Last Updated on 05 Jul 2025

Understanding Fraud and Cybersecurity Challenges in the iGaming Industry

Share in

Key Notes

•

Nearly 51% of iGaming operators cite fraud as a top business threat.

•

Over $14.2 billion in estimated losses from bonus abuse and multi-accounting annually.

•

40% of account takeovers in iGaming are linked to bot usage.

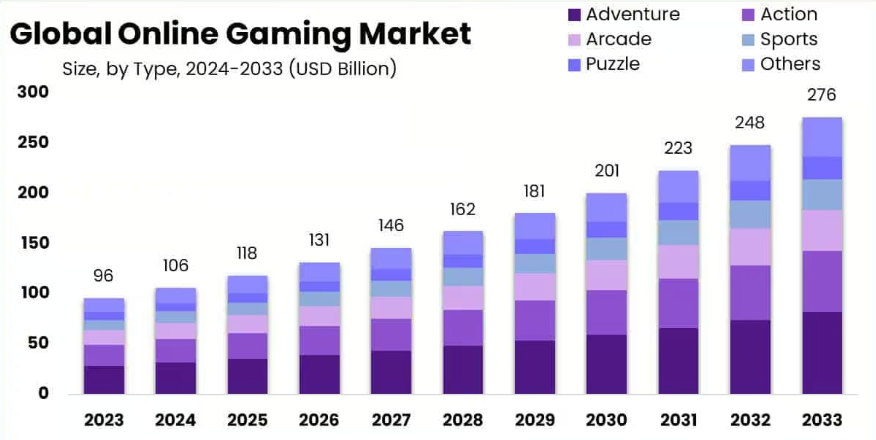

The Global Surge of the iGaming Industry

iGaming refers to any form of online gambling that involves betting or wagering on the outcome of a game or event. This includes online poker, casinos, sports betting, and fantasy sports platforms.

•

The global iGaming market is valued at over $88 billion in 2024, projected to reach $153 billion by 2030.

•

More than 180 million players participate in online gambling globally.

•

iGaming platforms are active in 100+ countries with localized regulatory frameworks.

•

There are thousands of implementation partners, including game developers, payment providers, and platform hosts.

Reference: Online Gaming Market Report

Fraud and Security Concerns in iGaming: The Big Picture

iGaming fraud can be categorized into three core types.

Definition: Involves unauthorized access using stolen or fake identities.

•

Account Takeover & Stolen Wallet Usage: Criminals gain access to legitimate accounts to steal funds.

•

Multi-Accounting / Gnoming: One user controls multiple accounts to exploit bonuses or bypass limits.

•

Device fingerprinting, behavioral monitoring, AI-driven access validation.

Definition: Attempts to influence game outcomes for unfair advantage.

•

Collusive Betting: Players conspire to win at the expense of others.

•

Bot Usage: Automated scripts play games instead of humans.

•

Mitigation: Action-sequence analysis, pattern deviation detection, time-based behavior tracking.

Definition: Targeting financial systems or marketing campaigns.

•

Bonus Abuse: Exploiting multiple sign-ups to claim rewards.

•

Gnoming: Using identity cloaking for payout manipulation.

•

Advanced identity validation, affiliate monitoring, bonus usage heuristics.

Identity & Access Fraud

Account Takeover & Stolen Wallet Usage

Definition:Criminals obtain login credentials (via phishing, leaks, or malware) and drain wallets through unauthorized logins and withdrawals.

Why It Matters:

•

Damages user trust.

•

Results in chargebacks and regulatory issues.

•

Often part of larger fraud rings.

Mitigation:

•

Strong MFA, behavioral anomaly detection, device/IP intelligence, real-time alerts.

Detection Features & AI Methods:

•

New login from different geolocation/device:

Models trained on login IP patterns detect sudden geo-switches using anomaly detection and clustering. Outputs include high-risk scores for flagged sessions.•

Unusual session timing:

AI evaluates time-of-day patterns; night-time activity spikes from new regions may indicate compromise.•

Rapid high-stake bets:

Recurrent neural networks track bet behavior; abnormal escalation in stakes triggers alerts.•

Prior failed login attempts:

Logistic regression and threshold models detect brute force behavior; sudden spikes trigger CAPTCHA or lockout.

Multi-Accounting

Definition:A single user creates multiple accounts, often using different emails but the same device or IP, to gain unfair advantage or abuse promotions.

Why It Matters:

•

Increases bonus abuse.

•

Disrupts fair gameplay.

•

Undermines affiliate systems.

Mitigation:

•

Device fingerprinting, clustering of player behavior, withdrawal tracking.

Detection Features & AI Methods:

•

Same IP/device across accounts:

AI fingerprinting clusters multiple accounts by device traits. Alerts surface when new accounts resemble existing profiles.•

Synchronized actions on same table:

Deep sequence models analyze timing of player decisions. Anomalous synchronization triggers alerts.•

Reused withdrawal methods:

Graph-based AI maps account-to-withdrawal relationships; shared patterns flagged.•

Shared fingerprint data:

Multi-dimensional similarity models compare session features. High-similarity pairs linked to fraud profiles.

Multi-Accounting with Withdrawal/Limit Bypass (Gnoming)

Definition:Fraudsters use multiple fake identities to evade deposit/withdrawal limits or bonus caps, often cashing out through the same target account.

Why It Matters:

•

Exploits regulatory and financial controls.

•

Commonly used in laundering schemes.

Mitigation:

•

Cross-account behavioral mapping, transaction analysis, anti-Gnoming AI rules.

Detection Features & AI Methods:

•

Multiple accounts with same withdrawal target:

Fraud graph AI links accounts via shared payout destinations. Suspicious clusters flagged.•

Similar betting behavior across accounts:

Behavioral similarity models reveal collusion. AI flags mirrored bet patterns.•

Device fingerprint reuse:

Unique device features tracked; reuse triggers alerts via unsupervised models.

Gameplay Manipulation Fraud

Bot Usage / Automated Play

Definition:Bots are software agents that simulate human gameplay, often outperforming legitimate players by acting instantly and tirelessly.

Why It Matters:

•

Destroys game integrity.

•

Lowers engagement from human players.

Mitigation:

•

Activity rhythm detection, entropy analysis, continuous human-input validation.

Detection Features & AI Methods:

•

Perfectly timed reactions:

Time-series models identify sub-second reactions. Human-like delays modeled as baseline.•

24/7 gameplay without rest:

Session clustering flags accounts with continuous use. AI evaluates play-rest cycles.•

No mouse/key movement:

UI telemetry analyzed for real interactions. No events = probable automation.•

Identical move sequences:

Markov chains or RNNs detect deterministic play patterns. Identical sequences trigger risk scores.

Collusive Betting (Player Collusion)

Definition:Multiple players coordinate to manipulate game results (e.g., chip dumping, soft play).

Why It Matters:

•

Drains bankroll of legitimate players.

•

Skews platform performance metrics.

Mitigation:

•

Co-occurrence tracking, outcome analysis, and behavior clustering.

Detection Features & AI Methods:

•

Frequent co-occurrence of player pairs at same table:

Graph analysis highlights abnormal link density among user pairs.•

Unusual win/loss ratio between specific players:

Statistical outlier detection on intra-pair outcomes.•

Bet timing similarity:

Time-based clustering and correlation models highlight coordinated bets.•

Clustered play patterns:

Behavioral segmentation used to isolate likely colluders.

Promotional & Financial Abuse

Bonus Abuse / Promotional Fraud

Definition:Multiple accounts or social engineering tactics are used to claim promotional rewards without intention to engage in genuine gameplay.

Why It Matters:

•

Inflates customer acquisition costs.

•

Leads to net revenue loss and skewed analytics.

Mitigation:

•

AI bonus abuse heuristics, affiliate abuse detection, velocity checks.

Detection Features & AI Methods:

•

Multiple accounts from same device/IP:

Fingerprinting clusters identify bonus-farming rings.•

Rapid signups followed by inactivity:

Sequence analysis highlights low-engagement signup flows.•

Bonus claimed without gameplay:

Cross-checks between bonus trigger and play logs flag misuse.•

Funds funneled to one account:

Flow-based analysis detects monetary clustering across accounts.

Gnoming

Definition:Fraudster operates several accounts with the intent to bypass limits or consolidate winnings into a single target account.

Why It Matters:

•

Linked to laundering and systemic fraud.

•

Deceives promotional and transaction.

Mitigation:

•

Cross-account behavior matching, device mapping, financial clustering.

Detection Features & AI Methods:

•

Multiple accounts with same withdrawal target:

AI graph-based mapping reveals suspicious financial routing.•

Similar betting behavior across accounts:

Player activity vectorization detects mirroring.•

Device fingerprint reuse:

Real-time fingerprint match with CrossClassify's identity graph.

Conclusion

The iGaming industry, while booming, is under persistent threat from diverse fraud schemes—ranging from account takeover to bot usage and financial manipulation. To ensure regulatory compliance, player trust, and platform integrity, operators must adopt advanced AI-driven detection systems. CrossClassify's behavioral monitoring, device intelligence, and risk scoring capabilities provide iGaming companies with a holistic solution to detect and prevent fraudulent behavior in real-time.

Learn how we protect iGaming: iGaming Security Platform by CrossClassify

See How Keep Your Players, Block the Fraudsters

Prevent account takeovers without compromising the gaming experience

Explore CrossClassify today

Detect and prevent fraud in real time

Protect your accounts with AI-driven security

Try CrossClassify for FREE—3 months

Share in

Related articles

Frequently asked questions

Let's Get Started

Discover how to secure your app against fraud using CrossClassify

No credit card required