Cybersecurity for Accounting

Prevent fraud in accounting systems with confidence

Robust monitoring and risk scoring tailored for accountants.

Stats on Accounting breaches

$13B

Fraud Losses in UK

Fraud losses in UK doubled in recent years, driven by accounting scams (The Guardian).

65%

Insider Fraud Cases

75% of fraud cases in accounting are committed by insiders exploiting access.

$0M

Average Regulatory Fine

$8 million average fine for regulatory breaches linked to accounting fraud.

Why Accounting Data Security Matters

Client trust rides on ledgers

Sensitive SLs, tax files, payroll, and PII make accounting systems prime targets. One breach can trigger client churn, audit scrutiny, and loss of license. CrossClassify protects portals, vendor onboarding, and workflows with continuous risk scoring.

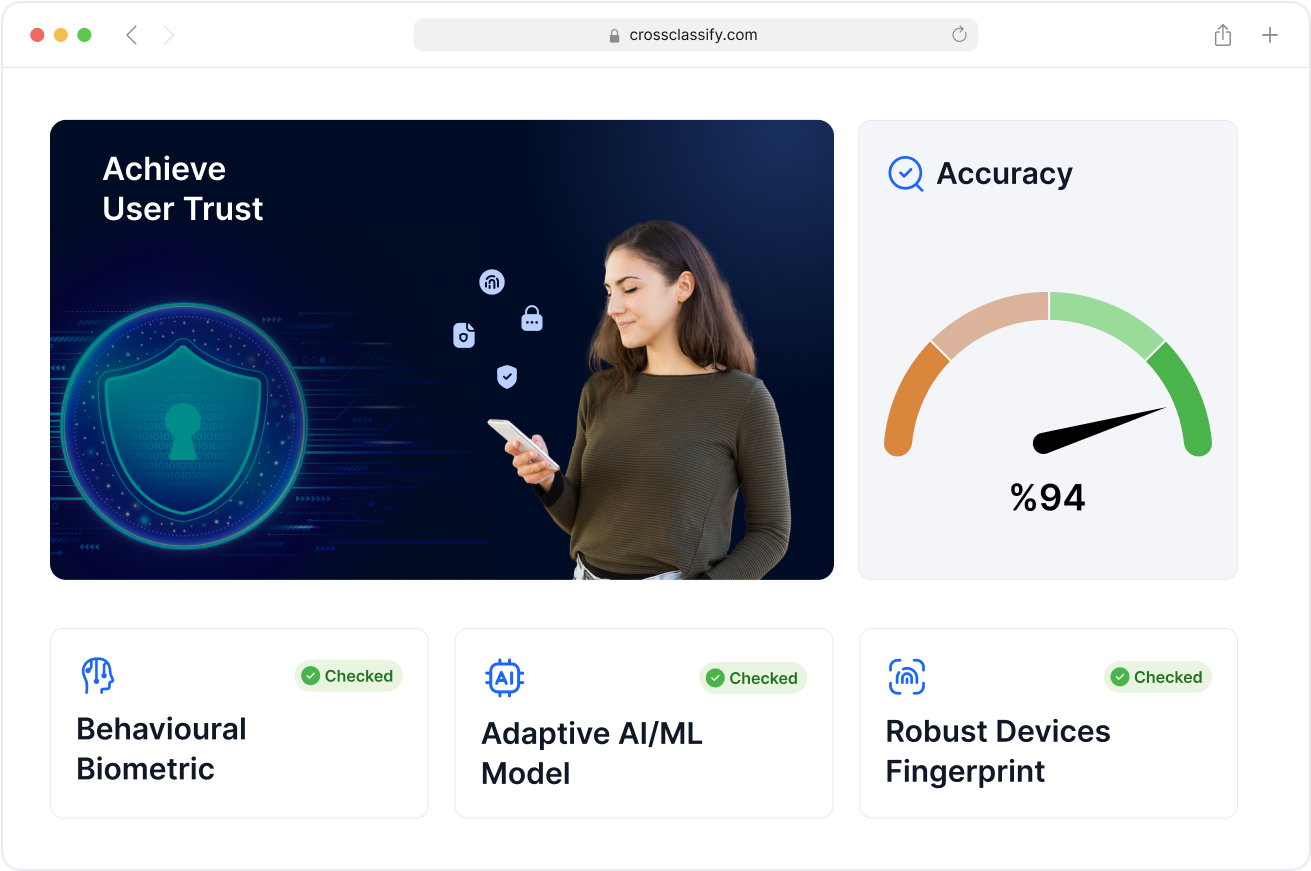

Account takeover hits portals first

Credential stuffing and phishing target accountant and client logins, then pivot to bank-detail changes and invoice fraud. We combine device fingerprinting, behavioral biometrics, and geo-velocity checks to stop ATO attacks early.

Invoice & vendor fraud drains margins

Shell vendors, fake invoices, and manipulated approvals bypass static rules. Our link analysis maps relationships across vendors, devices, sessions, and payments to uncover fraudulent rings early.

Insider threats evade perimeter tools

Privilege misuse, overrides, and after-hours edits seldom trigger legacy alerts. CrossClassify flags anomalous posting patterns, segregation-of-duties breaks, and risky sessions in real time.

Regulated and audit-ready

SOX/PCAOB scrutiny, GDPR data-minimization, and evidence trails demand fine-grained telemetry. We preserve audit artifacts and reduce false positives so finance teams stay efficient and compliant.

Bots exploit APIs and login flows

Automated traffic probes password reuse, pricing, and invoice endpoints. We throttle suspicious automation without hurting trusted accountants or clients.

Blog

Latest from Cross Classify

Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

Secure Accounting Portals Against Hijacks

Reduces account takeover in accounting platforms by up to 80% with device fingerprinting, behavioral biometrics, and adaptive trust scoring, while ensuring compliance with SOX, PCAOB, and audit integrity requirements.

62%

of accounting firms report rising ATO costs year-over-year

31%

of breaches in the accounting and finance sector involve stolen credentials.

How We Prevent Account Takeover

Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

Learn More ❯Continuous Monitoring for Accounting Systems

Monitor every payroll entry, vendor creation, and bank-detail modification in real time. This ensures fraudulent journal entries, like false expenses, duplicate vendors, or unauthorized overrides, are flagged before a ledger closes financial statements. Continuous oversight helps accounting firms maintain accuracy and compliance while reducing audit risks.

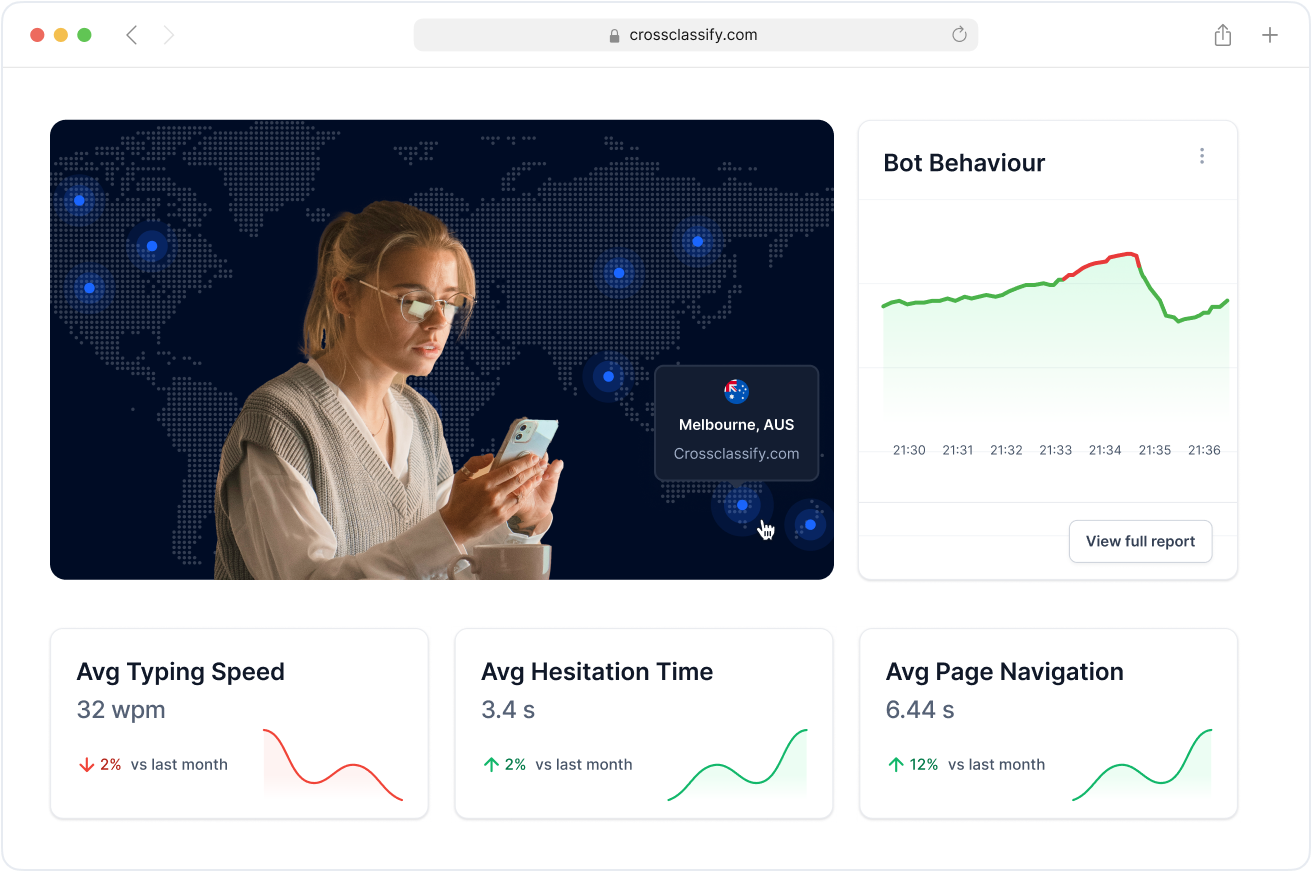

Behavior Analysis for Accountants and Clients

Analyze the way accountants and clients interact with ledgers and portals to detect unusual workflows, such as rapid vendor setup followed by immediate high-value payments. By learning normal behavior patterns, the system reduces false positives while surfacing genuine fraud attempts, making forensic accounting and fraud examination more efficient.

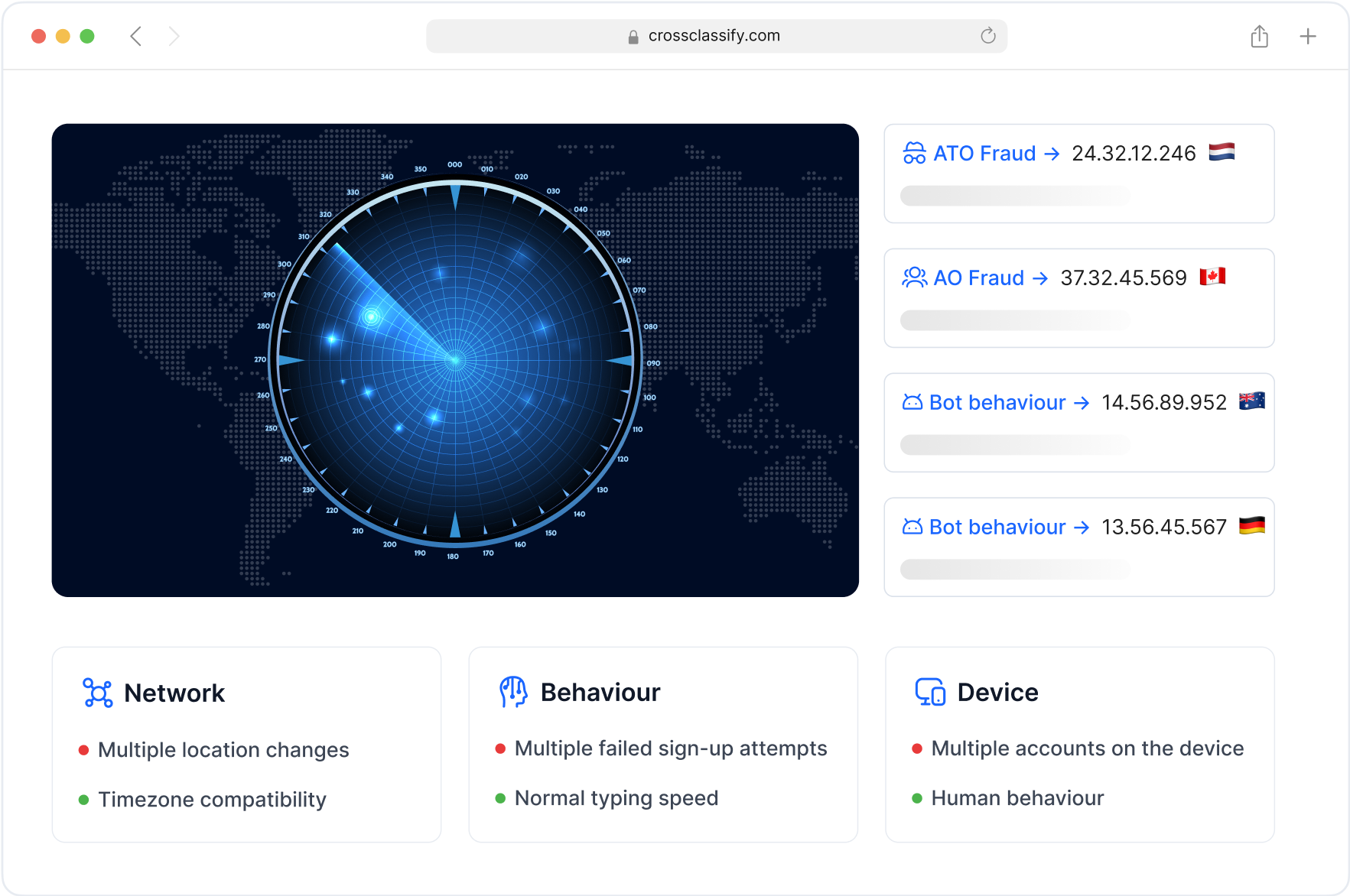

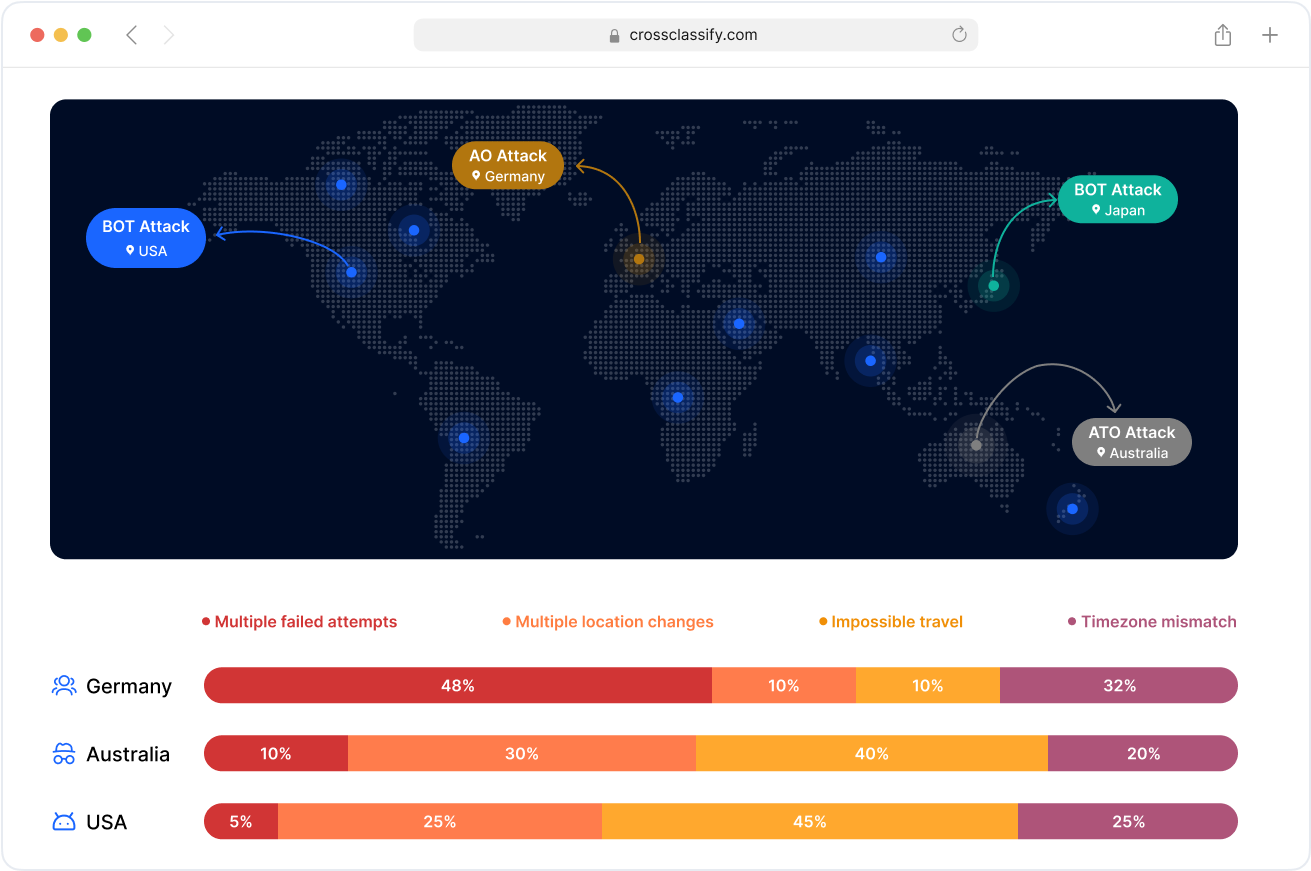

Geo Analysis in Accounting Platforms

Identify improbable logins to accounting software, such as access from TOR networks, VPNs, or countries unrelated to your operations. This helps prevent account takeover fraud by introducing step-up verification only when necessary, protecting accountants and clients without adding unnecessary friction to legitimate sessions.

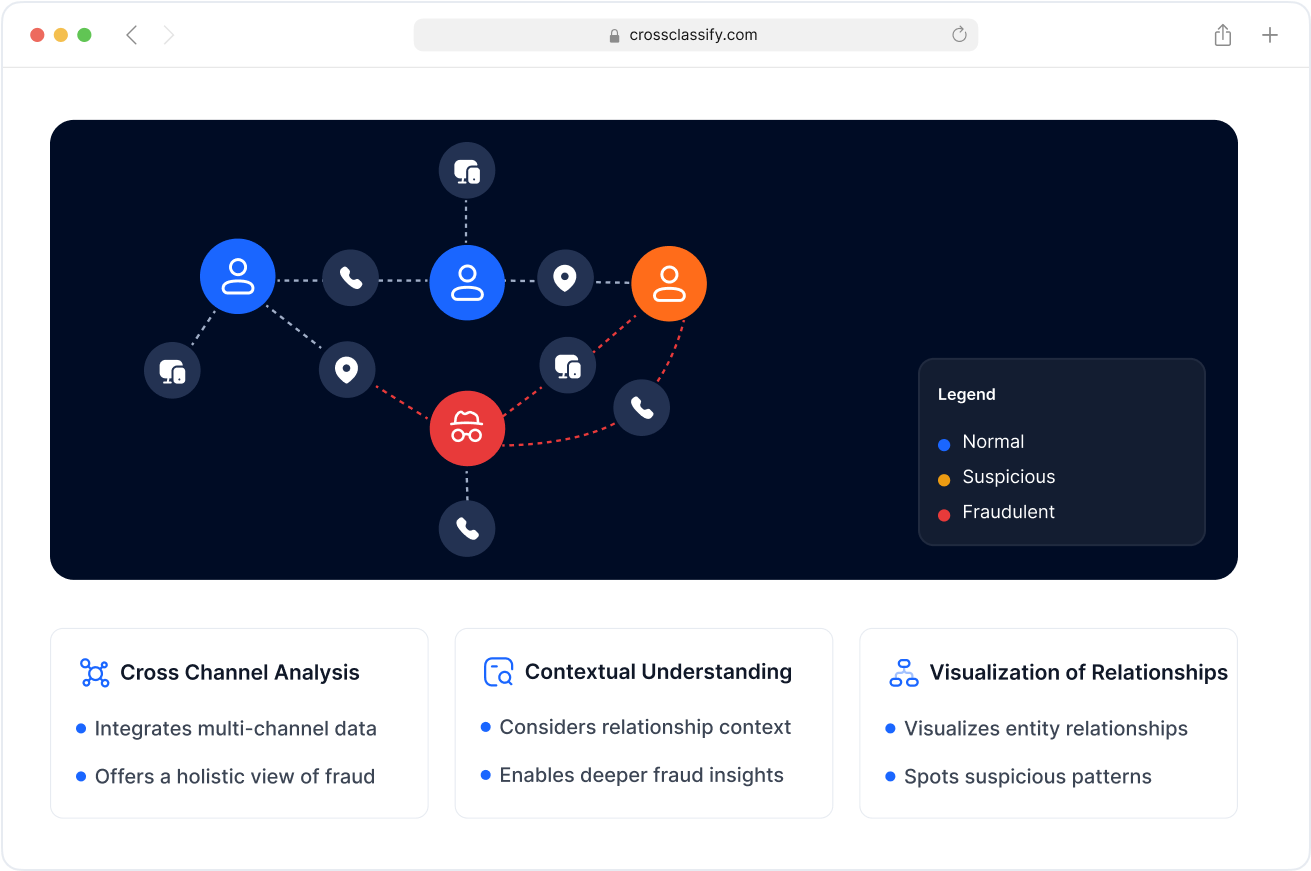

Link Analysis Across Vendors and Clients

Connect devices, emails, bank accounts, and invoice details to reveal hidden fraud rings or collusive vendor networks. By exposing relationships that static audits can’t detect, firms can prevent shell vendors, duplicate payments, and false accounting entries that undermine financial accuracy.

Enhanced Security and Accuracy

Calibrate fraud detection specifically for accounting workflows, including journal overrides, duplicate invoices, false revenue recognition, or late-night posting activity. This targeted accuracy ensures firms meet regulatory standards like SOX and PCAOB while avoiding costly errors and misstatements.

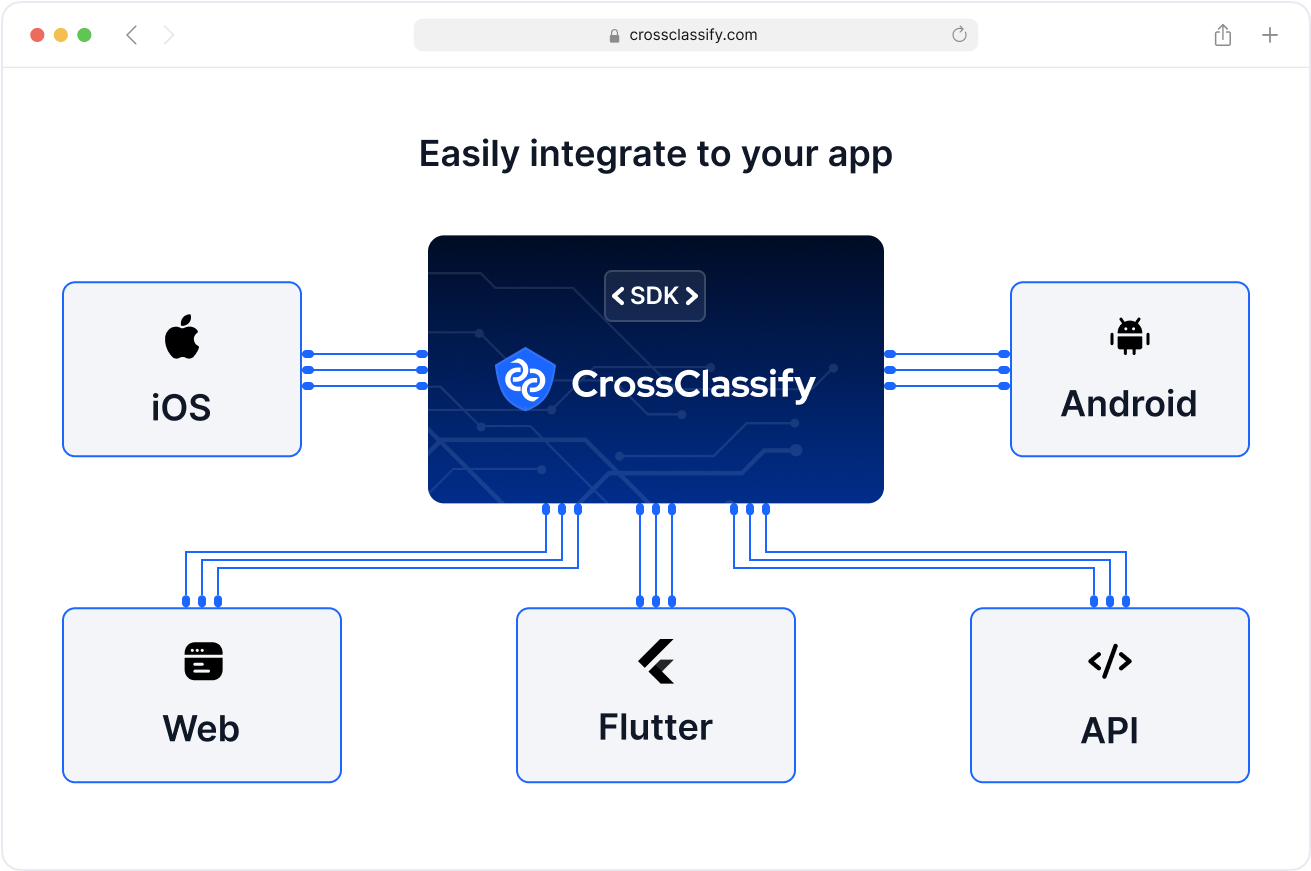

Seamless Integration with Accounting ERPs

Deploy CrossClassify into accounting systems like QuickBooks, Xero, NetSuite, SAP, or custom ERPs without disrupting operations. Native API and plug-in integrations streamline fraud detection into existing workflows, ensuring compliance and monitoring happen in the background without slowing daily accounting tasks.

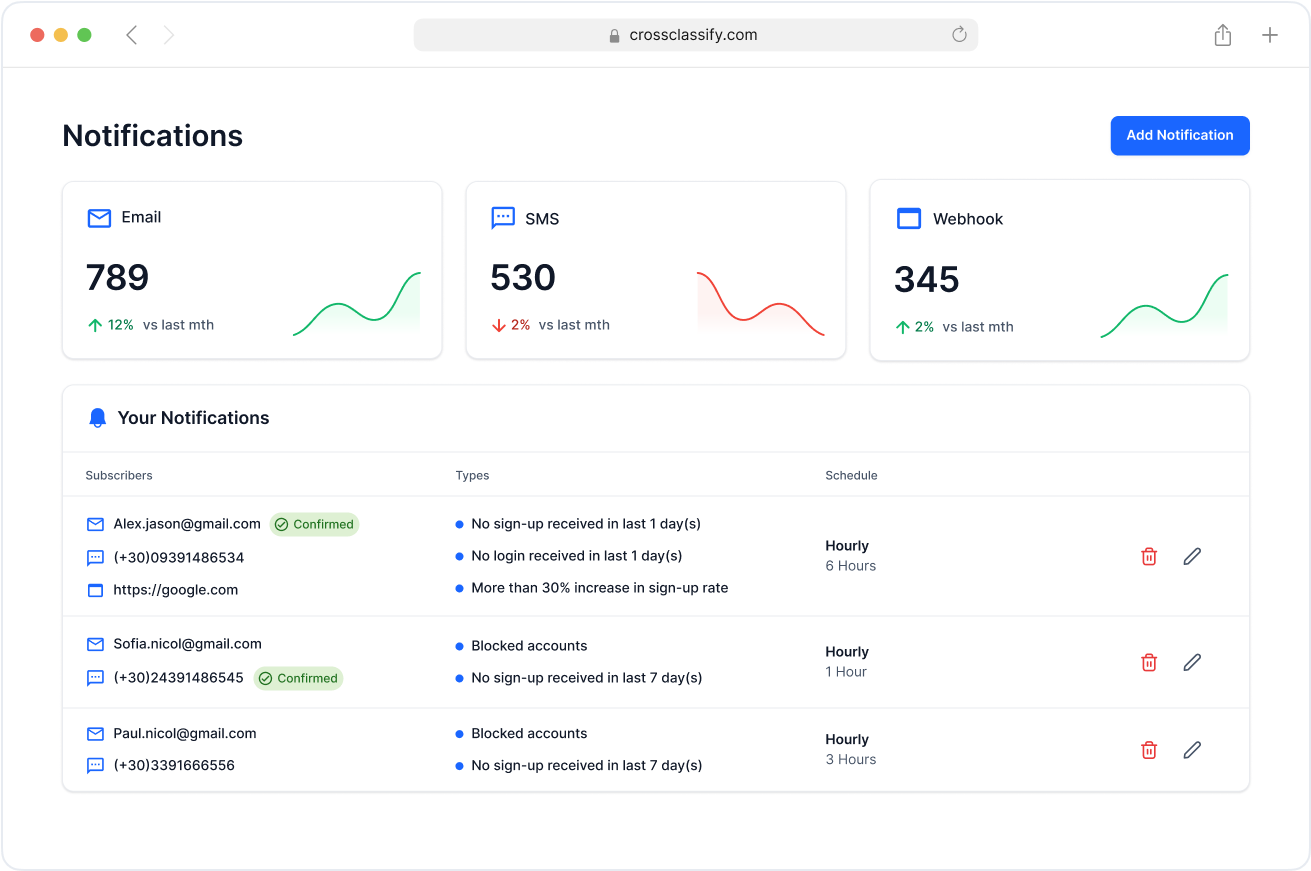

Alerting and Notification for Accounting Teams

Deliver instant alerts to controllers, auditors, and finance managers when suspicious activity is detected—such as vendor detail changes, journal overrides, or login anomalies. Real-time notifications ensure faster investigation and fraud containment, protecting accounting firms from escalating losses.

Compliance

Accounting Fraud and Compliance Standards

Sarbanes-Oxley Act (SOX)

Requires accurate financial reporting and internal controls to detect fraud

Case: HealthSouth fined $445M for accounting fraud violations.

GDPR (General Data Protection Regulation)

Governs data security for accounting firms handling EU client data

Case: Deloitte fined €425K in 2023 for GDPR breaches.

PCAOB Standards

Enforce fraud detection responsibilities for accounting auditors

Case: KPMG fined $25M in 2023 for audit failures in fraud detection.

FCPA (Foreign Corrupt Practices Act)

Prevents accounting fraud linked to bribery and false entries

Case: Ernst & Young fined $100M in 2024 for FCPA-related violations.

Fraud-Resistant Accounting Workflows

CrossClassify is purpose-built to secure accounting processes, payables, receivables, audits, and ledger entries, against fraud and manipulation.

Accounting Compliance Assurance

We support Sarbanes-Oxley (SOX), PCAOB standards, GDPR, and other accounting regulations, helping firms maintain compliance and avoid costly penalties.

AI-Driven Forensic Accuracy

Our behavioral AI detects anomalies in accounting records with precision, reducing false positives and safeguarding financial statement integrity.

Real-Time Accounting Fraud Prevention

Instead of discovering fraud after audits, CrossClassify stops suspicious journal entries, vendor fraud, and payroll manipulation in real time.

Specialized Accounting Fraud Expertise

Unlike generic cybersecurity tools, CrossClassify is tailored for forensic accounting fraud detection, ensuring protection against industry-specific threats.

Frequently asked questions

Let's Get Started

Elevate your accounting firm's security with CrossClassify. Schedule a personalized demo to see how we protect client data and ensure compliance with industry standards.