring for logistics across web, mobile and APIs. What follows is a practical hierarchy of the threats we see most often in freight and the exact signals and evidence your teams should monitor. Use it as a blueprint for runbooks, dashboards and board-ready reporting.

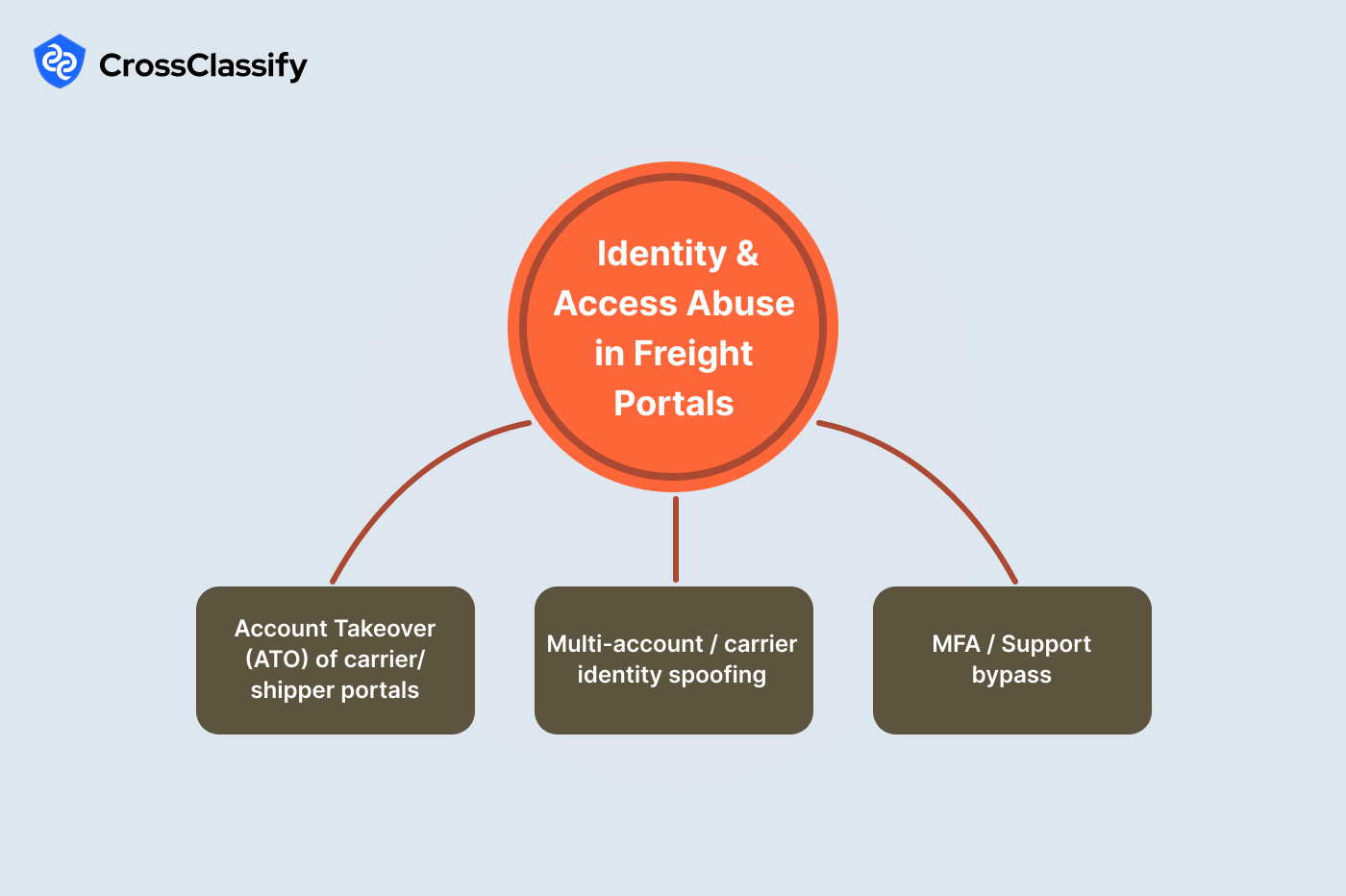

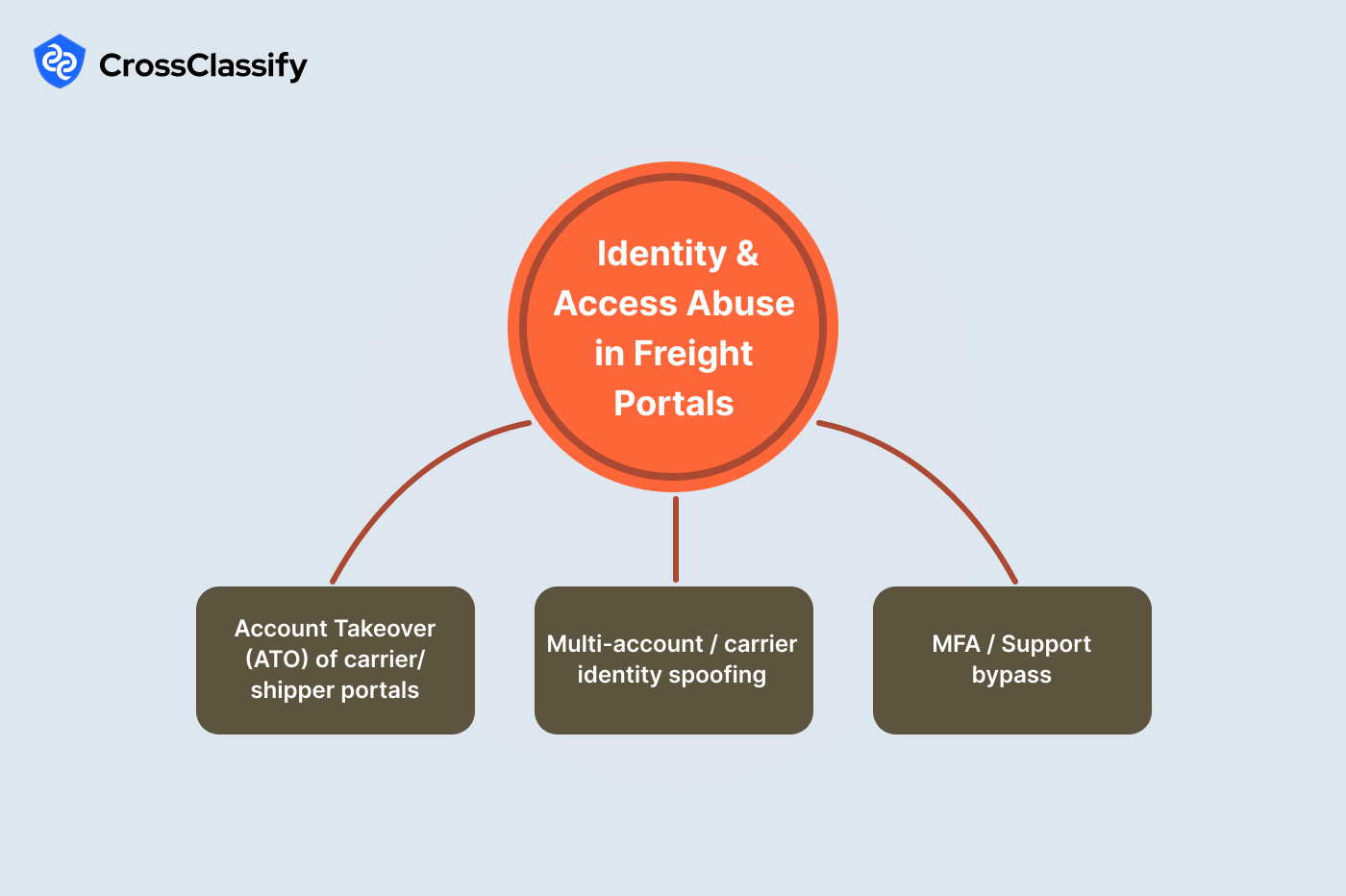

Identity and Access Abuse in Freight Portals

Account and session integrity drive the entire marketplace. When adversaries compromise a carrier or shipper portal, they jump tender queues, reroute payouts or stage double brokering. CrossClassify correlates identity attributes with device telemetry and behavioral signals at login and continuously during session to stop post-authentication drift. This section explains the most common identity abuses and the freight-specific signals that expose them. Real-world context: credential-stuffing waves routinely hit transportation customer portals, and several brokers have reported tender hijacks via compromised logins within minutes of acceptance.

1. Account Takeover of Carrier or Shipper Portals

Attackers use leaked credentials and OTP social-engineering to seize an account, then accept or cancel tenders and move payouts.

Signals and evidence:

- New logins from unfamiliar hubs immediately before tender acceptance: Heat-map by hub and hour

A sharp hotspot in an atypical metro just before a tender acceptance is a reliable precursor of takeover. The heat-map lets operations differentiate legitimate seasonal activity from attack windows and documents the time-boxed burst so compliance can act. - Spike of failed logins followed by a successful one: Line chart of failed vs. success over time

Bursts of failures that quickly flip to a success indicate credential-stuffing that finally landed a hit. Annotate the line chart with the targeted accounts and IP ranges to guide blocklists and MFA enforcement.

2. Multi-Account and Carrier Identity Spoofing

Fraud rings register look-alike carriers or recycle identities to win tenders at scale.

Signals and evidence:

- Many carrier accounts tied to the same device or IP bidding the same lanes: Devices to accounts network

A hub-and-spoke network where one device connects to many MC numbers reveals an operator farm. Degree centrality and community detection make the collusion visible for takedown. - Reused device fingerprints across distinct MC numbers: device_id to MC table

A simple table listing a device_id against multiple carriers is the evidence procurement teams need to suspend accounts pending KYC re-verification.

3. MFA and Support Bypass

Attackers persuade support to change contact details or reset passwords.

Signals and evidence:

- Email or phone change followed by password reset within minutes: Coupled time-series

Temporal coupling between profile change and reset is a classic bypass signature. The time-series clarifies whether your SLA or training gives attackers an exploitable window. - Support tickets immediately preceding credential changes: Proximity table

A table that lists ticket channel, change type and minutes between them highlights social-engineering runs that target chat or after-hours phone lines.

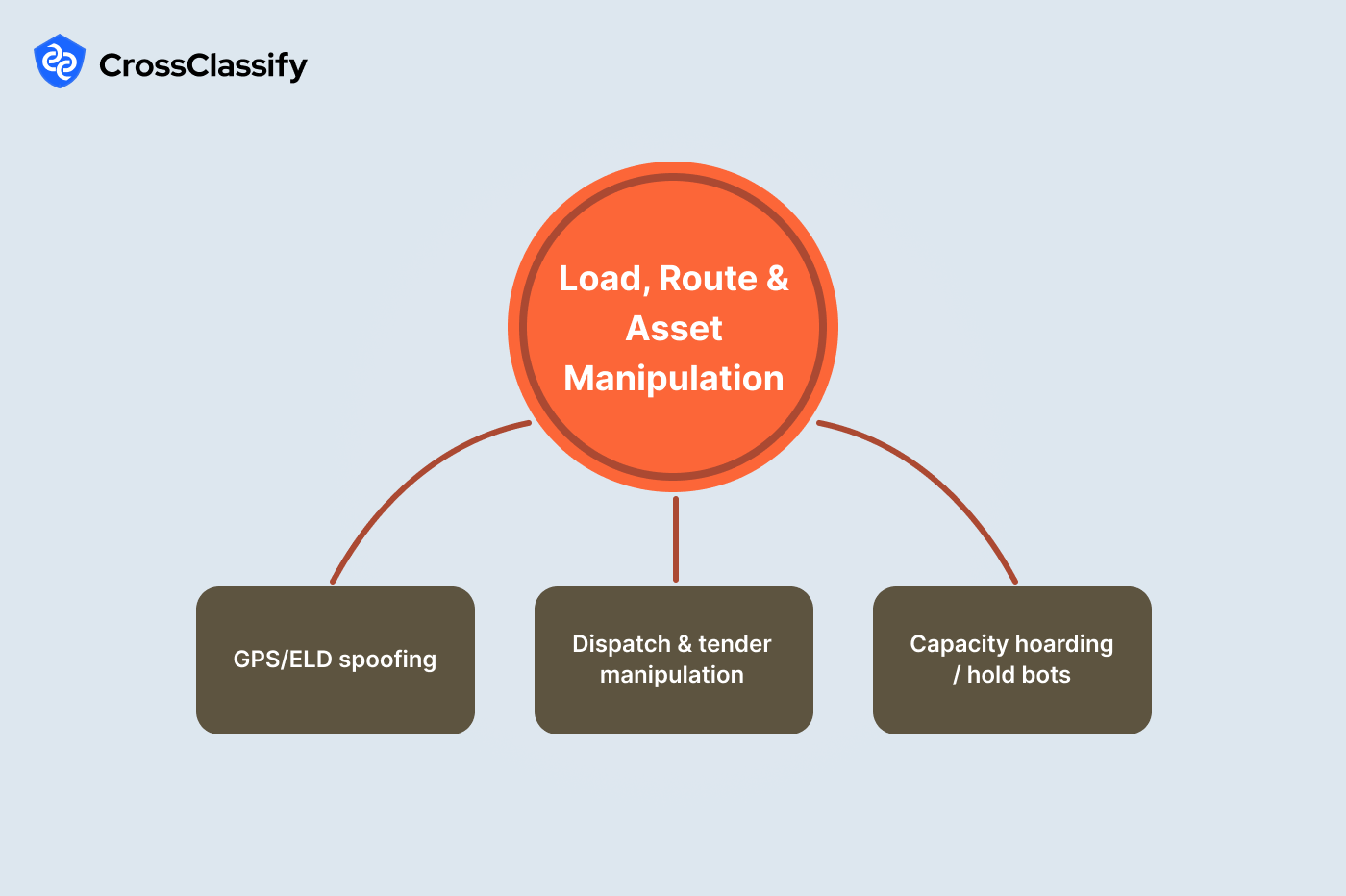

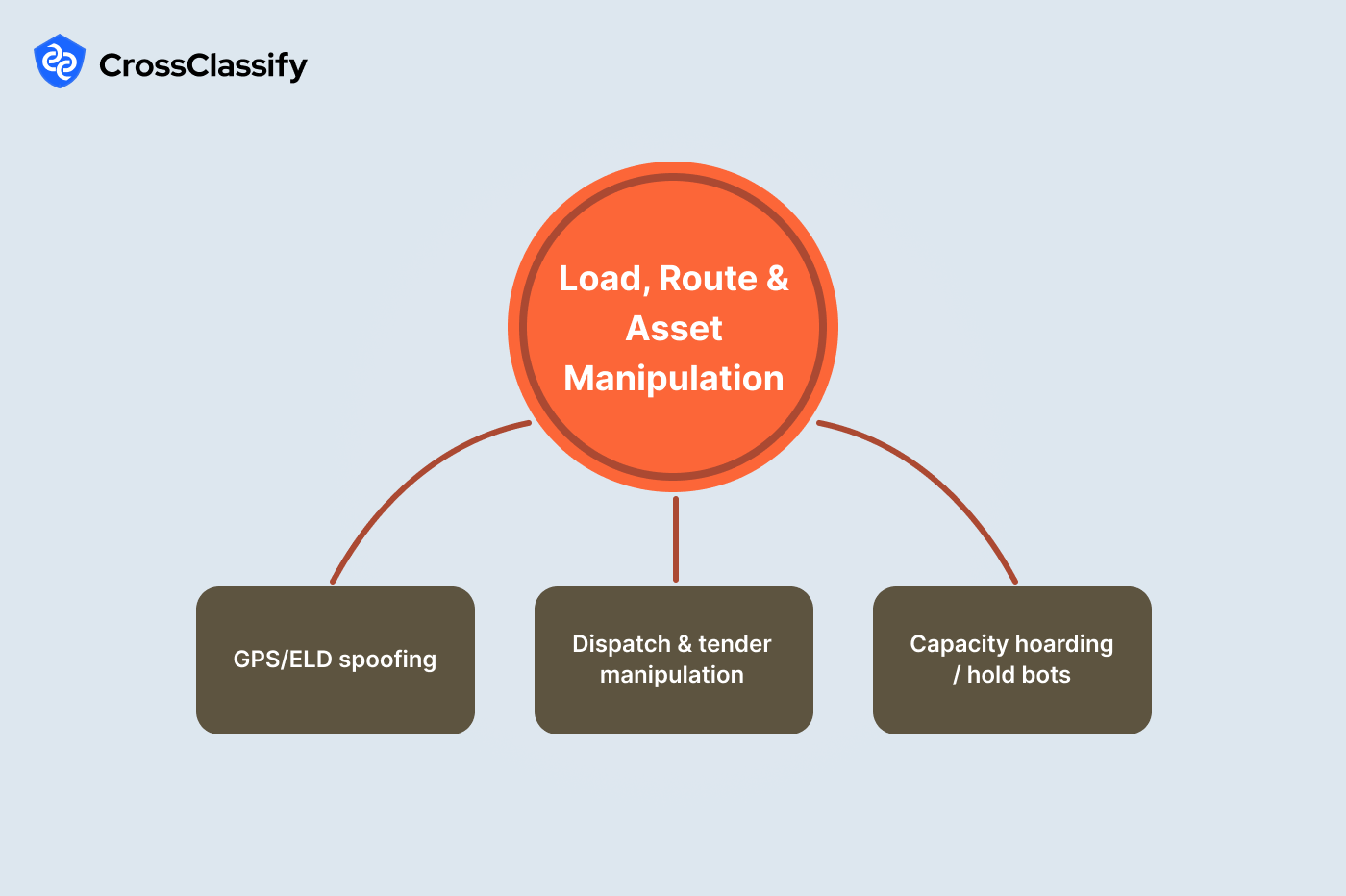

Load, Route and Asset Manipulation

When load data can be altered or telemetry can be spoofed, safety and margin suffer. The objective is to validate lanes, pings and dispatch decisions against human and sensor behavior. Maritime and trucking have both seen route manipulation; the NotPetya incident that disrupted a global ocean shipper is a long-standing reminder that transportation telemetry is a lucrative target.

1. GPS and ELD Spoofing

Spoofed coordinates or tampered logs hide theft, hours-of-service violations or unauthorized detours.

Signals and evidence:

- Truck speeds exceed policy thresholds: Speed vs. time line chart with a policy band

Sustained excursions above the threshold without corresponding road conditions point to edited ELD data or location spoofers. Pair this with driver and tractor identifiers to show repeat patterns. - Teleport jumps between pings: Miles between consecutive pings graph

Large distances in short time windows show that the location stream is not physically plausible. Escalate records above your plausibility baseline and correlate with mobile OS or head unit types.

2. Dispatch and Tender Manipulation

Coordinated operators accept tenders to lock capacity then cancel, forcing shipper concessions.

Signals and evidence:

- Accept-then-fast-cancel sequences: Accepts vs. cancels time-series

A co-spike in acceptances followed by cancellations is telltale tender gaming. Flag the cohort for stricter acceptance thresholds or pre-authorization holds. - Same device orchestrates dispatch for many carriers: Device to carrier counts table

Orchestrators using one workstation to manage many shell carriers stand out as outliers. The table gives auditing teams the evidence to request onsite validation.

3. Capacity Hoarding and Hold Bots

Bots place temporary holds across lanes to starve competitors of capacity.

Signals and evidence:

- High holds with low conversion across lanes and days: Lane by day heat-map

Persistent hotspots with few bookings surface inventory denial. Add a conversion overlay so product teams can apply targeted friction only where risk is highest. - Same device creates holds for many shippers: Hold device spread table

A wide distribution of shipper IDs per device signals a bot or aggregator. Use the table to feed device-level throttling and CAPTCHA escalation.

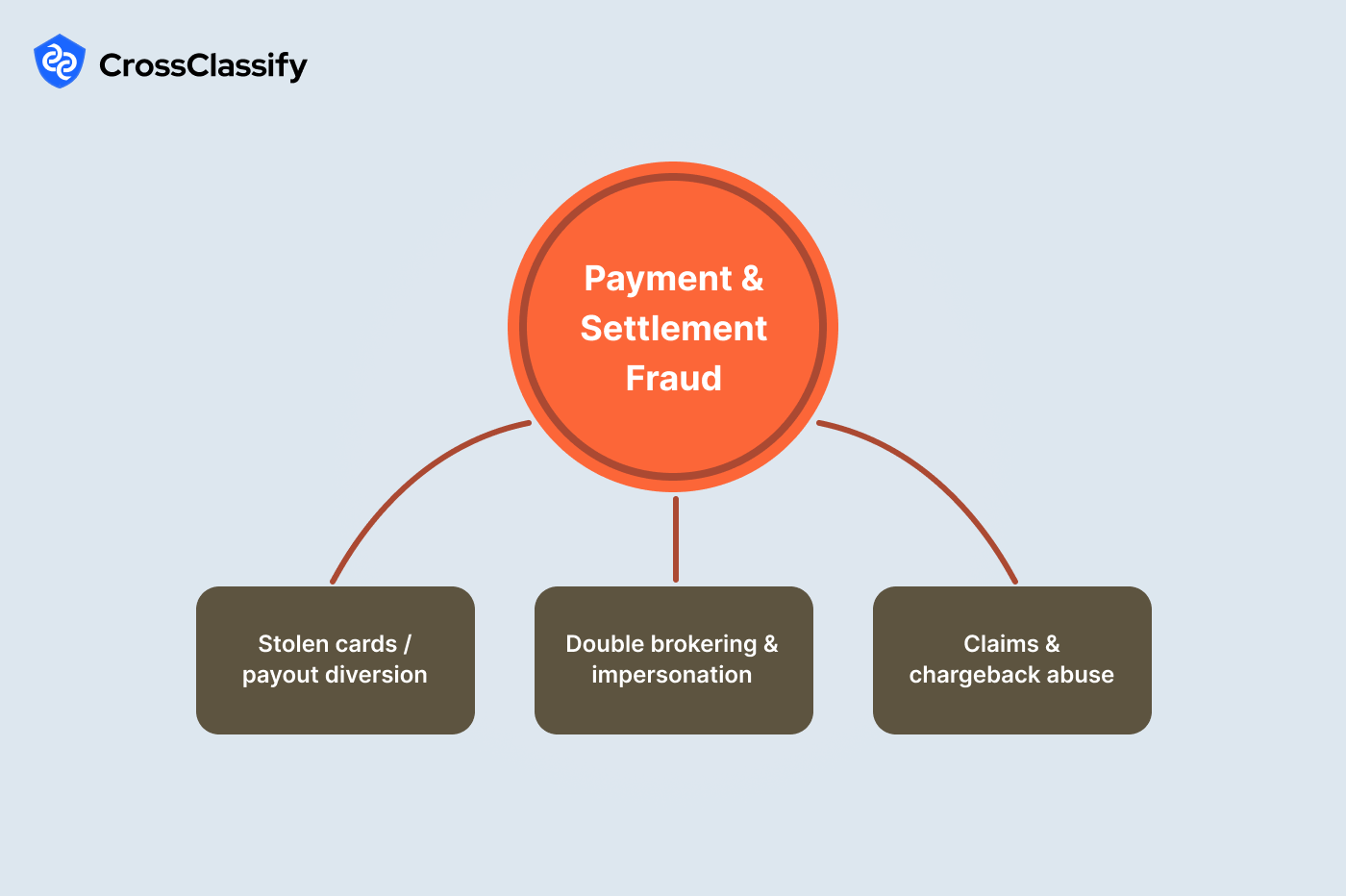

Payment and Settlement Fraud

Money movement is the endgame. Rings reroute funds, test cards and exploit weak dispute controls. Several U.S. brokers publicly reported seven-figure losses tied to double brokering and payout diversion, which often start with small bank-detail edits.

1. Stolen Cards and Payout Diversion

Attackers change payout targets or test BINs to prime larger thefts.

Signals and evidence:

- Payout bank change followed by a large payout within 24 hours: Coupled time-series

Tight coupling is a diversion hallmark and should trigger hold-and-review. Show both event markers so finance can justify delay decisions. - AVS or CVV mismatch spikes by BIN: Mismatch rate per BIN dashboard

A single BIN with elevated mismatches indicates testing. The bar chart becomes the basis for BIN-level rate limits or step-up verification.

2. Double Brokering and Impersonation

Illicit intermediaries re-sell loads under a different identity and capture margin or full payout.

Signals and evidence:

- Same bank account used by multiple carriers: Carriers to bank accounts network

Shared payout targets expose rings quickly. The network visualization helps procurement close the loop with banks and regulators. - Rate confirmation edits after acceptance: Post-accept edit table

Rapid edits shortly after acceptance are a reversal tactic. The table gives legal and operations a precise timeline for the dispute package.

3. Claims and Chargeback Abuse

Bad actors dispute deliveries or fabricate damage to claw back funds.

Signals and evidence:

- Repeat disputes by shipper: Disputes per shipper bar chart

Outlier shippers with high dispute counts are serial abusers. The chart directs account managers to remediation or removal. - High-value short-haul chargebacks: Heat-map by distance and value

Hot cells at short distance and high value signal opportunistic fraud. Use this evidence to tune pre-delivery photo requirements or POD verification.

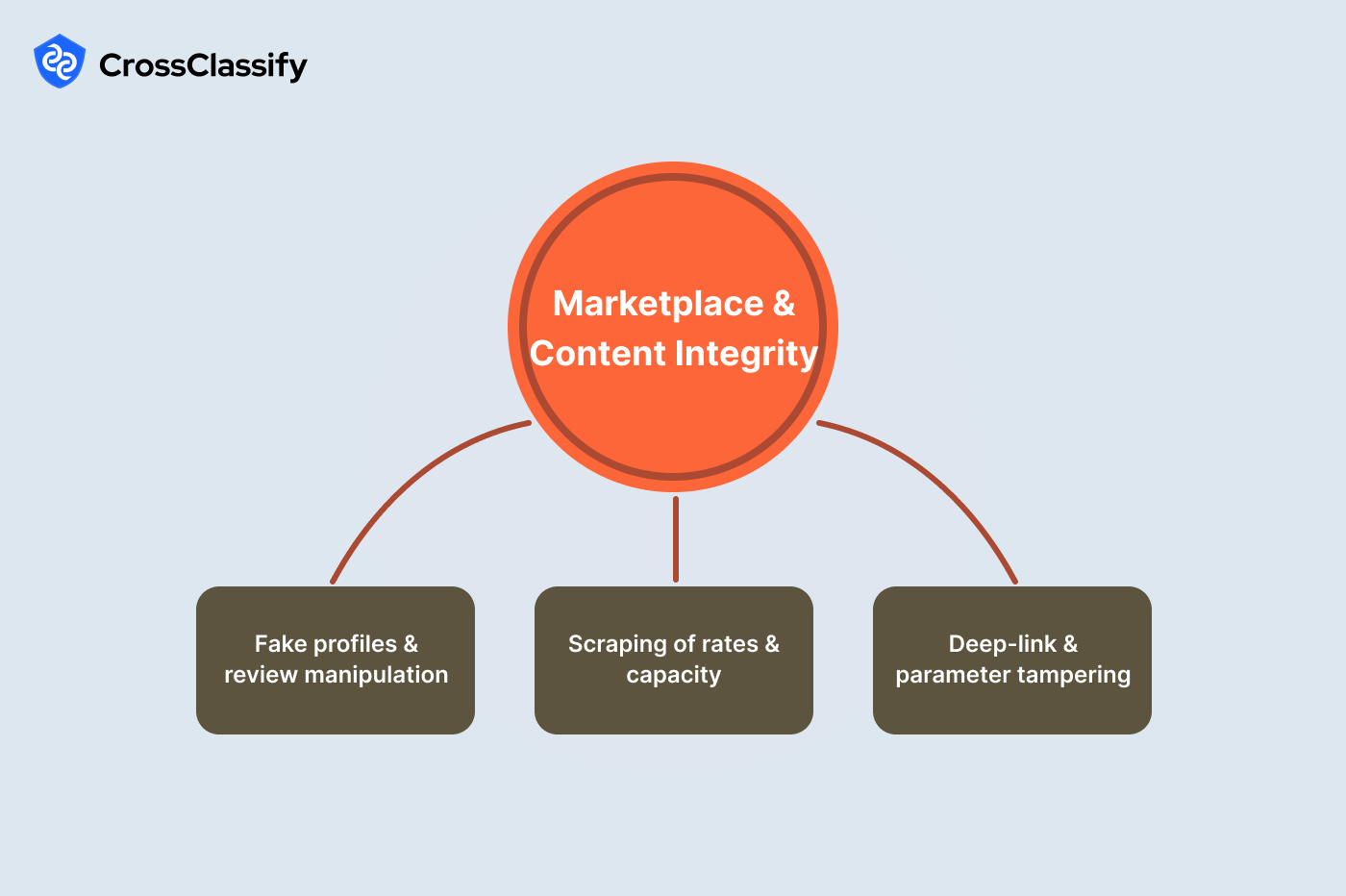

Marketplace and Content Integrity

Healthy marketplaces rely on authentic participants and fair information. Freight marketplaces have documented fake review waves and large-scale scraping that depressed margins and distorted prices.

1. Fake Profiles and Review Manipulation

New accounts astroturf reviews to inflate carrier ratings or smear competitors.

Signals and evidence:

- Review bursts from new accounts on the same day: Cohort review line chart

Same-day surges from first-time reviewers point to stuffing. Suppress the cohort while requiring higher trust levels for review privileges. - IP clusters posting across multiple profiles: IP to profile network

Central IP nodes linked to many profiles reveal coordination hubs. The network evidence is simple to present to moderation councils.

2. Scraping of Rates and Capacity

Automated agents harvest quotes and capacity signals to arbitrage or undercut.

Signals and evidence:

- Excessive search requests from headless or uncommon user-agents: Requests per user-agent bar dashboard

Headless and script user-agents dominating traffic indicates scraping. Throttle these signatures and require authenticated session context. - High search-to-booking ratios from specific IP ranges: S to B ratio table

Extreme ratios mean reconnaissance without purchase intent. Block the ranges or move them to delayed quotes.

3. Deep-Link and Parameter Tampering

Attackers change deep-link parameters to alter quoted or charged rates.

Signals and evidence:

- Mismatch between quoted and charged rate: Quoted vs. charged delta table

Positive deltas pinpoint where the handoff can be manipulated. Use them to harden signature checks or server-side recomputation. - Unsupported service codes in requests: Invalid code count bar chart

A rise in invalid codes indicates probing of your routing logic. The evidence supports WAF rules and schema validation.

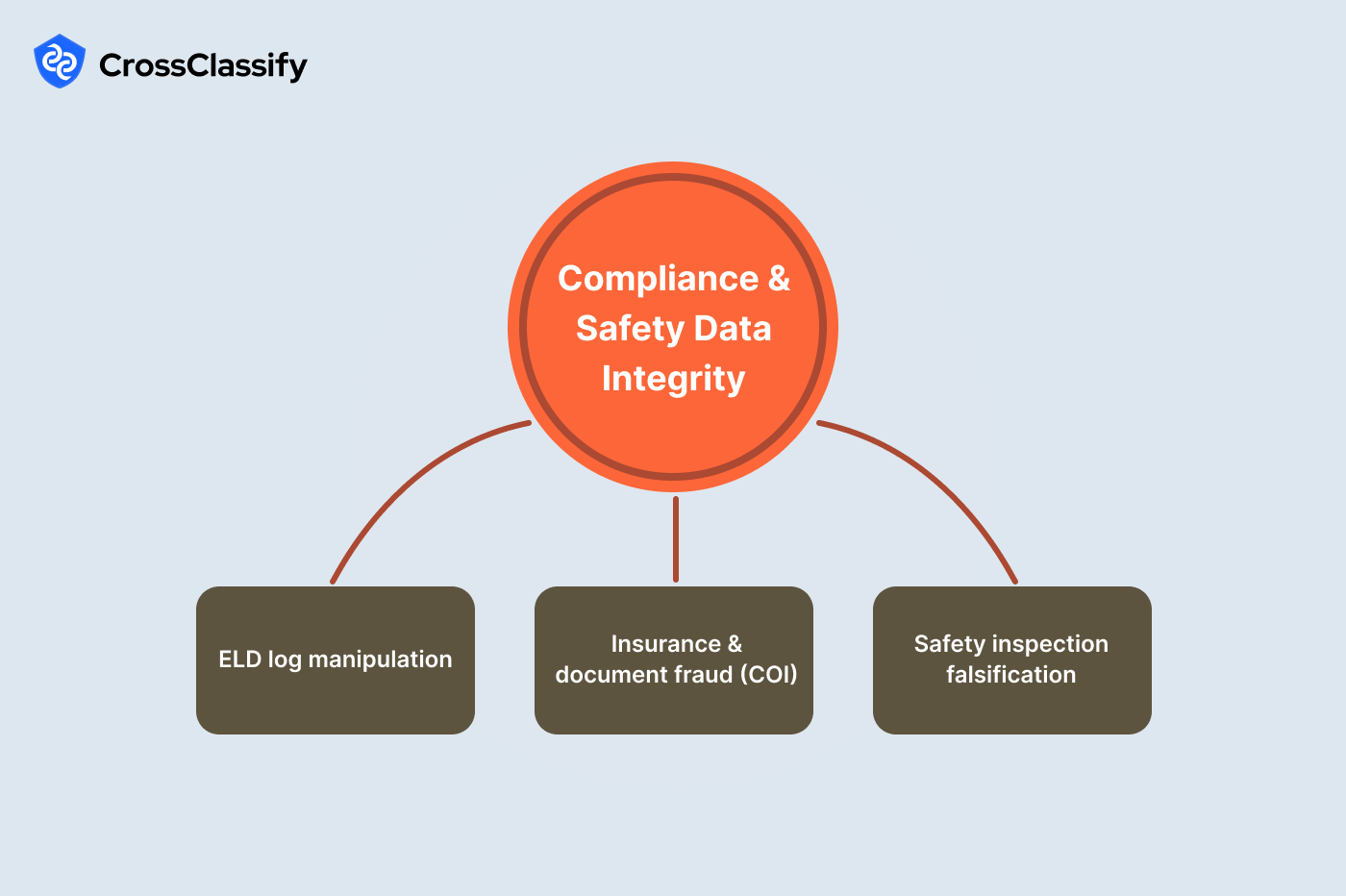

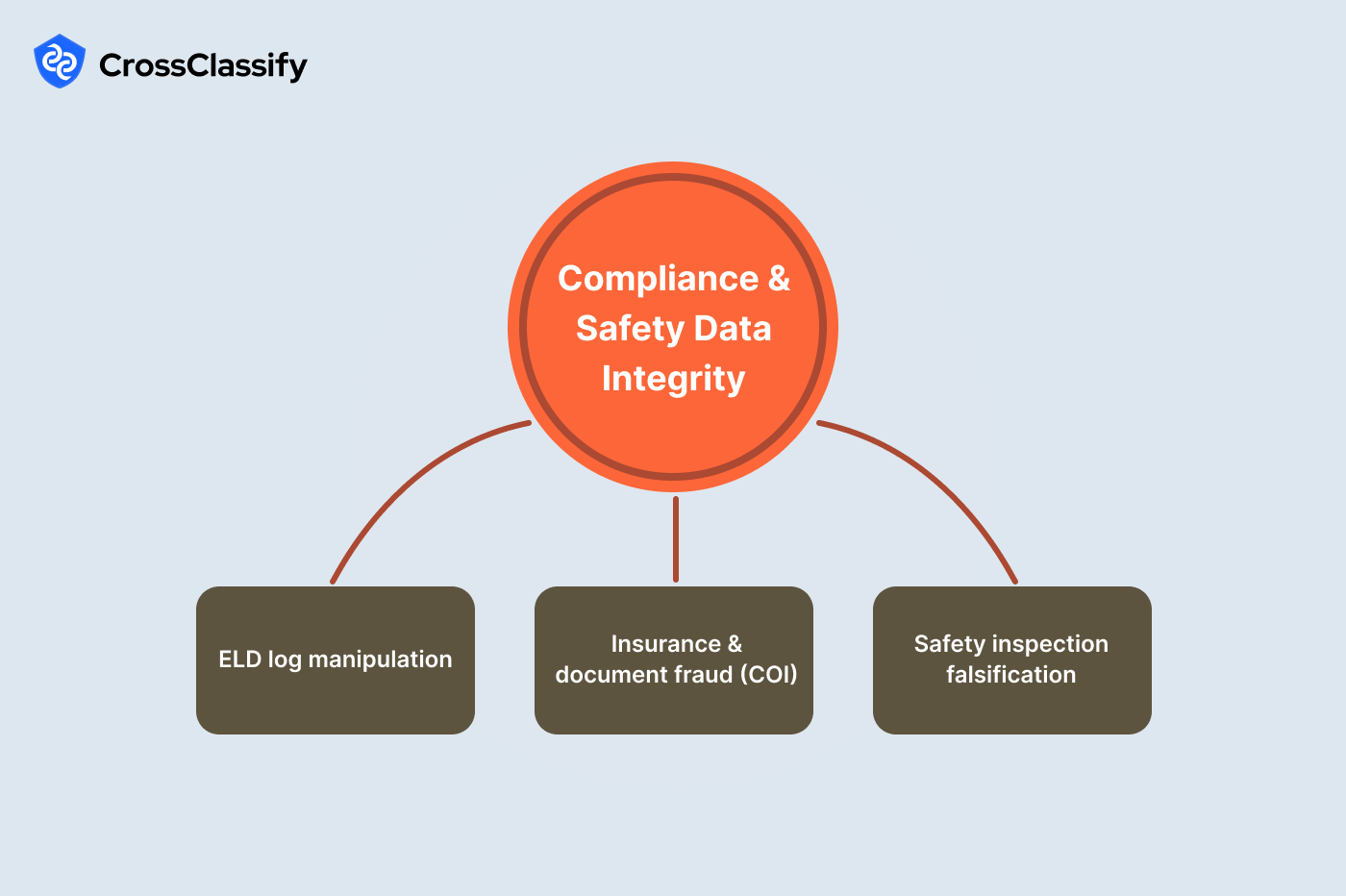

Compliance and Safety Data Integrity

Compliance failures create regulatory, legal and safety exposure. We frequently see coordinated ELD log edits and falsified inspections during audits.

1. ELD Log Manipulation

Drivers or coordinators edit logs to hide over-hours driving.

Signals and evidence:

- HOS off-duty driving violations by driver: Violations per driver bar chart

Outlier drivers exceed HOS limits or show improbable duty segments. The bar chart empowers compliance to escalate coaching or disciplinary action. - Identical log edit times across drivers: Log-edit heat-map

Synchronized edits suggest batch manipulation by a single operator. Pair the heat-map with workstation device fingerprints to close the loop.

2. Insurance and Document Fraud

Expired or forged certificates of insurance and recycled PDFs are still common.

Signals and evidence:

- Expired COI used at tender: Days-to-expiry table

Negative days indicate expired coverage at decision time. This is strong evidence for automated tender rejection. - PDF fingerprint reuse across carriers: Document hash reuse table

The same hash across multiple carriers indicates forgery or template reuse. Evidence supports KYC re-verification or removal.

3. Safety Inspection Falsification

Copy-pasted inspections or off-site submissions undermine trust.

Signals and evidence:

- Burst of inspection submissions in one minute: Submissions per minute dashboard

A single-minute burst shows copy-and-paste behavior. Enforce rate limits and require richer media proof. - Inspections outside facility geofence: Geofence hit table

No-hit rows mean forms were filed away from the site. The table is actionable proof for training or suspension.

How CrossClassify Maps To This Hierarchy

CrossClassify turns the hierarchy into a live control system that continuously measures risk, explains why a session is risky and applies the lightest effective control. The platform fuses identity signals, device fingerprinting for freight, and session behavior into a single score that updates at login, during navigation, at tender accept, at dispatch, at payout, and at claim submission. Scores are explainable and are backed by evidence objects that match your runbooks such as heat maps, tables, graphs, diagrams, and networks. This approach lets freight teams remove fraud and keep genuine carriers and shippers fast. The result is a measurable lift in tender conversion, on time pickup and cash flow protection.

1: Device intelligence and identity proofing that persist across environments

- What it does: CrossClassify builds durable device identities across web, mobile, ELD browser shells and API clients. The fingerprint blends stable hardware and software traits, TLS and clock characteristics, input entropy and network posture so it survives cookie clears, private browsing and many VPN or proxy scenarios.

- Why it matters for the hierarchy: The same device can be tied to multiple carrier accounts, repeated bank edits, capacity holds across shippers and orchestrated dispatch events. These connections power the networks that expose double brokering hubs and multi account farms.

- Actions: Step up authentication on unknown devices, quarantine payout changes that originate from risky devices, throttle lane holds from devices that span multiple shippers.

2: Behavioral biometrics for freight operators that feel invisible to good users

- What it does: The platform learns keystroke cadence, pointer paths, scroll velocity, form fill timing, screen dwell on portals, and ELD interaction rhythms such as sequence and timing of duty status edits. Models are per role and per tool so dispatchers, carrier admins and finance reviewers are judged against the correct baseline.

- Why it matters for the hierarchy: Takeovers and scripted bots deviate from human rhythms during tender acceptance, bank detail edits, rate confirmation changes and claim upload flows. Abnormal behavior inside a session triggers controls even when the credential was correct.

- Actions: Trigger one time verification inside the flow, lock high risk edits until a supervisor approves, cancel scripted rate scraping sessions, require additional media on suspect safety or claim submissions.

3: Real time risk scoring for logistics decisions

- What it does: A streaming scorer ingests login telemetry, device risk, behavioral features, telematics plausibility, user agent integrity, search to booking ratios, BIN mismatch rates and network linkage results. The score recalculates whenever new evidence lands so decisions stay current during long sessions.

- Why it matters for the hierarchy: Freight fraud unfolds quickly. The scorer raises risk at the exact moment a bank account is edited or a GPS ping jumps an impossible distance or an IP range floods search without booking.

- Actions: Pause payouts for review, block deep link parameter changes and recompute server side, lower tender priority for high risk carriers, enforce cooling off after support interactions that precede credential changes.

4: Graph and link analysis that reveal coordination

- What it does: CrossClassify resolves entities then builds networks across carriers, shippers, bank accounts, devices, IPs, document hashes, MC or DOT numbers and addresses. Graph features such as degree, triads, temporal motifs and community structure uncover hidden coordinators.

- Why it matters for the hierarchy: Double brokering, fake profiles, review stuffing and device sharing rely on coordination. Networks turn weak hints into decisive evidence that a small set of actors drives many events.

- Actions: Auto route clusters into enhanced due diligence, collapse payouts to a manual queue when a shared account node is detected, disable review privileges for cohorts tied to the same IP hub.

5: Evidence packs that match your controls and audits

- What it does: Every alert ships with a ready to share artifact that mirrors this hierarchy. You get a hub by hour heat map for account takeover, a failed versus success line chart for stuffing, a carriers to bank accounts network for duplicate payout targets, an S to B ratio table for scraping and a distance between pings graph for GPS plausibility.

- Why it matters for the hierarchy: Investigators need to act quickly and auditors need context. Evidence packs shorten decisions, improve dispute outcomes and create consistent communication with partners.

6: Freight native integrations that reduce time to value

- Sources: TMS and broker portals, carrier onboarding and KYC flows, payment processors, bank change forms, ELD and telematics feeds, GPS or mobile SDKs, WAF and CDN logs, SIEM, IAM and support systems.

- Controls: Session risk to the web and mobile front end, payout holds to finance, tender priority and rate quote hardening to marketplace logic, API throttles to platform gateways, and notifications to operations and compliance.

7: Privacy, safety and operations at scale

- Governance: Data minimization and tokenization keep personal data scoped while link analysis still works. Models are bias tested against geography and fleet size.

- Reliability: Edge collectors buffer during connectivity gaps that are common in yards and on long lanes, then sync when back online.

- Safety: Controls are shift and role aware so risk interventions do not block urgent dispatch and do not degrade safe driving.

Direct mapping from capabilities to hierarchy signals

- Account takeover signals are caught by the combination of device persistence, behavioral drift and hub by hour heat maps.

- Multi account and identity spoofing appear as dense device to account networks and multi MC device tables.

- Payout diversion is flagged by real time coupling of bank edits and payout attempts plus device risk.

- Scraping is controlled through user agent integrity, search to booking ratio tables and session depth analytics.

- Route manipulation is exposed by telematics plausibility graphs that compare speed and distance between pings.

For a product overview tailored to shippers, brokers and carriers, visit: CrossClassify Freight Solutions

For a deeper breakdown of fraud patterns and defenses in this sector, read: Defending the Freight Industry

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

Tender hijacks are usually preceded by risky session signals such as unusual geovelocity and failure-to-success login bursts right before acceptance. The best control is to keep sessions in continuous evaluation and trigger extra verification only when the risk truly rises. CrossClassify applies continuous, adaptive risk scoring and device-aware checks so good carriers move fast while suspicious sessions face step-up MFA. Freight-specific tactics and signals: Learn More and the adaptive approach: Read Here.

Double brokering often starts at onboarding with synthetic identities and reused payout targets that tie many "carriers" to one beneficiary. Catching the cluster early requires correlating device fingerprints, addresses, and bank accounts during application review. CrossClassify fingerprints devices, links them to KYC fields, and ranks clusters that share payout nodes so teams can stop the ring on day one. See why account-opening controls matter: Learn More and how device identity reveals hidden ties: Read Here.

Even in high-speed dispatch, trusted users exhibit stable keystroke cadence and navigation rhythms that drift during account sharing or scripted misuse. Monitoring these micro-behaviors surfaces abuse without slowing honest operators. CrossClassify learns normal patterns for each role and raises risk only when the deviations match known abuse signatures, adding targeted friction instead of blanket blocks. Learn how adaptive trust works in production: Learn More and see freight examples: Read Here.

Scrapers expose themselves through headless user agents, shallow session depth, and extreme search-to-booking ratios from a few IP ranges. Effective defense identifies the automation, introduces progressive challenges, and preserves a smooth path for real buyers. CrossClassify combines device fingerprinting with session analytics to classify traffic and throttle only the risky cohorts. Why device identity is foundational: Learn More and freight scraping patterns you should watch: Read Here.

The strongest early warning is a beneficiary edit tightly followed by a large payout, especially when the destination account is reused across multiple carrier profiles. Aligning these timelines with device identity produces evidence strong enough to pause funds safely. CrossClassify fuses event streams, surfaces bank-change-to-payout coupling, and auto-places a temporary hold while generating an analyst-ready case. See playbooks and visuals: Learn More and the adaptive decisioning model behind the hold: Read Here.

Coordinated manipulation appears as bursts from fresh accounts and IPs that post across many profiles within a short window. The most persuasive evidence combines cohort timelines with IP-to-profile networks that expose hubs. CrossClassify automatically builds these graphs and timelines, links them to device fingerprints, and packages the artifacts for moderation. Device lineage that anchors your case: Learn More and end-to-end freight patterns to compare against: Read Here.

True spoofing creates sustained speed breaches and "teleport" jumps that normal GPS noise does not. Reliability comes from correlating speed over policy, inter-ping distance, and driver or device identity. CrossClassify blends telematics with continuous risk scoring to flag impossible movement patterns and edited logs at fleet scale. Field examples and thresholds: Learn More and the scoring approach that avoids false positives: Read Here.

Attackers often change contact details and then immediately request password or MFA resets, using helpdesk rapport to bypass controls. Measuring the proximity between tickets, profile edits, and resets is key to detection. CrossClassify alerts when these events couple too tightly and enforces stronger re-verification before any sensitive action completes. Recognize the ATO playbook: Learn More and see how to adapt controls in real time: Read Here.

Abuse concentrates in a few shippers or in specific lane segments, while genuine service issues spread more evenly across the book. Presenting dispute-per-shipper rankings alongside distance-by-value heat maps makes the pattern unambiguous. CrossClassify generates these exhibits automatically and ties them to device and account lineage so policy decisions are defensible. Freight dispute patterns to model: Learn More and why continuous trust signals strengthen business decisions: Read Here.

Hoarding shows up as lane-by-day hotspots of holds that rarely convert, often orchestrated by a few devices operating across many shippers. The fix is to escalate friction for orchestrator devices while keeping trusted carriers fast. CrossClassify identifies the devices behind the hotspots and applies graduated challenges that drain the bot's ROI without harming real demand. Freight-focused guidance: Learn More and the device identity techniques that make it possible: Read Here.

Client parameters are easily altered, which leads to mismatched quotes and charges or unauthorized service codes. Moving calculations server side and validating signed parameters removes the attacker's leverage. CrossClassify monitors for unsupported codes and price deltas, blocks bad requests, and re-quotes safely when needed. See practical defenses in freight workflows: Learn More and how adaptive policies decide when to step up controls: Read Here.

Focus on applicants and carriers that share payout accounts, reused documents, or the same device signatures since those clusters drive the most exposure. Ranking these ties turns reverification into a high-return play. CrossClassify's account-opening risk engine and device fingerprinting surface synthetic umbrellas and orchestrator devices so you can act first where risk is concentrated. Why account-opening is the new front line: Learn More and the device intelligence underpinning those decisions: Read Here.

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required