30 Aug 2025

Your fintech platform isn’t bleeding money at onboarding. It’s bleeding inside live sessions.

Every fintech CEO and CTO I speak with worries about account fraud, security breaches, and looming cybersecurity gaps. And yet, most of them obsess over logins, verifications, and onboarding flows.

Here’s the uncomfortable truth:

Fraud doesn’t just happen at the door. It thrives once inside. Bots mimic real customers. Sophisticated fraud rings test stolen credentials. Malicious insiders exploit weak monitoring.

That’s why chasing “stronger KYC” alone is a losing battle. It’s like locking your front door but leaving the windows wide open.

So what’s the fresh take?

Fraud isn’t just a barrier problem. It’s a visibility problem. If you can’t see device fingerprints, behavioral anomalies, and geo-pattern shifts in real time, you’re not preventing fraud… you’re financing it.

At CrossClassify, we reframed the fight:

Instead of stopping at onboarding, we built continuous monitoring that profiles devices, analyzes behaviors, and flags suspicious sessions before they cost you revenue.

Here’s the kicker:

The fintech leaders who sleep easier aren’t the ones with bigger firewalls. They’re the ones who changed the question from “How do we block fraud upfront?” to “How do we detect fraud continuously?”

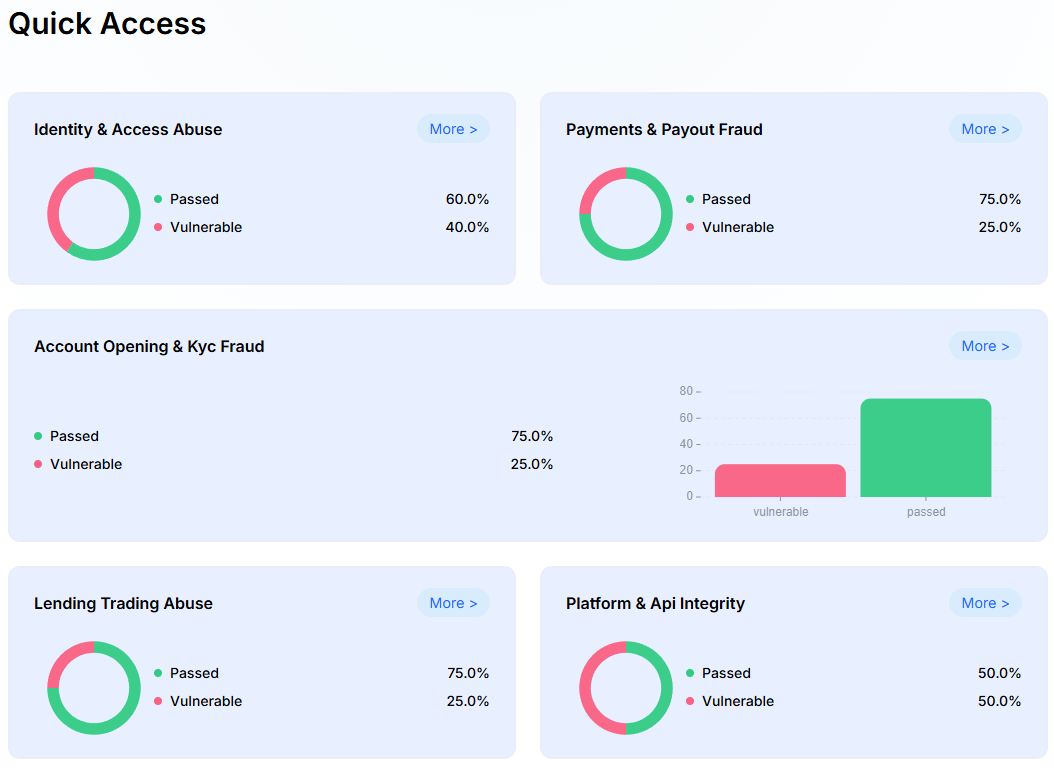

If you’re facing these issues, the technical breakdown of five core fintech fraud and cybersecurity concerns is here

And if you want to see how we solve them in practice, check this