Supporting CFOs to Protect Profitability and Financial Health

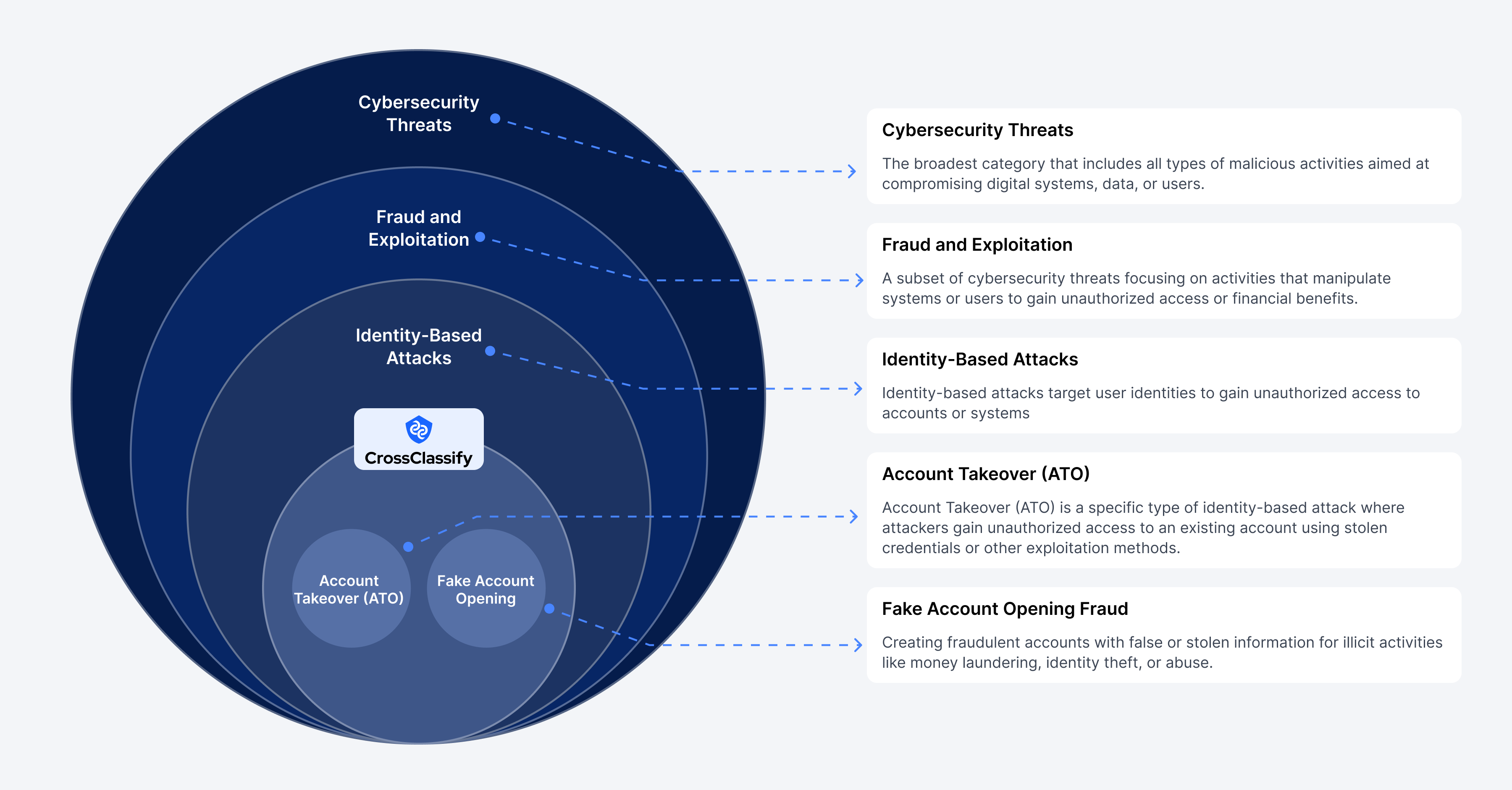

As a CFO, you need to drive performance while managing risk. CrossClassify supports your financial goals with intelligent fraud prevention, protecting against account takeovers, account opening fraud, bot attacks, and abuse, delivering cost savings and operational efficiencies. Secure your bottom line and build a resilient financial future with CrossClassify.

How CrossClassify Benefits You

We understand your challenges and offer a solution that equips your technical teams for success

Cost Savings

CrossClassify reduces financial losses from fraud, improving your organization's financial health. By preventing fraud before it impacts revenue, you preserve capital for growth and innovation. Our system minimizes chargebacks, reversals, and fees, boosting profit margins. With fewer fraud disruptions, your finance team can allocate resources more effectively, ensuring a strong return through cost reductions.

Better Forecasting

CrossClassify provides predictable, reliable fraud prevention, making financial planning easier. By reducing fraud-related variability, it enables more accurate budgeting and forecasting. With controlled fraud risks, CFOs can model revenue and expenses confidently, supporting smarter investments and operational efficiency. Plan with certainty, knowing your financial forecasts are protected from hidden fraud threats.

Lower Legal Costs

Fraud doesn’t just cost money—it can lead to costly legal battles and recovery efforts. CrossClassify prevents these issues by identifying and blocking fraud early, reducing the risk of disputes, penalties, and compliance violations. This proactive approach minimizes the need for legal action, ensuring more predictable expenses and reinforcing your organization’s financial stability.

Short Posts

Latest from Cross Classify

Frequently asked questions

Because fraud directly impacts your bottom line. From account takeover to fake user payouts, unchecked fraud leads to revenue loss, operational cost spikes, compliance risks, and reputational damage. CrossClassify gives CFOs the tools to monitor, reduce, and report fraud exposure with precision.

- Chargebacks and refund losses

- Promo abuse and bonus draining

- Manual investigation overhead

- Loss of real customer trust

CrossClassify helps eliminate these hidden costs by catching fraud before it impacts your financial reports

CrossClassify offers:

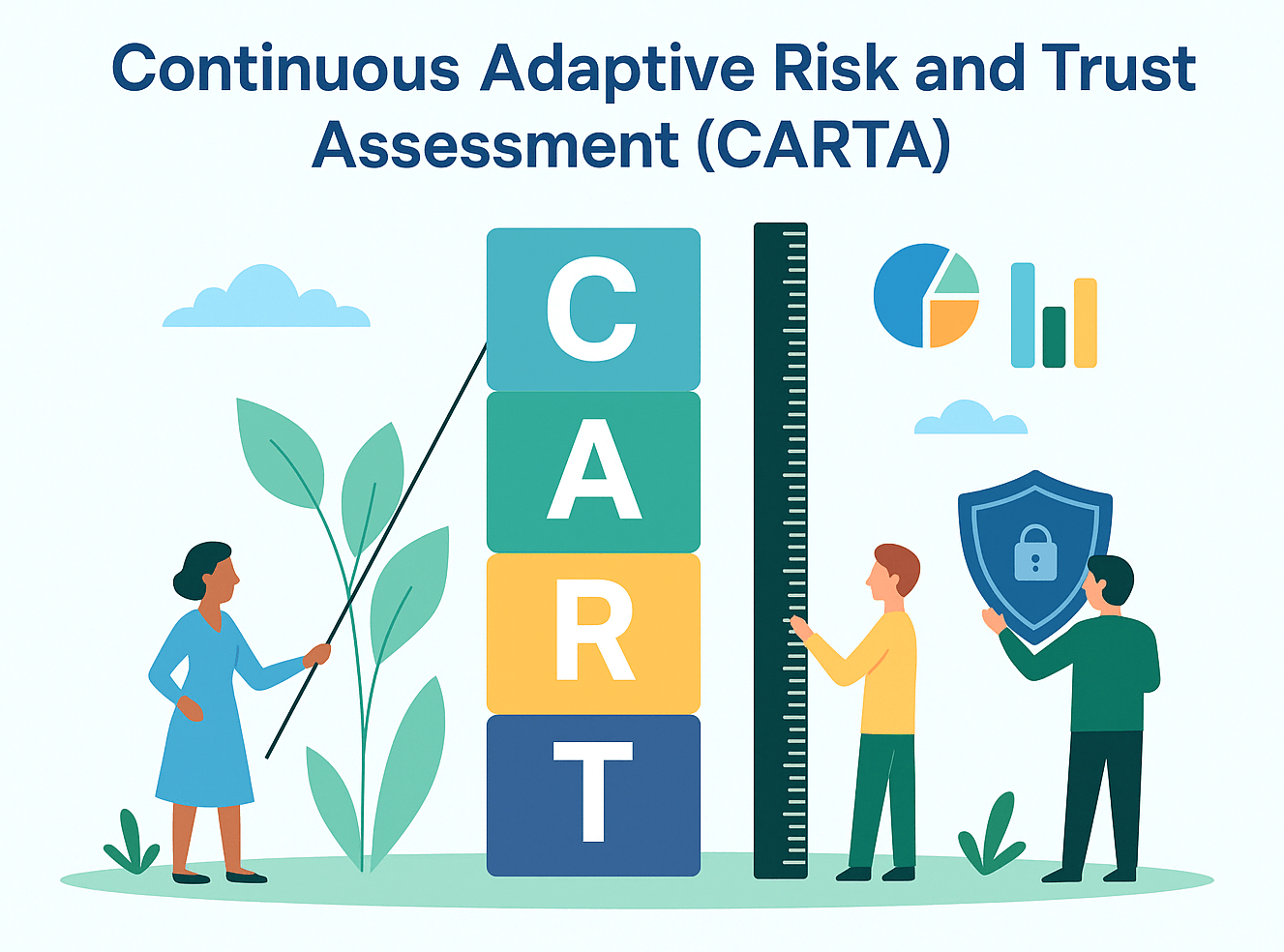

- Real-time fraud scoring at critical financial touchpoints

- Dashboards with clear metrics on fraud trends and risk zones

- Automated decisions to reduce manual costs

- Auditable logs for compliance and reporting

Yes. By filtering out fraudulent users and transactions , CrossClassify ensures that your growth, churn, and LTV models are based on real, verified user activity—not inflated metrics due to bots or abuse.

CFOs must ensure that fraud and cyber risks are financially quantified and included in budgeting, compliance, and vendor evaluation. With CrossClassify, CFOs gain visibility into fraud cost trends and the ROI of their cybersecurity spend.

We help organizations:

- Detect and block suspicious transactions

- Identify synthetic identity and fraud rings

- Maintain records for audit and AML compliance

- Integrate with KYC workflows

This makes CrossClassify valuable for meeting SOX, GDPR, PCI-DSS, and PSD2 requirements.

Beyond direct cost, these attacks skew your CAC, retention, and ROI metrics, resulting in poor financial decisions. CrossClassify detects and stops these attacks by scoring user legitimacy from the first interaction.

Fractional CFOs should:

- Evaluate fraud risk as part of financial due diligence

- Recommend scalable fraud prevention tools like CrossClassify

- Align security investments with revenue protection goals

- Leverage CrossClassify’s low-lift integration and transparent reporting for lean teams.

Absolutely. Investors want to know your metrics are clean and scalable. Proactively investing in fraud controls shows maturity, reduces financial exposure, and strengthens your case during fundraising, audits, and M&A.

Because we help them:

- Quantify fraud risk as a financial liability

- Improve fraud loss visibility

- Reduce operational waste and manual investigations

- Protect customer trust—without harming the user experience

CrossClassify is built for CFOs who want risk resilience and financial clarity in a digital-first world.

Let’s Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required