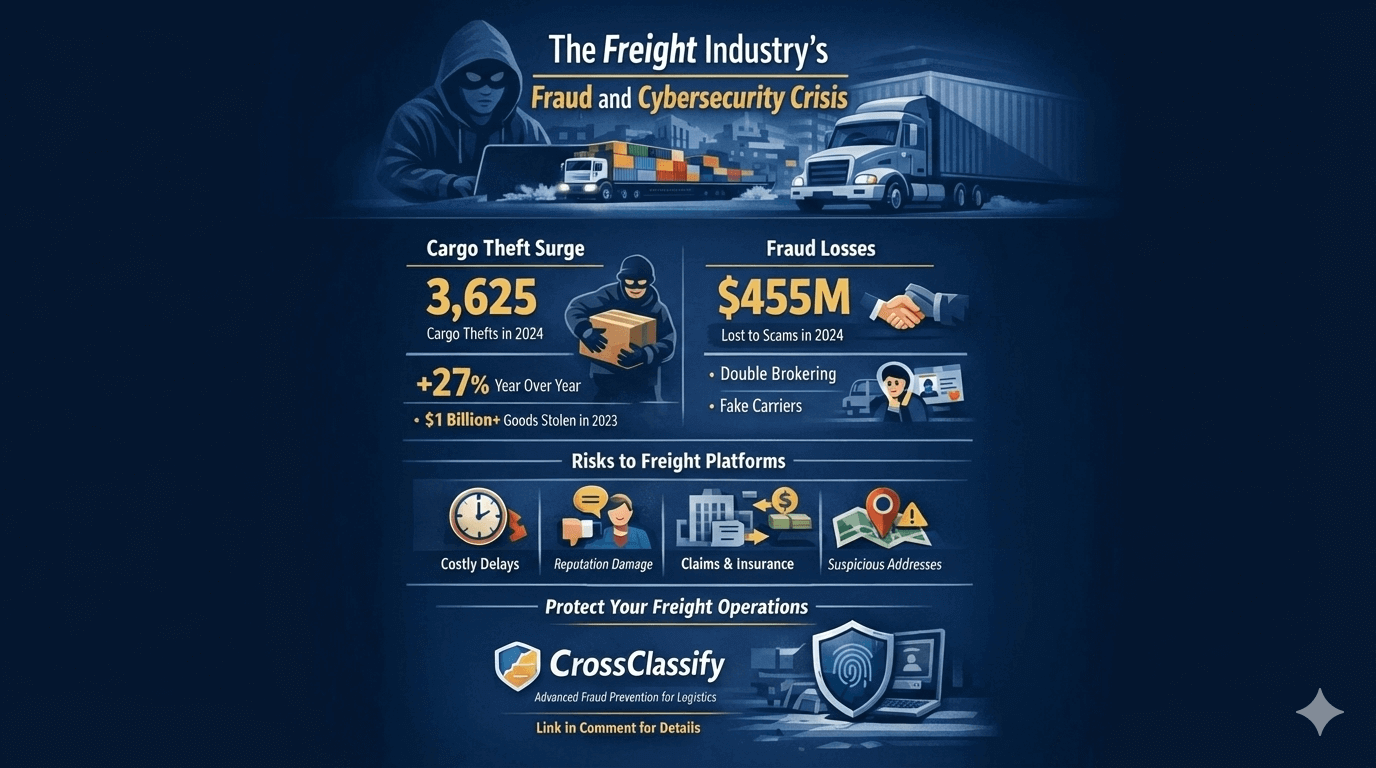

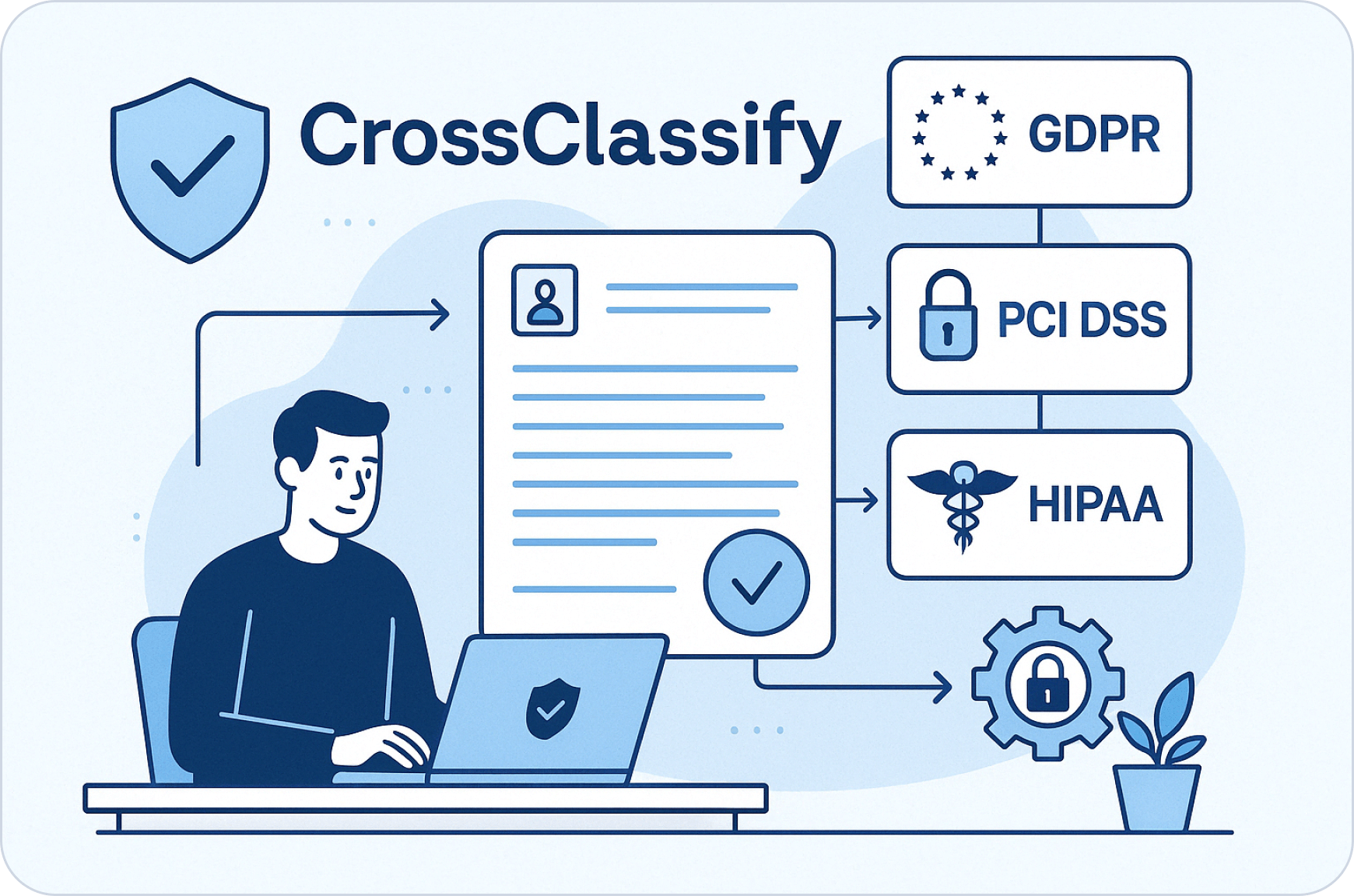

Supporting Compliance Officers to Ensure Security and Regulatory Confidence

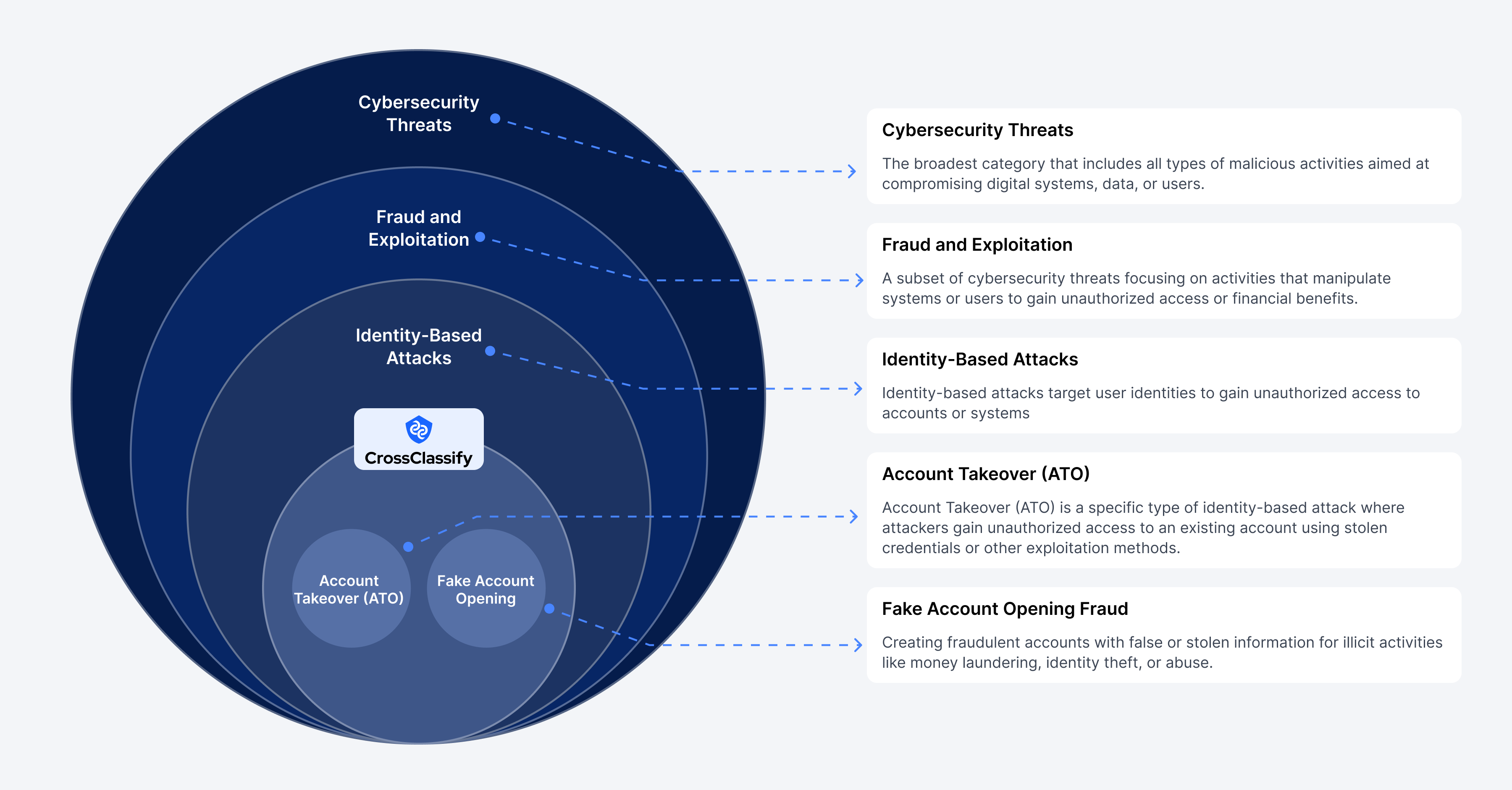

As a Compliance Officer, your goal is to manage legal risk and ensure regulatory adherence. CrossClassify strengthens compliance with intelligent fraud prevention, protecting sensitive data and meeting industry standards. It defends against account takeovers, account opening fraud, bot attacks and abuse, helping you reduce risks and maintain trust.

How CrossClassify Benefits You

We understand your challenges and offer a solution that equips your technical teams for success

Regulatory Compliance

CrossClassify ensures compliance with regulations like GDPR, PCI-DSS, and HIPAA, meeting data protection standards. With privacy and security at its core, our system supports secure processing, storage, and transmission of sensitive data. By embedding regulatory requirements into fraud detection workflows, we simplify compliance and reduce violation risks, helping you demonstrate adherence and avoid costly penalties.

Audit Trails

CrossClassify ensures compliance with comprehensive audit trails and detailed logs for seamless, transparent reporting. Every action is recorded, providing quick access to historical data during audits or investigations. Whether for routine checks or specific inquiries, our robust reporting tools help you prove diligence and integrity, ensuring you're always prepared for regulatory oversight.

Risk Reduction

CrossClassify mitigates the risk of data breaches and reputational damage by proactively detecting and preventing fraud, ensuring sensitive data remains secure. Our real-time fraud prevention reduces exposure to compliance violations, protecting your organization from financial penalties and legal fallout. By minimizing breach risks, we help maintain a strong risk management framework, keeping you protected and audit-ready.

Short Posts

Latest from Cross Classify

Frequently asked questions

Compliance:

- Reduces legal and financial risk

- Builds trust with customers and partners

- Demonstrates accountability to regulators

- Helps detect, prevent, and respond to fraud

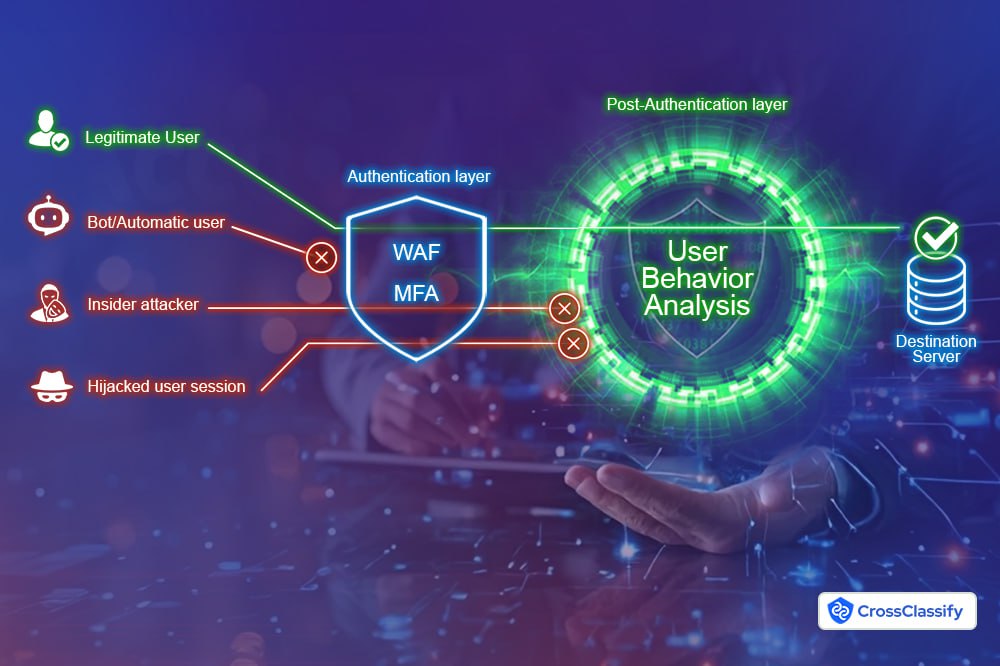

CrossClassify supports all of these through real-time monitoring, behavioral analysis, and auditable event logs.

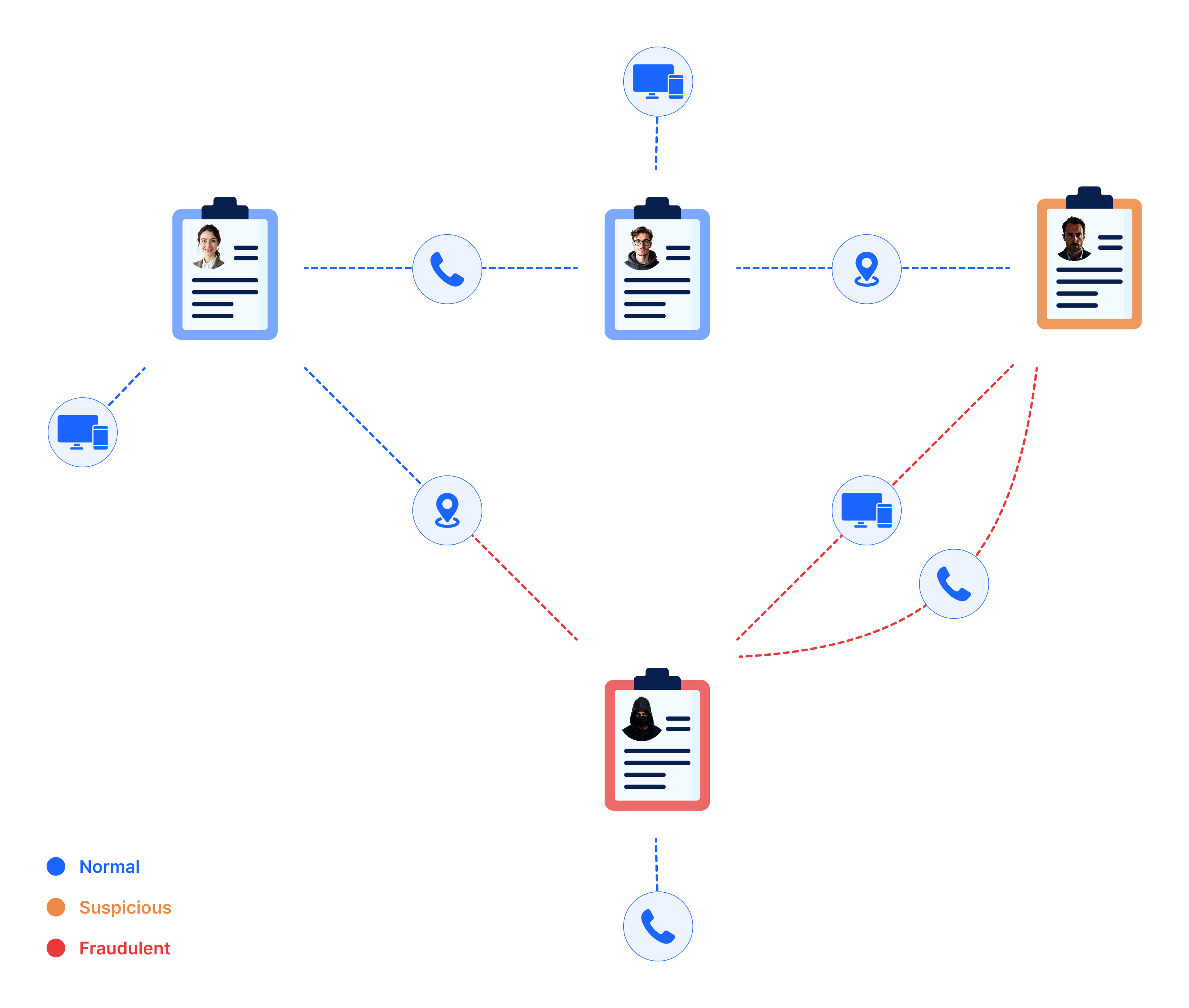

CrossClassify helps by:

- Logging behavioral anomalies and user risk events

- Enhancing identity verification during account creation

- Supporting AML, KYC, and fraud reporting requirements

- Generating evidence for audits with time-stamped, device-linked user trails

CrossClassify is designed to complement frameworks like:

- NIST Cybersecurity Framework

- GDPR (privacy and data minimization)

- SOX (for fraud control in public companies)

- PCI-DSS (transactional integrity)

- PSD2 (for financial risk management in fintech)

While we’re not a policy platform, our signals support enforcement of these standards.

We provide:

- Detailed user interaction records

- Device and behavior-based fingerprinting

- Session histories and event timelines

- Export-ready data to demonstrate fraud defense protocols and traceability

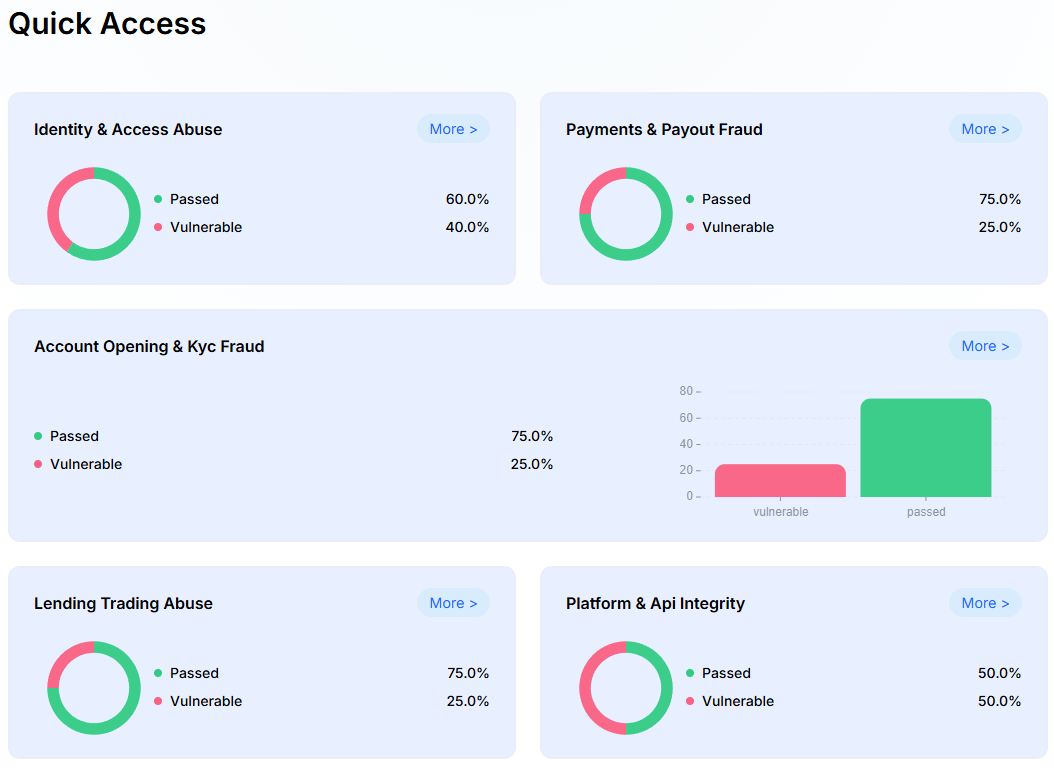

By identifying:

- Synthetic or fake accounts at onboarding

- Account takeovers using real but compromised credentials

- Bot-driven login and signup abuse

This helps prevent data misuse and supports your user integrity reporting obligations.

Regulations often require timely response to suspicious activity. Delays in fraud detection can lead to:

- GDPR breach notification violations

- AML/KYC compliance failures

- Loss of licensing (e.g., gaming, fintech, or banking sectors)

CrossClassify identifies and stops fraud as it happens, keeping your organization in line with its obligations.

Because we:

- Offer privacy-aware, policy-compliant data handling

- Enhance your fraud controls without compromising UX

- Support auditability, transparency, and real-time intervention

- Help bridge the gap between security, risk, and compliance teams

CrossClassify is the compliance officer’s invisible ally—detecting fraud, documenting intent, and reinforcing regulatory defenses.

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required