Supporting CEOs to Lead Secure, Scalable Growth

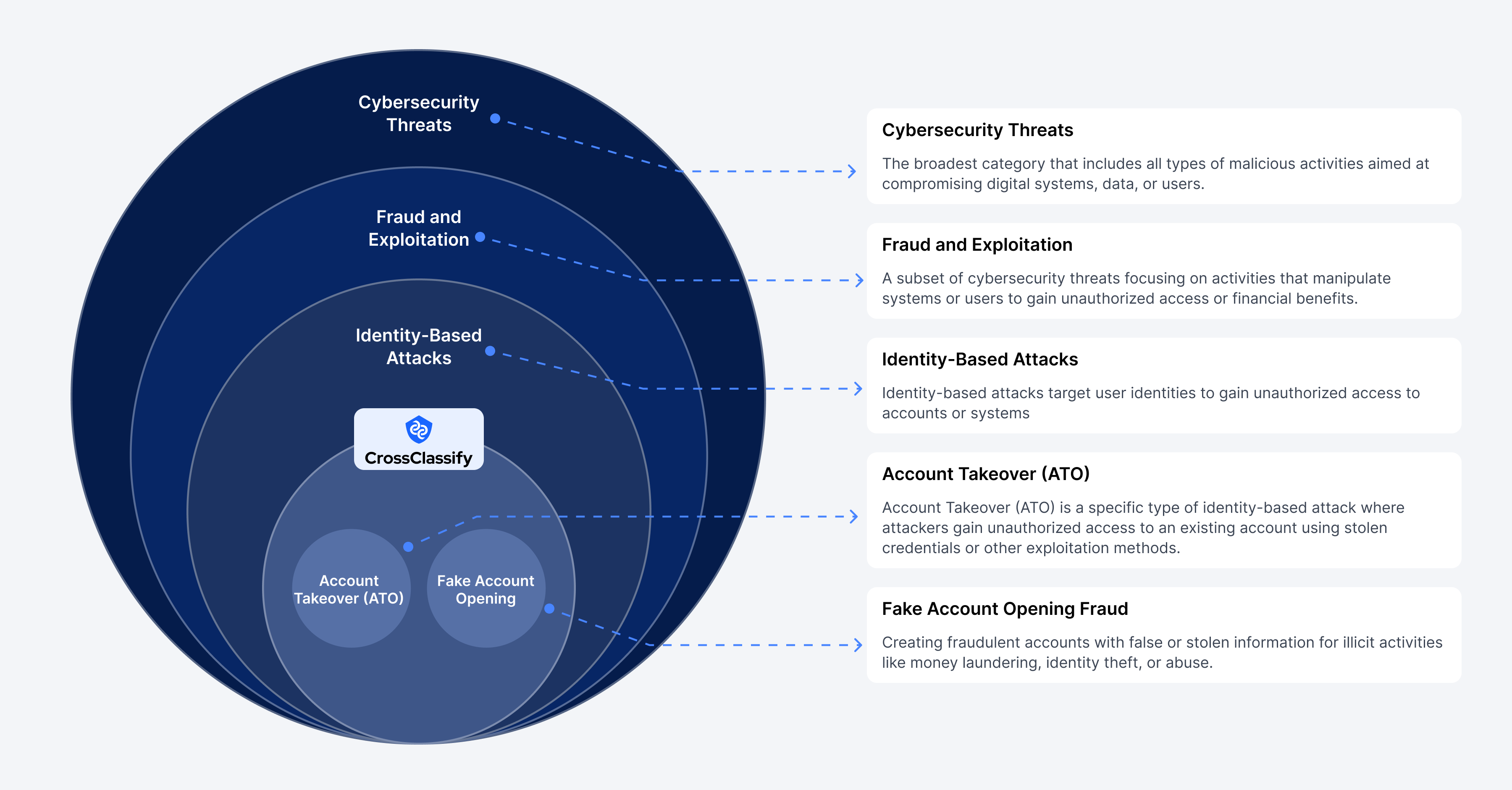

At CrossClassify, we know your goal as CEO is sustainable growth and long-term trust. In today’s digital world, fraud is more than a security issue—it’s a business threat. Our intelligent platform defends against account takeovers, account opening fraud, bot attacks, and abuse, while supporting your goals for profitability, brand leadership, and efficiency. CrossClassify keeps you ahead of fraud, so you can stay focused on growth.

How CrossClassify Benefits You

We understand your challenges and offer a solution that equips your technical teams for success

Reduced Financial Loss

CrossClassify reduces financial risk by proactively detecting and stopping fraudulent transactions in real time. Our platform prevents account takeovers, revenue loss, and disruption—without compromising customer experience. CEOs gain clear ROI as fraud losses drop and secure growth continues.

Brand Protection

A CEO knows reputation is everything. CrossClassify protects your brand from fraud and data breaches, preserving trust with customers, partners, and investors. Our proactive approach keeps incidents out of the spotlight, reinforcing your promise of security and leadership.

Growth

CrossClassify scales with your business, delivering robust fraud protection without added complexity. Seamlessly integrating with your systems, it adapts as you grow—so you can expand confidently while we keep fraud risks in check.

Short Posts

Latest from Cross Classify

Frequently asked questions

Because fraud is no longer just an IT issue—it's a strategic business risk. Account takeover, fake accounts, and bot abuse can lead to financial losses, brand damage, regulatory fines, and loss of stakeholder trust. CrossClassify helps CEOs proactively protect revenue and reputation.

CEOs set the tone at the top. Your leadership can ensure cybersecurity is treated as a business priority, not just an IT cost. That means championing proactive defenses like behavioral risk scoring, real-time fraud detection, and continuous threat visibility—areas where CrossClassify excels.

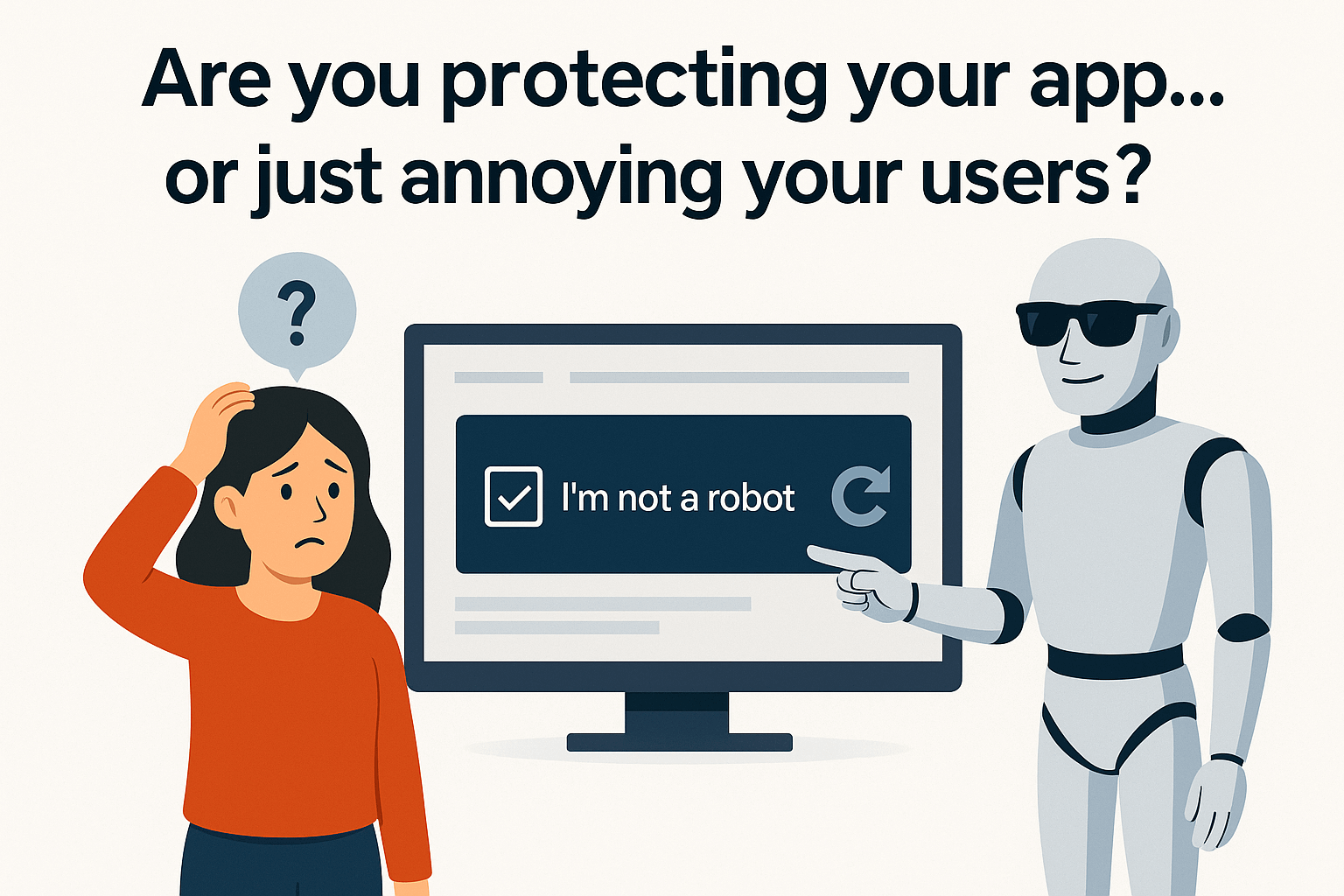

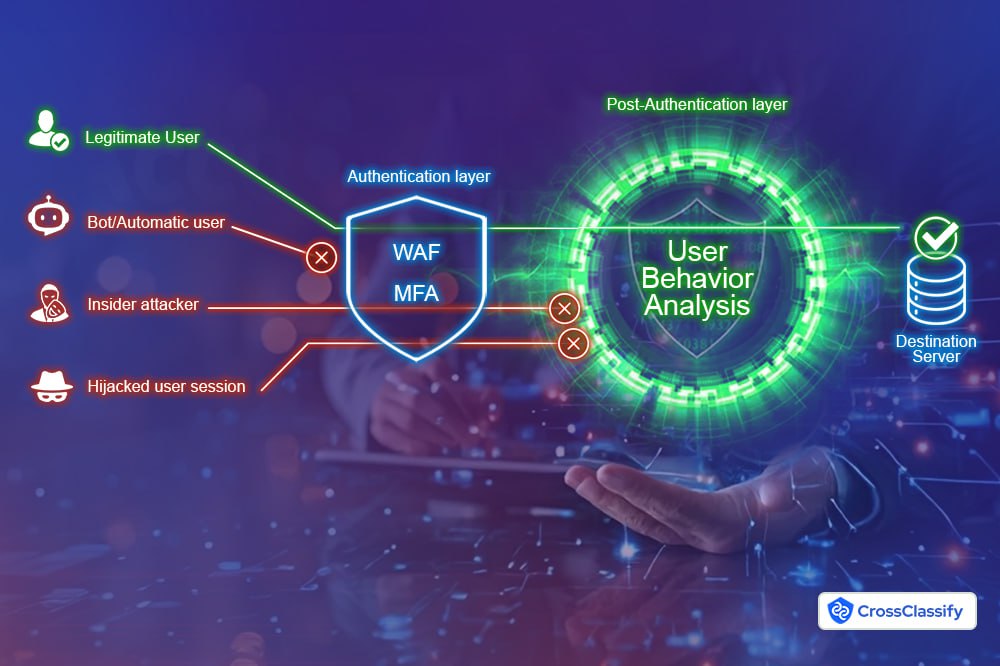

By detecting abnormal behavior before harm occurs. CrossClassify uses

- Device fingerprinting to block fake users

- AI-driven behavioral analytics to flag risky logins or transactions

- Real-time scoring to assess user trust

This means CEOs get peace of mind with a system that adapts as threats evolve.

- Loss of customer trust and retention

- Operational costs tied to chargebacks and manual reviews

- Regulatory penalties (GDPR, HIPAA, PSD2)

- Board scrutiny and media fallout

With CrossClassify, CEOs can show measurable reduction in fraud and stronger governance posture.

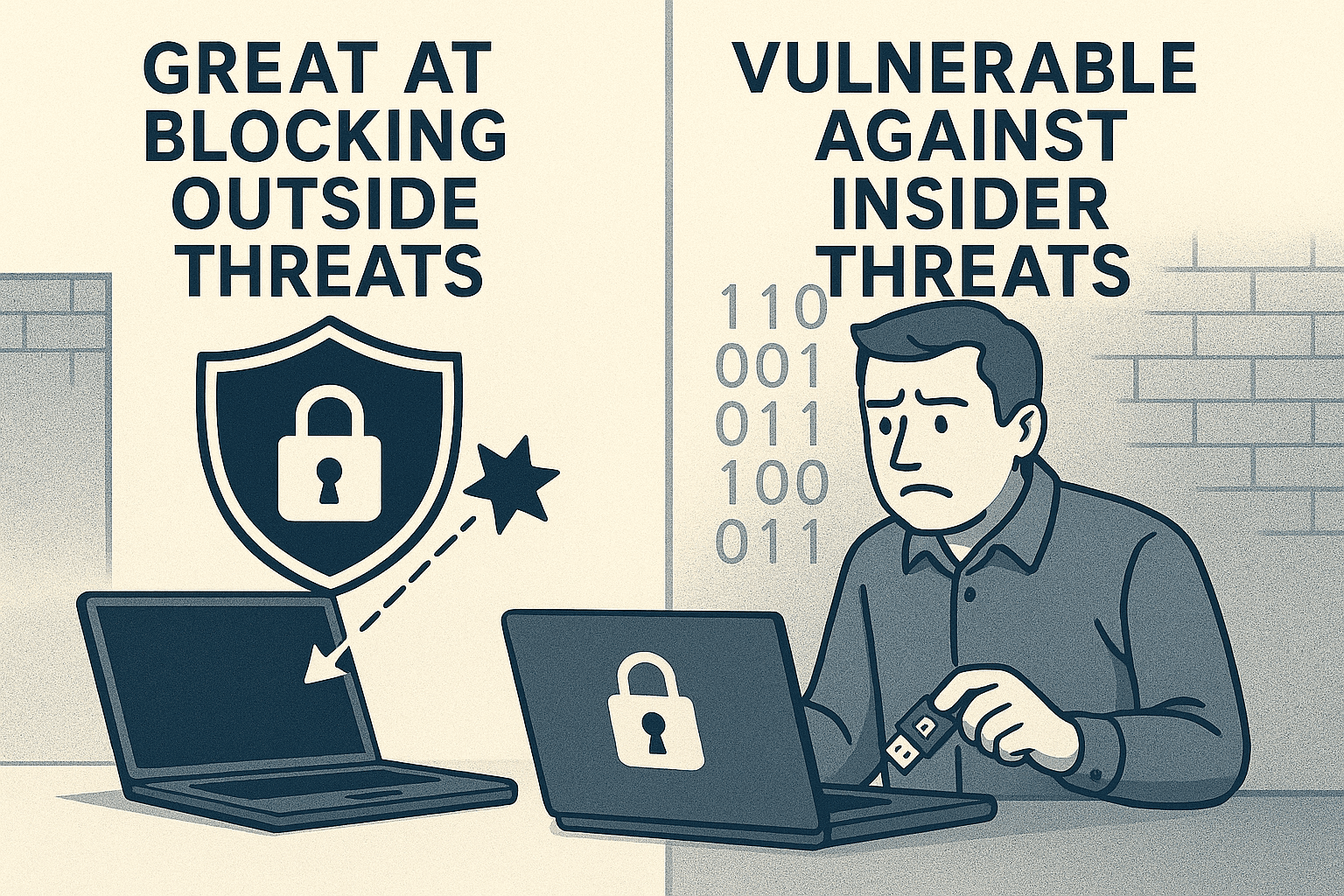

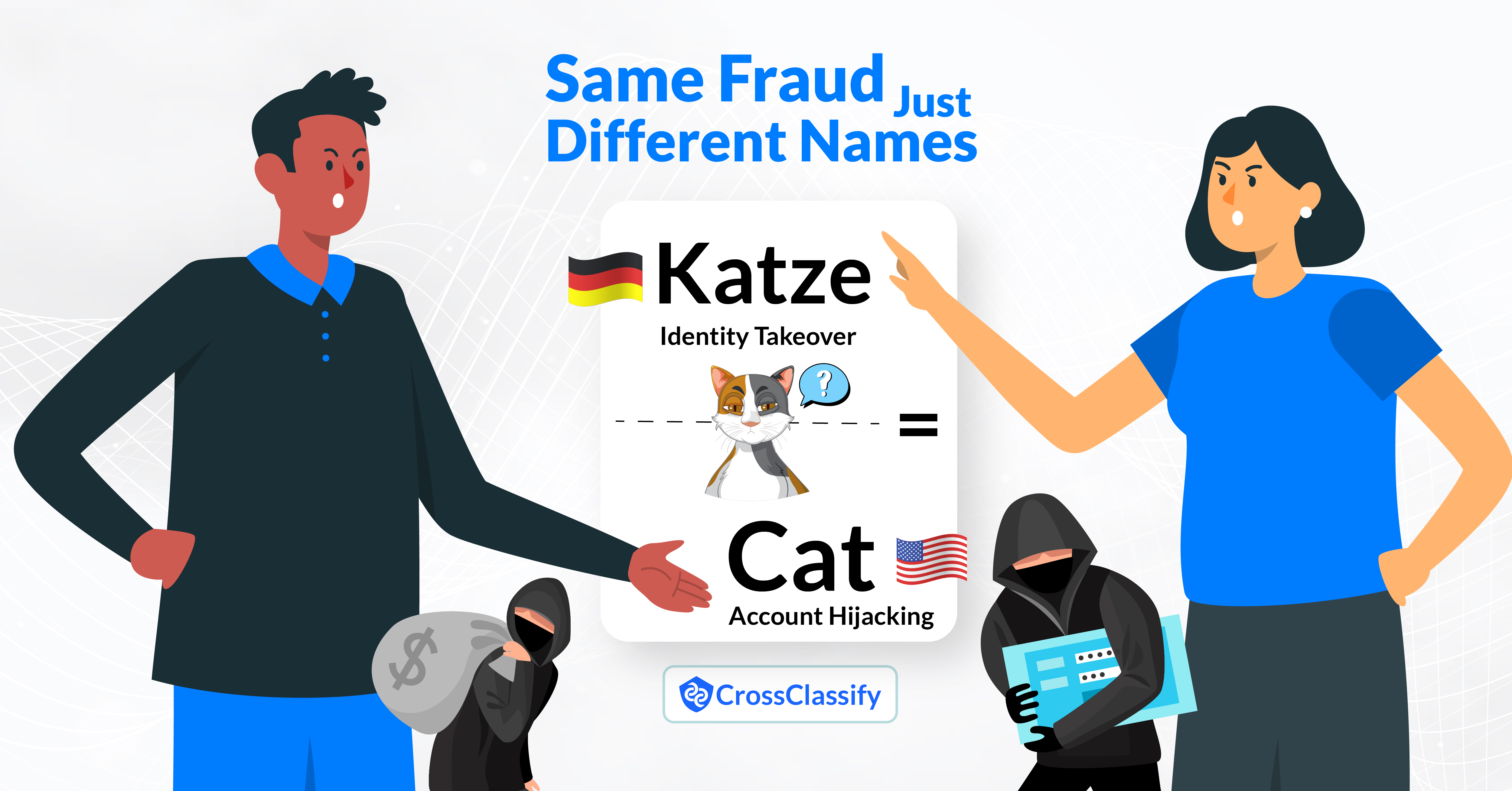

Because fraudsters now use real credentials, clean devices, and bot-driven attacks that bypass static defenses. Firewalls, CAPTCHAs, and rule-based engines fall short. CrossClassify detects what the user does—not just what they present.

Key metrics include:

- Reduction in chargebacks or abuse incidents

- Lower customer support costs

- Improved conversion rates by removing friction for real users

- Faster regulatory compliance reporting

CrossClassify provides dashboards and reporting that connect fraud signals to business outcomes.

The most effective path combines:

- Real-time fraud detection with AI

- Behavioral monitoring beyond login

- Device and session fingerprinting

CrossClassify offers all three—helping CEOs avoid future headlines and regain control over digital risk.

Yes. We offer lightweight API-based integration designed to complement existing IAM, SIEM, or MFA tools. No rip-and-replace is needed—just smarter signals added to your decision-making layer.

Done right, it’s a competitive moat. Reducing fake users and fraud improves customer experience, operational efficiency, and brand trust—all helping CEOs differentiate in crowded markets. CrossClassify turns risk mitigation into a growth enabler.

We focus on business outcomes, not just tech specs. CrossClassify gives CEOs:

- Visibility into fraud risks in real time

- Trust scores to guide policy decisions

- Protection across industries—from fintech to healthcare

We help you prevent loss, maintain trust, and lead with confidence in a threat-filled world.

Let’s Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required