Last Updated on 03 Sept 2025

Fraud Prevention and Cybersecurity Solutions for the Accounting Industry

Share in

Key Notes

•

Over $5.14 billion in accounting fraud losses reported globally in recent years, with rising detection challenges.•

70% of fraud cases involve manipulation of financial statements.•

Companies using advanced fraud detection cut fraud losses by up to 60%.

Introduction to the Accounting Industry

The accounting industry underpins global business, ensuring financial transparency and compliance. It involves firms, auditors, forensic specialists, and technology providers managing records, audits, and fraud detection. With digital transformation, accounting has shifted from paper-based ledgers to cloud-based systems, opening both opportunities and new fraud risks. According to Zoho, fraud in accounting remains one of the most costly challenges across industries, often impacting investor confidence and regulatory trust. Accounting professionals must now blend traditional skills with advanced technologies to prevent fraud.

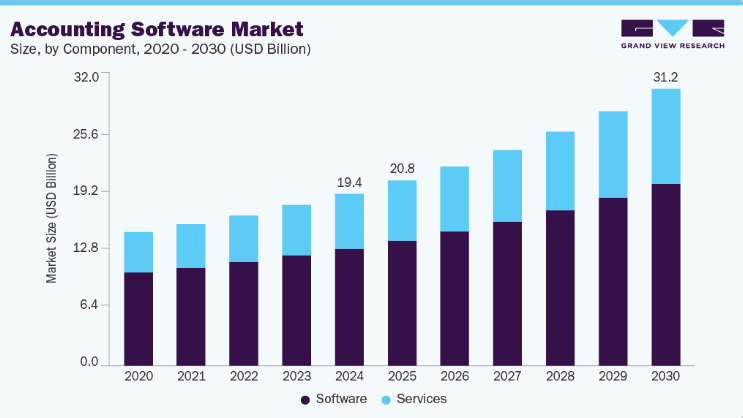

Market Size of the Accounting Industry

The accounting services market surpassed $600 billion globally in 2023, with consistent annual growth driven by compliance, digital tools, and outsourcing (source). Millions of accountants and auditors operate worldwide, supported by thousands of firms specializing in tax, audit, and forensic accounting. Cloud accounting adoption has accelerated, with over 70% of small and medium firms now using cloud solutions, significantly expanding the potential attack surface. This growth makes the sector both indispensable and increasingly vulnerable to cybersecurity and fraud attacks.

The Massive Scope of Fraud in the Accounting Industry

Fraud in the accounting profession represents a staggering financial burden, costing organizations billions of dollars annually and eroding trust in financial systems worldwide.

Eye-Opening Statistics

- A landmark global study by the Association of Certified Fraud Examiners (ACFE) analyzed 1,921 real-world fraud cases across 138 countries between January 2022 and September 2023, revealing a total loss of $3.1 billion ACFE.

- On average, organizations lose about 5% of their annual revenue to occupational fraud, a conservative estimate that excludes indirect costs like reputational damage and productivity loss.

- Extending that 5% to the global economy, these fraud losses amount to over $5 trillion each year Wikipedia.

- While asset misappropriation schemes account for the majority of fraud incidents (about 89% of cases), the median per-case loss remains significant at $120,000, and up 20% year-over-year Wikipedia.

- Financial statement fraud, though less frequent (only about 5% of occupational fraud cases), inflicts far greater damage—median losses per case soared to $766,000, marking a 29% increase from 2022 Wikipedia.

Historic Scandals, A Stark Reminder

Corporate collapses like Enron, WorldCom, and others offer powerful testimony to the destructive potential of accounting fraud:

- WorldCom overstated its assets by roughly $11 billion and falsely declared profits of about $3.8 billion, leading to its bankruptcy in 2002 Wikipedia.

- Enron’s deceptive practices including off-balance-sheet entities and misuse of mark-to-market accounting, ultimately led to one of the largest bankruptcies in U.S. history. Shareholders lost an estimated $40–45 billion, and total hits reached nearly $74 billion in stock value decline Wikipedia.

Why the Scale of Fraud Continues to Grow

Several factors contribute to the alarming scale and persistence of fraud:

- Weak internal controls and ineffective oversight make it easier for individuals to manipulate the system undetected.

- Complex financial transactions, especially those involving off-balance-sheet financing, still outpace many traditional detection methods.

- Industry shifts and technology-enabled fraud further complicate matters; digital systems, and associated vulnerabilities, create fertile ground for new forms of fraud.

- Beyond financial loss, fraud significantly undermines investor confidence, triggers regulatory penalties, and causes long-lasting reputational harm that can linger for years.

Real-World Cases of Fraud in the Accounting Industry

Accounting fraud has shaped corporate history. Some prominent cases include:

- Enron Accounting Fraud: Enron used complex structures to hide debt, leading to bankruptcy in 2001. This scandal triggered the Sarbanes-Oxley Act.

- WorldCom Accounting Fraud: In 2002, WorldCom inflated assets by over $11 billion, one of the largest frauds in history.

- HealthSouth Scandal: Misreporting profits by $2.7 billion revealed weaknesses in internal accounting controls.

- Recent Tesla Allegations: Claims of accounting manipulation highlight that modern companies remain vulnerable to fraudulent reporting.

Main Consequences of Not Being Protected Against Fraud and Data Breach

The consequences of neglecting fraud prevention and cybersecurity in the accounting industry extend far beyond immediate financial damage. The ripple effects can jeopardize the survival of an entire organization.

- Financial Loss: Fraudulent activities often result in billions of dollars in losses through asset misappropriation, overstated revenues, or concealed liabilities. These losses not only drain working capital but also distort financial reporting, leading to poor business decisions and lost investor value.

- Regulatory Penalties: Non-compliance with regulations such as the Sarbanes-Oxley Act (SOX) in the United States or equivalent international standards results in significant fines, mandatory restatements, and heightened scrutiny from regulators. In some cases, auditors and accounting firms also face sanctions for failing to detect fraud.

- Reputational Harm: Once fraud or a breach is exposed, the damage to a company’s reputation can be irreparable. Investors, clients, and partners lose confidence in the business’s ability to maintain integrity, which can trigger stock declines, customer churn, and long-term brand erosion.

- Operational Disruption: Fraud investigations demand enormous resources, often diverting accountants, executives, and compliance officers away from core responsibilities. These investigations may freeze accounts, delay audits, and disrupt day-to-day operations, creating a cycle of inefficiency and vulnerability.

- Legal Consequences: Organizations implicated in fraud often face class-action lawsuits from shareholders and customers, alongside potential criminal charges for executives. Litigation costs can escalate into the millions, while individual leaders risk imprisonment and permanent bans from holding executive roles.

- Loss of Competitive Advantage: Fraud incidents expose sensitive data, including trade secrets, financial models, or client information. Once leaked, these assets can be exploited by competitors or cybercriminals, reducing a firm’s competitive standing.

- Erosion of Employee Morale: When fraud scandals surface, employee trust in leadership diminishes. Honest staff may feel betrayed, increasing turnover, disengagement, and the risk of further internal misconduct.

Compliance Issues in the Accounting Industry

Compliance frameworks, particularly the Sarbanes-Oxley Act (SOX) in the US, set strict rules for financial reporting. Firms must ensure transparency, maintain records, and enforce internal controls. Non-compliance leads to harsh penalties, both financial and criminal. Internationally, IFRS and local GAAP standards impose similar accountability. Increasingly, firms face pressure to integrate forensic accounting and fraud examination into compliance processes, ensuring fraud risks are minimized. Compliance is not only about ticking boxes but creating resilience against modern cyber-enabled fraud schemes.

Fraud Types in the Accounting Industry

Accounting fraud is not a single phenomenon but a collection of schemes and manipulations that exploit weaknesses in financial systems. Each type of fraud carries its own risks, consequences, and detection challenges, requiring organizations to adopt layered and adaptive defenses.

- Financial Statement Fraud: This occurs when companies deliberately misrepresent revenues, expenses, or assets to manipulate financial results. Common tactics include inflating revenues, hiding liabilities, or overstating asset values. It is considered the most damaging type of fraud because it distorts the true financial health of a company, misleads investors, and can collapse entire firms, as seen in the Enron and WorldCom scandals. According to Investopedia, financial statement fraud remains the most impactful form of accounting fraud globally.

- Asset Misappropriation: This involves the theft or misuse of company assets, which may include cash, inventory, or intellectual property. Methods range from fraudulent expense claims and unauthorized personal purchases to false billing schemes. Though often smaller in scale than statement fraud, asset misappropriation is the most common type of accounting fraud worldwide, particularly in small and medium-sized enterprises that lack robust internal controls.

- False Accounting Fraud: Also known as “cooking the books,” this fraud relies on entering misleading or fictitious records to distort financial performance. Examples include premature revenue recognition, concealed expenses, or deliberately misclassified accounts. False accounting can artificially boost stock prices in the short term, but once exposed, it results in regulatory penalties and reputational collapse.

- Payroll Fraud: Payroll manipulation is a frequent issue in organizations with large employee bases. Fraudsters may create ghost employees, inflate overtime hours, or falsify commission records to divert company funds. Even small-scale payroll fraud can lead to significant revenue leakage over time, especially if unnoticed for long periods.

- Vendor and Billing Fraud: Involving collusion with external vendors or the creation of fake supplier accounts, this type of fraud exploits procurement and payment systems. Fraudsters may overbill for services, submit duplicate invoices, or charge for non-existent goods. These schemes often persist for years if vendor relationships are not properly monitored.

- Forensic Accounting Fraud Investigation Cases: Specialized forensic audits often uncover concealed embezzlement, off-balance-sheet activities, and other manipulations. These investigations leverage advanced analytics, behavioral tracking, and cross-system reconciliations to detect discrepancies that traditional audits may overlook.

Fraud and Security Concerns: The Big Picture

Fraud and security risks in the accounting industry are complex, interconnected, and constantly evolving. These threats can be broadly classified into three major categories that affect organizations of every size and maturity level.

Internal Threats

Internal risks remain one of the most damaging forms of fraud in accounting. They include insider fraud, weak internal controls, and occupational misconduct. Employees with privileged access may manipulate financial records, misappropriate assets, or bypass controls for personal gain. Inadequate segregation of duties and insufficient monitoring create fertile ground for these schemes to flourish. Internal fraud often goes undetected for long periods of time, resulting in significant financial losses and reputational damage.

External Threats

The rise of digital accounting platforms has exposed organizations to a growing set of external threats. Cybercriminals target vulnerabilities in accounting software, orchestrate phishing campaigns, and deploy fraudulent invoices to infiltrate financial systems. These attacks often begin with compromised credentials or social engineering tactics, and they can quickly escalate into large-scale financial theft. Attackers also exploit weaknesses in third-party integrations, cloud misconfigurations, and poorly managed access controls to compromise sensitive financial data.

Systemic Risks

Beyond individual incidents, the accounting industry faces systemic risks that amplify fraud exposure across the sector. Reliance on outdated auditing methods and legacy systems leaves organizations unable to detect sophisticated schemes in real time. Manual processes slow down fraud detection and allow perpetrators to exploit gaps in oversight. Inconsistent regulatory compliance frameworks across jurisdictions also increase complexity, forcing firms to balance operational efficiency with risk mitigation.

Why Traditional Defenses Are No Longer Enough

As highlighted in CrossClassify’s research, relying solely on static defenses such as multi-factor authentication (MFA) or a web application firewall (WAF) is no longer sufficient. Modern fraudsters are adept at bypassing these controls by exploiting session-level anomalies, device changes, and behavioral inconsistencies. Once inside, they often blend in with normal user activity, making detection extremely difficult with conventional tools.

Building True Resilience

Achieving real protection in the accounting industry requires a multi-layered security strategy. Organizations must adopt continuous risk and trust assessment, where every session and every user action is evaluated in real time. Adaptive authentication mechanisms that adjust security requirements based on context, device, and behavioral signals provide stronger safeguards than one-time verification. Finally, the integration of advanced analytics, device fingerprinting, and behavioral monitoring ensures that suspicious activity is detected early and stopped before it escalates into major financial or reputational loss.

How CrossClassify Could Help Protect Against Frauds

CrossClassify offers a comprehensive, multi-layered fraud detection and prevention platform designed specifically to address the complex risks facing the accounting industry. Unlike traditional tools that only react after fraud occurs, CrossClassify continuously monitors user activity, device behavior, and transaction patterns in real time to stop fraud before it escalates. Its holistic approach combines advanced AI, device intelligence, and behavioral analytics to protect firms from both internal manipulation and external cyber-enabled threats.

- Device Fingerprinting: CrossClassify creates a unique digital profile for every device interacting with accounting systems. By capturing hundreds of parameters such as browser type, operating system, IP address consistency, and device configurations, it can identify devices linked to suspicious logins or repeated fraud attempts. This prevents fraudsters from reusing compromised devices across multiple accounts and ensures that unauthorized access is stopped before any manipulation of records occurs. Learn more in device fingerprinting.

- Behavioral Biometrics: Beyond devices, CrossClassify analyzes the way users interact with systems. Typing speed, mouse movement, navigation patterns, and session flow become behavioral signals that help distinguish between genuine accountants and malicious actors. Sudden changes in behavior, such as unusual navigation through financial ledgers or attempts to export large volumes of data, trigger real-time alerts. This ensures insider fraud and credential-stuffing attacks are quickly identified. More at behavioral biometrics.

- Continuous Risk Assessment: Unlike static verification methods, CrossClassify applies continuous adaptive risk and trust evaluation throughout a session. Trust scores update dynamically as users type, move funds, or access sensitive financial reports. If a session shows anomalies—such as accessing from a new geography, switching between multiple accounts, or performing high-value entries—the system introduces friction, requiring additional authentication or automatically blocking the activity. See continuous adaptive risk.

- Account Takeover Protection: Accountants and finance teams are prime targets for account takeover (ATO) attacks, where criminals hijack valid credentials to alter financial statements or steal assets. CrossClassify prevents these intrusions by detecting credential stuffing, brute force attempts, and abnormal login behaviors. By analyzing device, IP, and session behavior together, it blocks attacks before fraudulent transactions can be executed. Details in anatomy of account takeover.

- Account Opening Fraud Detection: Fraudulent accounts can be used to launder funds, submit false invoices, or exploit weak vendor controls. CrossClassify’s AI-driven risk engine screens every new account in real time, using device and identity signals to block synthetic or fake accounts from entering the system. This protects firms against downstream risks like fraudulent vendors, false payroll entries, or shell companies. More at account opening fraud.

Conclusion

Accounting fraud continues to challenge organizations worldwide, combining old methods of manipulation with modern digital vulnerabilities. High-profile scandals from Enron to HealthSouth reveal the destructive power of financial deception. With billions lost annually, strict regulations, and rising cyber-enabled risks, firms must prioritize fraud prevention and cybersecurity in every process.

CrossClassify offers accounting professionals the tools to proactively combat fraud, integrating device fingerprinting, behavioral monitoring, and continuous adaptive trust assessment. By leveraging AI-driven analytics and real-time detection, CrossClassify ensures that firms not only stay compliant but also maintain investor trust, operational continuity, and long-term resilience.

CrossClassify offers accounting professionals the tools to proactively combat fraud, integrating device fingerprinting, behavioral monitoring, and continuous adaptive trust assessment. By leveraging AI-driven analytics and real-time detection, CrossClassify ensures that firms not only stay compliant but also maintain investor trust, operational continuity, and long-term resilience.

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Frequently asked questions

Accounting fraud is the deliberate manipulation of financial records to mislead stakeholders, hide losses, or inflate profits. It can cause billions in losses and lead to regulatory action. CrossClassify strengthens defenses with accounting fraud detection software that combines behavioral analysis and device intelligence. Learn more in Fraud Risk Management.

Prevention requires strong internal controls, real-time monitoring, and independent audits. Firms must also adopt technology that detects anomalies before they escalate. CrossClassify provides accounting fraud prevention solutions using device fingerprinting, behavioral biometrics, and continuous risk scoring. Explore more in Continuous Adaptive Risk and Trust Assessment.

The most frequent forms include financial statement fraud, asset misappropriation, payroll fraud, and false accounting. Each has unique detection challenges. CrossClassify uses AI tools for accounting fraud detection to analyze user behavior and transactions for signs of manipulation. Read more at Behavioral Biometrics.

Fraud undermines investor confidence, triggers customer loss, and damages long-term credibility. Once exposed, recovery is difficult. CrossClassify's cloud-based accounting fraud monitoring system identifies fraudulent sessions early, reducing reputational exposure. See Zero Trust Architecture and Modern AI Cybersecurity.

Legal outcomes can include fines, lawsuits, and even prison sentences for executives. Non-compliance with regulations like SOX adds further penalties. CrossClassify provides an accounting fraud risk management platform that helps firms maintain compliance and avoid costly sanctions. Learn more in Fraud Risk Management.

Detection methods include anomaly detection, pattern recognition, and real-time monitoring of transactions. AI has become central to uncovering fraud. CrossClassify delivers accounting fraud detection using machine learning, ensuring both large and small firms can spot risks immediately. See Device Fingerprinting.

Small firms often lack advanced fraud teams, making them vulnerable to payroll and vendor fraud. Implementing automated alerts and external monitoring is essential. CrossClassify offers accounting fraud detection services for small business with affordable, scalable technology. Learn more at Avoid Fake Accounts.

Auditors rely on forensic accounting, transaction analysis, and fraud risk assessment software. These tools highlight inconsistencies in statements and ledgers. CrossClassify supports auditors with accounting fraud detection for auditors and CPAs, providing forensic-level insights in real time. Read How Does Fingerprinting Work.

Yes, modern AI-driven systems analyze user behavior and device patterns instantly, flagging suspicious actions before damage occurs. CrossClassify enables real-time accounting fraud detection and response to block high-risk transactions on the spot. More at The Anatomy of Account Takeover.

Forensic accountants uncover hidden manipulations and embezzlement. However, software accelerates investigations and adds predictive analysis. CrossClassify enhances forensic work with accounting fraud investigation and compliance tools, linking suspicious activity to user behavior and devices. See New Account Fraud.

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required