Last Updated on 30 Sept 2025

Advanced Fraud Prevention for Online Gaming and Lottery Operators: Protecting iGaming Platforms Against Account Takeover, Multi-Accounting, and AI-Driven Attacks

Share in

Key Takeaways

•

Online gaming operators face rising fraud challenges such as account takeover, bonus abuse, multi-accounting, payment fraud, and AI-driven synthetic identities that directly impact revenue and compliance.•

CrossClassify delivers an end-to-end iGaming fraud prevention system, using behavioral biometrics, device fingerprinting, and continuous monitoring to reduce fraud while protecting the user experience.•

Rapid integration, transparent reporting, and compliance alignment make CrossClassify a future-ready choice for operators who need measurable ROI and resilient fraud controls tailored to gaming.

Experience in Online Gaming Fraud Prevention

Fraud in the iGaming and lottery sector has unique characteristics that make it more complex than traditional e-commerce fraud. Players exploit bonus systems, create multiple accounts, use synthetic identities, and manipulate geolocation to gain unfair advantages. CrossClassify has extensive experience with lottery and gaming companies, enabling us to detect these behaviors early through advanced scoring and continuous monitoring that is applied at onboarding, login, and transaction flows.

Our proven track record spans both gaming and other regulated industries. For example, in healthcare, organizations such as Helfie and Touchstone Life Care highlighted CrossClassify's ability to streamline operations, deliver precise fraud detection, and enhance integration with critical platforms. These success stories demonstrate that the same advanced models that worked in healthcare can be applied effectively to high-stakes environments like iGaming.

To learn more about our industry-specific expertise, explore the iGaming fraud prevention solution.

Our proven track record spans both gaming and other regulated industries. For example, in healthcare, organizations such as Helfie and Touchstone Life Care highlighted CrossClassify's ability to streamline operations, deliver precise fraud detection, and enhance integration with critical platforms. These success stories demonstrate that the same advanced models that worked in healthcare can be applied effectively to high-stakes environments like iGaming.

To learn more about our industry-specific expertise, explore the iGaming fraud prevention solution.

Fraud Scenarios and Threat Models in Online Gaming

The most common fraud scenarios in the online gaming industry include multi-accounting and bonus abuse. Fraudsters create dozens of accounts using device farms or identity reuse to maximize promotional rewards. This behavior directly reduces campaign ROI and exposes operators to reputational damage when bonus schemes are manipulated.

Account takeover is another critical threat, often driven by credential stuffing attacks using stolen credentials from external breaches. Fraudsters exploit weak passwords, session hijacking, and SIM swaps to compromise accounts and withdraw funds or hijack bonuses. With account takeover attacks now one of the fastest-growing threats in gaming, operators need real-time defenses.

Bot sign-ups and automated play are also increasingly observed. Attackers deploy emulators, form-fillers, and scripts to register accounts at scale, quickly exhausting promotional campaigns and overwhelming weak defenses. These automated strategies can look convincing without advanced tools that detect timing anomalies, behavior inconsistencies, and device-level spoofing.

For an in-depth breakdown of fraud types and their hierarchy, see our iGaming Fraud Hierarchy resource.

Account takeover is another critical threat, often driven by credential stuffing attacks using stolen credentials from external breaches. Fraudsters exploit weak passwords, session hijacking, and SIM swaps to compromise accounts and withdraw funds or hijack bonuses. With account takeover attacks now one of the fastest-growing threats in gaming, operators need real-time defenses.

Bot sign-ups and automated play are also increasingly observed. Attackers deploy emulators, form-fillers, and scripts to register accounts at scale, quickly exhausting promotional campaigns and overwhelming weak defenses. These automated strategies can look convincing without advanced tools that detect timing anomalies, behavior inconsistencies, and device-level spoofing.

For an in-depth breakdown of fraud types and their hierarchy, see our iGaming Fraud Hierarchy resource.

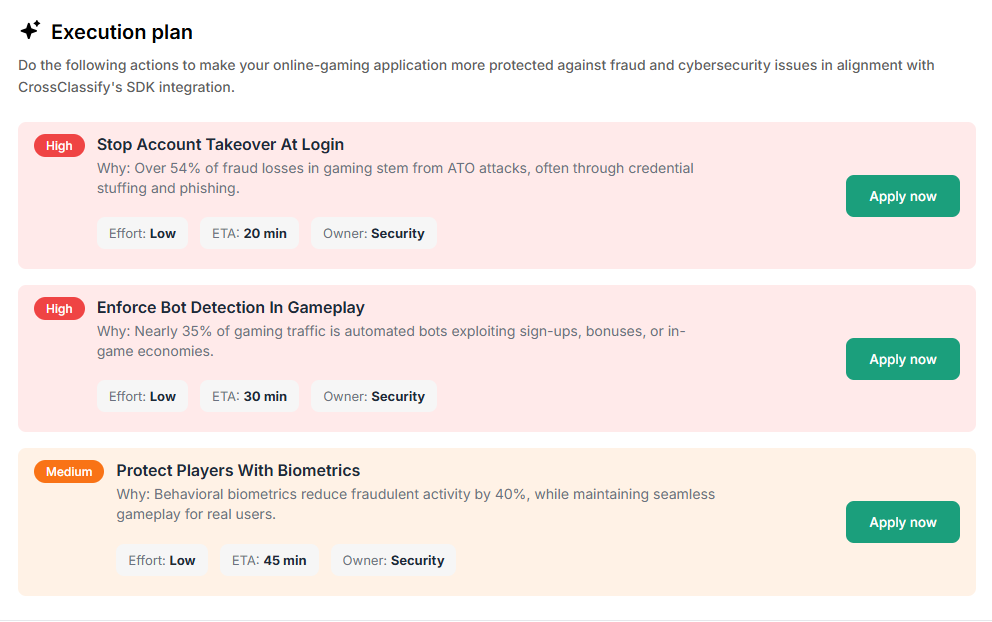

Data Requirements and Integration Process

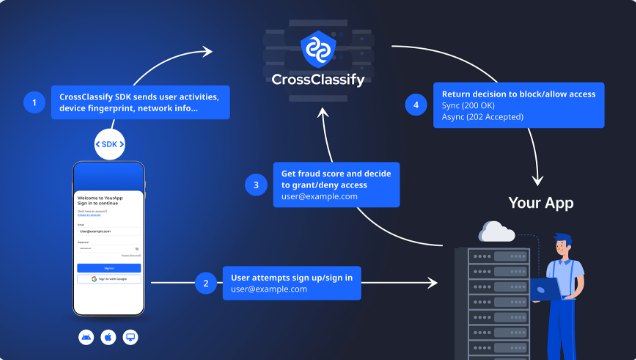

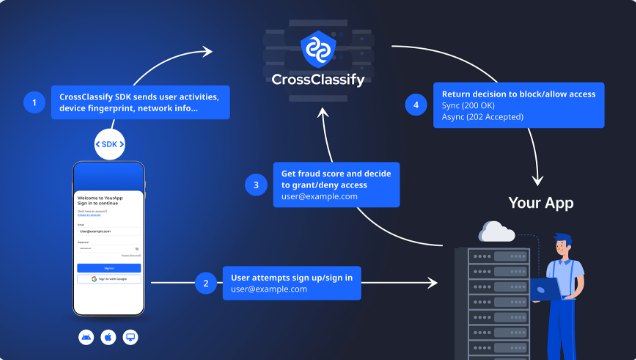

Operators often assume that deploying a new fraud prevention system takes weeks, but CrossClassify's solution is designed to integrate in less than a day. Our SDKs for iOS, Android, Flutter, Web, and APIs allow developers to connect quickly while minimizing operational burden. The only client resources needed are a developer for integration, a backend engineer for API keys, and a product owner to oversee risk thresholds.

The system uses device data, behavioral signals, payment information, and geo-location evidence to deliver accurate fraud decisions. Device fingerprinting reveals suspicious reuse or spoofing, behavioral biometrics distinguish bots from humans, and payment signals identify high-risk instruments. While no historical data is required, providing six months of event logs accelerates calibration and improves accuracy.

Our integration-first design ensures that the platform can work seamlessly with existing KYC, AML, and payment providers. We ingest external provider data via APIs and map the results into unified fraud scores. This reduces integration overhead and ensures operators can retain their preferred vendor stack while benefiting from CrossClassify's intelligence.

For a demonstration of seamless integration, explore https://www.crossclassify.com/integrations/how-it-works/

The system uses device data, behavioral signals, payment information, and geo-location evidence to deliver accurate fraud decisions. Device fingerprinting reveals suspicious reuse or spoofing, behavioral biometrics distinguish bots from humans, and payment signals identify high-risk instruments. While no historical data is required, providing six months of event logs accelerates calibration and improves accuracy.

Our integration-first design ensures that the platform can work seamlessly with existing KYC, AML, and payment providers. We ingest external provider data via APIs and map the results into unified fraud scores. This reduces integration overhead and ensures operators can retain their preferred vendor stack while benefiting from CrossClassify's intelligence.

For a demonstration of seamless integration, explore https://www.crossclassify.com/integrations/how-it-works/

Real-Time Decisioning and Automated Fraud Response

Fraud decisions in online gaming must occur instantly to avoid frustrating genuine players. CrossClassify delivers decisions in 80 to 200 milliseconds, allowing operators to approve, block, or escalate in real time. This ensures seamless onboarding and gameplay experiences while blocking fraud attempts.

Our decisioning engine combines rule-based logic with machine learning. Deterministic rules capture known patterns such as VPN use, impossible travel, and high-velocity transactions, while machine learning adapts to novel behaviors such as synthetic identity creation or automated gameplay. This hybrid approach ensures explainability for regulators and adaptability for operators.

Operators can customize rules, test them in shadow mode, and run A/B simulations before deployment. Automated enforcement can cap withdrawals, freeze promotions, or escalate to analysts when thresholds are crossed. This flexibility ensures both fraud reduction and optimized player experience.

Read more about our hybrid approach to security in our iGaming cybersecurity article.

Our decisioning engine combines rule-based logic with machine learning. Deterministic rules capture known patterns such as VPN use, impossible travel, and high-velocity transactions, while machine learning adapts to novel behaviors such as synthetic identity creation or automated gameplay. This hybrid approach ensures explainability for regulators and adaptability for operators.

Operators can customize rules, test them in shadow mode, and run A/B simulations before deployment. Automated enforcement can cap withdrawals, freeze promotions, or escalate to analysts when thresholds are crossed. This flexibility ensures both fraud reduction and optimized player experience.

Read more about our hybrid approach to security in our iGaming cybersecurity article.

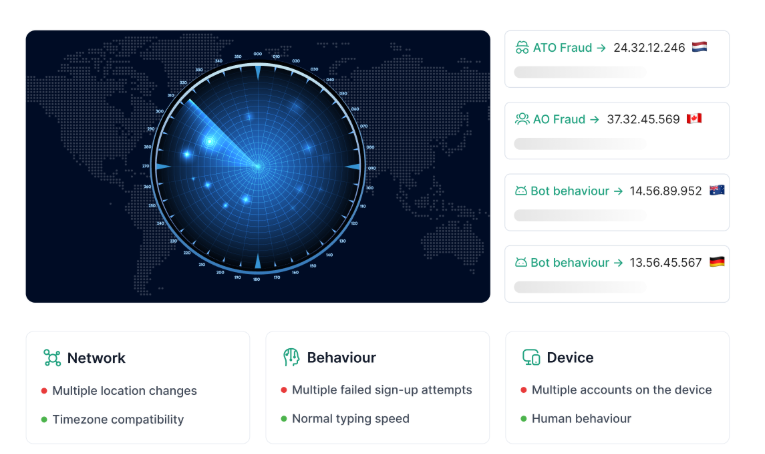

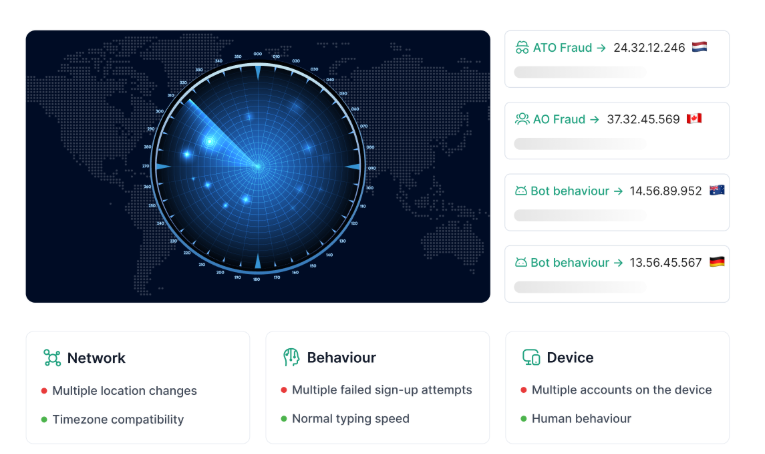

Transparent Reporting and Fraud Dashboards

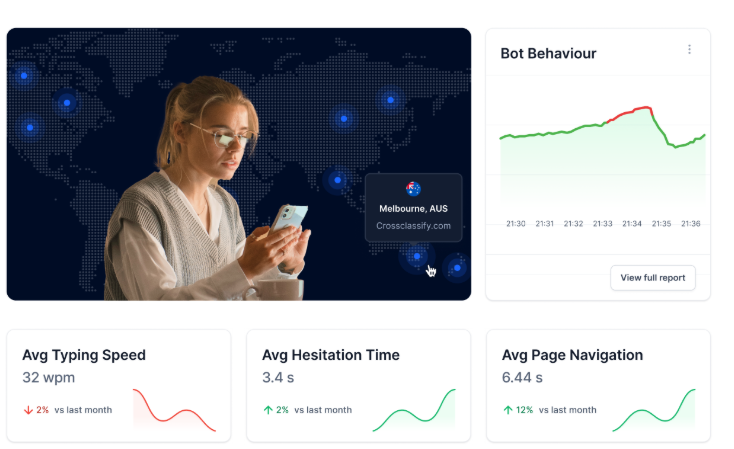

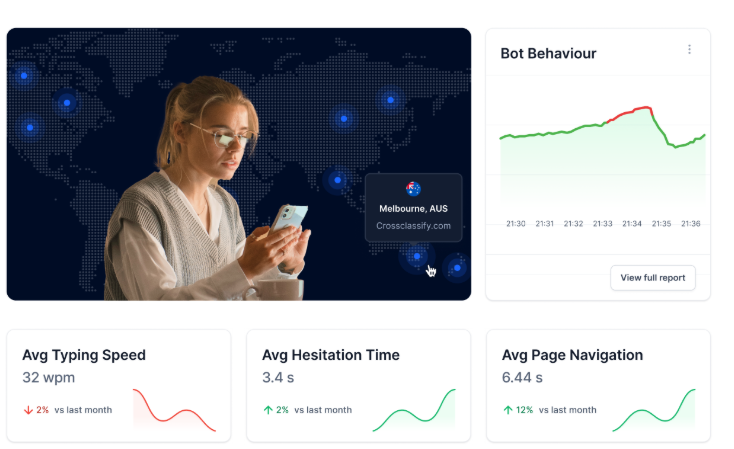

Fraud prevention is not just about detection; it is about visibility. CrossClassify offers dashboards that allow operators to track fraud trends across markets, products, and player cohorts. Each decision is explained through an evidence tray showing device fingerprints, geo anomalies, and behavior analysis.

The system includes advanced features such as geo heatmaps, velocity indicators, and link graphs that uncover fraud rings. Analysts can pivot from a single suspicious transaction to a full view of related accounts, devices, and payment instruments. This level of transparency accelerates investigations and strengthens compliance audits.

Operators can experience these dashboards firsthand through our iGaming demo portal.

The system includes advanced features such as geo heatmaps, velocity indicators, and link graphs that uncover fraud rings. Analysts can pivot from a single suspicious transaction to a full view of related accounts, devices, and payment instruments. This level of transparency accelerates investigations and strengthens compliance audits.

Operators can experience these dashboards firsthand through our iGaming demo portal.

Compliance and Responsible Gaming Alignment

Fraud detection in iGaming must align with regulatory frameworks such as GDPR and local gambling laws. CrossClassify is GDPR-ready, with configurable retention, EU data residency, and strict audit trails. Our explainable AI ensures every decision can be justified to regulators with transparent reasoning.

Equally important is the balance between fraud prevention and responsible gaming. Our system uses granular risk scoring instead of blunt blocking, ensuring genuine players are not unfairly interrupted. We integrate with features such as deposit limits, self-exclusion lists, and time controls, making fraud detection a complement rather than a conflict to responsible gaming.

By ensuring privacy, fairness, and transparency, CrossClassify enables operators to comply with regulations while maintaining trust among both players and regulators.

Equally important is the balance between fraud prevention and responsible gaming. Our system uses granular risk scoring instead of blunt blocking, ensuring genuine players are not unfairly interrupted. We integrate with features such as deposit limits, self-exclusion lists, and time controls, making fraud detection a complement rather than a conflict to responsible gaming.

By ensuring privacy, fairness, and transparency, CrossClassify enables operators to comply with regulations while maintaining trust among both players and regulators.

Operational Support and Analyst Workflows

Fraud teams in online gaming require not just tools but workflows that align with their daily operations. CrossClassify provides an analyst panel that consolidates all evidence in one view, including device history, geo signals, and behavioral patterns. Analysts can trace user journeys from sign-up to withdrawal and make informed decisions quickly.

Case management workflows allow fraud teams to assign roles, set SLAs, and document investigations with notes and attachments. Queues can be segmented by product or market, enabling teams to prioritize the most pressing threats. Export options and API connections support reporting to AML systems and regulators.

Automation further reduces manual workloads. Webhooks connect to Slack or ticketing systems, enabling real-time alerts for spikes in suspicious activity. Threshold-based rules can automatically limit deposits, pause promotions, or trigger manual reviews. This ensures that high-risk scenarios are intercepted without creating unnecessary friction for genuine players.

Explore the full operational toolkit in our iGaming quick-access dashboards.

Case management workflows allow fraud teams to assign roles, set SLAs, and document investigations with notes and attachments. Queues can be segmented by product or market, enabling teams to prioritize the most pressing threats. Export options and API connections support reporting to AML systems and regulators.

Automation further reduces manual workloads. Webhooks connect to Slack or ticketing systems, enabling real-time alerts for spikes in suspicious activity. Threshold-based rules can automatically limit deposits, pause promotions, or trigger manual reviews. This ensures that high-risk scenarios are intercepted without creating unnecessary friction for genuine players.

Explore the full operational toolkit in our iGaming quick-access dashboards.

Addressing Emerging Threats in Online Gaming

The next frontier in iGaming fraud involves AI-driven tactics such as agentic bots, synthetic identities, and deepfake-based KYC fraud. CrossClassify addresses these by combining behavioral biometrics, device intelligence, and adaptive learning.

Behavioral biometrics identify micro-interactions such as keystroke timing and mouse movement curves, which AI struggles to replicate. Device fingerprinting detects emulators, spoofed environments, and anti-detect browsers that are often used to scale synthetic accounts. Link analysis maps fraud rings by correlating accounts, payments, and network traits, revealing the infrastructure behind seemingly unique identities.

Our adaptive machine learning models continuously retrain using supervised feedback from analyst reviews. Shadow testing and canary rollouts ensure new models are safe before full deployment. This enables operators to respond quickly to evolving attack patterns without waiting for static rule updates.

For more on how we adapt to new risks, visit our behavioral biometrics page.

Behavioral biometrics identify micro-interactions such as keystroke timing and mouse movement curves, which AI struggles to replicate. Device fingerprinting detects emulators, spoofed environments, and anti-detect browsers that are often used to scale synthetic accounts. Link analysis maps fraud rings by correlating accounts, payments, and network traits, revealing the infrastructure behind seemingly unique identities.

Our adaptive machine learning models continuously retrain using supervised feedback from analyst reviews. Shadow testing and canary rollouts ensure new models are safe before full deployment. This enables operators to respond quickly to evolving attack patterns without waiting for static rule updates.

For more on how we adapt to new risks, visit our behavioral biometrics page.

Pricing and Contract Flexibility

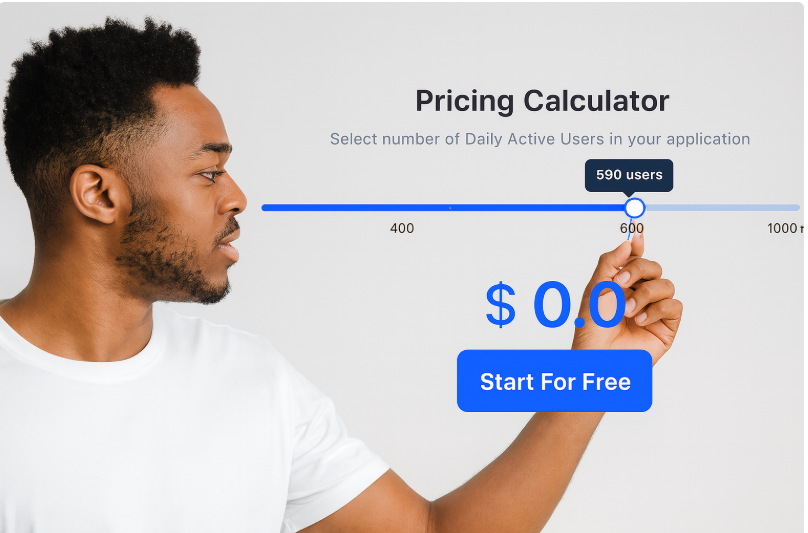

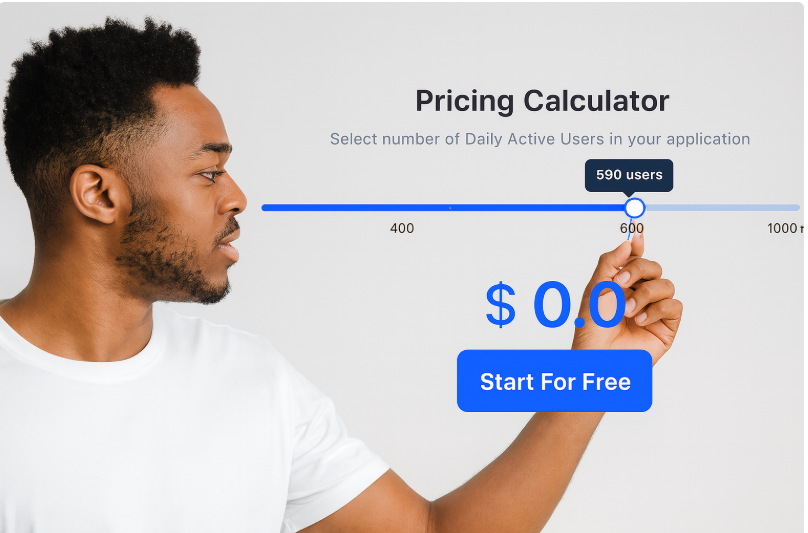

CrossClassify uses a Daily Active User (DAU) pricing model, giving operators predictable costs that scale with activity. We offer a 30-day free trial with no credit card required, along with a 70-day money-back guarantee. This ensures that operators can validate value before making a long-term commitment.

Contracts are flexible, with no minimum period required. Operators can scale usage up or down, change tiers, or cancel at any time. For those seeking proof-of-concept, we offer pilot projects that demonstrate measurable fraud reduction before full deployment.

Learn more about pricing and flexible packages on our https://www.crossclassify.com/pricing/

Contracts are flexible, with no minimum period required. Operators can scale usage up or down, change tiers, or cancel at any time. For those seeking proof-of-concept, we offer pilot projects that demonstrate measurable fraud reduction before full deployment.

Learn more about pricing and flexible packages on our https://www.crossclassify.com/pricing/

Conclusion

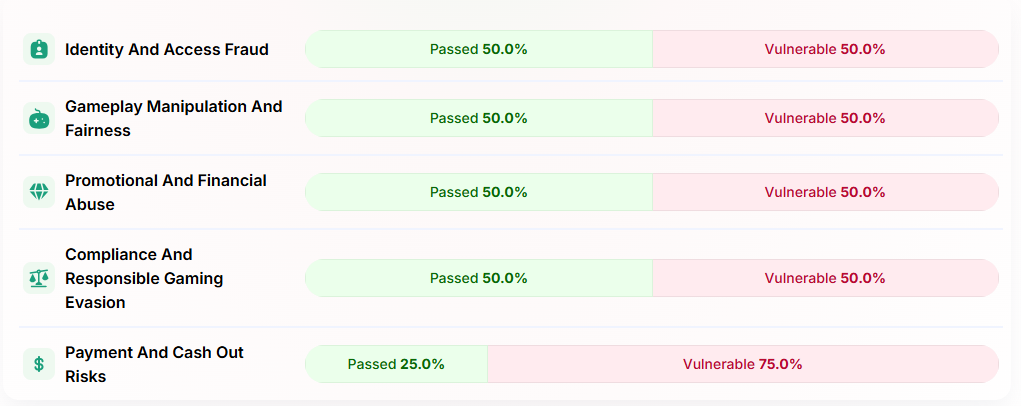

The online gaming industry faces a rapidly evolving fraud landscape, with threats ranging from multi-accounting and bonus abuse to AI-generated identities and account takeover. Operators need solutions that provide real-time detection, transparent reporting, and compliance-ready evidence.

CrossClassify delivers exactly that: an end-to-end fraud prevention platform built for iGaming. By combining behavioral biometrics, device fingerprinting, link analysis, and explainable AI, we help operators cut fraud losses by 30 to 60 percent while protecting the player experience.

Ready to secure your platform? Start with our iGaming quick-access demo and see CrossClassify in action.

CrossClassify delivers exactly that: an end-to-end fraud prevention platform built for iGaming. By combining behavioral biometrics, device fingerprinting, link analysis, and explainable AI, we help operators cut fraud losses by 30 to 60 percent while protecting the player experience.

Ready to secure your platform? Start with our iGaming quick-access demo and see CrossClassify in action.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

The online gaming industry faces several fraud challenges, but the most damaging is multi-accounting combined with bonus abuse. Fraudsters use device farms, VPNs, and identity reuse to register multiple accounts and drain promotional campaigns. This is often paired with account takeover attacks where stolen credentials allow unauthorized access to genuine accounts. CrossClassify helps operators fight these issues with iGaming-specific fraud prevention solutions that combine behavioral biometrics, device fingerprinting, and continuous monitoring.

Account takeover is one of the fastest-growing threats in iGaming. CrossClassify uses real-time behavioral biometrics and device fingerprinting to detect suspicious logins, credential stuffing attempts, and emulator-based attacks. Our hybrid system blocks malicious access instantly while maintaining a seamless experience for genuine players. Learn more in our resource on the anatomy of account takeover.

Yes. Bots are increasingly used to flood registration funnels, claim bonuses, or perform automated gameplay. CrossClassify identifies these attacks through behavior analysis that evaluates typing patterns, mouse movements, and timing rhythms. Automated scripts struggle to mimic natural human variability, allowing our system to flag bots in real time and stop fraudulent account creation before it impacts the business.

Integration is fast and painless. Most operators complete setup in less than a day using our SDKs for iOS, Android, Flutter, and Web, along with backend APIs. CrossClassify is built to require minimal client resources and fits easily into sign-up, login, deposit, and promotional flows. You can explore the integration experience in our iGaming quick-access demo.

CrossClassify is fully GDPR-ready with features such as data minimization, configurable retention policies, and audit logs. We align fraud controls with responsible gaming requirements including self-exclusion, deposit limits, and affordability checks. Our explainable AI ensures regulators can see clear evidence for each fraud decision. More details are available in our article on iGaming cybersecurity.

Yes. CrossClassify is API-first and integrates seamlessly with KYC and AML providers, payment gateways, and internal systems. We can ingest provider events, enrich risk scores, and send unified fraud decisions back to your application without disrupting your existing vendor stack.

Many fraud solutions block legitimate players, hurting revenue and trust. CrossClassify reduces false positives through a hybrid approach that blends deterministic rules with adaptive machine learning. Device fingerprinting, behavior biometrics, and link analysis provide context, ensuring that suspicious activity is accurately distinguished from normal play.

Operators typically see a 30–60% reduction in fraud losses within the first 3–6 months of deployment. ROI is achieved through fewer chargebacks, reduced bonus abuse, lower manual review costs, and better compliance alignment. These savings directly improve operator profitability while protecting long-term player trust.

Fraudsters are increasingly using synthetic identities and AI-generated content to bypass onboarding. CrossClassify counters this with cross-signal validation that compares document data, device intelligence, and behavioral patterns for consistency. AI-generated content may look real in isolation but fails under holistic validation. Our models are also continuously retrained to adapt to new fraud tactics.

CrossClassify uses a transparent Daily Active User (DAU) pricing model. Operators can start with a 30-day free trial and benefit from a 70-day money-back guarantee. There are no long-term commitments, and plans can scale up or down based on operator activity. Full details are available on the iGaming solutions page.

Yes. Fraud prevention and responsible gaming must work hand in hand. CrossClassify integrates with tools that enforce session monitoring, deposit caps, and self-exclusion workflows. This ensures fraud detection aligns with player protection obligations rather than conflicting with them.

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required