Supporting CTOs to Drive Secure, Scalable Innovation

As CTO, you're building the future. CrossClassify protects it with advanced fraud prevention that integrates effortlessly into your stack—securing against account takeovers, account opening fraud, bot attacks, and abuse, while supporting performance and scalability.We handle fraud, so you can focus on innovation.

How CrossClassify Benefits You

We understand your challenges and offer a solution that equips your technical teams for success

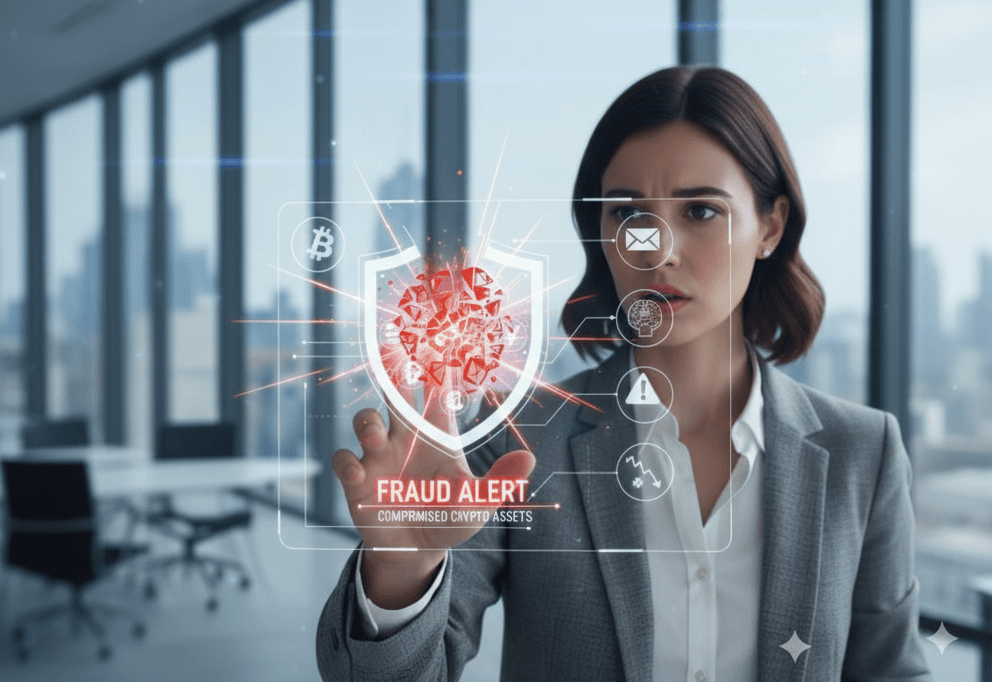

Enhanced Security

CrossClassify delivers accurate fraud detection with minimal false positives, protecting users without disrupting their experience. Our adaptive machine learning evolves with threats, ensuring strong, real-time defenses. For CTOs, that means fewer fires to fight—and more time to innovate.

Reduced IT Overhead

CrossClassify’s automation-first approach reduces manual work, letting your IT team focus on what matters. Seamlessly integrating into your systems, it handles fraud detection, alerts, and risk scoring automatically—streamlining operations with minimal IT effort.

Scalable Solutions

CrossClassify scales with your growth—no major infrastructure changes needed. Built for cloud-native environments, it adapts to increased demand, integrates with complex stacks, and ensures fraud protection keeps pace. A future-proof solution CTOs can count on.

Short Posts

Latest from Cross Classify

Frequently asked questions

We help CTOs by:

- Reducing fraud without increasing engineering overhead

- Offering lightweight, API-based integration

- Scaling protection with your app across regions, platforms, and user volumes

- Giving insights into user behavior anomalies that can improve both security and UX

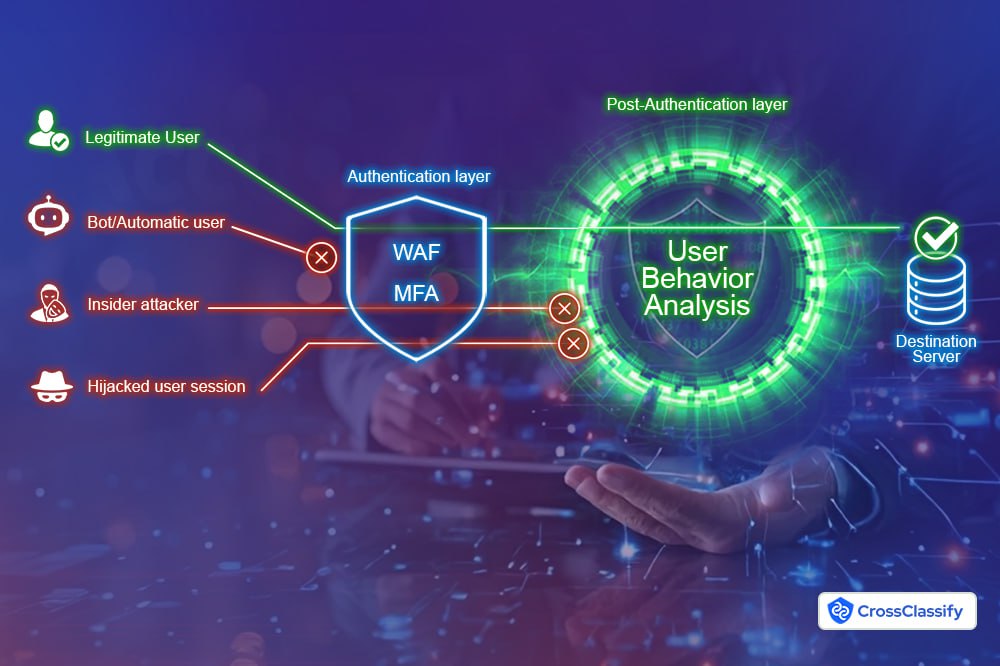

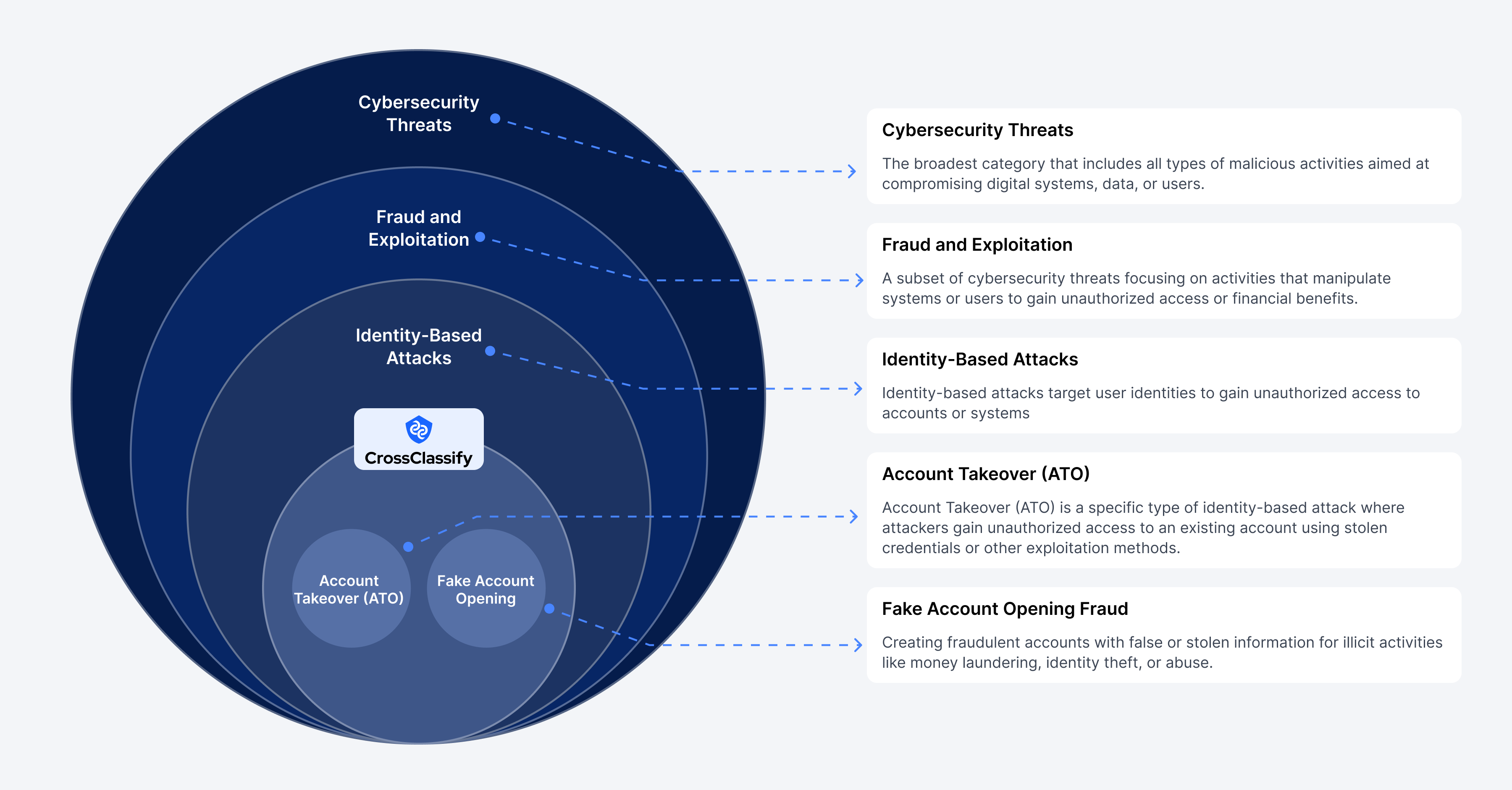

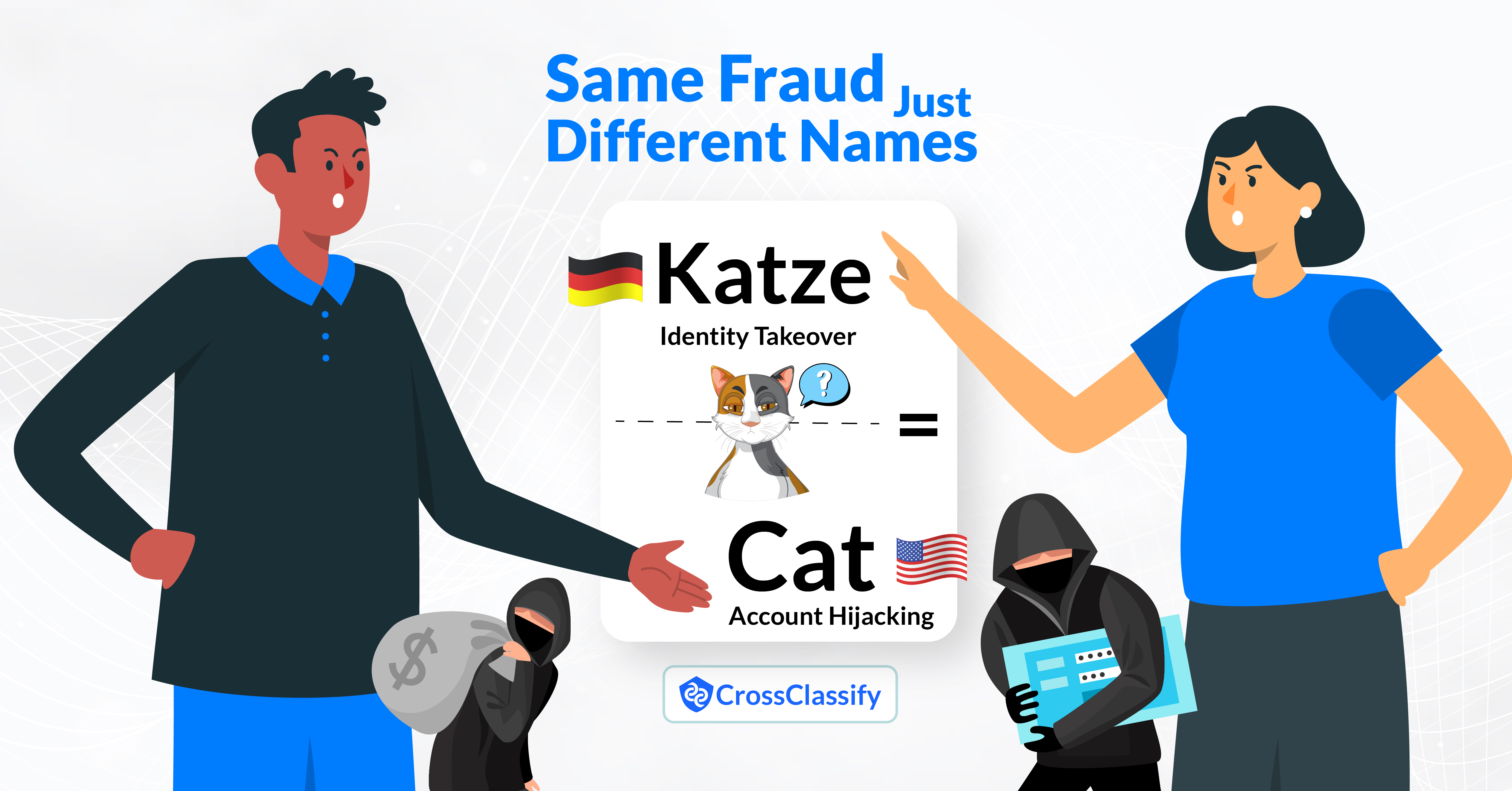

- Account takeover (ATO) using stolen credentials

- Bot attacks on signup, login, and API endpoints

- Fake or synthetic account creation

- Session hijacking or privilege escalation

- Shadow APIs and integration vulnerabilities

CrossClassify detects and mitigates these threats in real time.

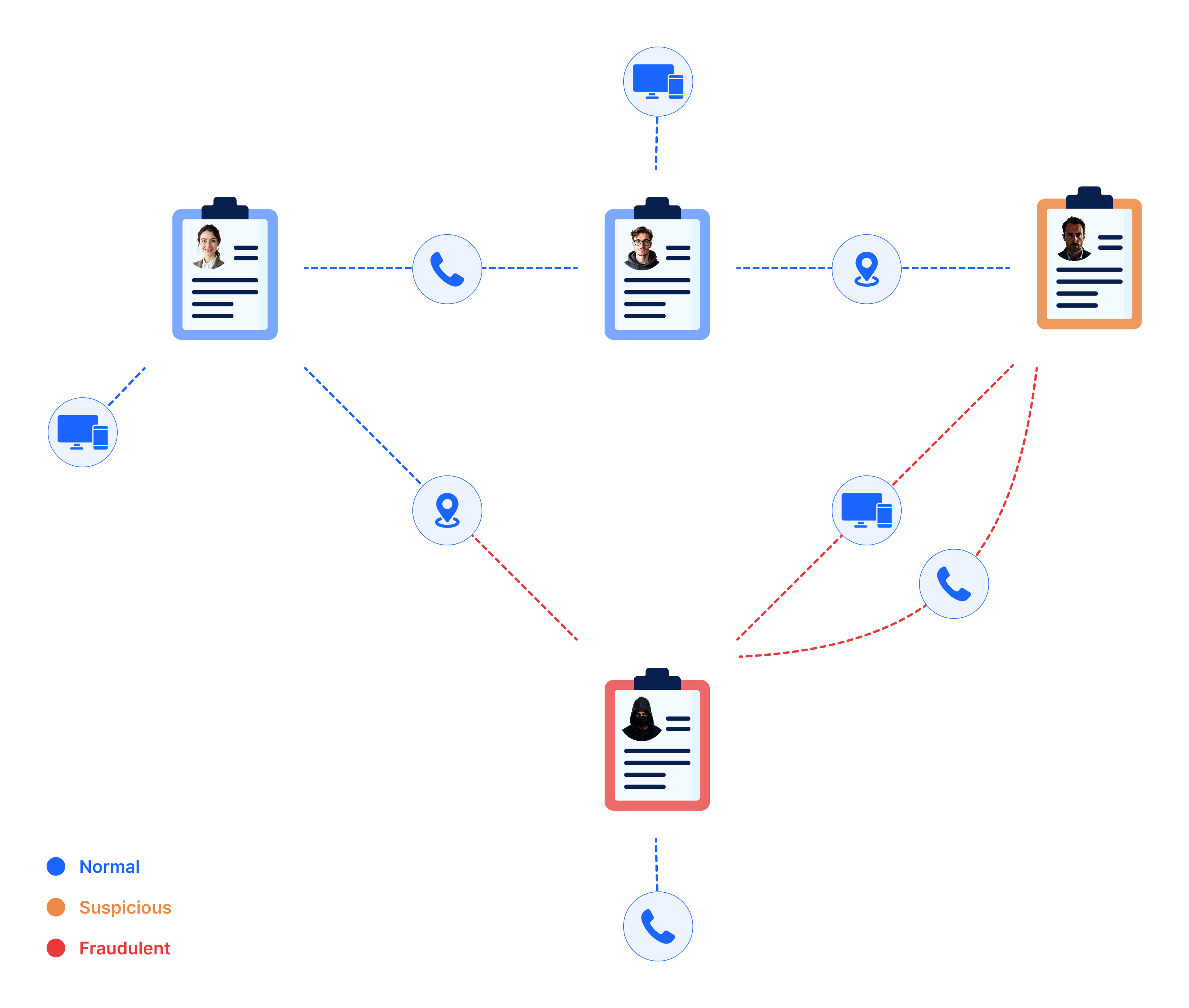

We analyze:

- Device signals (OS, browser, hardware traits)

- Network intelligence (IP, proxies, VPN use)

- Behavioral patterns (click flow, typing, velocity)

- Session context (repeat interactions, anomalies)

Our models combine this data into a unique risk fingerprint for each user.

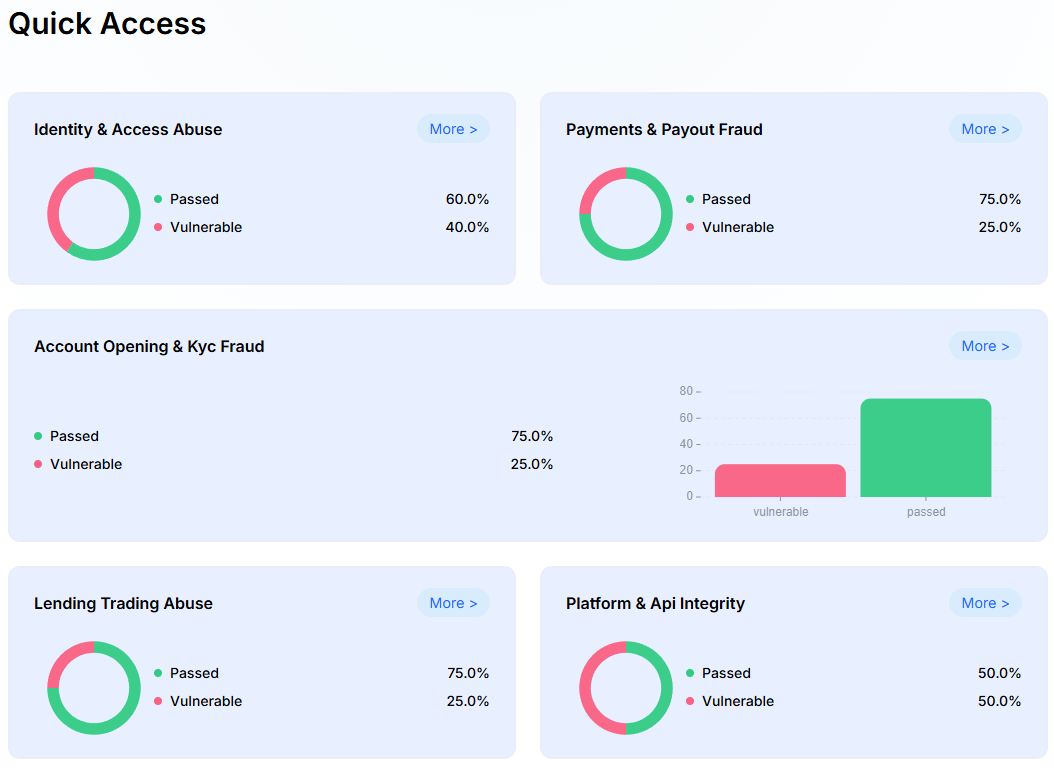

We help with:

- Real-time fraud monitoring aligned with KYC/AML needs

- Audit trails and reporting for compliance

- Risk classification of users across the session lifecycle

- Reducing operational burden through automation

Perfect for CTOs managing infrastructure in finance, healthcare, and telecom sectors.

Let’s Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required