Cybersecurity for Crypto

Secure crypto exchange accounts against takeover and bot fraud

Protect users from ATO, bots, fake registrations and payment fraud.

Stats on Crypto Breaches

$0.7B+

Global Crypto Scam Losses

More than $10.7 billion was lost globally to crypto scams, including $3.9 billion in the U.S. from around 150,000 complaints

35%

Rise in Crypto Fraud Losses

Crypto-related fraud losses grew 45%, with over $5.6 billion lost globally, driven primarily by investment scams

798%

ATO Surge in Finance & Crypto

Year-on-year increase in reported ATO incidents affecting financial and crypto accounts reached 808%

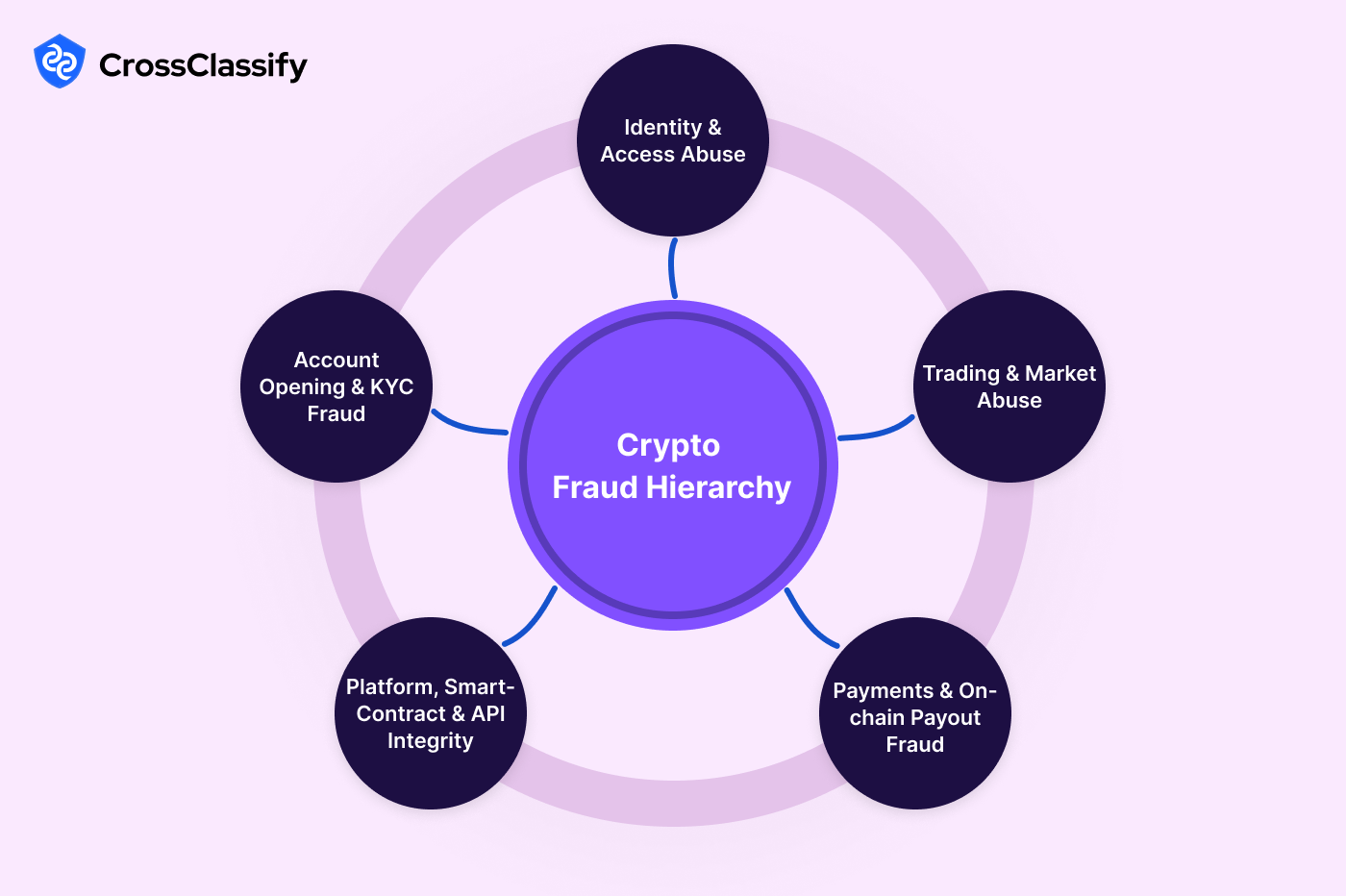

Why Crypto Data Security Matters

Stop Account Takeover on Crypto Exchanges Before Assets Disappear

Crypto platforms are prime targets for account takeover (ATO) attacks that exploit stolen credentials and weak authentication flows. Without advanced ATO protection, exchanges risk both user loss and financial theft.

Prevent Bot Fraud and Fake Account Creation on Crypto Platforms

Fraudsters use automated bots to mass-create fake accounts for airdrop abuse, bonus exploitation, and laundering. General bot protection fails, only crypto-specific bot detection based on behavior and device profiling works.

Monitor Suspicious Crypto Wallet Activity and Risky Transactions

General fraud tools can’t track on-chain behavior or wallet-level risks. CrossClassify provides deep wallet fingerprinting and crypto transaction monitoring to flag abnormal usage patterns before a breach.

Go Beyond KYC: Block Synthetic IDs and Crypto Fraud Rings

KYC/AML checks aren't enough against synthetic identity fraud and organized crypto fraud networks. Our solution adds real-time fraud scoring and behavioral risk signals to prevent abuse at the source.

Blog

Latest from Cross Classify

Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

Prevent Crypto Exchange Account Hijacks Now

Reduces crypto account takeover risk by up to 90%, securing wallet access.

~76%

Of crypto fraud attempts occur post-onboarding

200+

Victims were defrauded for ~$20.9M by Deepfake crypto investment scams

How We Prevent Account Takeover

Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

Learn More ❯Continuous Monitoring for Crypto Fraud

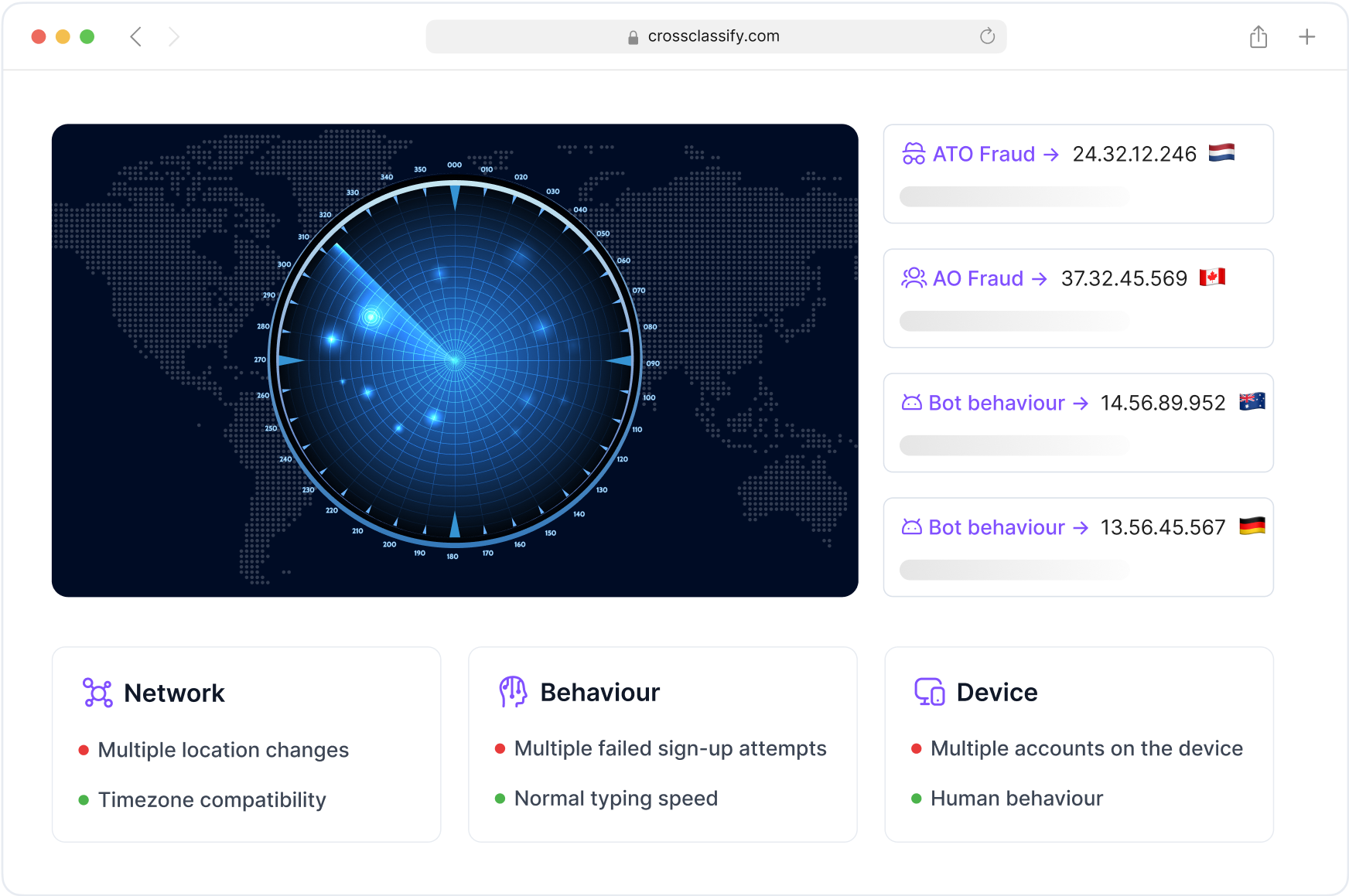

Stay ahead of evolving crypto threats with continuous monitoring of wallet logins, exchange interactions, KYC bypass attempts, and suspicious transaction patterns. CrossClassify provides real-time fraud detection and behavioral baselining tailored for crypto exchanges, DeFi platforms, and Web3 wallets. By continuously analyzing user activity, our platform ensures dynamic risk assessment across your blockchain infrastructure.

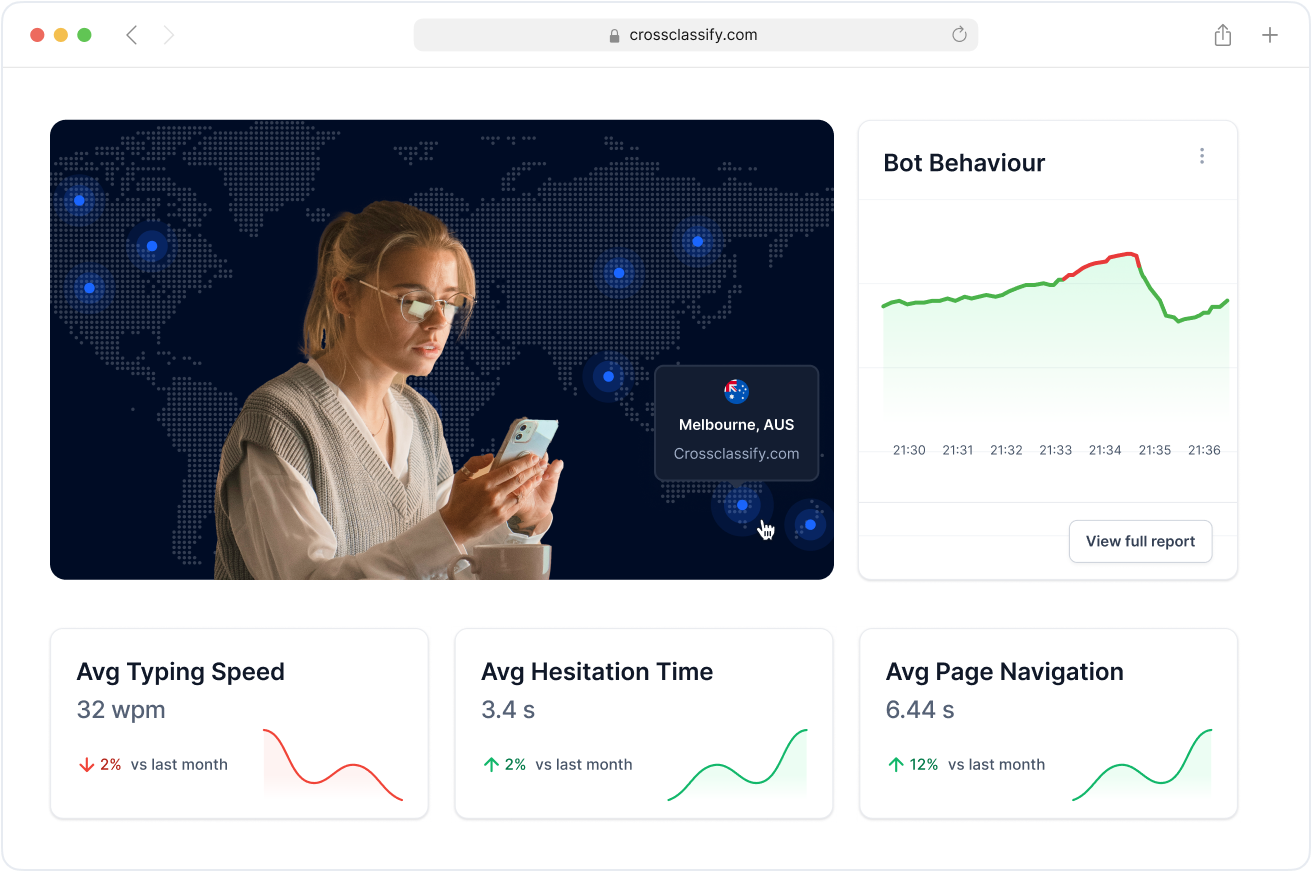

Behavior Analysis for Crypto User Verification

Detect bot-operated wallets, mule accounts, and synthetic identity fraud using behavioral biometrics and session intelligence. Our platform tracks how users interact with exchange platforms, identifying anomalies in wallet creation, trading behaviors, and access routes. Stop automated abuse and suspicious login attempts before they compromise assets.

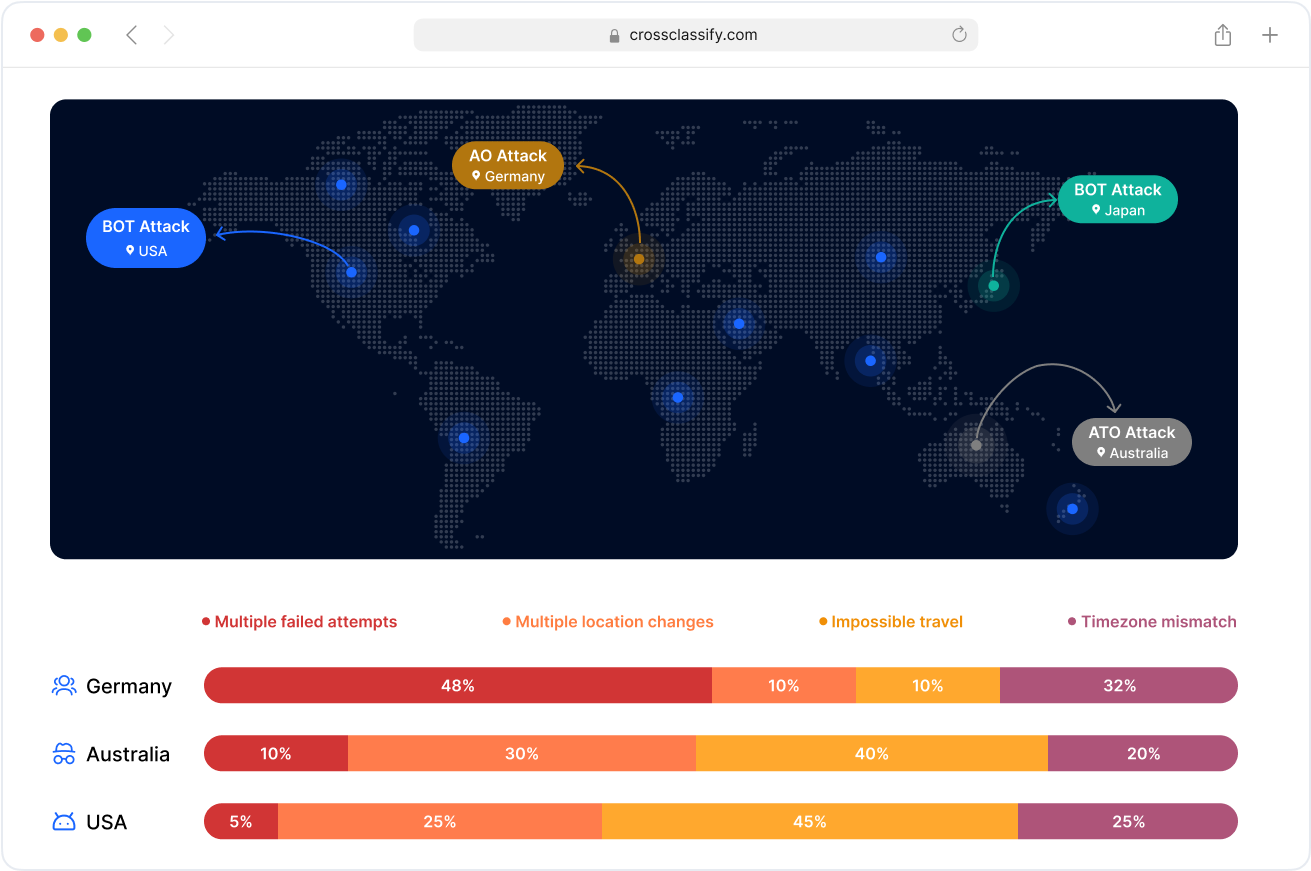

Geo Analysis for Suspicious Crypto Activity

Pinpoint geolocation mismatches in wallet access, login spikes from high-risk jurisdictions, and proxy/VPN-based obfuscation in real time. CrossClassify flags anomalies in IP-to-wallet behavior, helping crypto companies combat geo-spoofing and enforce geo-based restrictions.

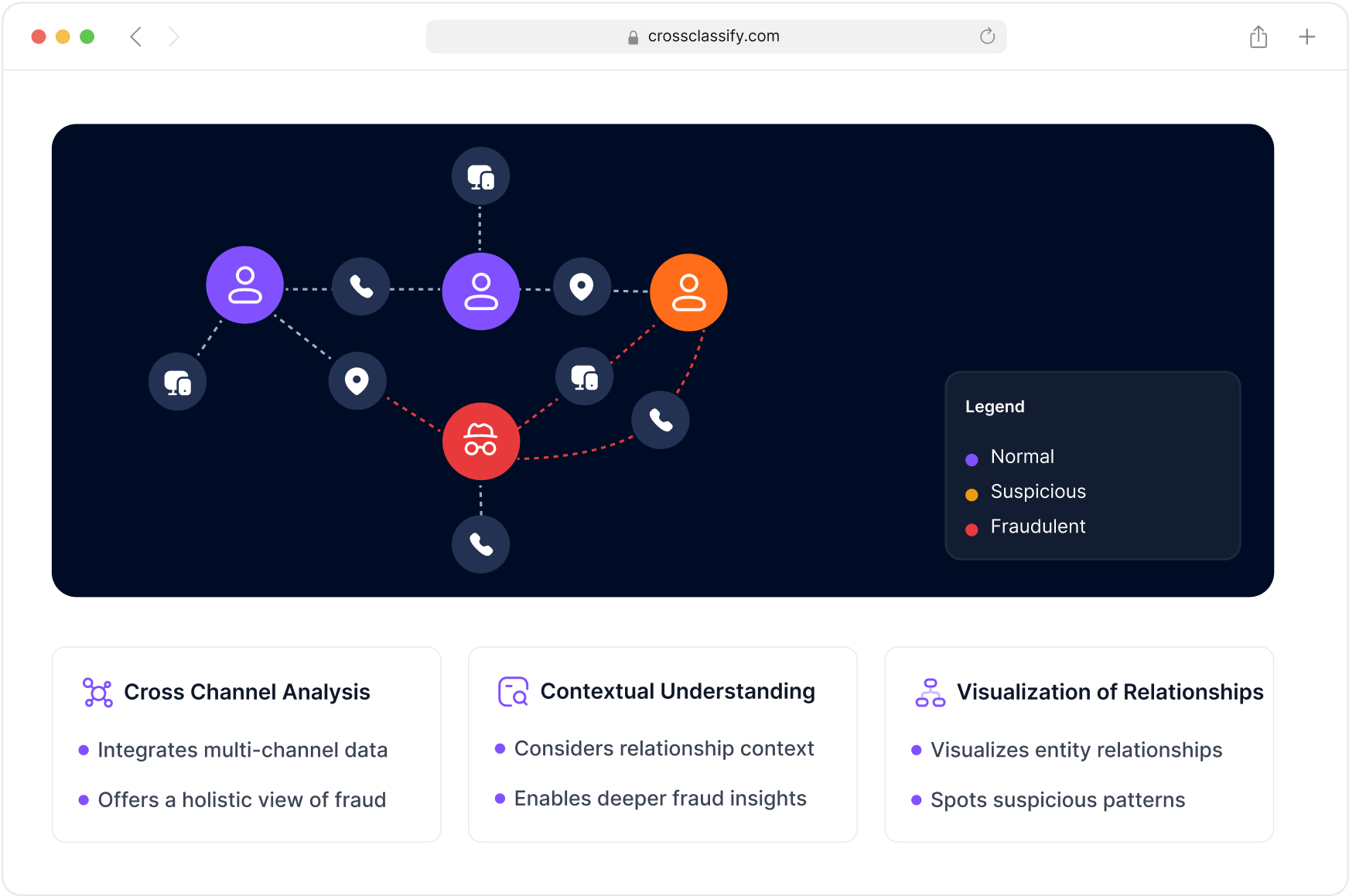

Link Analysis of Blockchain and User Networks

Identify collusion patterns between wallet addresses, detect multi-account abuse, and expose money laundering networks by analyzing user relationships and digital trails. CrossClassify’s graph-based wallet link analysis reveals how fraud rings exploit exchange platforms.

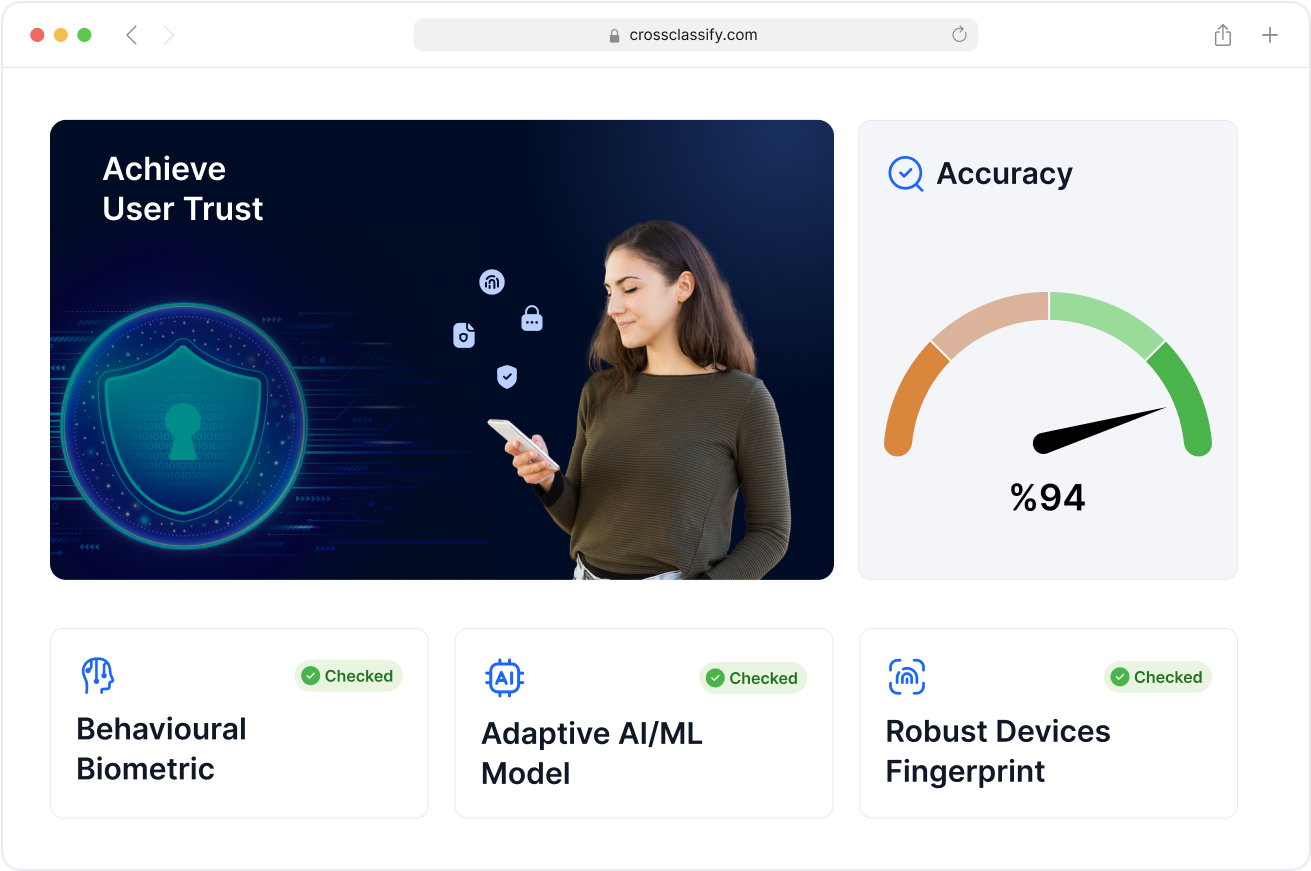

Enhanced Security and Accuracy for Digital Assets

CrossClassify empowers crypto businesses with AI-driven fraud prevention tailored for Web3. Our accuracy-first engine adapts to both hot and cold wallet behaviors, ensuring smart differentiation between real users and fraudsters without impacting UX.

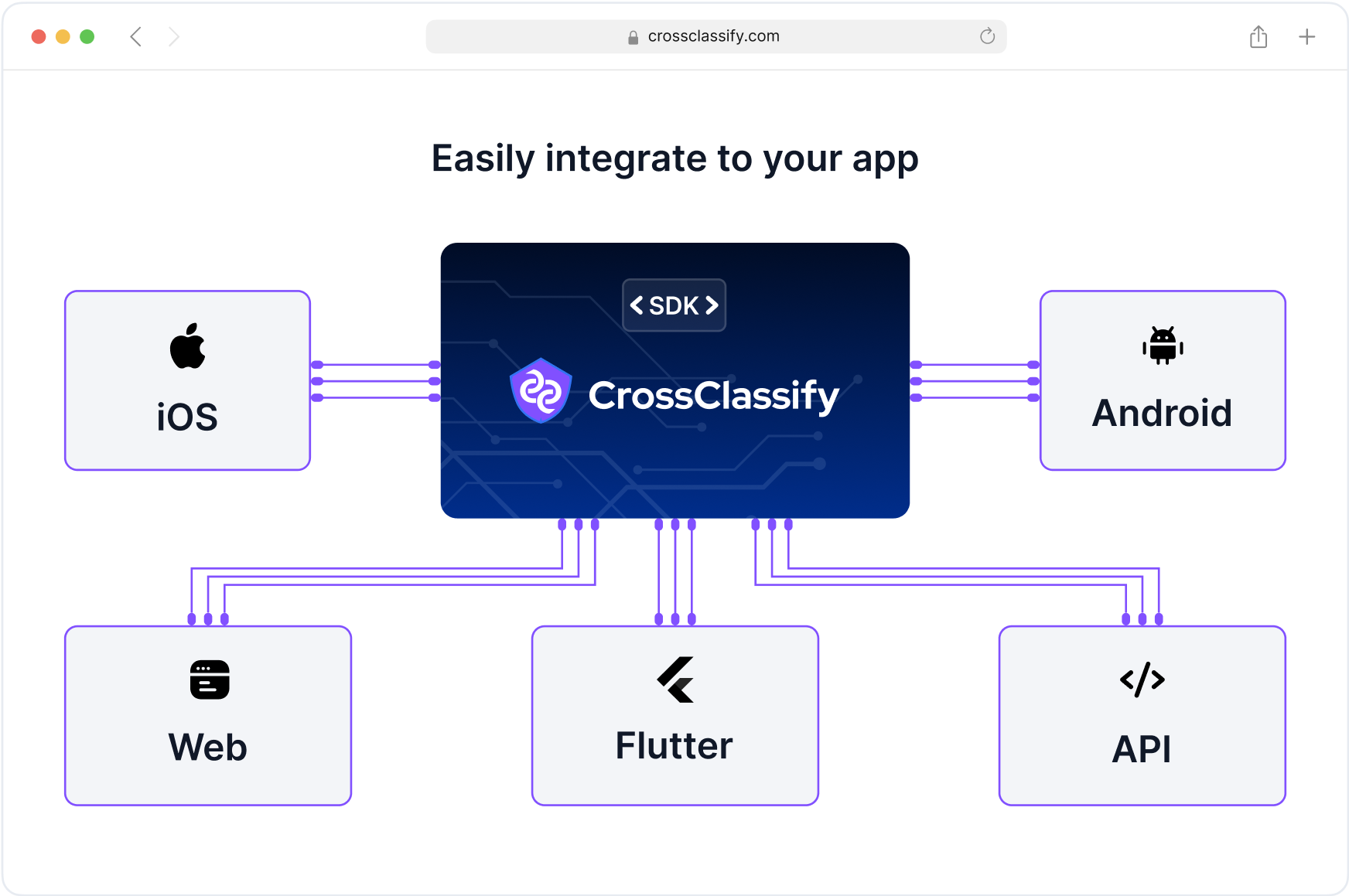

Seamless Integration with Crypto Platforms

Easily integrate CrossClassify into crypto exchanges, DeFi dashboards, and KYC providers with our modular SDKs and APIs. Enable real-time fraud scoring for user sessions and automate actions like wallet freezing or risk-based 2FA without performance loss.

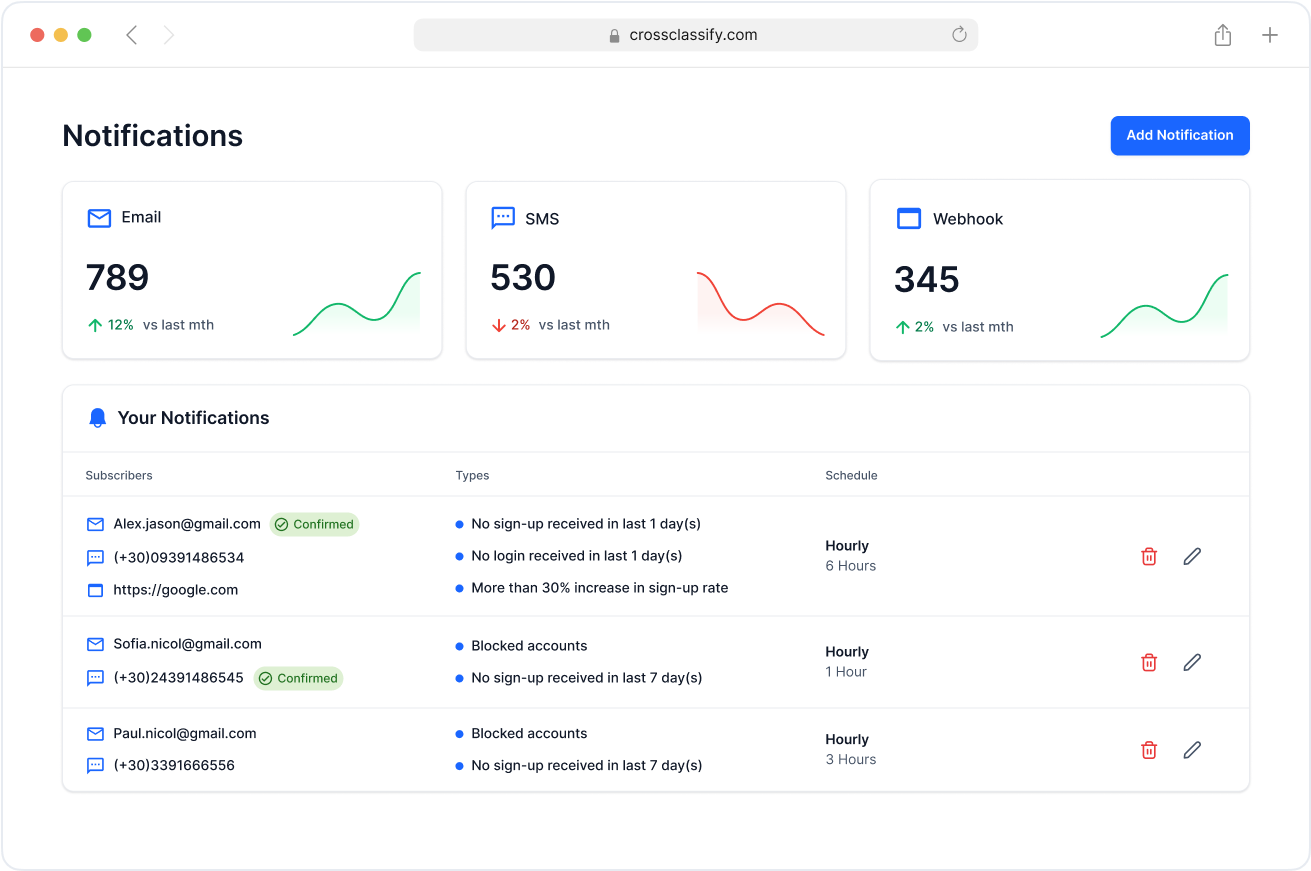

Alerting and Notification in Real Time

Receive instant alerts on wallet compromise, suspicious trading, or bot activity targeting your crypto platform. CrossClassify sends automated notifications to your security team or SIEM based on real-time threat scores—supporting rapid incident response and fraud triage.

Compliance

From Compliance to Credibility

Anti-Money Laundering (AML) Regulations

Binance: Pleaded guilty to violating U.S. anti-money laundering laws, resulting in a $4.3 billion fine. CEO Changpeng Zhao resigned and personally paid a $50 million fine

OKX: The operator, Aux Cayes FinTech Co, pleaded guilty to operating an unlicensed money transmitting business, agreeing to pay nearly $505 million in fines and forfeitures.

KuCoin: Pleaded guilty to operating an unlicensed money transmitting business and agreed to pay over $297 million in fines and forfeitures.

Know Your Customer (KYC) Requirements

Binance: Fined $4.3 billion by U.S. regulators for violating anti-money laundering laws and operating without proper KYC procedures. CEO Changpeng Zhao also paid a $50 million personal fine

BitMEX: Agreed to pay $100 million to the U.S. Commodity Futures Trading Commission (CFTC) and Financial Crimes Enforcement Network (FinCEN) for failing to implement a compliant KYC and AML program.

Superior Crypto Risk Engine

Our crypto risk engine uses adaptive AI to detect wallet takeover, phishing, and bot fraud in real time. Offers granular wallet fraud detection and transactional risk scoring.

With a dynamic AI-based engine built for blockchain flows, we outpace static rules. Protect hot/cold wallets and detect suspicious transfers instantly. Minimize false positives while maximizing exchange fraud prevention efficiency.

Behavioral Biometrics for Crypto

Monitor how users interact with your crypto platform, from typing to gestures, to detect bots, scripts, and synthetic identities. No passwords or captchas required.

Our behavior engine flags risk with no added friction. Protect the UX of onboarding, trading, or withdrawing while silently preventing automated threats.

DAI-Powered Crypto Fraud Detection

Our AI crypto fraud detection engine identifies wallet takeovers, phishing attempts, account farming, and exchange abuse in real time. Tailored scoring tracks abnormal trading behaviors and high-risk device patterns.

CrossClassify adapts to evolving blockchain threats faster than traditional rule-based systems. From login to withdrawal, every crypto user action is continuously monitored to prevent exchange fraud and protect user assets.

Frequently asked questions

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Let's Get Started

Elevate your Crypto app's security with CrossClassify. Schedule a personalized demo to see how we protect customer accounts and ensure compliance with industry standards.