Last Updated on 19 Aug 2025

Supply Chain Fraud Hierarchy: A Field Guide For Securing Supplier Portals, RFQ Workflows, Telematics, and Payouts

Share in

Introduction

Modern supply chains run on interconnected portals, APIs, EDI bridges, and IoT feeds. The same openness that powers speed also gives fraud rings and opportunistic actors a broad attack surface. What wins in this environment is an AI powered supply chain fraud detection platform that uses behavioral biometrics for supply chain operators, device fingerprinting for supplier portals, and real time risk scoring for logistics to stop risk as it unfolds. This article turns your hierarchy into a practical playbook for procurement, logistics, finance, and security teams. Where helpful, we reference well known incidents such as the NotPetya malware that disrupted a global shipper in 2017, the Target vendor breach that entered through a third party supplier, and the SolarWinds software compromise that showed how supplier access can ripple across ecosystems.

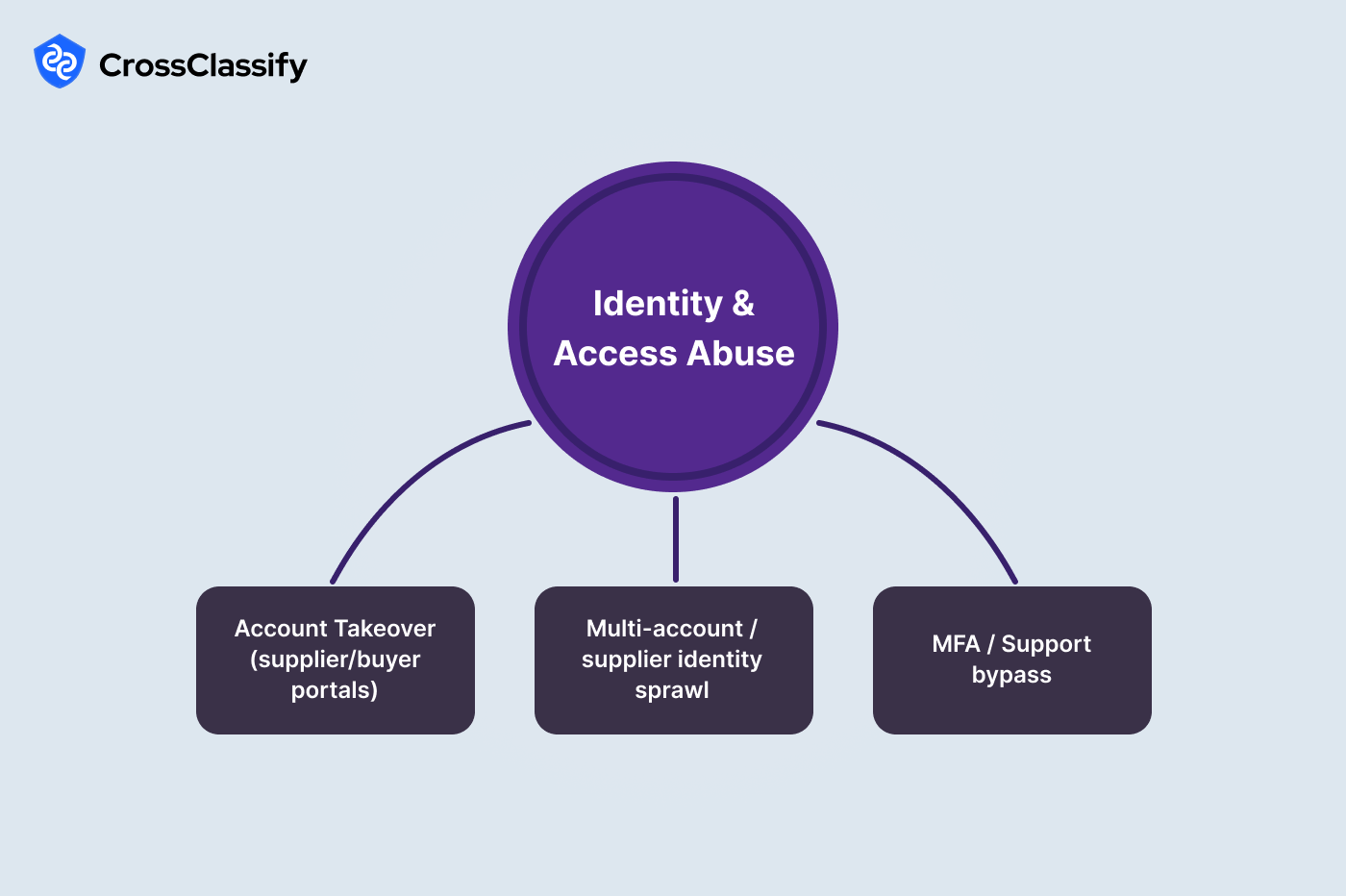

Identity and Access Abuse in Supply Chain Platforms

Account integrity is the first guardrail for every PO approval, RFQ, tender acceptance, and payout decision. Attackers use leaked credentials, OTP phishing, and help desk social engineering to stage takeovers or to create swarms of look-alike supplier accounts. In high volume buying seasons the timing signal is decisive, because a compromised account often accepts or edits within minutes of login. The objective is to link every action to a persistent device and to human behavior that looks like the real operator, then to push targeted friction only when the score climbs. Public incidents reinforce the stakes, for example the Target supplier access breach demonstrated how a modest vendor login can become a large operational impact when trust boundaries are weak.

1. Account Takeover of Supplier or Buyer Portals

ATO leads to unauthorized PO approvals, price edits, and diversion of goods or funds. Rings often test credentials first, then attempt the action inside a short window. The defense is continuous risk scoring that does not stop at login and the ability to freeze edits in session when the score spikes.

- New logins from unfamiliar regions immediately before PO approvals or price updates: When the heat map shows time boxed hotspots in regions outside your normal operating footprint right before approvals, you are seeing staging for takeover. A clean pass clusters around your home markets and routine hours, which is what auditors expect to see.

- Spike of failed logins followed by a successful one: A short burst of failures that flips to a success is classic credential stuffing that finally struck an active account. Expect to see the edit or approval event within the next few minutes if you do not intervene.

2. Multi-account and Supplier Identity Sprawl

Fraud shops register many near-duplicate suppliers, often reusing equipment or networks. Their goal is to flood RFQs, win low margin parts, and manipulate charge and delivery terms. The fastest way to expose this is to attach activity to devices and networks that persist across sessions.

- Many supplier accounts tied to the same device or IP submitting RFQs: A hub device that connects to many supplier nodes is an operator farm, especially when those suppliers bid the same lanes or parts. Sparse and evenly distributed edges indicate healthy diversity.

- Reused device fingerprints across distinct VAT or EIN tax IDs: When the same device fingerprint appears against multiple tax identities, you are looking at synthetic umbrellas or impersonation. A pass is a clean one to one mapping of device to tax identity.

3. MFA and Support Bypass

Attackers convince support to change email or phone, then push a reset. The pattern is fast and time coupled, often during evening shifts. Training helps, but the durable fix is analytics on ticket proximity and a short hold after risky contact edits.

- Email or phone change followed by password reset within minutes: If the curves are synchronized, you likely have a bypass playbook in flight. Uncorrelated lines mean changes are happening with healthy separation.

- Support tickets immediately preceding credential changes: Short minute gaps between ticket and change, especially on chat and after hours phone, are a red flag. Long gaps and extra verification are what you want to see.

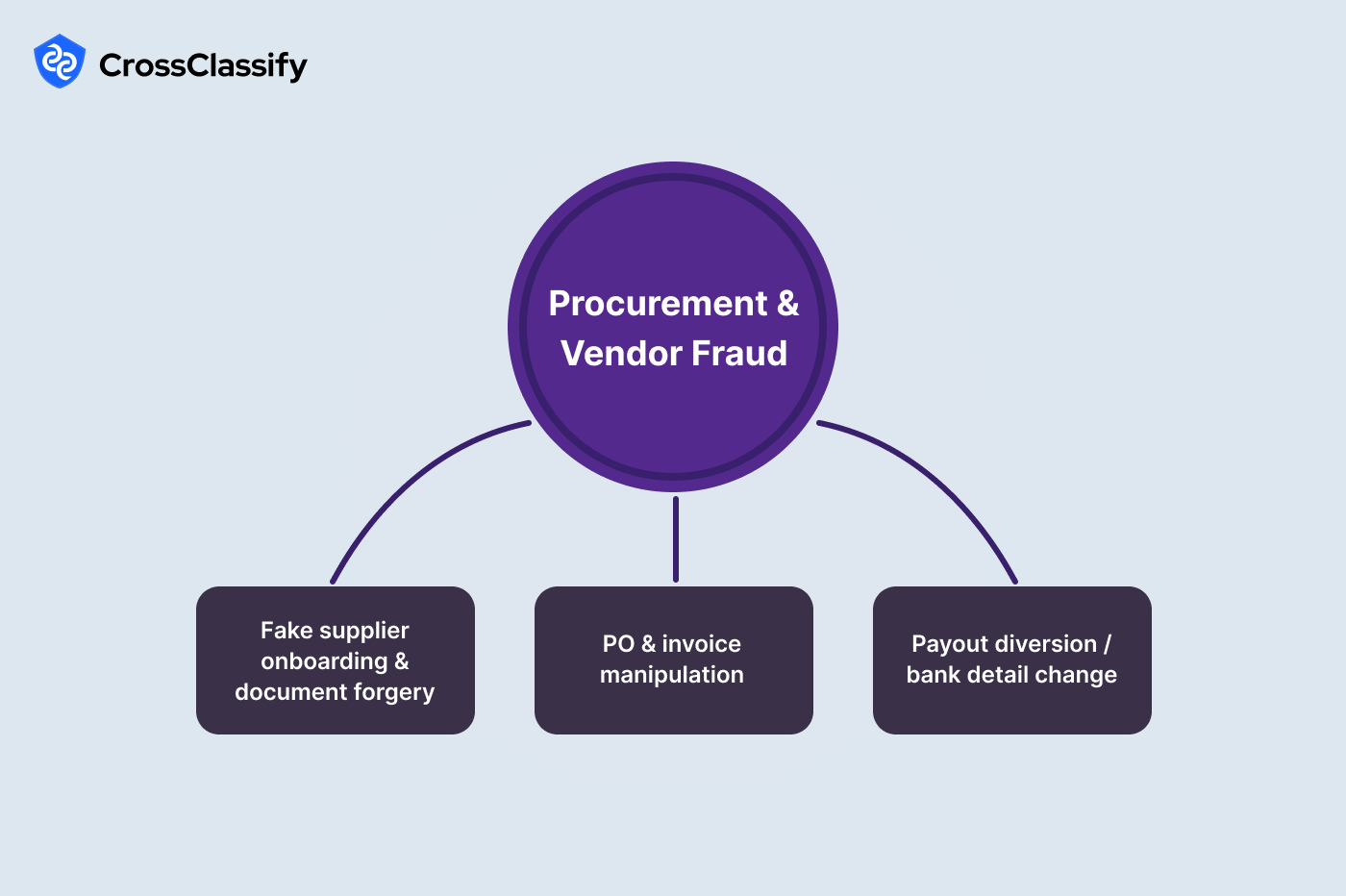

Procurement and Vendor Fraud

Procurement is attractive to adversaries because a single approval can authorize large value. Real world cases of invoice fraud frequently involve duplicate numbers, recycled documents, and last minute bank changes. Strong vendor KYC and device-level persistence lower your false positives while catching coordinated rings. Evidence should always travel with the alert so finance, legal, and sourcing can act with confidence.

1. Fake Supplier Onboarding and Document Forgery

Fraudsters fabricate COI, COA, or certificate files and reuse them across multiple entities. They also register new email domains to look like established companies. The goal is to pass the initial checks, then execute PO or payout fraud downstream.

- COI, COA, ISO document fingerprint or hash reuse across suppliers: When one hash appears for many suppliers, you have recycled paperwork and likely identity obfuscation. Unique hashes mapped to single suppliers indicate a clean control.

- Newly registered or low reputation email domains on applications: A cluster of very young domains points to throwaway identities. Mature domain ages align with established businesses and lower your onboarding risk.

2. PO and Invoice Manipulation

Once inside, actors alter approved amounts or submit duplicates. Many organizations only detect this during monthly reconciliation, which is too late. Real time detection focuses on delta monitoring and number uniqueness.

- PO amount materially increased after approval: Large positive deltas within short windows indicate bump fraud. Minor symmetric changes with approvals are acceptable.

- Duplicate invoice numbers across suppliers: Spikes on specific numbers are double billing attempts. A flat near-zero distribution is the healthy baseline.

3. Payout Diversion and Bank Detail Changes

Adversaries switch beneficiary accounts, then trigger a high value payout. This is common in public reports of wiring fraud and it thrives where bank edits do not cause a step up.

- Beneficiary bank change followed by large payout within 24 hours: Tight coupling is the hallmark of diversion. Uncoupled series mean your controls are working.

- Same bank account used by multiple suppliers: Shared payout nodes expose impersonation, laundering, or a broker ring. One account per supplier is your target pattern.

Logistics and Inventory Manipulation

When load data or telemetry is manipulated, margin and safety suffer. NotPetya's impact on a global shipper showed how fragile logistics becomes when core systems are disrupted. A more common daily threat is local and opportunistic, such as ASN tampering, shrink via suspicious adjustments, or GPS spoofing. The answer is a set of plausibility checks and operator accountability that span systems and roles.

1. ASN Tampering and Mis-shipments

Edits often arrive just before trucks hit the gate, which hides shortages or swaps. Warehouse and transportation teams need a shared dashboard to see these in one view.

- ASN quantity deviates from received quantity: Large negative bars for specific SKUs show under deliveries that deserve a recount and supplier conversation. Small symmetric differences imply normal operations.

- ASN edits spike minutes before truck arrival: When edits cluster just ahead of arrivals, enforce holds and photo evidence. Uncorrelated lines mean process discipline is strong.

2. Inventory Shrinkage and Adjustment Fraud

Adjustment abuse hides loss, resale, or misrouting. Night shifts and high value categories are common hotspots.

- Repeated high value adjustments concentrated in night shifts: Persistent hot cells at specific hours and categories demand targeted oversight. A diffuse pattern without hotspots is a pass.

- Same user or device performing adjustments across many warehouses: A single operator spanning many sites is an orchestrator pattern. Limited span aligns with role expectations.

3. GPS and IoT Telemetry Spoofing

Spoofed coordinates or edited speed data hide detours, unsafe driving, or theft. Colonial Pipeline's event reminded everyone that operational telemetry can become a national headline when integrity fails, so simple plausibility checks pay for themselves.

- Speeds beyond policy thresholds: Sustained excursions above policy without road context imply device tampering or unsafe behavior. Lines inside the policy band reflect compliant operations.

- Large distance between consecutive pings: Sudden multi-mile jumps are physically impossible and surface GPS spoofing or buffering games. Smooth micro-movements show a healthy stream.

Marketplace and Data Integrity

Scrapers depress margins by harvesting quotes and capacity signals. At the same time, fake reviews distort supplier scorecards and influence sourcing teams. Public e-commerce platforms have documented large scraping and review campaigns, and B2B marketplaces see many of the same tactics through headless browsers and scripts.

1. Price Scraping and RFQ Botting

Scraping often shows as headless user agents and extreme search to RFQ ratios. Throttling and session depth checks keep good users fast while blocking bots.

- Excessive requests from headless or script user agents: A dominance of headless and scripting agents means automated harvesting. Healthy traffic is led by mainstream browsers.

- High search-to-RFQ ratios from specific IP ranges: Reconnaissance ranges produce many searches and almost no RFQs. Balanced ratios across blocks indicate normal buyer behavior.

2. Fake Reviews and Rating Manipulation

Astroturf campaigns boost or smear suppliers in short bursts. Cross linking IPs and cohorts gives the evidence moderation teams need.

- Review bursts from new accounts on the same day: Same day spikes for the newest cohort are reliable stuffing signals. Gradual growth across cohorts is a pass.

- IP clusters posting across multiple vendor or product profiles: A central IP tied to many profiles is a coordination hub. Dispersed edges show independent, organic activity.

3. Deep Link and Parameter Tampering

If you trust client parameters, motivated actors will tamper with them. The cure is server side recomputation and request signature validation.

- Mismatch between quoted and charged price: Positive deltas show manipulation or calculation drift. Small symmetric deltas inside tolerance are acceptable.

- Unsupported parameters or codes in requests: Rising counts of unknown parameters indicate probing and fuzzing. Rare occurrences show healthy validation.

Compliance, Quality and Safety Documentation Integrity

Compliance data is often trusted implicitly and checked only at audit time. That delay is exactly what fraudsters need. Bringing document hashing, geofencing, and chain-of-custody analytics into daily workflows gives teams immediate leverage. High profile operational incidents show how easily a weak link in documentation or inspection can become systemic.

1. Certificate and Document Fraud

Expired or forged COI, COA, or ISO files are still common. Reuse of the same PDF across many suppliers indicates template fraud or identity manipulation.

- Expired COI or COA or ISO used with shipments or tenders: Negative days to expiry during active activity mean you should auto reject until updated. No negatives is the pass state.

- PDF fingerprint reuse across different suppliers: The same hash across many suppliers points to forgery or templates. Unique hashes per supplier show healthy controls.

2. Inspection and Quality Control Falsification

Copy pasted inspections or off-site submissions undermine trust with customers and regulators.

- Burst of inspection submissions in a single minute: A one minute spike suggests pasted forms. Even distributions show real inspections.

- Inspections recorded outside the site geofence: “No” hits indicate off-site filings. Universal “Yes” hits confirm onsite work.

3. ESG and Provenance Integrity

Outlier suppliers with many violations deserve immediate review. Low, even counts across suppliers indicate discipline.

- Chain of custody timestamps out of order: Outlier suppliers with many violations deserve immediate review. Low, even counts across suppliers indicate discipline.

- Unusual path anomalies in provenance graph: Steps that connect to many batches are shortcuts that mask origin. Diffuse networks without dominant shortcuts are healthy.

How CrossClassify Maps To This Hierarchy

CrossClassify operationalizes the hierarchy by unifying signals from identity, devices, browsers, user behavior, telematics, content, and payments into a single, continuously refreshed risk score. Unlike point tools that score only at login, our AI powered supply chain fraud detection platform evaluates every sensitive step inside the workflow. As a result, approvals, edits, payouts, adjustments, and submissions are protected in motion, not just at the perimeter.

Device fingerprinting for supplier portals persistently links actions to the true device behind a session, even when actors rotate IPs, clear cookies, switch to private browsing, or tunnel through a VPN. This binding connects PO approvals, RFQs, bank account edits, certificate uploads, and inspection submissions back to stable device identities. CrossClassify then analyzes cross account reuse to expose hubs that coordinate multi account bidding, double brokering, or payout diversion.

Behavioral biometrics for supply chain operators learn the legitimate rhythm of your users. We capture keystroke cadence on approval forms, dwell time on ASN screens, mouse travel during QC entries, and navigation paths in WMS or TMS portals. The models adapt per role, site, and shift, so a dispatcher working a night window is treated differently from a finance approver at headquarters. When the behavior diverges from the learned pattern, the score climbs and targeted friction is introduced only for that session.

Real time risk scoring for logistics fuses plausibility checks that matter to operations. We validate ASN quantity versus receipt quantity, compute distance between consecutive pings, detect speed excursions relative to policy, and verify session integrity for mobile scanners and in cab devices. The moment risk rises, CrossClassify can pause a payout, require step up on an approval, lock a bank edit, hold an ASN, or throttle a scraping session. All actions are evidence backed with the exact table, graph, dashboard, diagram, or network that triggered the decision, so procurement, logistics, finance, and security can close the loop quickly.

Below is how that capability maps directly to each concern in your hierarchy:

- Identity and Access Abuse

- ATO before approvals or price changes: device binding plus geo and hour heat maps flag unfamiliar regions during decision windows and prompt step up before the change is committed.

- Credential testing followed by success: time series models spot failure bursts that convert to a success and temporarily harden the session.

- Support or MFA bypass: ticket proximity analytics enforce a cooling period after contact edits, while behavior checks verify the real operator is present.

- Procurement and Vendor Fraud

- Fake supplier onboarding: document hashing detects COI and COA reuse; domain age and DNS signals boost risk for throwaway domains; device reuse across tax identities exposes synthetic clusters.

- PO and invoice manipulation: approval to final amount deltas are scored in stream; duplicate invoice numbers are caught before posting.

- Payout diversion: coupling of bank change to payout triggers hold and re verification, and network views reveal shared payout accounts across suppliers.

- Logistics and Inventory Manipulation

- ASN tampering: CrossClassify correlates edit bursts with arrival timestamps and SKU value to pause receiving only where it matters.

- Shrink via adjustments: night shift heat maps and cross warehouse operator spread highlight orchestrators while keeping normal adjustments fast.

- Telemetry spoofing: ping distance and speed plausibility detect impossible moves and unsafe spikes with minimal false positives.

- Marketplace and Data Integrity

- Price scraping and RFQ botting: user agent classification, session depth, and search to RFQ ratios throttle automated harvesters without slowing real buyers.

- Fake reviews: cohort timelines and IP to profile networks give moderators the evidence to remove coordinated campaigns.

- Deep link and parameter tampering: server side recomputation and parameter allow lists block price deltas and unknown codes at the edge.

- Compliance, Quality, and Safety Documentation

- Certificate and document fraud: PDF fingerprinting and expiry checks prevent expired or recycled files from being used in tenders or shipments.

- Inspection and QC falsification: minute level submission bursts and geofence checks ensure inspections happen on site and at human speed.

- Provenance and ESG integrity: chain of custody order checks and path anomaly graphs expose shortcuts that mask true origin.

What teams receive out of the box

- An evidence pack attached to every alert that includes the exact table, graph, dashboard, diagram, or network that triggered the decision.

- Decisioning playbooks that apply targeted friction such as step up authentication, edit lock, payout hold, ASN hold, rate limiting, or case creation, all driven by the unified score.

- Low touch integrations to ERP, WMS, TMS, EDI, IoT gateways, and SIEM so signals stream without re platforming.

- Auditable logs for procurement, finance, and compliance, aligning with ISO, SOC, and internal policy reviews.

Explore the full capability set on the solution page.

And dive deeper into typical attack paths and layered controls in the comprehensive fraud and cybersecurity article.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

Strong MFA at login helps, but the real advantage is continuous session risk that reacts at the moment of approval or edit. CrossClassify raises risk when device and behavior drift, then applies step up only for the risky session. Read: supply chain fraud patterns

For deeper tactics and defenses, see the ATO breakdown: account takeover anatomy and how adaptive risk works in production: continuous adaptive risk. Our approach to behavioral biometrics is outlined here: behavioral biometrics.

For deeper tactics and defenses, see the ATO breakdown: account takeover anatomy and how adaptive risk works in production: continuous adaptive risk. Our approach to behavioral biometrics is outlined here: behavioral biometrics.

Correlate device fingerprints, payout accounts, and domain age to reveal clusters. CrossClassify's device persistence and link analysis expose shared devices and bank targets on day one so onboarding can require enhanced verification. Article: supply chain fraud patterns

See how device identity stitches accounts across aliases: device fingerprinting. For patterns common in synthetic onboarding, review: account opening fraud and practical steps to avoid fake accounts: avoiding fake accounts.

See how device identity stitches accounts across aliases: device fingerprinting. For patterns common in synthetic onboarding, review: account opening fraud and practical steps to avoid fake accounts: avoiding fake accounts.

Track deltas between approved and final amounts in real time and alert on large positive shifts. CrossClassify streams approval and edit events to score bumps as they happen and opens a case with the PO delta table attached. Details: supply chain fraud patterns

The scoring logic that adapts mid-session is explained here: continuous adaptive risk, with device continuity that anchors the edits here: device fingerprinting.

The scoring logic that adapts mid-session is explained here: continuous adaptive risk, with device continuity that anchors the edits here: device fingerprinting.

Hold high value payouts that occur shortly after beneficiary edits and re-verify ownership. CrossClassify detects tight coupling between bank changes and payout attempts and automatically routes them to a review queue. Learn more: supply chain fraud patterns

See the device link that ties edits to real hardware: device fingerprinting and how CARTA policies trigger only targeted friction: continuous adaptive risk.

See the device link that ties edits to real hardware: device fingerprinting and how CARTA policies trigger only targeted friction: continuous adaptive risk.

Use cohort timelines and IP-to-profile networks to show coordination. CrossClassify generates the cohort line chart and the IP network so moderation can remove the burst and sanction the hub. See: supply chain fraud patterns

Adaptive throttles that engage during bursts are described here: continuous adaptive risk, and device-level attribution that exposes hubs is here: device fingerprinting.

Adaptive throttles that engage during bursts are described here: continuous adaptive risk, and device-level attribution that exposes hubs is here: device fingerprinting.

Yes, speed over policy and distance between pings expose most spoofing. CrossClassify combines these plausibility checks with device telemetry so risky trips are flagged without flooding teams with false alarms. Guide: supply chain fraud patterns

How the in-stream risk engine gates actions is covered here: continuous adaptive risk.

How the in-stream risk engine gates actions is covered here: continuous adaptive risk.

Temporal proximity to arrival is a high risk feature, especially for high value SKUs. CrossClassify correlates dock schedules with ASN edit bursts and pauses receiving until a supervisor review completes. Reference: supply chain fraud patterns

For real-time scoring patterns and session integrity checks, see: continuous adaptive risk and device-level continuity: device fingerprinting.

For real-time scoring patterns and session integrity checks, see: continuous adaptive risk and device-level continuity: device fingerprinting.

Document hash reuse across multiple entities is decisive. CrossClassify computes hashes and maps reuse to a simple table so onboarding can reject or escalate immediately. Article: supply chain fraud patterns

These cases frequently accompany new or synthetic accounts; background here: new account fraud and here: account opening fraud.

These cases frequently accompany new or synthetic accounts; background here: new account fraud and here: account opening fraud.

Detect headless user agents and extreme search to RFQ ratios, then slow only those sessions. CrossClassify adds targeted friction for bot signatures while keeping mainstream browsers fast. Read: supply chain fraud patterns

The risk-adaptive throttling model is outlined here: continuous adaptive risk, and device-based separation of humans from automation is here: device fingerprinting.

The risk-adaptive throttling model is outlined here: continuous adaptive risk, and device-based separation of humans from automation is here: device fingerprinting.

Measure how close ticket events are to credential changes and enforce a cooling off rule. CrossClassify alerts agents when proximity is risky and requires stronger re-verification before allowing the change. See: supply chain fraud patterns

Common ATO paths that exploit help desks are detailed here: account takeover anatomy, and behavioral biometrics that confirms the real operator is here: behavioral biometrics.

Common ATO paths that exploit help desks are detailed here: account takeover anatomy, and behavioral biometrics that confirms the real operator is here: behavioral biometrics.

Show shared payout accounts, device reuse, and dispute or adjustment outliers on one page. CrossClassify packages networks, tables, and charts as an evidence pack that makes the decision straightforward. More: supply chain fraud patterns

Attribution back to hardware fingerprints is covered in: device fingerprinting, while risk-weighted decisioning is explained in: continuous adaptive risk.

Attribution back to hardware fingerprints is covered in: device fingerprinting, while risk-weighted decisioning is explained in: continuous adaptive risk.

Focus on timestamp order and step connectivity rather than heavy manual checks. CrossClassify computes violations and highlights path anomalies so operations can intervene only where it matters. Background: supply chain fraud patterns

For session-aware controls that escalate only when risk grows, see: continuous adaptive risk and supportive identity hygiene during onboarding here: avoiding fake accounts.

For session-aware controls that escalate only when risk grows, see: continuous adaptive risk and supportive identity hygiene during onboarding here: avoiding fake accounts.

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required