Last Updated on 07 Oct 2025

Freight Industry Fraud: Risks, Impacts, and Prevention Strategies

Share in

Key Notes

•

Rising fraud costs. The freight industry faces billions in annual losses, with single incidents costing over $200,000 due to cargo theft, payment fraud, and reputational damage.•

Third-party vulnerabilities. The complex network of brokers, carriers, and shippers amplifies risks, with 22% of brokers reporting losses exceeding $200,000 in 2025 from fraudulent carriers.•

AI-driven solutions. Platforms like Overhaul’s FraudWatch and CrossClassify’s AI-driven detection reduce fraud by flagging anomalies pre-shipment.

Introduction: Scope, Significance, and Economic Importance of the Freight Industry

The freight industry is the backbone of global and domestic supply chains, moving goods via trucks, rails, ships, and air to connect producers with consumers. From raw materials to finished products, it ensures businesses thrive and essential items reach markets. In 2025, despite challenges like tariffs and a freight recession, the freight industry remains critical. The U.S. trucking sector supports millions of jobs and contributes significantly to GDP, with projections showing gradual recovery fueled by industrial activity and consumer demand (American Trucking Associations).

Economically, the freight industry is a powerhouse, accounting for a substantial share of logistics spending. Recent insights note that, despite slowdowns in global air cargo and trucking capacity reductions, the sector is rebounding (Transport Topics). The U.S. Bureau of Economic Analysis projects steady growth in goods transport, with annual increases around 3.5% through 2026, reinforcing its role in economic stability. This resilience supports industries like manufacturing, retail, and agriculture, where disruptions can ripple, impacting employment and trade balances.

Economically, the freight industry is a powerhouse, accounting for a substantial share of logistics spending. Recent insights note that, despite slowdowns in global air cargo and trucking capacity reductions, the sector is rebounding (Transport Topics). The U.S. Bureau of Economic Analysis projects steady growth in goods transport, with annual increases around 3.5% through 2026, reinforcing its role in economic stability. This resilience supports industries like manufacturing, retail, and agriculture, where disruptions can ripple, impacting employment and trade balances.

Business Structure of Freight: Roles of Carriers and Brokers

The freight industry operates through a network of interconnected players, with carriers and brokers at its core. Carriers own or lease equipment trucks, trains, or vessels to physically transport goods, handling pickup, transit, and delivery, often specializing in specific routes. Brokers, acting as intermediaries without owning assets, connect shippers (businesses needing cargo moved) with carriers, negotiating rates, ensuring compliance, and managing documentation (Transportation Intermediaries Association).

Carriers and brokers interact symbiotically yet complexly. Brokers vet carriers based on insurance, safety ratings from the Federal Motor Carrier Safety Administration (FMCSA), and performance history, building extensive networks. Carriers rely on brokers for consistent loads, especially in volatile markets. For example, a manufacturer shipping produce from California to New York contacts a broker, who matches the load with a vetted carrier via load boards or software, handles contracts, and tracks progress. Strong relationships ensure reliability: brokersprioritize trusted carriers, while carriers leverage brokers’market insights to optimize routes and avoid empty hauls (FreightWaves). This structure boosts efficiency but introduces dependencies that fraudsters exploit.

Carriers and brokers interact symbiotically yet complexly. Brokers vet carriers based on insurance, safety ratings from the Federal Motor Carrier Safety Administration (FMCSA), and performance history, building extensive networks. Carriers rely on brokers for consistent loads, especially in volatile markets. For example, a manufacturer shipping produce from California to New York contacts a broker, who matches the load with a vetted carrier via load boards or software, handles contracts, and tracks progress. Strong relationships ensure reliability: brokersprioritize trusted carriers, while carriers leverage brokers’market insights to optimize routes and avoid empty hauls (FreightWaves). This structure boosts efficiency but introduces dependencies that fraudsters exploit.

Risks and Common Frauds in the Freight Industry

The freight industry faces escalating risks in 2025, driven by its reliance on rapid, trust-based transactions and digital platforms. Criminals exploit these vulnerabilities through sophisticated schemes like email scams, payment fraud, billing fraud, cargo theft, and identity theft, disrupting operations and causing substantial financial losses. Below are the primary fraud types, with examples illustrating their execution and impact.

- Email Scams and Phishing: Fraudsters impersonate brokers, carriers, or shippers via spoofed emails to steal sensitive information or redirect funds. For instance, a scammer might mimic a broker’s email domain, instructing a carrier to reroute a load to a fraudulent destination, resulting in cargo theft. Another tactic involves fake invoices with altered payment details, tricking shippers into wiring funds to illegitimate accounts. In 2025, AI-driven phishing emails have become harder to detect, mimicking legitimate styles (CrossClassify: Defending the Freight Industry).

- Payment Fraud: Criminals use stolen or fabricated identities to pose as carriers, booking loads and requesting upfront payments like fuel advances before disappearing. A hypothetical example: a fraudster registers a fake carrier profile on a load board, secures a high-value load, and demands a $2,000 advance, only to vanish, leaving the broker liable (Overhaul).

- Billing Fraud: This includes inflated invoices, double-billing, or charging for unrendered services. For example, a dishonest broker might bill a shipper twice for the same load by creating duplicate invoices or claim fees for fictitious services like “expedited handling.” Double-brokering subcontracting loads without disclosure complicates matters, causing delays and disputes (FreightWaves).

- Cargo Theft and Hijacking: Organized groups target high-value loads, such as electronics or pharmaceuticals, using stolen carrier credentials or insider information. In 2025, a notable case involved a fraudulent entity holding over 36 loads hostage, demanding ransom from brokers, resulting in millions in losses (FreightWaves). Such schemes often involve falsified Bills of Lading or GPS spoofing.

- Identity Theft and MC Number Fraud: Fraudsters steal or purchase Motor Carrier (MC) numbers to impersonate legitimate carriers, securing loads before absconding. Sold MC numbers bypass carrier vetting, leading to cargo theft. “Ghost carriers,” entities existing only on paper, facilitate fraud (FMCSA: Fraud Prevention).

- Freight Forwarder Scams: Fraudulent forwarders pose as intermediaries, collecting payments without arranging transport. In 2025, such scams have surged on digital platforms with lax verification (Transport Topics).

The Significant Impact of Frauds in the Freight Industry

Freight frauds have profound repercussions, amplified by the freight industry’svast third-party networks. A single incident can cost over $200,000, with industry-wide losses reaching billions annually (Overhaul). The ecosystem’s complexity shippers relying on brokers, who vet carriers creates vulnerabilities. Weak links, like sold MC numbers or impersonated identities, trigger cascading failures.

For example, fraudulent carriers using stolen credentials secure loads and disappear, leaving brokers liable and eroding trust. In 2025, 22% of brokers reported losses over $200,000 in six months, raising insurance premiums and damaging reputations (FreightWaves). A mid-sized retailer facing a hijacked shipment might delay inventory, lose sales, and face legal claims, showing how fraud disrupts the supply chain. Fraud also increases operational costs, as companies invest in recovery, legal battles, and security, straining margins (Transport Topics).

For example, fraudulent carriers using stolen credentials secure loads and disappear, leaving brokers liable and eroding trust. In 2025, 22% of brokers reported losses over $200,000 in six months, raising insurance premiums and damaging reputations (FreightWaves). A mid-sized retailer facing a hijacked shipment might delay inventory, lose sales, and face legal claims, showing how fraud disrupts the supply chain. Fraud also increases operational costs, as companies invest in recovery, legal battles, and security, straining margins (Transport Topics).

Exploitation of Email and Digital Channels in Freight Scams

Email scams are prime vectors in the freight industry due to its reliance on rapid, remote communication. Fraudsters hack inboxes or spoof domains to impersonate stakeholders, requesting payment changes or load diversions (CrossClassify: Defending the Freight Industry). In 2025, AI-driven attacks have intensified, producing realistic email forgeries and spoofed GPS data to mimic legitimate movements (FreightWaves).

A typical scenario involves a scammer posing as a carrier, claiming a breakdown and requesting fuel advances, then disappearing. Load boards host fake profiles that enable payment fraud (Transport Topics). Cybersecurity breaches at major firms expose data for exploitation, compounding risks in an industry driven by quick decisions. Real-time fraud prevention tools, like those on CrossClassify’s Freight Quick-Access Dashboard, can identify these threats early.

A typical scenario involves a scammer posing as a carrier, claiming a breakdown and requesting fuel advances, then disappearing. Load boards host fake profiles that enable payment fraud (Transport Topics). Cybersecurity breaches at major firms expose data for exploitation, compounding risks in an industry driven by quick decisions. Real-time fraud prevention tools, like those on CrossClassify’s Freight Quick-Access Dashboard, can identify these threats early.

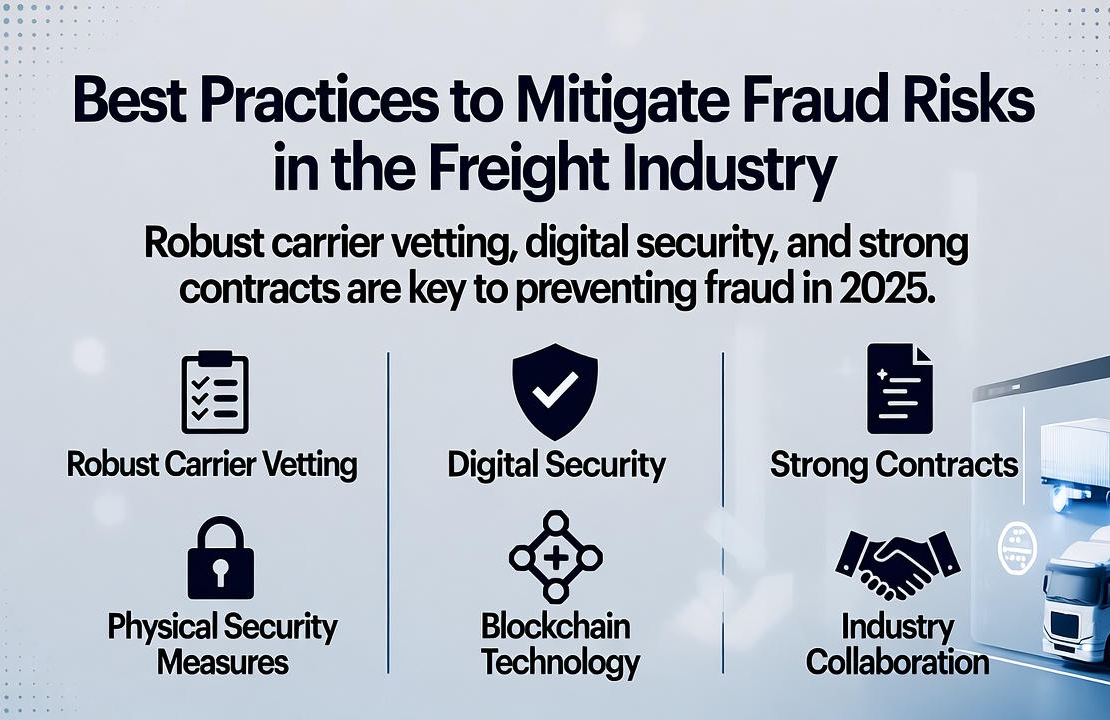

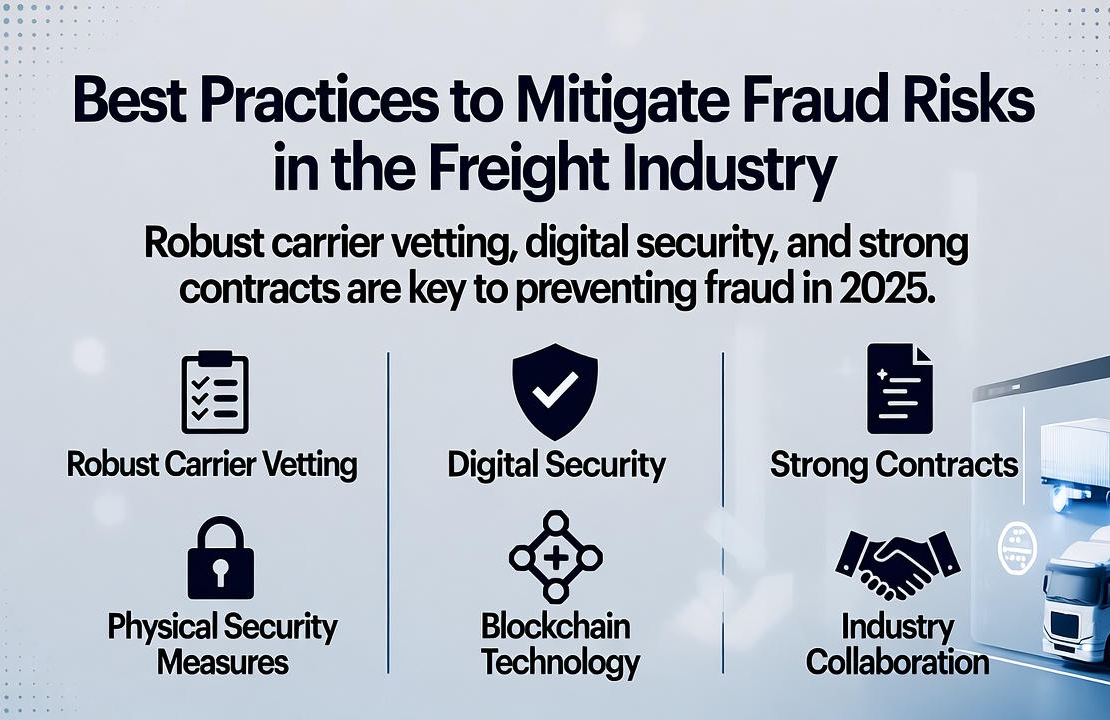

Best Practices and Strategies to Mitigate Fraud Risks

To counter fraud, freight industry companies adopt proactive strategies combining technology and diligence:

- Robust Carrier Vetting: Verify MC numbers, insurance, and references via FMCSA databases and real-time monitoring tools (FMCSA).

- Digital Security: Implement multi-factor authentication for emails and use AI-driven detection platforms like Overhaul’s FraudWatch to flag anomalies before shipment

- Strong Contracts: Include penalties for non-compliance and diversify vendors to reduce dependency

- Physical Measures: Use trailer locks and ID checks to complement digital defenses

- Blockchain and Traceability: Adopt blockchain for transaction verification, reducing cargo theft by enhancing traceability

- Industry Collaboration: Engage with groups like the Transportation Intermediaries Association to report fraud to WatchDog systems and promote education (TIA).

Conclusion

The freight industry drives economic growth but faces escalating fraud risks due to its complex, trust-based ecosystem. Email scams, payment fraud, billing fraud, and cargo theft exploit digital channels and third-party networks, causing significant financial and operational damage. By adopting robust carrier vetting, advanced technologies like AI-driven detection and blockchain, and strong collaboration, companies can mitigate these threats. These strategies safeguard operations, maintain trust, and ensure the industry’s resilience in 2025 and beyond.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

The industry’s reliance on rapid transactions, extensive third-party networks, and digital communication creates vulnerabilities that fraudsters exploit, requiring robust carrier vetting and real-time monitoring (CrossClassify for Freight).

Verifying MC numbers, insurance, and performance history through FMCSA databases ensures only legitimate carriers are engaged, reducing risks of identity theft and cargo theft (FMCSA).

Email is a primary tool for quick coordination, but spoofed domains and phishing attacks exploit this trust, often bypassing basic security (Defending the Freight Industry).

Platforms like CrossClassify analyze behavioral and transactional anomalies in real time, flagging suspicious activities before losses occur (Freight Quick-Access Dashboard).

Double-brokering occurs when a broker subcontracts a load without disclosure, leading to delays, disputes, and potential fraud, as shippers lose visibility (FreightWaves).

Real-time monitoring and carrier vetting tools can reduce fraud incidents within weeks, while blockchain and AI-driven detection platforms offer long-term ROI by minimizing losses (CrossClassify for Freight).

Trailer locks, GPS trackers, and ID checks add layers of security, deterring cargo theftalongside digital safeguards (Transport Topics).

Groups like the Transportation Intermediaries Association enable fraud reporting and education, fostering a collective defense against common schemes (TIA WatchDog).

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required