Last Updated on 03 Sept 2025

Best Recruitment Fraud Protection and Cybersecurity Software for Hiring Platforms

Share in

Key Notes

•

Recruitment fraud costs job seekers and employers over $2 billion annually worldwide (Action Fraud UK).•

More than 14% of job seekers globally reported recruitment scams in 2023 (Visma).•

40% of HR teams admit they lack effective fraud detection tools in applicant screening (Reed).

The Recruitment Industry: Scale and Growth

The recruitment industry connects millions of job seekers with employers across the world, acting as a critical link in the employment ecosystem. With the rise of digital platforms such as LinkedIn, Indeed, and global staffing firms, recruitment has grown into a multi-billion-dollar industry serving nearly every country. According to Statista, the global staffing industry reached over $650 billion in 2022, with more than 20 million workers placed annually. Recruitment agencies, job boards, and enterprise HR teams increasingly rely on digital tools, which expands both opportunities and risks. The industry's size and its reliance on online interactions make it an attractive target for fraudsters.

Fraud and Security Concerns: The Big Picture

Recruitment fraud and cybersecurity concerns span multiple layers of the hiring ecosystem. These risks are not limited to isolated scams but form part of a broader pattern that threatens job seekers, recruitment agencies, and enterprises alike. They can be grouped into three overarching categories:

Insider-related fraud is one of the most underestimated risks in recruitment. It includes recruiters within agencies abusing their access by leaking candidate data, manipulating placement records, or taking bribes for job offers. Fake resume submissions by candidates also fall into this category, with applicants exaggerating or fabricating work experience, certifications, or educational history. Such falsifications often lead to costly mis-hires, wasted recruitment resources, and long-term productivity losses. In some cases, coordinated insider fraud rings have been uncovered where multiple staff members collude to profit from fraudulent placements or resell candidate information to third parties.

These threats originate outside the organization, often from cybercriminals exploiting the trust-based nature of recruitment platforms. Common tactics include impersonating well-known companies, creating fraudulent job postings, and tricking applicants into paying fees or revealing sensitive information. Phishing campaigns target both candidates and HR personnel, using realistic job descriptions and spoofed domains to harvest credentials. According to the FTC, scammers regularly impersonate global brands on platforms like LinkedIn to lure unsuspecting job seekers. These attacks not only defraud individuals but also tarnish the reputation of legitimate employers whose names are misused in the scams.

Beyond isolated incidents, the recruitment industry faces structural vulnerabilities that fraudsters continue to exploit. Outdated screening systems make it difficult to verify candidate identity in real time, while reliance on legacy HR software leaves organizations exposed to exploitation. Many agencies lack advanced fraud detection mechanisms, meaning that fraudulent resumes, synthetic identities, or fake recruiter accounts can circulate undetected. This absence of robust security standards across job boards, staffing agencies, and enterprise recruitment systems creates systemic risks. These weaknesses undermine confidence in the hiring process and open the door to large-scale recruitment fraud campaigns that can spread across entire markets.

Internal Threats:

Insider-related fraud is one of the most underestimated risks in recruitment. It includes recruiters within agencies abusing their access by leaking candidate data, manipulating placement records, or taking bribes for job offers. Fake resume submissions by candidates also fall into this category, with applicants exaggerating or fabricating work experience, certifications, or educational history. Such falsifications often lead to costly mis-hires, wasted recruitment resources, and long-term productivity losses. In some cases, coordinated insider fraud rings have been uncovered where multiple staff members collude to profit from fraudulent placements or resell candidate information to third parties.

External Threats:

These threats originate outside the organization, often from cybercriminals exploiting the trust-based nature of recruitment platforms. Common tactics include impersonating well-known companies, creating fraudulent job postings, and tricking applicants into paying fees or revealing sensitive information. Phishing campaigns target both candidates and HR personnel, using realistic job descriptions and spoofed domains to harvest credentials. According to the FTC, scammers regularly impersonate global brands on platforms like LinkedIn to lure unsuspecting job seekers. These attacks not only defraud individuals but also tarnish the reputation of legitimate employers whose names are misused in the scams.

Systemic Risks:

Beyond isolated incidents, the recruitment industry faces structural vulnerabilities that fraudsters continue to exploit. Outdated screening systems make it difficult to verify candidate identity in real time, while reliance on legacy HR software leaves organizations exposed to exploitation. Many agencies lack advanced fraud detection mechanisms, meaning that fraudulent resumes, synthetic identities, or fake recruiter accounts can circulate undetected. This absence of robust security standards across job boards, staffing agencies, and enterprise recruitment systems creates systemic risks. These weaknesses undermine confidence in the hiring process and open the door to large-scale recruitment fraud campaigns that can spread across entire markets.

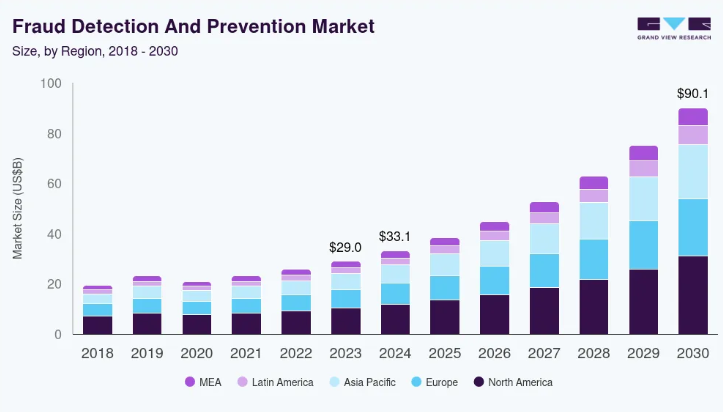

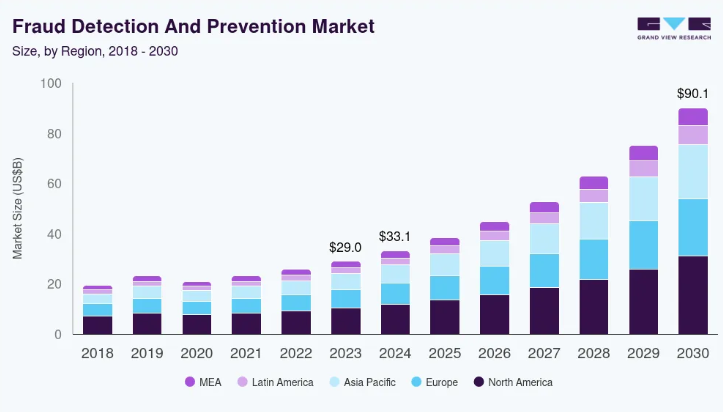

Fraud Size in the Recruitment Industry

Recruitment fraud has escalated into a global problem with severe financial and reputational implications for both job seekers and employers. According to Action Fraud UK, victims collectively lose more than $2 billion each year to fraudulent hiring schemes. On an individual level, job seekers report average losses of around $1,500 per case, typically from paying fake processing fees, travel costs, or training deposits for jobs that never existed.

In emerging markets such as India, the issue has grown so acute that major corporations including Infosys and Tech Mahindra have been forced to issue repeated fraud alerts. These warnings highlight scams where fraudsters impersonate recruiters, use forged company letterheads, and pressure candidates into making upfront payments under the pretext of securing interviews or positions. Similar alerts have been issued by multinational firms like Kelly Services and Concentrix, underlining the global nature of the threat.

The fraud size extends beyond monetary loss. Recruitment fraud undermines confidence in hiring platforms, damages the reputation of legitimate employers, and burdens HR departments with additional verification work. A survey by Reed Screening revealed that over 60% of recruiters encounter suspicious applications annually, with fake resumes and manipulated references ranking among the most common problems. Furthermore, online job boards such as LinkedIn and Indeed face constant threats from fraudulent postings, with cybercriminals exploiting their vast reach to scale recruitment scams worldwide.

This scale of fraud demonstrates that recruitment fraud is not a marginal issue but a systemic challenge that affects all stakeholders. It erodes trust in digital recruitment channels, inflates operational costs for employers, and causes significant financial and emotional harm to job seekers. Without stronger detection and prevention measures, losses are expected to grow alongside the continued expansion of digital hiring ecosystems.

Reference : https://www.grandviewresearch.com/industry-analysis/fraud-detection-prevention-market

In emerging markets such as India, the issue has grown so acute that major corporations including Infosys and Tech Mahindra have been forced to issue repeated fraud alerts. These warnings highlight scams where fraudsters impersonate recruiters, use forged company letterheads, and pressure candidates into making upfront payments under the pretext of securing interviews or positions. Similar alerts have been issued by multinational firms like Kelly Services and Concentrix, underlining the global nature of the threat.

The fraud size extends beyond monetary loss. Recruitment fraud undermines confidence in hiring platforms, damages the reputation of legitimate employers, and burdens HR departments with additional verification work. A survey by Reed Screening revealed that over 60% of recruiters encounter suspicious applications annually, with fake resumes and manipulated references ranking among the most common problems. Furthermore, online job boards such as LinkedIn and Indeed face constant threats from fraudulent postings, with cybercriminals exploiting their vast reach to scale recruitment scams worldwide.

This scale of fraud demonstrates that recruitment fraud is not a marginal issue but a systemic challenge that affects all stakeholders. It erodes trust in digital recruitment channels, inflates operational costs for employers, and causes significant financial and emotional harm to job seekers. Without stronger detection and prevention measures, losses are expected to grow alongside the continued expansion of digital hiring ecosystems.

Reference : https://www.grandviewresearch.com/industry-analysis/fraud-detection-prevention-market

Real-World Cases of Recruitment Fraud

Several high-profile cases show how serious recruitment fraud can be:

- Infosys Recruitment Fraud: Fraudsters impersonated recruiters, sending fake offer letters and demanding deposits. Infosys had to issue multiple public fraud warnings.

- Kelly Services Scam: Victims were tricked into sharing sensitive data under the pretext of employment, highlighting weaknesses in identity verification.

- Army Recruitment Fraud: Authorities worldwide have exposed fraud rings exploiting military recruitment drives to extract money from applicants.

- LinkedIn Fake Job Offers: Scammers impersonated HR managers from global corporations, tricking applicants into sharing banking details or paying "application fees."

Consequences of Not Being Protected Against Fraud and Data Breach

The consequences of failing to address recruitment fraud and data breaches extend far beyond isolated incidents. They create cascading risks that affect financial stability, brand trust, compliance, and overall business operations.

Recruitment fraud drains resources from both sides of the hiring process. Candidates lose money through fake job application fees, travel expenses, and fraudulent training costs. Employers face direct losses from fraudulent hires who may drain salaries and benefits without contributing, as well as chargebacks from fraudulent transactions on recruitment platforms. According to Action Fraud UK, losses per victim average $1,500, but the aggregate costs for employers and platforms run into billions annually.

When recruitment agencies or companies are associated with scams, even indirectly, their brand reputation suffers. Candidates who are defrauded under the company's name often share negative experiences online, reducing the organization's ability to attract top talent. High-profile cases, such as fake postings under the names of Infosys or Tech Mahindra, demonstrate how fraudsters exploit trusted brands. Once trust is eroded, rebuilding it requires significant time, investment, and public reassurances.

Recruitment involves processing sensitive personal and financial data. Mishandling this data or failing to implement adequate security safeguards exposes organizations to severe compliance risks under frameworks such as GDPR, CCPA, and labor regulations. Non-compliance can result in multimillion-dollar fines, lawsuits, and even liability under common law if employers are found negligent in preventing recruitment fraud. Regulatory scrutiny is intensifying, especially in industries where background checks and identity verification are legally mandated.

Fraudulent applications consume valuable recruiter time and resources. HR teams waste hours verifying fake resumes, chasing false references, and filtering synthetic candidates, delaying the hiring of genuine talent. In high-volume recruitment settings, such inefficiencies can cripple staffing pipelines, leading to unfilled positions, project delays, and increased turnover. Fraudulent activity also places additional strain on IT and compliance teams, who must investigate and remediate breaches instead of focusing on strategic initiatives.

Beyond immediate consequences, unprotected recruitment systems face long-term risks. Fraud undermines data integrity, skewing hiring analytics and workforce planning. It also discourages qualified candidates from applying, as fear of scams makes them hesitant to engage with certain employers or job boards. Over time, this weakens the talent pipeline and erodes competitiveness in industries where skilled labor is already scarce.

Financial Losses:

Recruitment fraud drains resources from both sides of the hiring process. Candidates lose money through fake job application fees, travel expenses, and fraudulent training costs. Employers face direct losses from fraudulent hires who may drain salaries and benefits without contributing, as well as chargebacks from fraudulent transactions on recruitment platforms. According to Action Fraud UK, losses per victim average $1,500, but the aggregate costs for employers and platforms run into billions annually.

Reputational Damage:

When recruitment agencies or companies are associated with scams, even indirectly, their brand reputation suffers. Candidates who are defrauded under the company's name often share negative experiences online, reducing the organization's ability to attract top talent. High-profile cases, such as fake postings under the names of Infosys or Tech Mahindra, demonstrate how fraudsters exploit trusted brands. Once trust is eroded, rebuilding it requires significant time, investment, and public reassurances.

Compliance Violations:

Recruitment involves processing sensitive personal and financial data. Mishandling this data or failing to implement adequate security safeguards exposes organizations to severe compliance risks under frameworks such as GDPR, CCPA, and labor regulations. Non-compliance can result in multimillion-dollar fines, lawsuits, and even liability under common law if employers are found negligent in preventing recruitment fraud. Regulatory scrutiny is intensifying, especially in industries where background checks and identity verification are legally mandated.

Operational Inefficiency:

Fraudulent applications consume valuable recruiter time and resources. HR teams waste hours verifying fake resumes, chasing false references, and filtering synthetic candidates, delaying the hiring of genuine talent. In high-volume recruitment settings, such inefficiencies can cripple staffing pipelines, leading to unfilled positions, project delays, and increased turnover. Fraudulent activity also places additional strain on IT and compliance teams, who must investigate and remediate breaches instead of focusing on strategic initiatives.

Long-Term Strategic Risks:

Beyond immediate consequences, unprotected recruitment systems face long-term risks. Fraud undermines data integrity, skewing hiring analytics and workforce planning. It also discourages qualified candidates from applying, as fear of scams makes them hesitant to engage with certain employers or job boards. Over time, this weakens the talent pipeline and erodes competitiveness in industries where skilled labor is already scarce.

Compliance Issues in the Recruitment Industry

Recruitment involves the processing of sensitive personal and financial information. This makes compliance with global data protection and labor laws essential. Regulations such as GDPR (EU), CCPA (California), and employment-specific rules require strict protection of candidate information. Employers and agencies can also face liability for fraud in recruitment under common law if they fail to maintain secure hiring processes. Failure to comply with these regulations leads to heavy fines, lawsuits, and reputational damage.

Fraud Types in the Recruitment Industry

Recruitment fraud manifests in multiple ways, each with distinct methods and consequences that undermine the integrity of hiring processes. Fraudsters adapt quickly, exploiting the digital nature of recruitment platforms and the trust candidates place in well-known companies. The most common types include:

Fraudsters publish fraudulent listings on job boards, social media platforms, or even cloned websites of real companies. These postings often mimic legitimate job descriptions, luring applicants into submitting personal information such as passports, bank details, or social security numbers. In many cases, candidates are pressured to pay for application processing, training programs, or travel expenses, only to discover that no job exists. Fake postings damage the reputation of the companies impersonated and erode confidence in widely used recruitment channels.

Candidates intentionally misrepresent their qualifications by exaggerating work experience, fabricating educational credentials, or providing false references. This deception leads to poor hiring decisions, wasted recruitment resources, and increased turnover when mis-hires are eventually discovered. A survey by Reed Screening found that over 60% of recruiters encounter suspicious applications each year, with resume fraud being the most common. For highly regulated industries like healthcare or finance, hiring under false credentials can also trigger compliance violations and legal penalties.

Cybercriminals impersonate recruiters or HR managers from well-known companies, sending fraudulent offer letters and communications through email, phone, or WhatsApp. Victims are asked to pay deposits, purchase equipment, or share sensitive identity documents. For example, Infosys and Tech Mahindra have repeatedly issued public warnings about impersonators using their logos and letterheads. This type of fraud not only harms job seekers but also tarnishes the credibility of the organizations being impersonated.

Fraudsters create emails, job ads, or portals designed to look identical to legitimate recruitment systems. Unsuspecting candidates are redirected to fake websites where they enter login credentials, financial details, or upload CVs. These stolen details are later sold on the dark web or used for account takeover. Phishing is particularly dangerous because it can also target HR professionals, compromising enterprise systems and exposing entire databases of candidate information.

With the rise of generative AI, fraudsters now create entirely fictitious applicants. These synthetic candidates are built using AI-generated resumes, stock photos, or even deepfake videos to pass video interviews. Such fabricated identities can be used to infiltrate organizations, particularly in remote-first roles where in-person verification is minimal. This form of fraud creates significant risk for employers as it bypasses traditional screening processes and introduces untraceable insiders into the workforce.

Global job seekers are frequent targets of scams perpetrated by fraudulent "recruitment agencies." These agencies charge fees for overseas placements, work permits, or visas that never materialize. Cases of Indeed international recruitment fraud have shown how fraudsters exploit cross-border hiring demand by setting up fake offices or websites to impersonate legitimate staffing firms. These scams are particularly damaging because victims may invest large sums, relocate, or abandon secure jobs in pursuit of opportunities that turn out to be fabricated.

Each of these fraud types has been reported in real-world cases across platforms such as LinkedIn, Indeed, and other global job boards. Collectively, they highlight the urgent need for robust fraud detection measures in the recruitment industry. Without proactive solutions, fraudsters will continue to exploit vulnerabilities in candidate screening, recruiter verification, and digital hiring workflows.

Fake Job Postings:

Fraudsters publish fraudulent listings on job boards, social media platforms, or even cloned websites of real companies. These postings often mimic legitimate job descriptions, luring applicants into submitting personal information such as passports, bank details, or social security numbers. In many cases, candidates are pressured to pay for application processing, training programs, or travel expenses, only to discover that no job exists. Fake postings damage the reputation of the companies impersonated and erode confidence in widely used recruitment channels.

Resume Fraud:

Candidates intentionally misrepresent their qualifications by exaggerating work experience, fabricating educational credentials, or providing false references. This deception leads to poor hiring decisions, wasted recruitment resources, and increased turnover when mis-hires are eventually discovered. A survey by Reed Screening found that over 60% of recruiters encounter suspicious applications each year, with resume fraud being the most common. For highly regulated industries like healthcare or finance, hiring under false credentials can also trigger compliance violations and legal penalties.

Recruiter Impersonation:

Cybercriminals impersonate recruiters or HR managers from well-known companies, sending fraudulent offer letters and communications through email, phone, or WhatsApp. Victims are asked to pay deposits, purchase equipment, or share sensitive identity documents. For example, Infosys and Tech Mahindra have repeatedly issued public warnings about impersonators using their logos and letterheads. This type of fraud not only harms job seekers but also tarnishes the credibility of the organizations being impersonated.

Phishing Scams:

Fraudsters create emails, job ads, or portals designed to look identical to legitimate recruitment systems. Unsuspecting candidates are redirected to fake websites where they enter login credentials, financial details, or upload CVs. These stolen details are later sold on the dark web or used for account takeover. Phishing is particularly dangerous because it can also target HR professionals, compromising enterprise systems and exposing entire databases of candidate information.

Synthetic Candidates:

With the rise of generative AI, fraudsters now create entirely fictitious applicants. These synthetic candidates are built using AI-generated resumes, stock photos, or even deepfake videos to pass video interviews. Such fabricated identities can be used to infiltrate organizations, particularly in remote-first roles where in-person verification is minimal. This form of fraud creates significant risk for employers as it bypasses traditional screening processes and introduces untraceable insiders into the workforce.

International Agency Scams:

Global job seekers are frequent targets of scams perpetrated by fraudulent "recruitment agencies." These agencies charge fees for overseas placements, work permits, or visas that never materialize. Cases of Indeed international recruitment fraud have shown how fraudsters exploit cross-border hiring demand by setting up fake offices or websites to impersonate legitimate staffing firms. These scams are particularly damaging because victims may invest large sums, relocate, or abandon secure jobs in pursuit of opportunities that turn out to be fabricated.

Each of these fraud types has been reported in real-world cases across platforms such as LinkedIn, Indeed, and other global job boards. Collectively, they highlight the urgent need for robust fraud detection measures in the recruitment industry. Without proactive solutions, fraudsters will continue to exploit vulnerabilities in candidate screening, recruiter verification, and digital hiring workflows.

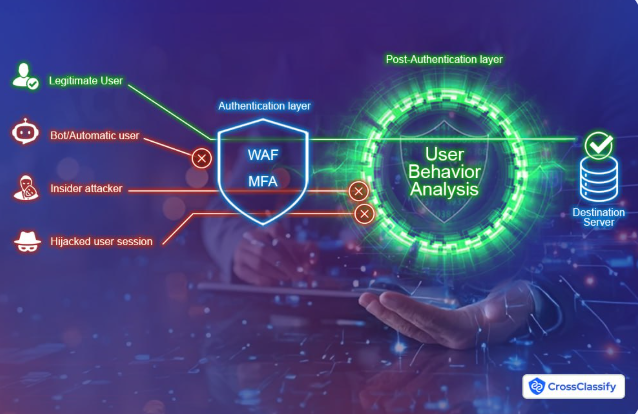

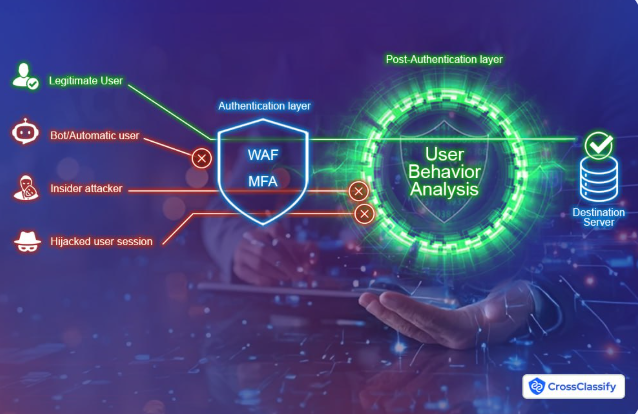

Why MFA and WAF Are Not Enough

Some organizations believe that simple defenses like multi-factor authentication (MFA) or web application firewalls (WAF) are enough to secure recruitment systems. However, fraudsters adapt quickly. They bypass MFA by exploiting session hijacking and SIM swap attacks, and they evade WAF protections by blending malicious traffic into normal traffic patterns. As noted in CrossClassify's article Uncover the Threats WAF and MFA Miss, true protection requires continuous adaptive risk assessment, behavioral biometrics, and device fingerprinting to detect anomalies at the session and user level.

How CrossClassify Could Help the Recruitment Industry

Recruitment agencies, job boards, and enterprise HR teams face constant threats from fraudsters who exploit digital hiring platforms. Traditional defenses such as password protections, multi-factor authentication (MFA), or manual background checks are no longer sufficient. CrossClassify offers an advanced, AI-driven fraud prevention framework that equips the recruitment industry with real-time protection against evolving threats. Its solutions combine device intelligence, behavioral analysis, and continuous monitoring to secure every stage of the hiring process.

Fraudulent applicants often recycle the same devices to create multiple fake identities or submit fraudulent resumes. CrossClassify's Device Fingerprinting technology detects these patterns by analyzing hardware, software, and network configurations. Even when fraudsters use VPNs or change browser settings, unique device signatures expose links between fake accounts. This helps recruiters identify and block fraudulent applicants before they enter the screening pipeline.

Resumes can be falsified, but behavior is much harder to fake. CrossClassify applies Behavioral Biometrics to analyze keystroke dynamics, mouse movements, and interaction patterns. This makes it possible to distinguish between genuine candidates and synthetic applicants generated by AI tools. It also helps recruiters identify manipulated resumes by correlating candidate behavior with declared qualifications, reducing the risk of costly mis-hires.

Static checks like MFA or identity documents only provide one-time verification, leaving systems vulnerable to session hijacking, SIM swaps, and insider fraud. CrossClassify employs Continuous Adaptive Risk and Trust Assessment to monitor user behavior and device signals throughout the hiring process. This ensures anomalies are flagged instantly, such as when a candidate switches devices mid-application or when a recruiter account shows unusual login activity.

Fraudsters often target recruiter or candidate accounts to steal data, hijack communications, or launch large-scale scams. CrossClassify integrates defenses against both Account Takeover and Account Opening Fraud. By monitoring login behaviors, device changes, and suspicious identity creation patterns, the system blocks unauthorized access attempts while preserving a seamless experience for legitimate users.

By combining these capabilities, CrossClassify transforms recruitment fraud prevention into a proactive, adaptive process. Agencies can protect candidate data, job boards can maintain trust in their platforms, and enterprises can safeguard their brands from impersonation attacks. Ultimately, these tools enable HR teams to focus on hiring the right talent without the burden of fraud undermining the recruitment process.

Device Fingerprinting:

Fraudulent applicants often recycle the same devices to create multiple fake identities or submit fraudulent resumes. CrossClassify's Device Fingerprinting technology detects these patterns by analyzing hardware, software, and network configurations. Even when fraudsters use VPNs or change browser settings, unique device signatures expose links between fake accounts. This helps recruiters identify and block fraudulent applicants before they enter the screening pipeline.

Behavioral Biometrics:

Resumes can be falsified, but behavior is much harder to fake. CrossClassify applies Behavioral Biometrics to analyze keystroke dynamics, mouse movements, and interaction patterns. This makes it possible to distinguish between genuine candidates and synthetic applicants generated by AI tools. It also helps recruiters identify manipulated resumes by correlating candidate behavior with declared qualifications, reducing the risk of costly mis-hires.

Continuous Risk Assessment:

Static checks like MFA or identity documents only provide one-time verification, leaving systems vulnerable to session hijacking, SIM swaps, and insider fraud. CrossClassify employs Continuous Adaptive Risk and Trust Assessment to monitor user behavior and device signals throughout the hiring process. This ensures anomalies are flagged instantly, such as when a candidate switches devices mid-application or when a recruiter account shows unusual login activity.

Account Takeover and Opening Protection:

Fraudsters often target recruiter or candidate accounts to steal data, hijack communications, or launch large-scale scams. CrossClassify integrates defenses against both Account Takeover and Account Opening Fraud. By monitoring login behaviors, device changes, and suspicious identity creation patterns, the system blocks unauthorized access attempts while preserving a seamless experience for legitimate users.

By combining these capabilities, CrossClassify transforms recruitment fraud prevention into a proactive, adaptive process. Agencies can protect candidate data, job boards can maintain trust in their platforms, and enterprises can safeguard their brands from impersonation attacks. Ultimately, these tools enable HR teams to focus on hiring the right talent without the burden of fraud undermining the recruitment process.

Conclusion

Recruitment fraud is a rapidly growing issue that threatens both job seekers and employers. Fake job ads, resume fraud, phishing, and recruiter impersonation cost billions each year, while compliance pressures and reputational risks add to the burden. Without robust protection, the recruitment industry risks losing trust, efficiency, and profitability.

CrossClassify offers enterprise-grade AI recruitment fraud prevention solutions that combine device fingerprinting, behavioral biometrics, and adaptive risk monitoring. By adopting these tools, HR teams and recruitment agencies can safeguard their operations, comply with data protection laws, and build trust in hiring processes.

CrossClassify offers enterprise-grade AI recruitment fraud prevention solutions that combine device fingerprinting, behavioral biometrics, and adaptive risk monitoring. By adopting these tools, HR teams and recruitment agencies can safeguard their operations, comply with data protection laws, and build trust in hiring processes.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

Recruitment fraud occurs when scammers impersonate legitimate recruiters, staffing firms, or job platforms to deceive job seekers. Victims are tricked into paying fees, sharing sensitive information, or engaging with fake job offers. This not only causes financial harm but also erodes trust in digital hiring channels. CrossClassify prevents recruitment fraud by applying device fingerprinting and behavioral monitoring, which expose fraudulent activity and protect both employers and candidates.

Resume fraud happens when candidates exaggerate, fabricate, or manipulate qualifications, employment history, and references. This often results in poor hiring decisions, compliance risks, and financial losses for employers. CrossClassify combats this problem using AI-driven analytics and device fingerprinting, which identify inconsistencies and link suspicious submissions back to the same fraudulent sources.

Recruitment scams usually involve upfront fee requests, suspiciously urgent job offers, and emails from unverifiable domains. Scammers may also use cloned company websites or impersonate HR managers to mislead applicants. CrossClassify's behavioral biometrics detect unusual candidate or recruiter interactions in real time, flagging these red flags before victims fall prey.

Fraudulent job postings lure candidates into submitting personal data, financial details, or even direct payments under the false promise of employment. Victims often face identity theft or long-term financial consequences. CrossClassify safeguards against these risks through continuous monitoring and fake account detection, ensuring applicants are not exposed to fraudulent job ads.

Account takeover occurs when fraudsters hijack recruiter or candidate accounts to steal information, reroute communication, or carry out scams under a trusted identity. This type of fraud compromises both job seekers and organizations. CrossClassify prevents these attacks with session-level analysis and device intelligence, blocking unauthorized logins and protecting recruitment ecosystems.

Artificial intelligence enhances fraud detection by analyzing patterns across resumes, postings, and recruiter activities at scale. It can identify subtle anomalies invisible to human reviewers. CrossClassify integrates AI and zero-trust security frameworks to continuously monitor recruitment platforms, reducing the risk of undetected fraudulent behavior.

Multi-factor authentication (MFA) and web application firewalls (WAF) provide a first layer of defense, but they are insufficient against modern fraud tactics such as SIM swaps, session hijacking, or synthetic identities. Fraudsters exploit behavioral and contextual gaps that these tools cannot cover. CrossClassify closes this gap with adaptive risk assessment and behavioral analytics, delivering protection beyond traditional defenses.

Online recruitment fraud (ORF) refers to scams conducted through job boards, social media platforms, and fake recruitment websites. Fraudsters exploit the anonymity of digital spaces to scale their attacks globally. CrossClassify secures these platforms using new account fraud prevention, which detects fraudulent profiles, prevents impersonation, and ensures only legitimate candidates are engaged.

Staffing firms face constant risks from falsified applications, which lead to costly mis-hires and client dissatisfaction. Traditional verification methods alone are not enough. CrossClassify enhances prevention with behavioral biometrics and fingerprinting, which uncover synthetic candidates and block repeat fraudsters using the same digital footprint.

Recruitment firms handle sensitive candidate data, making compliance with regulations such as GDPR, CCPA, and labor laws critical. Failure to secure this data can result in heavy fines, lawsuits, and reputational harm. CrossClassify strengthens compliance by embedding fraud risk management directly into recruitment processes, ensuring both legal obligations and fraud prevention needs are met simultaneously.

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required