Last Updated on 03 Dec 2025

Technical White Paper for Fraud and Cybersecurity Concerns in the Fintech / Digital Banking / Online Payments Industry

Real-time Protection of Fintech Applications Against Account Takeover, Synthetic Identity Fraud, Card Testing, and Bot Attacks using Adaptive AI and Behavioral Biometrics

Share in

Abstract

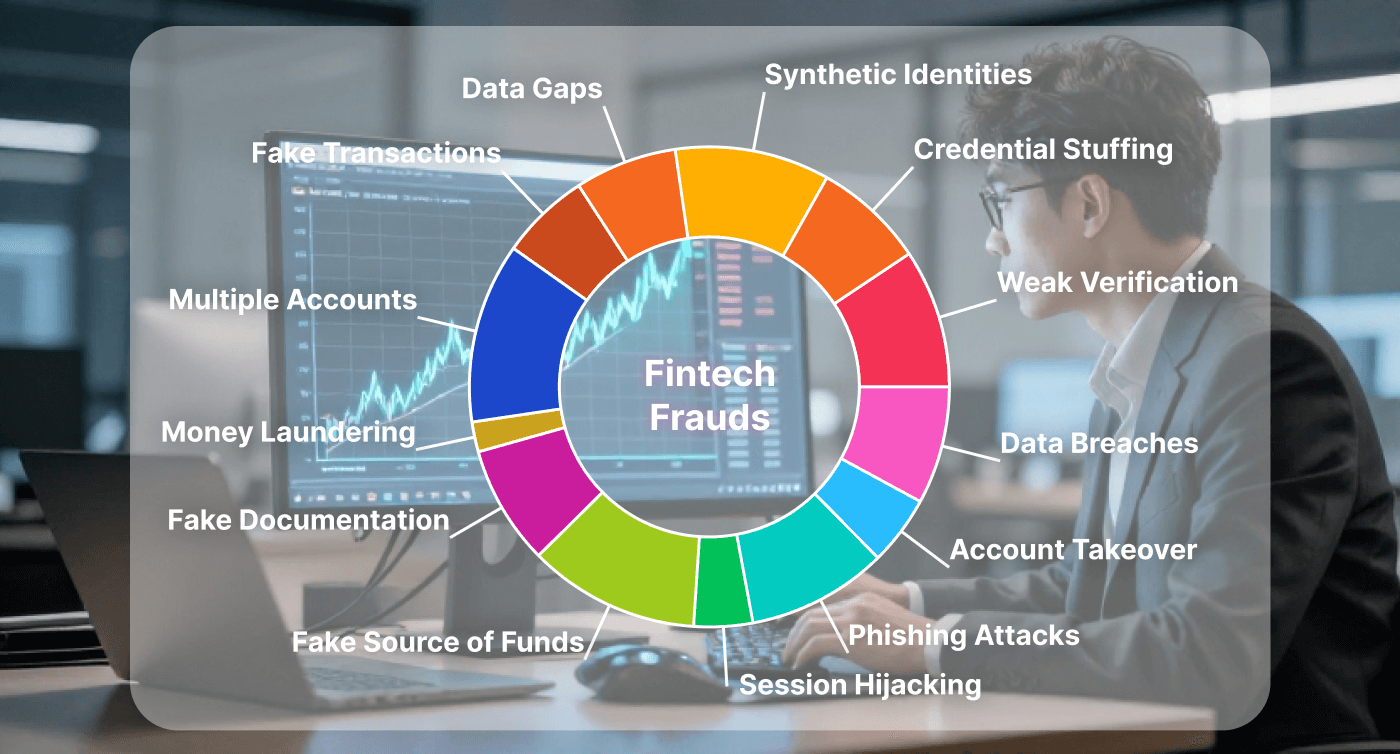

The fintech, digital banking, and online payments industry operates at a rapid pace, characterized by real-time money movement, which means fraud losses materialize instantly, challenging traditional, slow security models. The primary threats are highly sophisticated, including large-scale Account Takeover (ATO) of customer portals and mobile wallets; Account opening and KYC fraud, often employing synthetic identities and mule accounts; and high-velocity Payments and payout fraud like card testing and chargeback abuse. The fundamental difficulty is that fintech platforms move money in real time, and attackers utilize global mule networks and easily obtainable fake KYC documents to open accounts that effortlessly bypass static onboarding and security checks.

This paper introduces the CrossClassify solution, an AI-powered, real-time fintech fraud prevention stack that offers a holistic defense by combining continuous identity, device, behavior, and payment scoring. Our approach leverages Device Fingerprinting and Identity Intelligence to block synthetic identities at the onboarding stage and Continuous Behavioural Biometrics and Session Monitoring on logins, transfers, and payouts to instantly detect ATO and scripted bot flows, even when credentials appear valid. By applying Link and Network Analysis across devices, IPs, and payout accounts, CrossClassify effectively reveals multi-account rings, mule routing patterns, and loan stacking schemes that static checks fail to see.

The key result and main motto of CrossClassify is "Real-Time Fraud Detection for Apps", which, in the fintech domain, is realized through a single SDK solution that continuously scores every login, payment, payout, loan application, and trading action in real time. This provides evidence-backed risk scores, allowing the platform to adaptively raise friction only when risk is high, thereby protecting the platform without sacrificing the smooth user experience that fintechs must balance with intense regulatory pressure. This technical white paper is essential reading for all key decision-makers, including Founders, CTOs and CPOs of fintech startups and digital banks, Fraud, risk and compliance leaders at neobanks, and Security engineers, who are urgently seeking solutions to combat systemic fraud and cyber risk across their digital channels.

Download this White Paper to get a real-world B2B guide on fraud prevention trends, challenges, and solutions for the fintech, digital banking, and online payments industry.

Share in

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required