Cybersecurity for Fintech

Stop transaction fraud before it hits your fintech stack

Score user risk in milliseconds across payments, login, and API usage

Stats on Fintech Breaches

70%

Digital Fraud in Finance

Fraud events at financial institutions occurred 80% via online or mobile channels

63%

Of financial organizations

Lost over $1 million to fraud

$290K

Costly Identity Fraud

Companies (45%) and end-users (44%) reported identity fraud at least once; average fraud cost per event was $300,000

Why Fintech Data Security Matters

Payment Fraud Can Erode Trust and Compliance

In the fintech industry, real-time transactions come with real-time risk, especially when it comes to payment fraud and false declines. Our adaptive fraud detection ensures every transaction is evaluated without disrupting legitimate users.

Fintech Onboarding is Vulnerable to Fake Accounts and Bonus Abuse

Fraudsters exploit digital onboarding flows digital onboarding flows to create synthetic identities, bypass KYC checks, and abuse signup incentives. CrossClassify prevents fake account creation through layered identity, device, and behavioral analysis.

Traditional Cybersecurity Misses Post-Login Threats

Most fintech fraud happens after login—via social engineering, session hijacking, or silent fraud. CrossClassify delivers post-login behavioral analysis to detect risky behavior even from verified users.

Bots Are Exploiting Fintech APIs at Scale

Fraudsters automate attacks on fintech APIs to test stolen cards, scrape pricing, or simulate activity. CrossClassify detects bot fraud in real-time across APIs, mobile, and web traffic.

Blog

Latest from Cross Classify

Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

Fintech ATO Defense, Built for Scale

Reduces fintech ATO fraud by ~75% within weeks.

$12B

In fintech losses globally attributed to account takeover fraud.

43%

Of fraud incidents reported by digital banks are ATO-related.

How We Prevent Account Takeover

Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

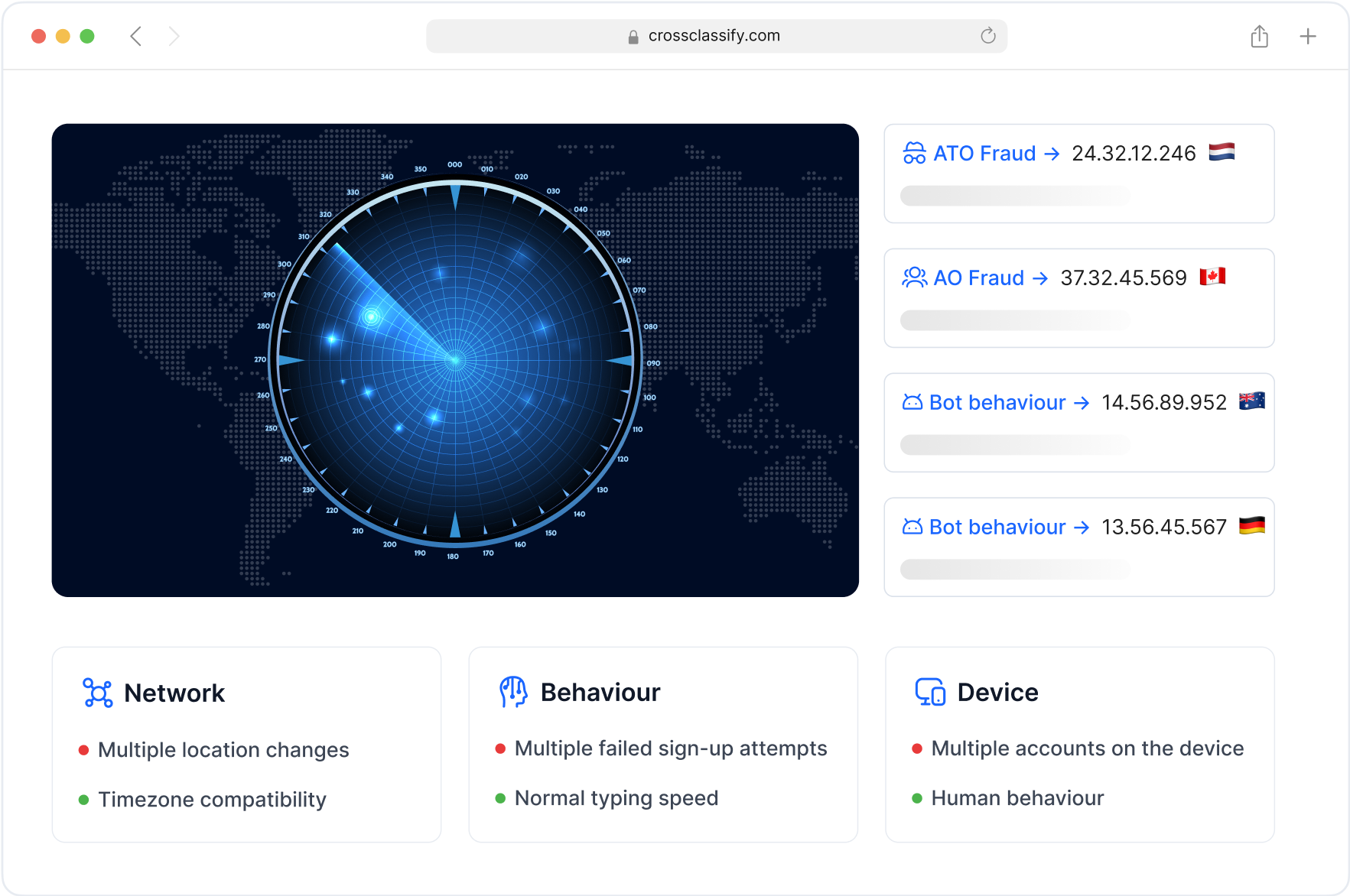

Learn More ❯Continuous Monitoring for Fintech Risk Signals

CrossClassify continuously monitors fintech user behavior, devices, and session data to detect emerging fraud patterns in real-time. This proactive layer is critical in financial services where attackers often operate slowly and across multiple touchpoints. By analyzing login, transaction, and KYC signals, we help fintech companies maintain adaptive risk scoring across the entire user journey.

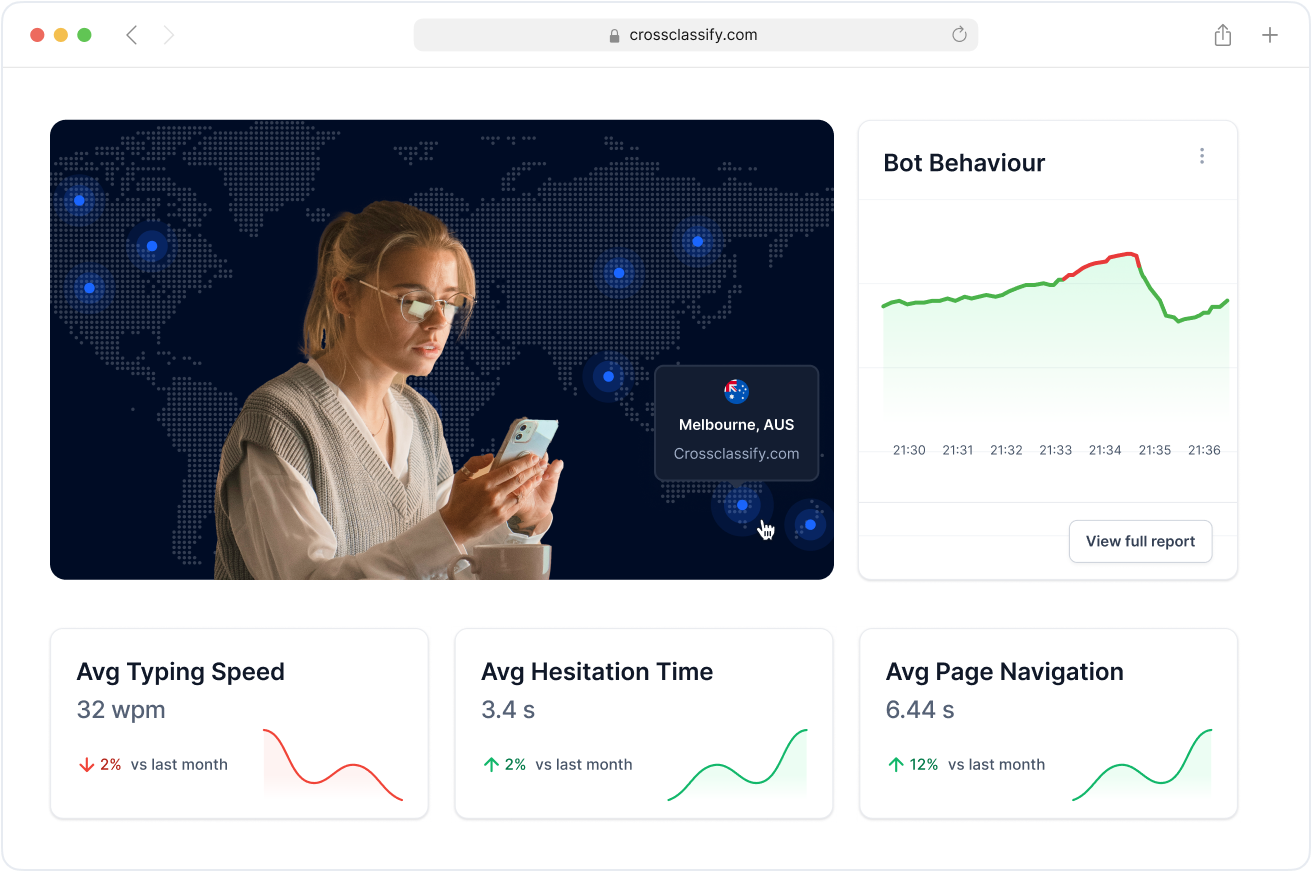

Behavior Analysis for Transaction and Login Fraud

Fintech platforms face evolving threats like session hijacking, transactional fraud, and device spoofing. Our platform applies behavioral analysis to detect anomalies in typing, swiping, and mouse movements that flag suspicious sessions. This strengthens fraud prevention during high-risk moments like fund transfers or loan applications.

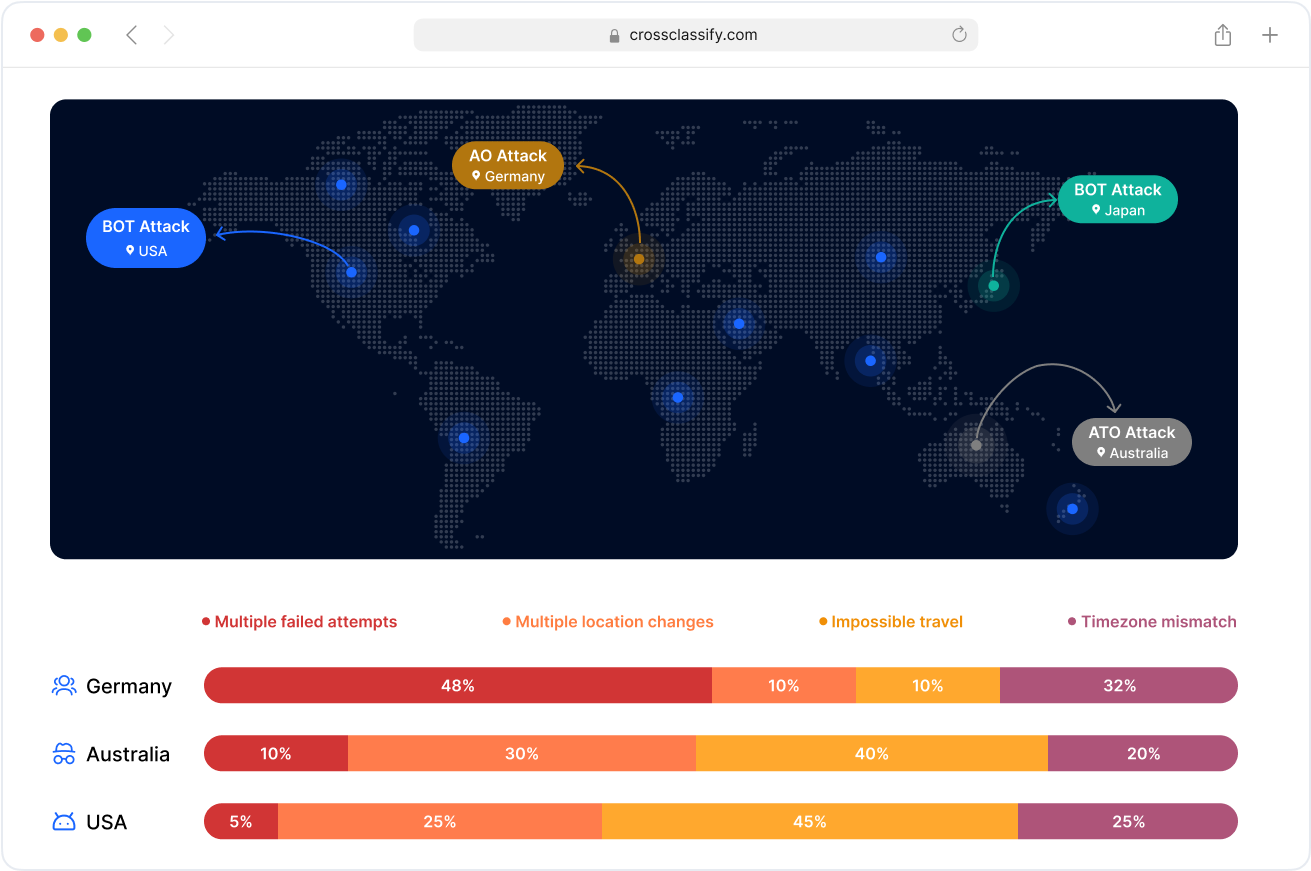

Geo Analysis for Fintech Transaction Integrity

Fintechs often operate across borders, making them vulnerable to IP spoofing, proxy abuseproxy abuse, and geographic fraud patterns. CrossClassify correlates IP, device location, and user behavior to flag abnormal access from high-risk or unexpected regions. This helps financial apps detect geo anomalies in login attempts, wire transfers, and payment processing.

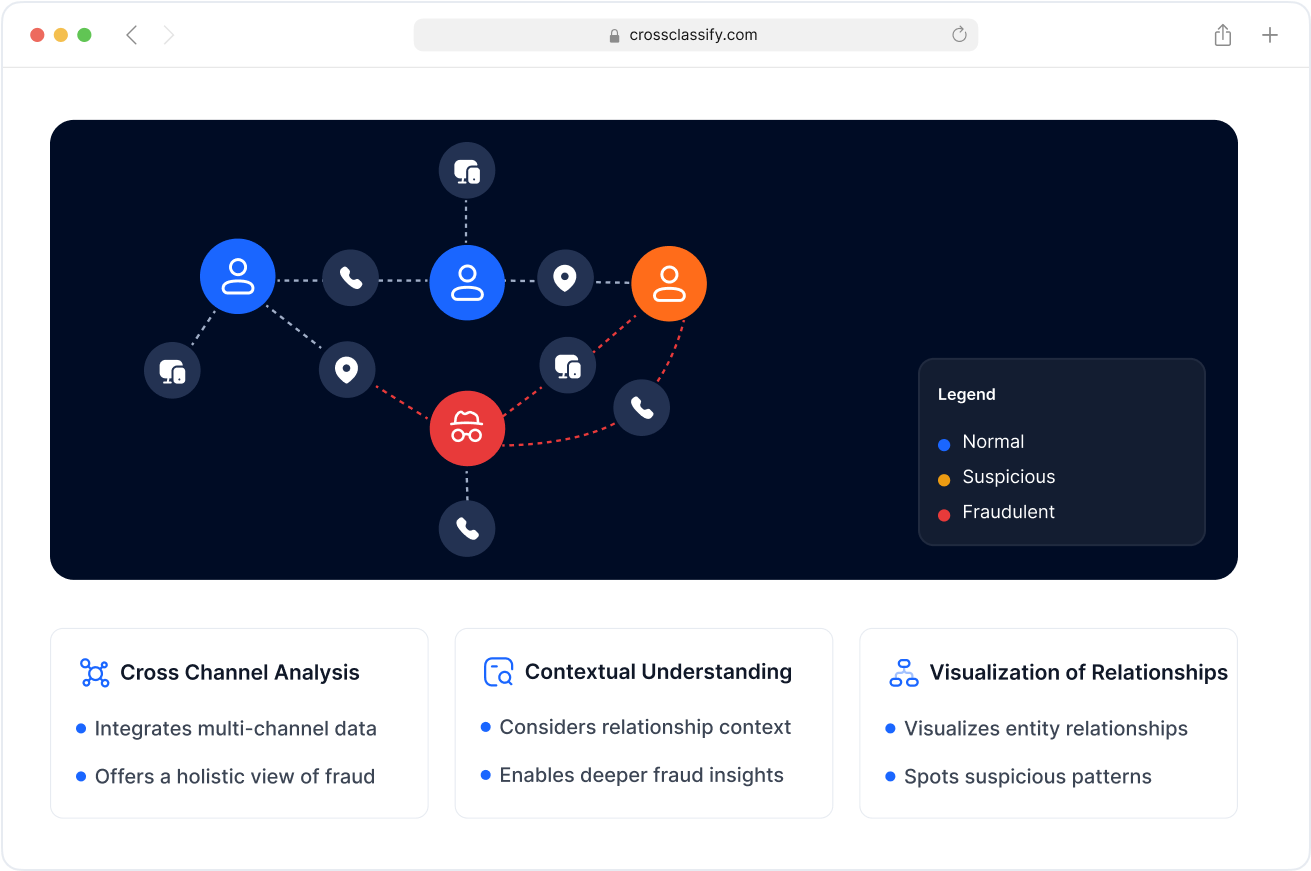

Link Analysis to Uncover Fraud Rings

Fraud in fintech often involves interconnected users, shared devices, or repeat patterns in identity usage. Our link analysis engine connects the dots between accounts, IPs, and devices to expose bot networks, fraud rings, and synthetic identity clusters. This is essential for detecting collusive behavior in digital banking and fintech apps.

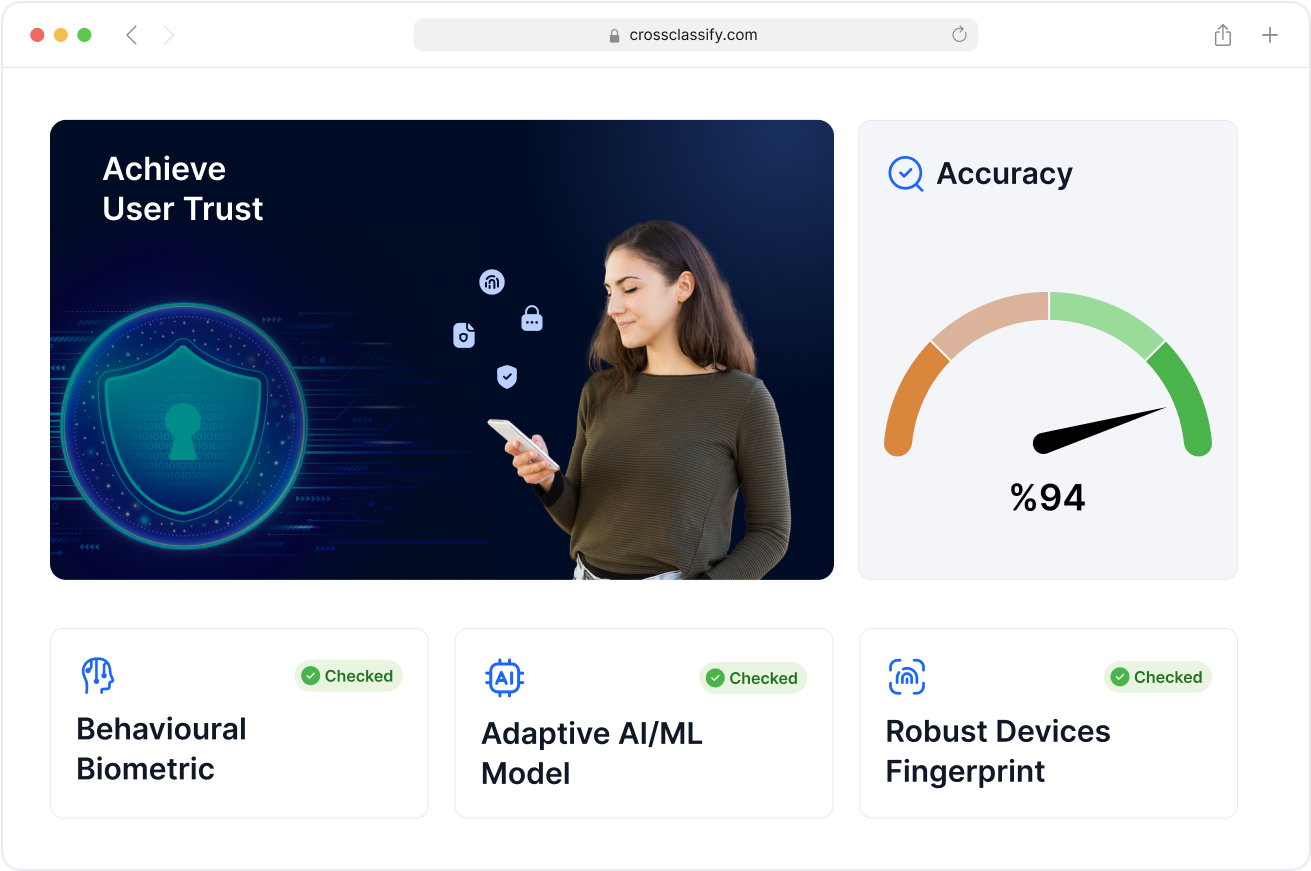

Enhanced Security and Accuracy for Financial Transactions

CrossClassify combines machine learning, device intelligence, and real-time scoring to deliver unmatched accuracy in fraud detection. Our engine adapts to fintech-specific workflows like peer-to-peer transfers, microloan approvals, and instant credit checks, minimizing false positives and enhancing user trust.

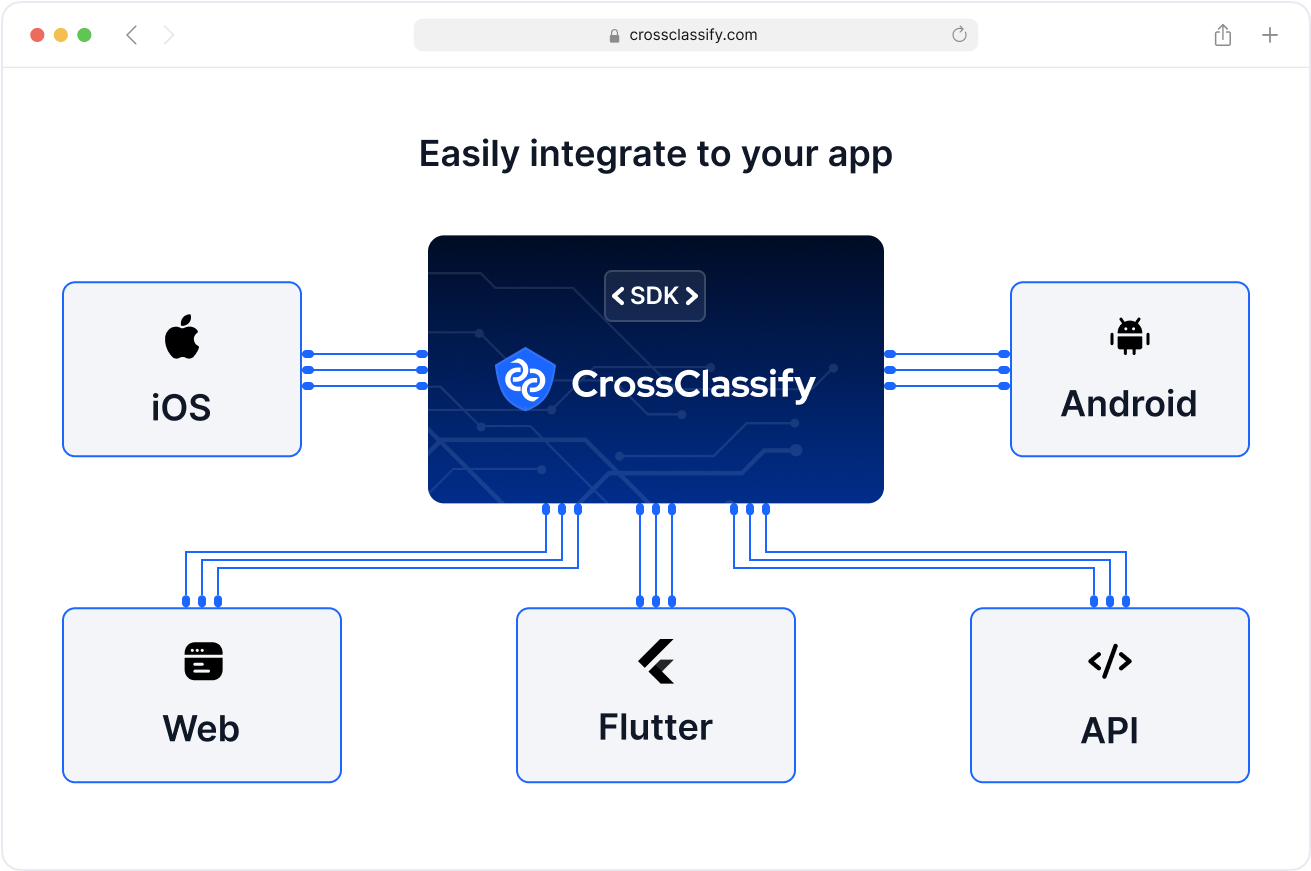

Seamless Integration with Fintech Infrastructure

Whether you're using banking APIs, core processing platforms, or mobile-first apps, CrossClassify integrates easily via SDKs and APIs. Our integration model ensures minimal latency and quick deployment into payment gateways, identity flows, and customer onboarding pipelines.

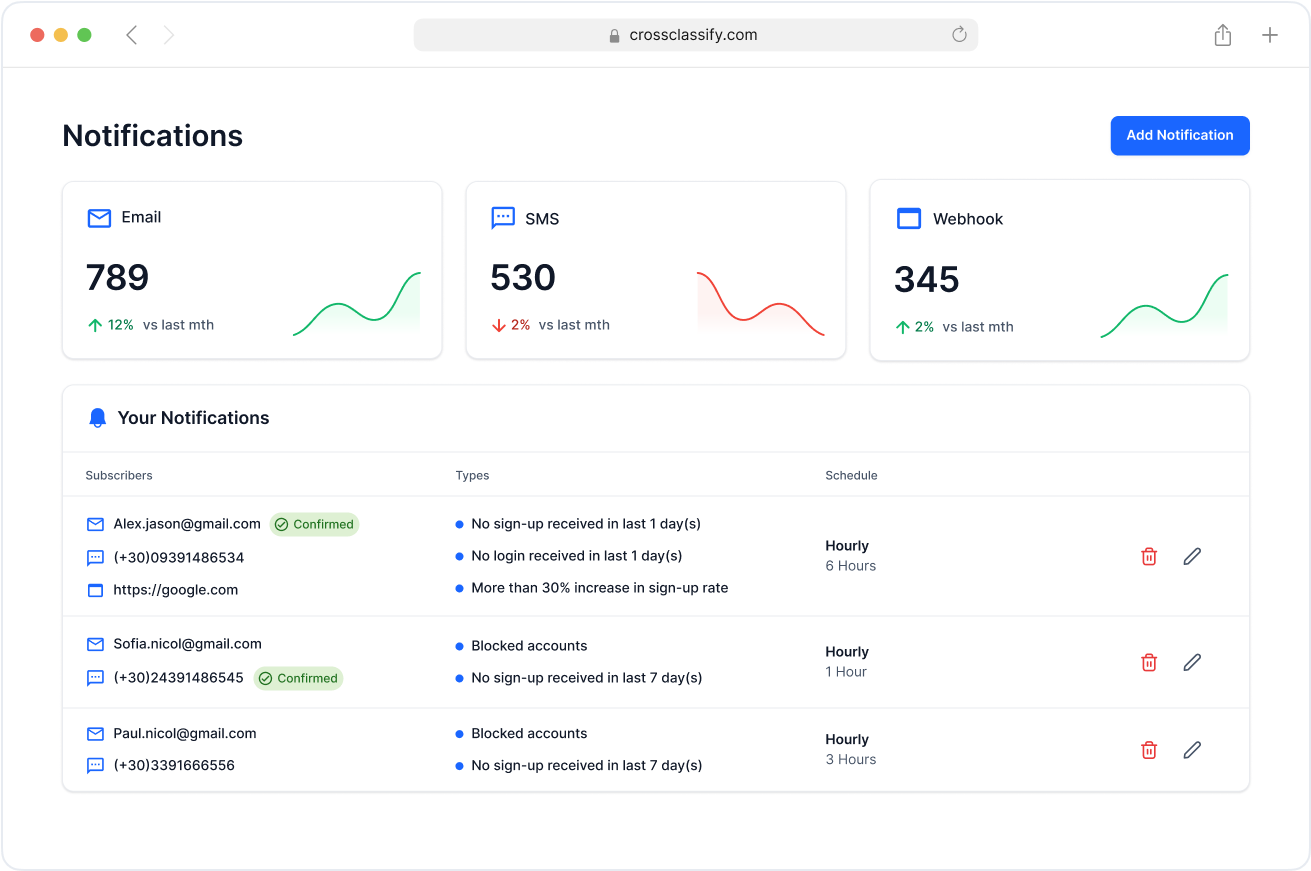

Real-Time Alerting and Notification for Fintech Teams

Receive real-time alerts for risky sign-ups, unusual login attempts, or suspicious transactionsdirectly in your fraud ops dashboard or SIEM system. Customize thresholds for specific fintech flows like card issuance, mobile wallet access, or investment account creation to respond fast and reduce risk exposure.

Compliance

From Regulation to Reputation

GDPR: Securing EU Data via Safe Handling and Breach Reporting

Meta (Facebook) was fined €1.2 billion for unlawful data transfers to the U.S.

Amazon Europe was fined €746 million for processing personal data without valid consent.

PCI DSS – Sets standards for encrypting and securing payment card data.

Heartland Payment Systems paid over $110 million in settlements after a data breach involving 100M+ cards.

Non-compliant merchants risk $5,000–$100,000/month in penalties from card brands.

Real-Time Fintech Risk Scoring

CrossClassify analyses account events, login, transactions instantly to assign adaptive risk scores. This supports instant decisions and regulatory compliant workflows. Keeps regulatory compliance intact and reduces fraud latency.

Behavioral Intelligence for Fintech Fraud

We analyze device behavior, user biometrics, and session patterns to detect and block fraudulent fintech activity in real time. Our system flags credential stuffing, automated account takeovers, and API abuse before they escalate. This allows neobanks, payment platforms, and digital lenders to stop bot-driven fraud without disrupting user experience.

Compliance-Ready for Fintech

Our platform supports PSD2, GDPR, KYC/AML controls while preserving seamless onboarding and CX. Ensures fintechs comply without sacrificing conversion.

Frequently asked questions

Let's Get Started

Elevate your Fintech app's security with CrossClassify. Schedule a personalized demo to see how we protect customer accounts and ensure compliance with industry standards.