Supporting Fraud Analysts to Stay One Step Ahead

As a Fraud Analyst, you’re on the front lines against evolving threats. CrossClassify gives you the tools to spot complex fraud fast and act with confidence—detecting account takeovers, account opening fraud, bot attacks, and abuse Turn data into action and stop fraud in its tracks.

How CrossClassify Benefits You

We understand your challenges and offer a solution that equips your technical teams for success

Faster Detection

With CrossClassify, fraud never gets a head start. Real-time alerts flag threats instantly, giving analysts the visibility to act fast. Our system scans continuously for high-risk behavior, ensuring quick response and rapid resolution.

In-Depth Analysis

Fraud is evolving, and so is CrossClassify. Using behavioral biometrics and advanced pattern recognition, our platform detects complex fraud schemes that traditional methods may miss. By analyzing user behavior, like typing rhythms and mouse movements, we uncover subtle anomalies, giving fraud analysts deeper insights to strengthen defenses and improve security.

Data-Driven Decisions

CrossClassify turns vast data into AI-driven insights, enabling faster, more accurate decisions. By analyzing historical fraud patterns and adapting to new behaviors in real-time, the platform helps predict and prevent future attacks. This adaptive intelligence ensures data-backed decisions, enhancing your ability to counter evolving fraud with confidence and precision.

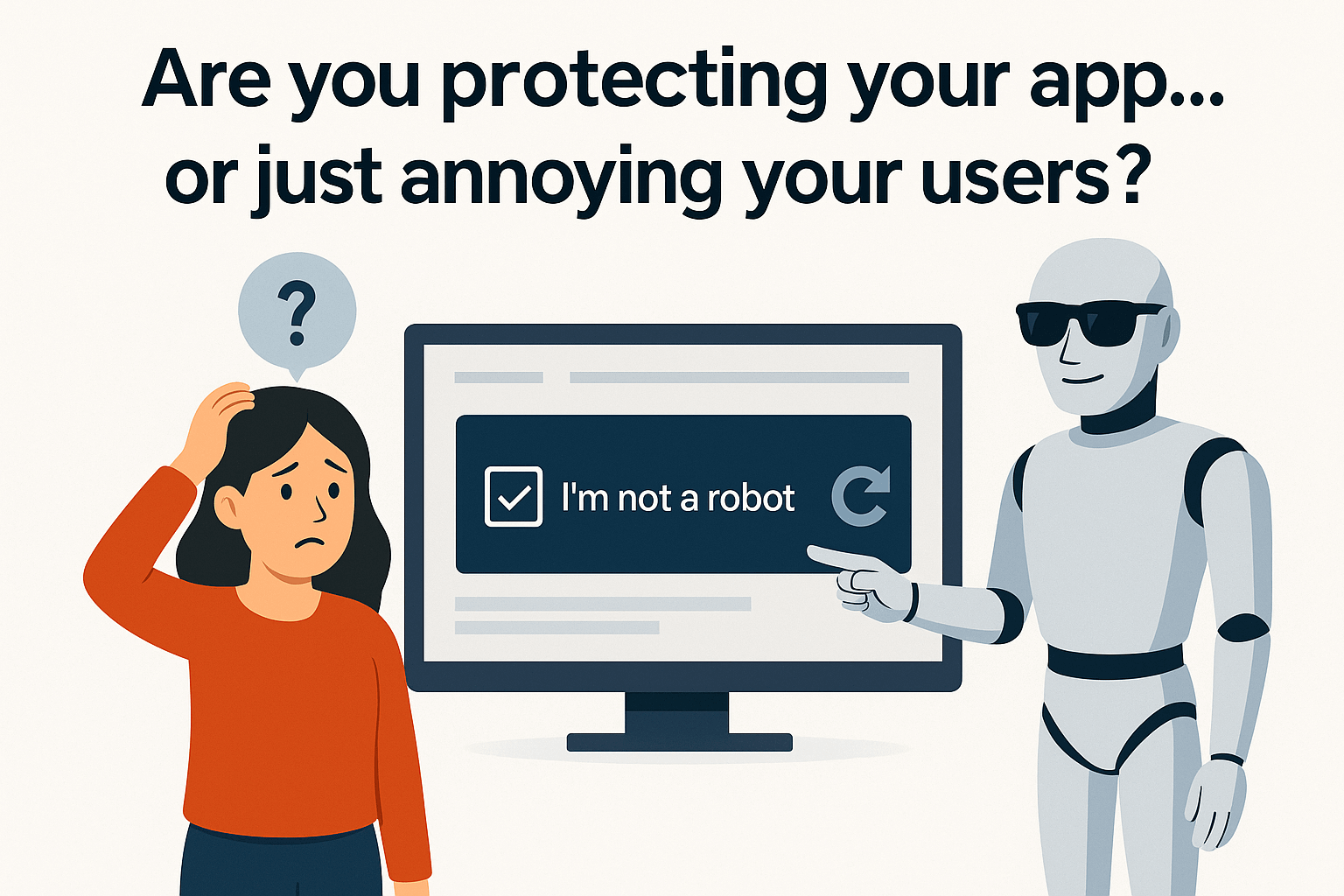

Reduced False Positives

Not all alerts require attention. CrossClassify cuts through the noise by minimizing false positives, allowing analysts to focus on real threats. Our precise models accurately distinguish between normal and abnormal behavior, preventing false flags for legitimate users. This improves efficiency, saves time, and enhances the customer experience by reducing unnecessary friction, ensuring that CrossClassify’s alerts are actionable and reliable.

Collaboration

Fraud prevention is a team effort. CrossClassify promotes collaboration across departments by providing shared visibility into fraud data and trends. With intuitive dashboards and reporting tools, Fraud Analysts can easily communicate findings and align on strategies with IT, compliance, and customer support. This fosters teamwork, accelerates case resolution, and strengthens the organization’s defense against fraud.

Short Posts

Latest from Cross Classify

Frequently asked questions

A fraud analyst investigates suspicious activity, detects fraud patterns, and implements defense strategies. They analyze user behavior, device signals, and transactional anomalies to prevent financial loss and maintain platform trust. Tools like CrossClassify enhance this role with real-time behavioral insights.

CrossClassify provides:

- Real-time risk scores at signup, login, and transaction

- Detailed device and session fingerprints

- Behavioral anomalies flagged with contextual metadata

- APIs and dashboards that surface relevant data instantly

This allows analysts to resolve cases faster and more accurately.

Traditional rule-based systems often trigger on superficial signals. CrossClassify reduces false positives by analyzing user intent, not just technical attributes. This means low-risk users aren’t mistakenly flagged, and analysts can focus on what truly matters.

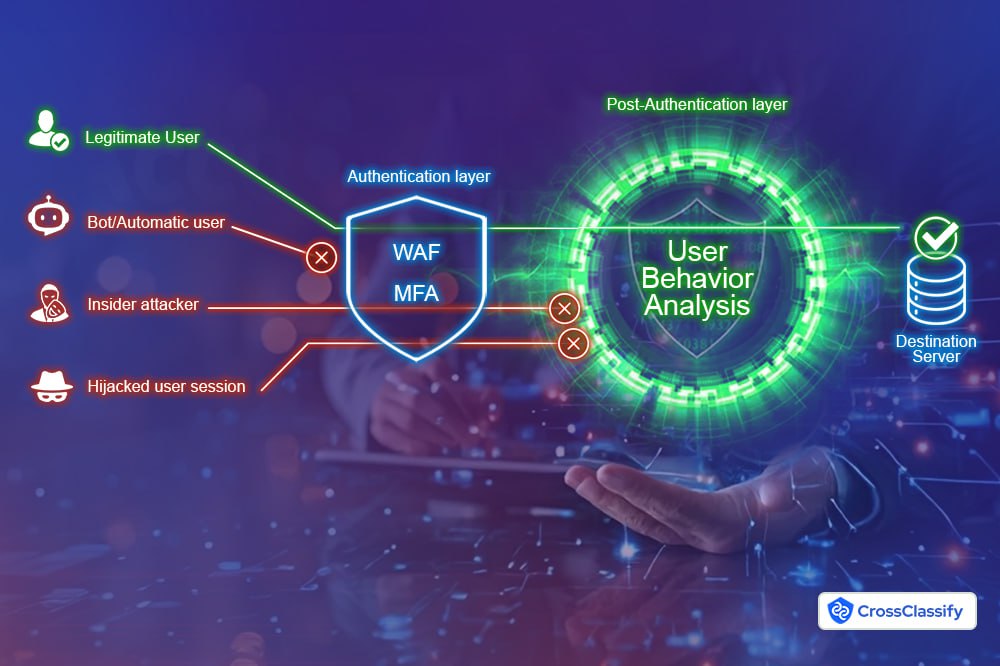

Yes. Our platform detects ATOs through:

- Unusual login behavior

- Device or IP changes

- Geo-inconsistencies

- Session anomalies (e.g., sudden changes in behavior)

All of this is surfaced for fraud analysts to review or automate action against.

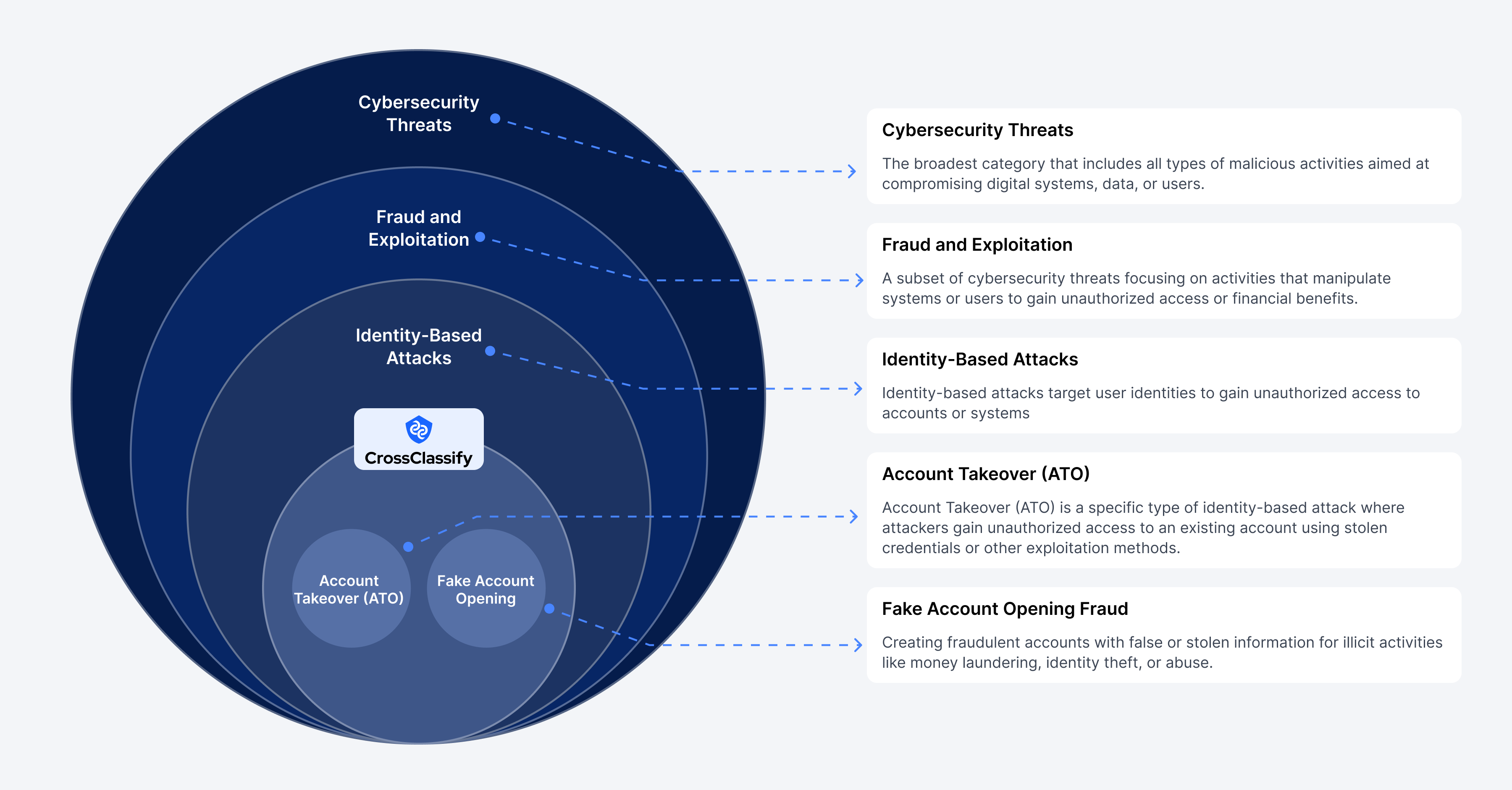

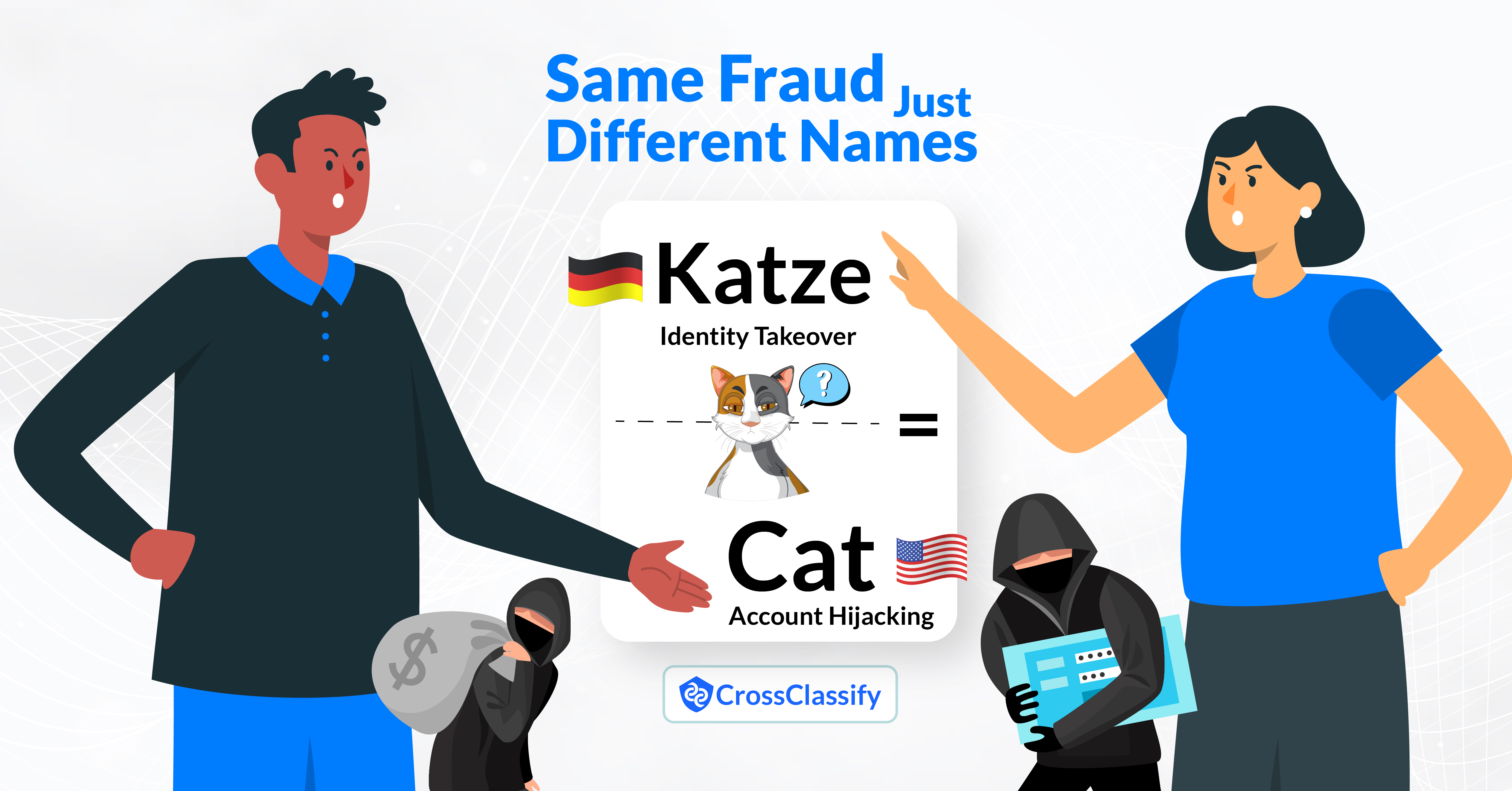

We detect:

- Account Takeover (ATO)

- Fake and synthetic account creation

- Bot and abuse fraud

- Promo or referral abuse

- Session hijacking and farming behavior

Perfect for analysts working across fintech, crypto, gaming, or e-commerce.

By eliminating noise. Analysts get:

- Prioritized alerts based on dynamic risk scoring

- Session trails with behavioral markers

- Unified device-level user profiles

No more stitching together logs or guessing—just focused investigation and faster case resolution.

Yes. You can:

- Flag or block high-risk sessions in real time

- Trigger step-up authentication

- Send scores to internal fraud engines or SIEMs

All powered by our low-latency APIs and fully auditable scoring logic.

Absolutely. CrossClassify supports custom:

- Risk score thresholds per event type,

- Automated responses (approve, challenge, block),

- Data exports and webhook integrations

Analysts stay in control, with flexibility to tune response strategies.

It goes beyond static signals. Behavioral analysis reveals how users interact:

- Are they human or bot?

- Are they rushing through steps abnormally?

- Are they copying/pasting personal info?

These subtle cues help analysts detect fraud with greater precision.

Because we help them:

- Detect faster with AI-powered insights

- Investigate smarter with complete context

- Prevent loss with real-time protection

- Scale safely across millions of users and devices

CrossClassify is more than a signal—it’s an analyst’s daily advantage.

Let’s Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required