Cybersecurity for Fintech

Block Fintech Fraud Before Transactions Happen

Catch high-risk users instantly with device and behavioral analysis.

Stats on Fintech Breaches

$2.5B

Fraud Losses

In 2024, U.S. consumers lost over $12.5 billion to fraud — a 25% rise from the previous year.

73%

Of Organizations

In 2024, 83% of organizations faced at least one account takeover, underscoring the threat’s reach.

89%

Of Monitored Organizations

In 2024, 99% faced ATO attempts; 62% saw at least one breach.

Why Fintech Data Security Matters

Account Takeovers Are Draining Fintech Platforms

Even with MFA in place, fintech users fall victim to session hijacking, phishing, and SIM swaps. Without continuous behavioral monitoring, account takeover fraud often goes undetected until damage is done.

Fintech Onboarding Is Vulnerable to Synthetic Fraud

Fraudsters use fake identities to exploit loans, open mule accounts, and launder funds. Legacy KYC and document checks miss the behavioral and device-level signals needed to spot them.

Fintech Compliance Demands Real-Time Risk Insights

AML, KYC, and PSD2 regulations require accurate fraud detection and audit trails. Static rules and delayed signals increase exposure to fines and reputational damage.

Fraud Doesn’t Stop at Login

Once inside, fraudsters exploit post-login blind spots to move money, change settings, or hijack accounts. Fintech systems need continuous post-authentication monitoring, not just perimeter security.

Solution

Issues We Resolve

We protect your app from the most prevalent cyber attacks

Secure Logged-In Users, Not Just Logins

Reduces account takeover losses by up to 62% while maintaining seamless user experience.

Book a Demo83%

Financial firms experienced at least one ATO.

$13B

ATO cost for fintechs in 2023 alone

How We Prevent Account Takeover

Learn More →Prevent identity theft and data breaches caused by unauthorized access to user accounts. Account Takeover (ATO) attacks exploit vulnerabilities using tactics like impersonation, keylogging, smishing and phishing, and session hijacking, putting sensitive information and trust at risk.

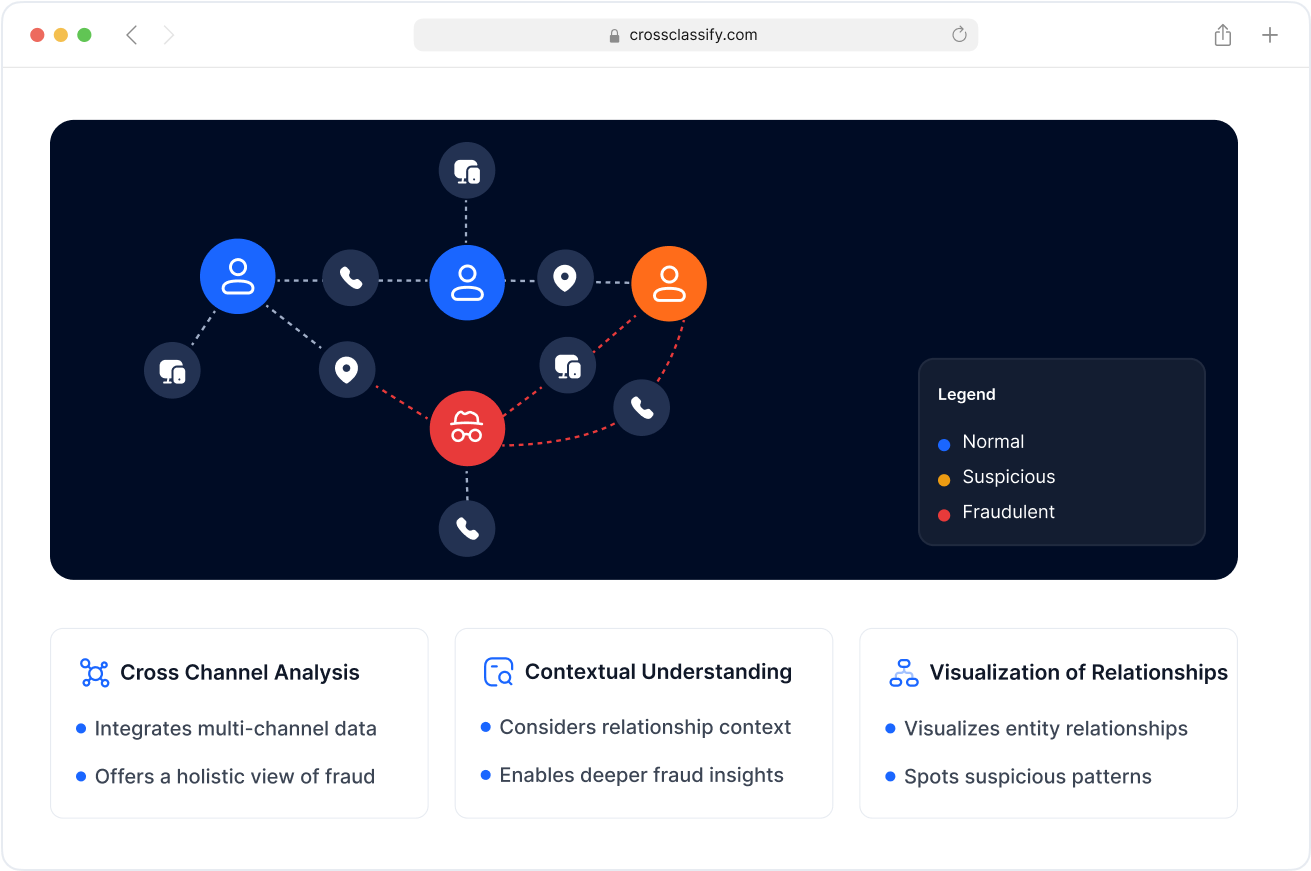

Learn More →Link Analysis for Fraud Rings

Uncover connections between suspicious fintech users, devices, IPs, and fake accounts using graph intelligence.

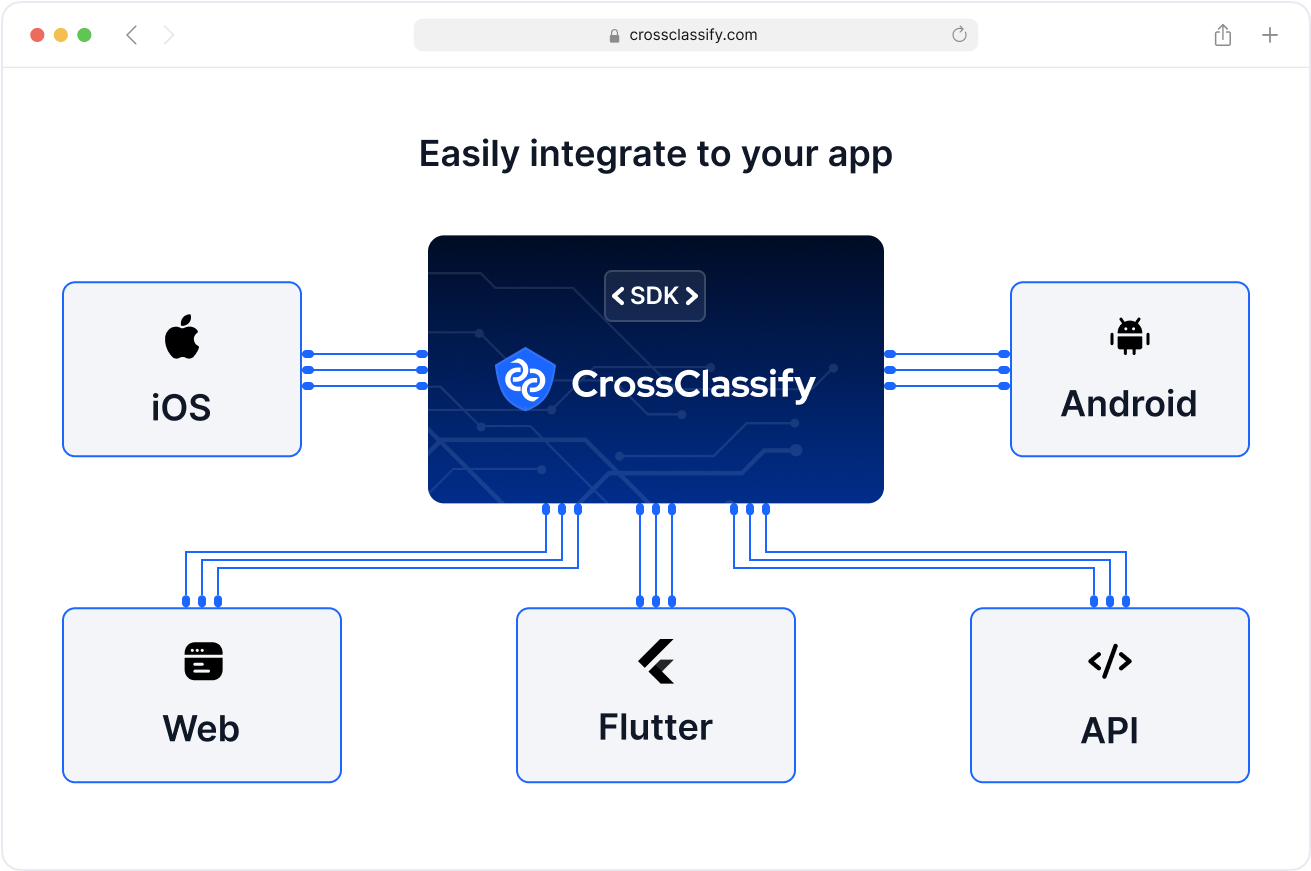

Seamless Integration with Fintech Stack

Deploy via API alongside KYC, AML, payment gateways, MFA, and core banking or crypto systems.

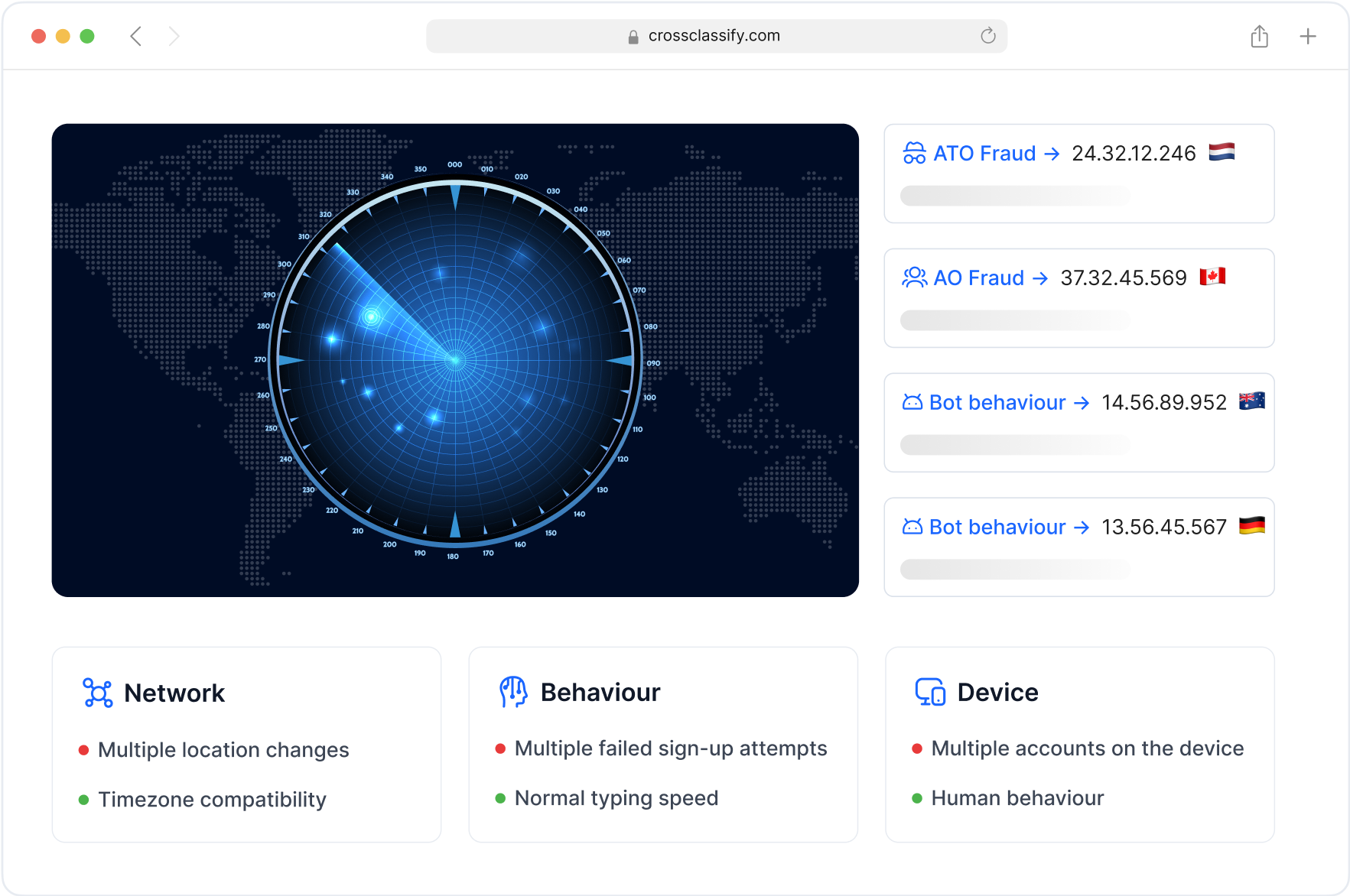

Continuous Monitoring for Transactions

Track user behavior and session risk across logins, wallet access, and financial transactions in real time.

Compliance

From Regulation to Reputation

GDPR: Securing EU Data via Safe Handling and Breach Reporting

Meta (Facebook) was fined €1.2 billion (2023) for unlawful data transfers to the U.S.

Amazon Europe was fined €746 million (2021) for processing personal data without valid consent.

PCI DSS – Sets standards for encrypting and securing payment card data.

Heartland Payment Systems paid over $110 million (2015-2019) in settlements after a data breach involving 100M+ cards.

Non-compliant merchants risk $5,000–$100,000/month in penalties from card brands.

Fintech Security Beyond Login

Most attacks now happen after authentication. CrossClassify detects fraud during sessions, transfers, and account changes. Traditional security misses this post-login activity.

Behavioral Biometrics for Finance

We analyze how users swipe, type, and navigate. These patterns reveal fraud even when credentials are valid. Behavior never lies.

Compliance-Ready Risk Scoring

CrossClassify helps meet PSD2, KYC, AML instantly. Real-time risk scoring supports fast, compliant decisions. Stay audit-ready effortlessly.

Frequently asked questions

Fintech platforms manage sensitive financial data and transactions, making them prime targets for fraudsters. With digital onboarding, instant payments, and decentralized systems, fintechs face unique threats—from account takeover to synthetic identity fraud—that demand real-time, intelligent protection.

Fintech platforms often face:

- Account takeover (ATO) via credential stuffing

- Fake account creation for money mule activity

- Bot attacks for promo and referral abuse

- Phishing and social engineering

- Fraudulent transactions using stolen credentials or cards

CrossClassify detects and blocks these threats with device fingerprinting and behavioral analytics.

We provide:

- Real-time fraud scoring at login, signup, and transaction

- Device and session fingerprinting to catch repeat offenders

- Behavioral pattern detection to identify bots or outlier users

- API-based risk assessment integrated into your fintech workflows

Our AI engine adapts to emerging fraud tactics without adding friction to legitimate users.

Fintech companies face:

- Rapid digital growth without mature risk controls

- Pressure to onboard users quickly (increasing fraud exposure)

- Regulatory requirements like GDPR, PCI-DSS, SOX, and PSD2

- Gaps in fraud visibility between mobile apps, web portals, and APIs

CrossClassify helps unify fraud signals across all platforms for better compliance and insight.

Best practices include:

- Using risk-based authentication

- Blocking suspicious device fingerprints

- Monitoring for high-risk behavior in real time

- Validating identities without relying solely on static KYC

- Integrating fraud prevention tools like CrossClassify from day one

It’s the process of identifying, assessing, and mitigating risks related to digital finance operations. This includes:

- Credit risk from unverified applicants

- Fraud risk from fake users and transactions

- Cyber risk from external attacks and data breaches

CrossClassify strengthens fintech risk controls by preventing fraud before it happens.

Cyberattacks in fintech can result in:

- Financial loss from unauthorized transfers

- User churn due to breached trust

- Reputational damage

- Regulatory fines

- Operational downtime

CrossClassify offers preemptive defense against these outcomes by detecting fraud signals early.

Traditional checks often miss fake accounts. CrossClassify detects:

- Suspicious email/IP combinations

- Velocity of registrations

- Emulated devices or anonymizers

- Bot-like interactions (e.g., copy-paste, zero hesitation time)

We deliver a fraud score instantly, helping fintech apps filter fake users with precision.

Yes—fintech companies often scale faster and rely heavily on open APIs, third-party tools, and digital touchpoints. Without layered fraud prevention, they face more sophisticated attacks and less room for error compared to regulated banks.

Unlike static rules or CAPTCHA-based defenses, CrossClassify:

- Adapts to attacker behavior with machine learning

- Profiles users based on device, behavior, and network

- Integrates seamlessly into modern tech stacks

- Balances security and user experience with invisible protection

Let’s Get Started

Elevate your Fintech app's security with CrossClassify. Schedule a personalized demo to see how we protect customer accounts and ensure compliance with industry standards.